You just finished talking to a buyer of your house and lot in Quezon City, so you need to draft a deed of sale. You are glad that, after intense negotiation, you have finally agreed on the contract price.

How do you then draft a deed of sale to ensure all the terms and conditions you agree to are reflected in the contract?

This guide will walk you through drafting a deed of sale.

DISCLAIMER: This article has been written for general informational purposes only and is not legal advice or a substitute for legal counsel. You should contact your attorney to obtain advice with respect to any particular issue or problem. The use of the information contained herein does not create an attorney-client relationship between the author and the user/reader.

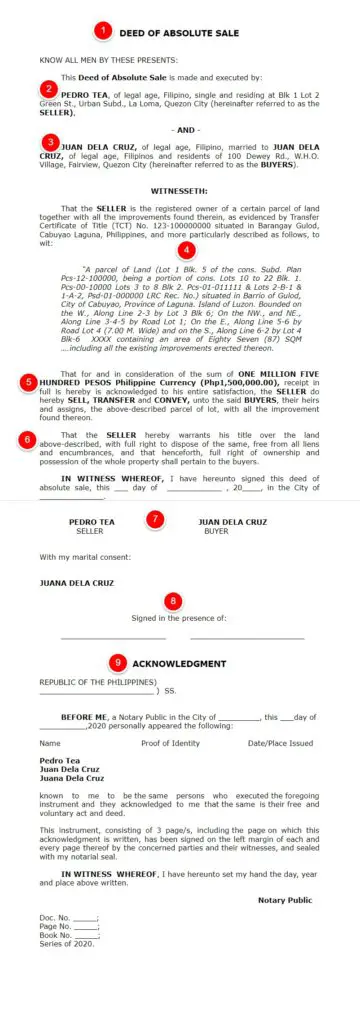

Free Downloadable/Editable Deed of Sale Sample Templates

To save you the hassle of writing a deed of sale from scratch, you may download the following samples and edit the contents using the above guide:

What Is a Deed of Sale?

Under Article 1458 of the New Civil Code of the Philippines, a deed of sale or a contract of sale is a document executed when one of the contracting parties (called the seller) obligates himself to transfer the ownership and to deliver a determinate thing (e.g., house and lot or motor vehicle), and the other (called the buyer) to pay the price certain in money or its equivalent.

A contract of sale may be absolute or conditional.

Deed of Absolute Sale vs. Deed of Conditional Sale vs. Contract To Sell: What’s the Difference?

1. Deed of Absolute Sale

The Supreme Court, in one case provides that a contract of sale is absolute when:

- The title to the property passes to the buyer upon delivery of the property sold. Delivery is either actual (when the item is given to the buyer) or constructive (i.e., executing a Deed of Absolute Sale in the case of real property).

- The contract has no statement or condition that the property title remains with the seller until full payment of the purchase price.

- No provision in the contract gives the seller the right to cancel the contract unilaterally (meaning without the buyer’s consent) when the buyer fails to pay within the agreed period.

2. Deed of Conditional Sale and Contract to Sell

A conditional sale occurs when there is a condition in the contract of sale, and ownership of the property will only pass to the buyer upon fulfilling the condition.

On the other hand, in the contract to sell, the prospective seller binds himself to sell the property exclusively to the prospective buyer upon fulfilling the conditions agreed upon, e.g., the full payment of the contract price. In a contract to sell, the agreement is about the promise to sell.

The ownership in both conditional sale and contract to sell remains with the seller and does not pass to the buyer.

However, in a deed of conditional sale (also known as a contract of conditional sale), the ownership is automatically transferred to the buyer when the condition is fulfilled. For example, you are the buyer, and the condition is the full payment of the contract price. Once you have fully paid the contract price, the ownership of the property is automatically transferred to you by operation of law without any further action to be done by the seller.

It is not the same in a contract to sell. Ownership is not automatically transferred even if the buyer fulfills the obligation, and the property may have already been delivered. The prospective seller still has to transfer the title to the prospective buyer by executing a deed of absolute sale because the agreement in the contract to sell is only a promise to sell and not yet a sale of the property.

Please note that if the contract contains a clause that the seller shall execute a Deed of Absolute Sale only after full payment of the purchase price, it is a contract to sell.

Is there a need to execute a Deed of Absolute Sale in a Deed of Conditional Sale?

Although jurisprudence says ownership is automatically transferred to the buyer by operation of law without any further action to be done by the seller, in practice, a Deed of Absolute Sale still has to be executed because one of the requirements in the Register of Deeds for the transfer of title of the real property is a Deed of Absolute Sale. This also confirms the buyer has fulfilled the condition.

Deed of Absolute Sale vs. Contract of Sale With Pacto De Retro: What’s the Difference?

Property ownership transfer is absolute without conditions in the Deed of Absolute Sale. In a contract of sale with pacto de retro, the buyer gives the seller the right to repurchase the property within the agreed timeline.

If you execute a pacto de retro sale, the ownership of the property is immediately transferred to the vendee a retro (the buyer). However, since the seller a retro is given the option to buy back the property, the ownership reverts to the seller when the latter exercises this right.

The parties can fix the date when the seller should repurchase the property, but the period should not be more than ten years from signing the contract. The default is four years from signing the document if the period is not stated.

How To Draft a Deed of Absolute Sale: 3 Steps

For this guide, we will be using the sale of real property as a sample, as it is the most common type of transaction.

1. Prepare the document

A Deed of Absolute Sale should contain the following parts:

- Title of the document. If it is an absolute sale, it should be titled as such

- Name of the seller, a statement that the latter is of legal age, civil status, citizenship, and residence address.

- Name of the buyer, a statement that the latter is of legal age, civil status, citizenship, and residence address.

- The identification of the real property, its address, and the technical description (can be found on the title of the property)

- The consideration or the purchase price.

- Warranty of the seller

- The signature of the parties

- Signature of the witnesses

- Acknowledgment before a notary public

2. Print at least 3-5 copies of the document

- One copy goes to the notary public

- One or two copies go to the seller

- One or two copies go to the buyer

3. Go to a notary public to have your document notarized

Don’t forget to bring valid IDs, as the notary will have to verify the identities of the parties.

Tips and Warnings

- In drafting a contract of sale, it is crucial to ascertain the real intention of the parties. Several cases have been decided by the Supreme Court whereby an agreement titled a Deed of Conditional Sale was ruled to be a Contract to Sell due to the clauses in the contract. This is because it is not the title of the contract that will prevail but the express terms and conditions that will determine whether you entered into an absolute contract of sale, conditional contract of sale, or a contract to sell.

Frequently Asked Questions

1. Should a Deed of Sale of Real Property be notarized?

Yes. A sale deed of real property should be notarized per the requirements under Article 1358 of the New Civil Code, which provides that any contract that creates, transmits, modifies, or extinguishes rights over the real property should be in a public document.

The notarization of a private document converts it into a public record.

2. How much is the cost for the notarization of a Deed of Sale in the Philippines?

The cost varies depending on the location or the IBP (Integrated Bar of the Philippines) Chapter to which the notary public belongs. The going rate is around 1% of the contract price. In IBP Cebu Chapter, the standard rate seems to be 2% of the actual amount of the contract but not less than Php 1,500 whichever is higher. On the other hand, in Dumaguete, the standard rate is a minimum of Php 2,000 or 3% of the property's fair market value, whichever is higher.

3. Who pays for the notarization of a Deed of Sale?

Depending on both parties’ agreement during the negotiation process, it could be the seller or the buyer.

4. How can I sign the Deed of Sale in the Philippines if I am abroad?

You may appoint a person based in the Philippines to sign the Deed of Sale on your behalf by executing a Special Power of Attorney in favor of your agent in the Philippines.

5. Does a Deed of Sale have an expiration date?

A Deed of Sale has no expiration date per se, but it can be extinguished (canceled or nullified) by the same causes as all other obligations.

For example, in a Deed of Conditional Sale, the contract may be extinguished due to the non-payment of the contract price or breach of other obligations.

In a Deed of Sale with Pacto de Retro, the sale is extinguished by the redemption of the seller of the property sold.

6. What is the difference between a Deed of Sale and a Deed of Donation?

In donation, the transfer of property is gratuitous (meaning for free), usually because of the donor’s love and affection for the donee or due to the good service of the latter. There is always a consideration in the sale: money or its equivalent.

Both transfers require payment of fees and taxes. In addition to transfer tax, documentary stamp tax, among others, a donation is subject to donor’s tax of 6% computed based on the total gifts over Php 250,000 exempt in a calendar year (effective 01 January 2018 based on RA 10963 or the TRAIN Law).

On the other hand, a sale is subject to an outright capital gains tax of 6% of the total contract price or the fair market value of the property, whichever is higher, which must be paid to the BIR within 30 days from the date of signing the Deed of Sale.

A deed of sale and a deed of donation are both modes of transferring property ownership. However, the rules on donation are governed by Title III, while Title VI of Book III of the New Civil Code of the Philippines governs a sale.

7. What is an Open Deed of Sale? Is it valid?

An open deed of sale is just like a regular deed of sale, but the buyer’s name and other contract details, such as the price and the date of signing, are left blank or open.

This practice is common in selling second-hand motor vehicles or in a dealership where the dealer’s possession of the vehicle is temporary until the dealer finally finds a buyer. This scheme is done purportedly to avoid going through the rigorous process of transferring ownership of the vehicle and paying the transfer fees/taxes.

The Open Deed of Sale, on its face, is not a valid form of contract as there is no meeting of the minds between the buyer and the seller appearing on the document.

This practice is also risky for both parties. Under the law, the owner of a motor vehicle is the person whose name appears on the Certificate of Registration (CR) issued by the Land Transportation Office (LTO); hence, even if you have already sold the motor vehicle, if your name still appears on the CR, you remain responsible for it. If the motor vehicle injures a person or property, the victim will go after you, even if you are not driving the vehicle.

The same is true if you are the buyer. It will be hard to find out if the car has been involved in a crime, was carnapped, or is collateral of a loan without your knowledge.

It is best to avoid executing an open deed of sale; otherwise, you risk exposing yourself to the above-mentioned untoward scenarios.

References