Situs of Taxation: How to Know Which is Taxable and Which is Not Taxable

As a resident of the Philippines, it is a given that you must pay your tax dues to your country. However, it may be confusing for some individuals about what specific taxes to pay in a foreign country. This may be a result of dual citizenship, clients or employers from a foreign country, exporting or importing businesses or just any income coming from other countries.

This article aims to provide readers with a general understanding of the Situs of taxation.

This is especially important for:

- OFWs;

- Freelancers with foreign clients;

- Producer or Manufacturer of goods;

- Exporters; and

- Whoever owns a property abroad including stocks.

Disclaimer: This article is for general information only and is not substitute for professional advice.

What is the Situs of Taxation?

Basically, this means the place of taxation. This helps the government classify actions and determine whether or not it is taxable in the Philippines. This also helps separate the taxation powers of foreign countries from the Philippines’.

Without this provision, any country can step on the boundaries of each other and even tax the citizens of other countries.

Why is it important?

The benefit of learning about the situs of your income includes:

- Knowing the available tax exemptions;

- Knowing your obligations to avoid incurring unnecessary penalties; and

- Determining the proper tax rates of certain transactions.

It is important to know where your income comes from because there are tax exemptions for certain individuals and additional tax obligations for others. Also, depending on the income, there are differences in tax treatment if it came from foreign sources.

For example:

a. Income from the sale of real property located in the Philippines is taxed at a 6% final capital gains tax

b. Sale of real property located abroad:

- part of the gross income of a resident Filipino citizen or;

- exempt if sold by a foreigner or a non-resident Filipino citizen including OFWs.

READ: How to Compute, File, and Pay Capital Gains Tax in the Philippines: An Ultimate Guide

Effects on Different Classes of Taxpayers.

| Classification | Income from PH | Income from Other Countries |

| Resident Filipinos and Domestic Corporations | Taxable | Taxable |

| Non-resident citizens, Foreigners earning income in the PH and Foreign Corporations | Taxable | Not Taxable |

As discussed in the classification of taxpayers, resident Filipino citizens and domestic corporations are taxed in their worldwide income. Meaning, any income they derive from foreign countries is also taxed here in the Philippines. But for other classifications like non-resident Filipino citizens, including Overseas Contractual Workers (OCWs), resident aliens and foreign corporations, only their income derived within the Philippines are taxed by the Philippine laws.

Related: How to Claim Foreign Tax Credit to Lower Your Tax Liabilities

Situs of Taxation: Important Points to Remember.

The following are the common items that can be quite confusing for taxpayers:

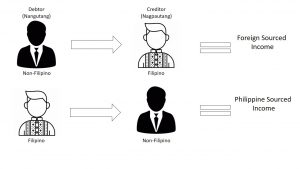

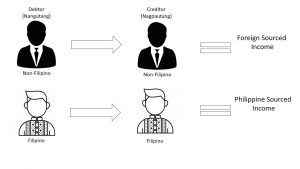

1. Interest.

Interest income generally comes from loans. The situs of interest income is the residence of the debtor. Thus, if the debtor is a resident of the Philippines, it is considered earned within the Philippines by the creditor.

Sample Case:

a. Juan, a resident citizen of the Philippines, loaned Php 50,000 to John, a resident of the US. Any interest that Juan receives from John will be treated as earned from foreign sources.

b. John, a resident of the US, loaned Php 25,000 to Juan, a resident citizen of the Philippines. Any interest that John receives from Juan will be treated as earned from the Philippines.

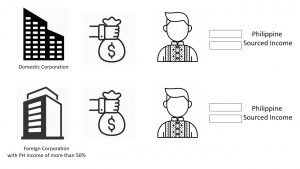

2. Dividends.

Dividends – received from:

a. From a domestic corporation – considered as earned within the Philippines regardless of the classification of the shareholder.

Domestic Corporations are corporations established here in the Philippines;

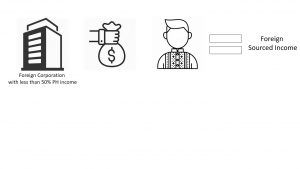

b. From a foreign corporation,

- If the income of the foreign corporation earned within the Philippines is equal to or more than 50% of its total income, including income from other countries, then the total dividends received from the foreign corporation are treated as earned within the Philippines.

- If the income of the foreign corporation earned within the Philippines is less than 50% of its total income, then only the dividends with the same ratio of the income from Philippine sources shall be treated as earned within the Philippines.

Foreign Corporations are corporations created and established in foreign countries.

Sample Case:

a. Juan, a resident Filipino, earned dividends from Joli Funeral Corp (JFC), a domestic corporation. Dividends he earns from JFC is considered earned in the Philippines.

b. Juan, a resident Filipino, earned dividends from Kenny Food Corp (KFC), a foreign corporation. Dividends he earns from KFC is considered earned from foreign sources.

c. Z Corporation received Php 10,000 dividends from X Corporation, a Japanese firm, which earned Php 200,000 from Philippine sources and Php 300,000 from Japan. The amount of dividends received by Z Corporation from Philippine sources is only P4,000 (Php 10,000 * Php 200,000/Php 500,000).

If instead of Php 200,000, X corporation earned Php 300,000 from PH, then the whole Php 10,000 dividends will be treated as earned within the Philippines because the Philippine income of the foreign corporation is equal to or more than 50% of its total income (Php 300,000/Php 600,000).

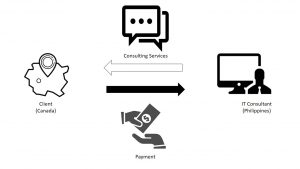

3. Services.

Services – where performed. Thus, if performed within the Philippines, it is considered earned here.

Sample Case:

Juan, a resident Filipino, earned Php 100,000 from his freelance business where he regularly provides IT consultation services to Z company, a corporation located in Canada. For Juan, the whole Php 100,000 is treated as earned here in the Philippines even if his client is located in a foreign country.

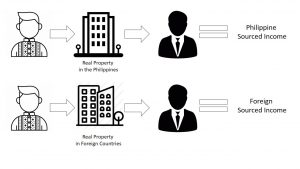

4. Rentals and Royalties.

Rentals and Royalties – where the property is located or the place of use of the property. As such, if the property is located in the Philippines, rentals, and royalties are considered earned within the Philippines.

Sample Case:

a. Juan owns a condo unit located in Makati where he earns Php 240,000 per month from rentals. Any income he derives from the condo unit is treated as income from the Philippines.

b. Juan also owns an apartment in the United States where he earns 500 USD per month. Any income he derives from the apartment is treated as foreign-sourced.

c. Bill G, an owner of a computer program, earns Php 120,000 from monthly subscriptions. The subscribers use the program in their day to day operations here in the Philippines. The monthly subscriptions are considered earned here in the Philippines even if the program was created in a foreign country because it is used here in the Philippines.

5. Sale of real property.

Sale of real property – where the real property is located. As such, gains, profits and income from the sale of real property located in the Philippines are considered earned here.

Real Properties, in simple terms, are properties that are grounded like Buildings, Land and other immovable properties.

Sample Case:

a. John, a US citizen, owns land located in the Philippines given to him by his father-in-law. If he chooses to sell it, any income derived from the sale shall be considered as earned in the Philippines.

b. Juan, a resident Filipino, sold all his property located in the Philippines before he migrated to the US. Any income derived from the sale shall be considered as earned in the Philippines.

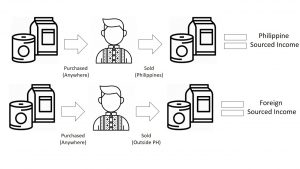

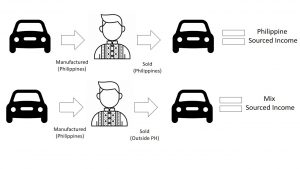

6. Sale of Personal Property.

Personal properties are any properties that are not classified as real properties. This includes cars, jewelry, perishable goods, computer hardware, etc.

Personal Property Purchased: where the property is sold. Regardless of where the property was purchased, only the country where it is sold is considered.

Personal Property Produced: if the personal property is produced in the Philippines and sold outside, it shall be treated as derived from sources partly within and partly without the Philippines. (see no. 7)

Except: sale of shares of stock of a domestic corporation, which shall be considered entirely earned within the Philippines even if sold outside.

Sample Case:

a. X Corporation regularly purchases canned goods from China. X corporation sold the goods in Bulacan where its sales branch is located. The income is treated as derived from the Philippines.

b. Y Corporation manufactures and produces cars in Cebu and sells them in Manila. The gains from the sale of the automobiles are treated as derived from the Philippines.

c. Z Corporation produces lanterns made from abaca in its factory in Laguna. The corporation exports the goods to Europe where it is sold. The income from the lanterns shall be considered as earned partly within and partly outside the Philippines.

7. Income partly within and partly without the Philippines.

Aside from the sale of personal property produced in the Philippines, income from transportation and other services rendered partly within and partly without is covered by this number.

Generally, income from whatever source is easily identifiable. However, in the case where the income is partly within and partly without the Philippines, the basic formula is to pro-rata or allocate the mixed sourced income.

Sample Case:

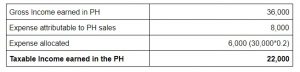

John is a citizen of the United States who went to the Philippines for a business trip together with his associates. The following can be found from his income statement:

Based on the above information, we can calculate the taxable income attributed to the Philippines by isolating it and allocating the 30,000 mixed expenses based on the ratio of gross income earned in the Philippines (36,000) to the Total gross income (180,000), which is 20%.

In conclusion, only the 22,000 out of the 180,000 is taxable on the part of John because he is a resident alien, meaning, he is taxable only from his income from Philippine sources.

Knowing where your income is sourced can lower your taxes and will help you avoid incurring unnecessary penalties when you fail to pay your tax dues.

Frequently Asked Questions.

1. I am a resident citizen of the Philippines, do I need to report my income from foreign sources?

Yes. You shall file the appropriate tax return and include your income from other countries.

2. I am an OFW, if I don’t have any income from the Philippines, should I still report my income from my job?

No. Non-resident citizens earning income solely from foreign sources are not required to file income tax returns in the Philippines.

3. I paid tax in the foreign country where I earned my other income, can I use that as a deduction for my tax in the Philippines?

Yes. Under the tax code, payments of foreign taxes is a valid deduction to gross income.

4. What are the penalties if I don’t report my income from foreign countries?

If you are required by law to report your income from foreign sources and you failed to do so, you are considered as a tax evader and will be penalized heavily.

The penalties include, but not limited to:

- Payment of tax based on the unreported income;

- Payment of surcharges equal to 25% to 50% of the unpaid tax;

- Payment of annual interest equal to 12% of the unpaid tax; and

- Possible jail time of not less than 6 months to 10 years.

5. What are the common items considered as income from foreign sources?

- Dividends from foreign corporations;

- Gains from selling stocks from foreign corporations;

- Sale of property located in a foreign country; and

Interest from loans given to a foreign national.

Go back to the main article: An Ultimate Guide to Philippine Tax: Types, Computations, and Filing Procedures

About the Author.

Miguel Dar is a CPA and an experienced tax consultant who specializes in tax audits. He provides tax advice to various start-up enterprises and clarified tax concerns of individual taxpayers. This includes assisting clients in registering their businesses, tax and bookkeeping training for start-up businesses, settling open cases, tax planning for future tax compliance and answering tax-related inquiries. Connect with him on Linkedin.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net