How To Compute Income Tax Refund in the Philippines: A Definitive Guide to Getting Your Money Back

One benefit of knowing how your tax return is prepared is knowing how much you already overpaid. By the principle of solutio indebiti, meaning, “payment to one that is not due to him”, you are entitled to a tax refund.

This article aims to provide information on tax refunds in the Philippines, why it happens, how to compute it, and how to avail.

Disclaimer: This article is for general information only and is not substitute for professional advice.

Related: How to File Income Tax Return in the Philippines: A Beginner’s Guide

What Is an Income Tax Refund?

Tax refunds result from the overpayment of taxes. The usual sources of tax refunds are salaries, the income of freelancers and payments to tax-exempt entities. Note that whatever the source is, tax refunds must be availed not later than 2 years from supposed filing.

Who Are Eligible To Apply for Income Tax Refunds?

Generally, anyone who pays income tax may apply for tax refunds. This includes:

- Employees;

- Registered businesses including self-employed individuals and freelancers and;

- Juridical Persons like Corporations and Partnerships.

Why Does It Happen?

Imagine you own a business but your customers can only pay once every quarter and some of them do not even pay on time. This may hinder budgeting, expansion or worse, failure to operate.

This is the same with the BIR. Most taxpayers are required to pay their taxes quarterly or even yearly. There are also instances that some taxpayers evade paying taxes by under-declaring sales or not filing at all. This is why the BIR created a withholding tax system, a system to allow taxpayers to pay in advance.

But what does this have to do with refunds? The withholding tax system works by estimating your annual income. Of course, as much as we want to have more earnings, there are times that our forecasts are wrong and the actual sales are lower, resulting in tax refunds because you paid more than you owe the government.

How To Compute Tax Refund in the Philippines

Formula

General Formula for computing annual income tax refunds:

Tax Due – Prepaid Tax Payments = Tax Payable or Refund

Sample Cases

A. Compensation Income (for employees)

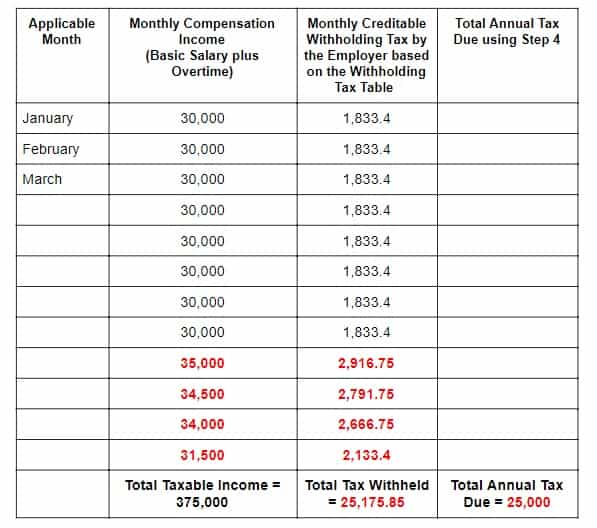

The employee has a basic salary of Php 30,000 monthly or Php 360,000 annually. However, in the last four months of the taxable year, he earned taxable overtime pay amounting to Php 5000, Php 4500, Php 4000 and Php 1,500 respectively, resulting in a Php 15,000 increase in gross taxable income.

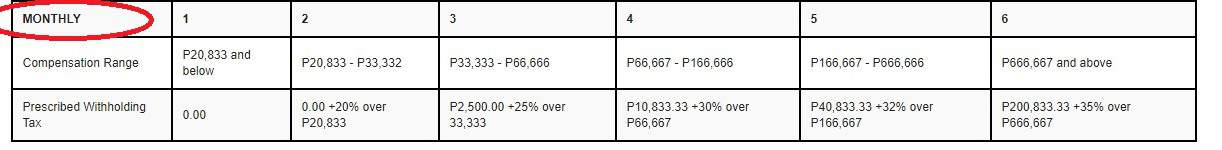

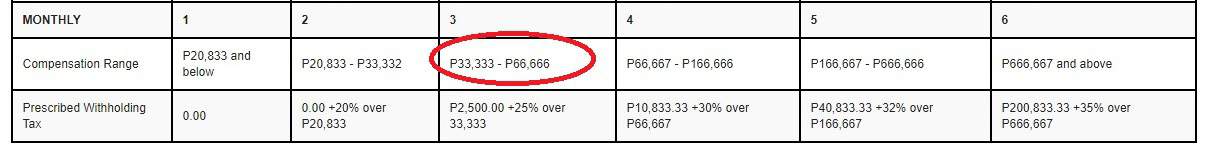

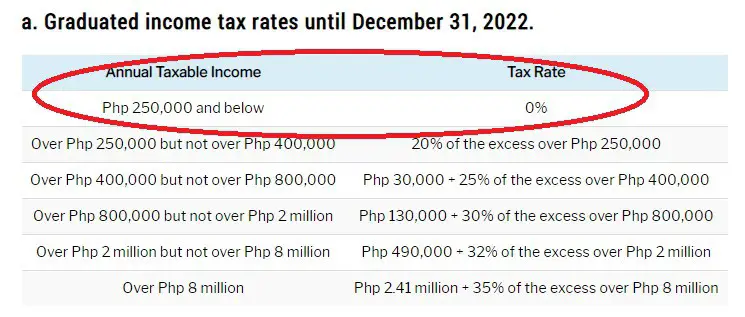

Step 1: Determine the applicable row of the compensation using the revised tax table.

Step 2: Determine the range of income.

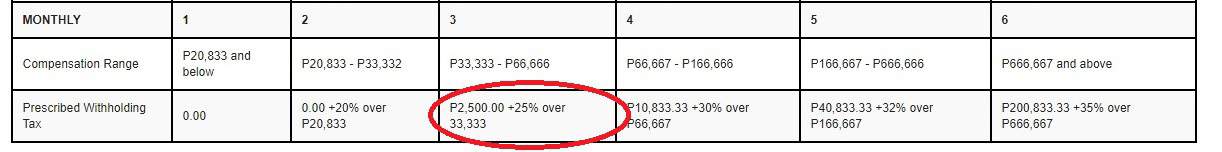

Step 3: Follow the prescribed withholding tax

Step 4: Calculate the tax due based on the total taxable income

Step 5: Compare the total amount of tax withheld and the total tax due from the employee.

Computation of Tax Refund:

Total Annual Tax Due = Php 25,000

Less: Total Creditable Tax = Php 25,175.85

Tax Refund = Php 175.85

Based on the information above, the employer over-withheld an amount equal to Php 175.85 and it shall be subsequently refunded to the employee on or before January 25 of the following year.

B. Income Tax Refund (for registered businesses, including licensed professionals, self-employed, and freelancers, etc.)

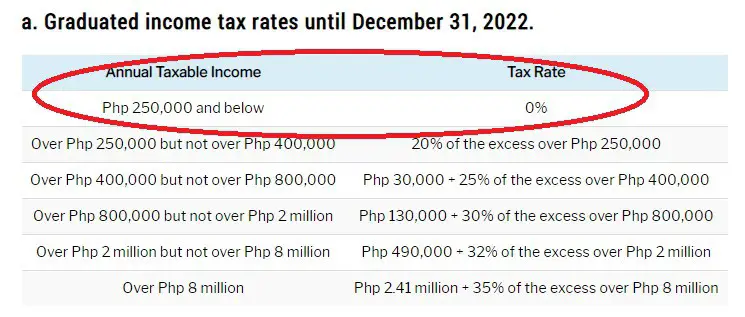

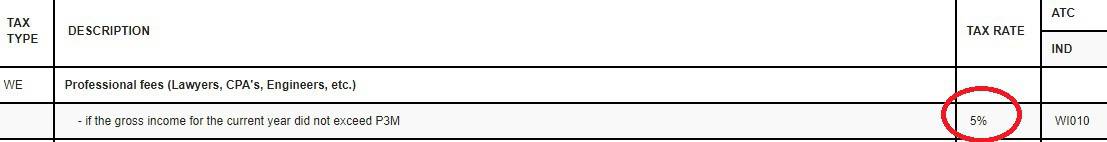

The following is an example of tax refund computation for licensed professionals (eg. doctors, lawyers, CPAs, etc.):

Gross Annual Receipts (income derived from professional services) = Php 250,000

Tax Payable based on the TRAIN Graduated Tax Table = 0

Creditable Withholding Tax based on the Expanded Withholding Tax System (5% of gross receipts in this case)

1= Php 12,500

Overpayment (for Tax Refund) = Php 12,500

Tax Payable

Expanded Withholding Tax

Based on the foregoing, the professional shall be entitled to a Php 12,500 refund from the BIR.

How To Avail of Tax Refund in the Philippines

1. For employees that are qualified for substituted filing

Employees sometimes overpay their taxes even if they do not have control over their payment because their employers file their tax returns on their behalf.

You are qualified for substituted filing if you are ALL of the following:

- Have only one employer for the whole taxable year (January to December); and

- When both you and your spouse don’t own a business.

For those who are qualified for substituted filing, you do not need to apply for a tax refund because your employer will be the one who will return your excess tax payments.

This is called year-end adjustments and the process is automatic (through the usual payroll processing) and will require no additional action from the employee.

2. For employees that are not qualified for substituted filing and business owners (including licensed professionals, self-employed individuals, and freelancers)

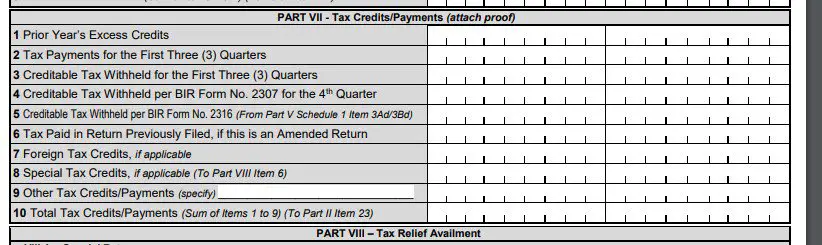

The taxpayers that are required to file their own taxes, using their respective tax returns, shall provide evidence of their overpayment by presenting withholding tax certificates namely, BIR Form 2307 for businesses and BIR Form 2316 for employees.

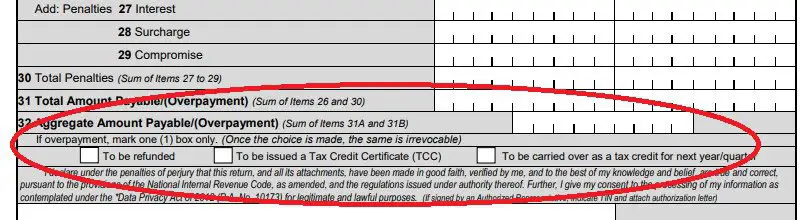

The total amount indicated in all the certificates shall be their creditable withholding tax (CWT) for the year. If their tax due is lower than their total CWT, the taxpayers have the following options:

- avail for tax refund; or

- carry it over to the next taxable year, which they can use to pay their taxes for the succeeding year.

Note: The option chosen is final and cannot be changed.

When Should Tax Refund Be Given?

1. For employees that are qualified for substituted filing

Tax refunds due to employees qualified for substituted filing are given on or before January 25 of the following year.

2. For employees that are not qualified for substituted filing and business owners (including licensed professionals, self-employed individuals, and freelancers)

Tax refunds are given to these types of taxpayers after the Commissioner of Internal Revenue has declared that the taxpayer has no other tax liability to the BIR. The processing time depends on the legal basis of the application and how much the taxpayer claims.

Frequently Asked Questions

1. Are there any other types of tax refunds?

Aside from the income tax refund discussed herein, there are other types such as VAT refund, excise tax refunds, etc. Basically, you can apply for a refund for any overpayment of taxes.

2. I already resigned from the company. Am I still entitled to the automatic tax refund (year-end adjustment)?

Yes, the tax refund shall be included on your final pay computation and is indicated in the BIR Form 2316 which shall be given to you by your employer.

3. I am an employee and I resigned in the middle of the year and got a new job. Can I still avail of the automatic tax refund from my second employer?

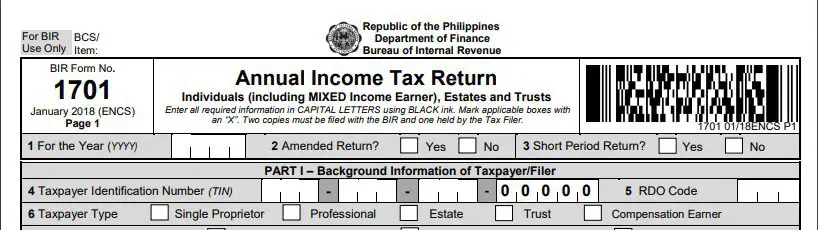

No, because you are no longer qualified for substituted filing. Instead, you need to file your own taxes using BIR Form 1700. If ever there would be a tax overpayment made by the second employer, the employee shall request for the tax refund directly from the BIR through the BIR Form 1914.

4. I am an employee who also owns a business or is also a registered freelancer. How do I apply for a tax refund?

You need to file your own taxes using BIR Form 1701. If ever there would be a tax overpayment, the employee/business owner shall request for the tax refund directly from the BIR through the BIR Form 1701.

5. How much can I get if I applied for a tax refund?

It depends on the excess payments. If you are a registered business, self-employed or a freelancer, it depends whether you have other tax liabilities to the government. An application for a tax refund entails a mandatory audit by the BIR and may take one to five years.

6. How can I claim my tax refund?

The RDO where you applied for your refund shall give you a check containing the amount requested less any tax liabilities.

Reference

- Expanded Withholding Tax Table. Retrieved 12 April 2020, from https://www.bir.gov.ph/index.php/tax-information/withholding-tax.html#wt16

Written by Miguel Antonio Dar II, CPA

in Accounting and Taxation, BIR, Government Services, Juander How

Miguel Antonio Dar II, CPA

Miguel Dar is a CPA and an experienced tax adviser specializing in tax audits. He gives tax advice to different start-ups and clarifies tax concerns of individual taxpayers. This includes helping clients register their businesses, training in tax and bookkeeping for start-up businesses, settling open cases, tax planning for future tax compliance, and responding to tax-related inquiries.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net