How To Pay Tax with GCash

You can pay for the following BIR transactions (a.k.a. “Form Series”) using GCash:

- 0600 (Payment Form)

- 1600 (Payment Form)

- 1700 (Income Tax Return)

- 1800 (Transfer Tax Return)

- 2000 (DST Return)

- 2200 (Excise Tax Return)

- 2500 (Percentage Tax & Vat)

Here’s a step-by-step guide on how to pay your taxes using GCash:

- Open your GCash app.

- Select the ‘Pay Bills’ option.

- From the list of bills payment categories, click ‘Government’.

- From the list of Government agencies, click ‘BIR’.

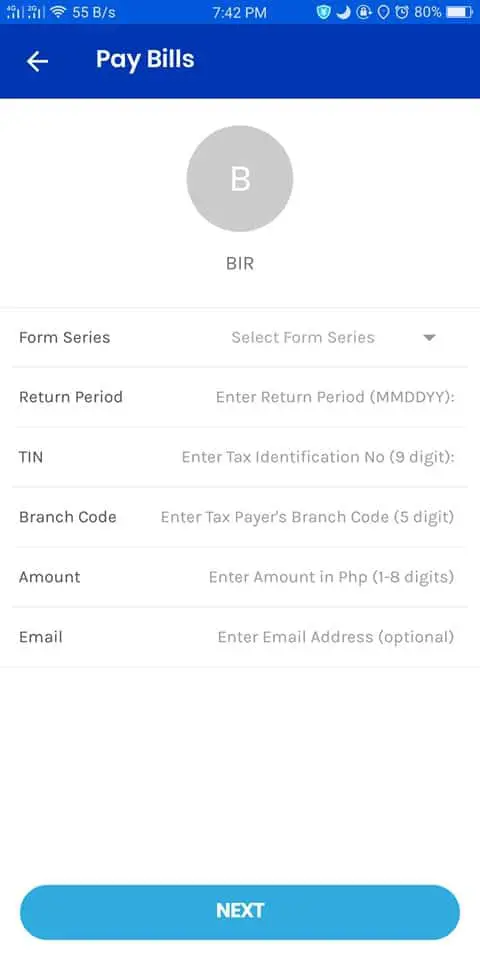

- Fill out the online transaction form and provide the following details: Form Series (see previous list above), Form Number and Tax Type (varies depending on the type of tax you’ll be paying), Return Period (i.e., the last day of the quarter or year for which you’re paying for. For example, if your paying income tax for October-December 2019, choose December 31, 2019), TIN (taxpayer identification number), Branch Code, Amount, and your email address.

- Click ‘Next’ and complete the transaction.

- Review the details and confirm the transaction.

- You’ll receive an SMS and email notification that the transaction has been completed.

Go back to the main article: How to Use GCash in the Philippines: An Ultimate Guide

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net