An Ultimate Guide to Loose Leaf Books of Accounts: Application, Requirements, Deadline, and Renewal

Whether you’re engaged in a trade or business or in the practice of profession registered with the Bureau of Internal Revenue (BIR), you are required to maintain books of accounts.

If you have recently registered a new business and have not applied for an alternative method of recording transactions, you’ll most likely use the Manual Books of Accounts, which are the BIR-mandated books where you record your business transactions.

Take note, however, that only manual handwriting is allowed when recording your business transactions using this method. Printouts of the accounting records that are pasted, glued, or inserted onto pages or sheets of the registered manual books of accounts are prohibited and subject to penalties1.

Fortunately, there is a legal way to avoid doing handwritten records, and one of the options is Loose-leaf Books of Accounts.

Table of Contents

- What Are Loose-Leaf Books of Accounts?

- What Are the Advantages of Having Loose-Leaf Books of Accounts Over Other Methods?

- What Are the Requirements To Apply for Loose-Leaf Books of Accounts?

- Step-by-Step Guide to Applying for Loose-Leaf Books of Accounts

- What Are Your Duties and Responsibilities in Maintaining Loose-Leaf Books of Accounts?

- How Do I Update My Permit To Use for Loose-Leaf Books of Accounts?

- Frequently Asked Questions

- 1. Am I required to have an accounting system to apply for Loose-leaf Books of Accounts?

- 2. If I apply for a Permit to Use (PTU) in the middle of the year, when do I start recording transactions using the Loose-leaf Books of Accounts?

- 3. During tax mapping, what should I present to the BIR officer if I do not have manual books of accounts to avoid penalties?

- 4. Can I request an extension for the deadline for submission of Loose-Leaf Books of Accounts?

- 5. Can I bind the books on a stapler or a folder instead of these being hardbound?

- References

What Are Loose-Leaf Books of Accounts?

Loose-leaf Books of Accounts are one of three BIR-approved methods for maintaining the business transactions of the taxpayer, as summarized in the table below.

| Manual | Loose-leaf | Computerized Accounting System | |

| Nature | Manual | Manual | Automated |

| Method of recording | Handwritten | Electronic | Electronic |

| Medium of Storage | Bound books with handwritten entries | Bound books with printed out entries | Electronic (DVD) |

| Annual Submission | Not required | Required | Required |

| Requires Permit to Use | No | Yes | Yes |

Based on our comparison, Loose-leaf Books of Accounts is a mix between the Manual Books and the Computerized Accounting System, since you can maintain electronic accounting records offered by Computerized Accounting Systems, but only having these printed out and book bound similar to manual books.

To use loose-leaf books, the taxpayer records their transactions using a computerized accounting system during the financial year (this may be as simple as an excel file, or it may be a large-scale accounting system). At the end of every year, the company must print out the records from the electronic records, have them bound together, and then submit the books to BIR for stamping.

According to the BIR, Loose-leaf Books of Accounts are still technically a “manual” form of maintaining company books, since you are submitting a print-out of such transactions, instead of electronic copies, to the BIR.

What Are the Advantages of Having Loose-Leaf Books of Accounts Over Other Methods?

The following are the advantages of Loose-leaf Books of Accounts:

1. Electronic Printouts of Transactions

This is a huge plus for loose-leaf books over manual books since it is generally faster to print out transactions generated by the accounting system versus writing each transaction by hand. This will save time for the bookkeeper, especially if there are a lot of transactions that will be recorded.

2. Accreditation of Accounting System Is Not Required

An advantage of Loose-leaf over a Computerized Accounting System is that it doesn’t require the accreditation of the accounting system to be used. This saves a lot of time, especially since the accreditation process may take some time to finish as the BIR needs to inspect the features and capabilities of the system the taxpayer is adopting.

What Are the Requirements To Apply for Loose-Leaf Books of Accounts?

For you to be able to use loose-leaf books, you must be issued a Permit to Use (PTU) Loose Leaf Books of Accounts, which is a certificate issued by the BIR that permits the taxpayer to use loose-leaf books.

To apply for the PTU, you must prepare the following forms and documents:

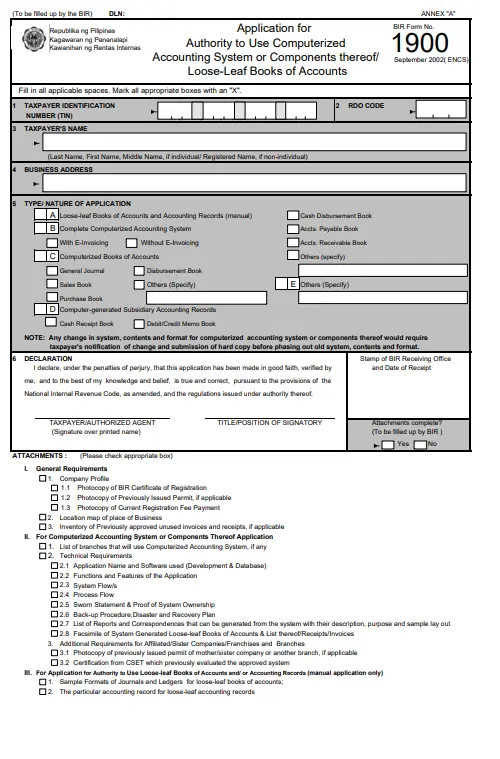

1. BIR Form 1900

The BIR Form 1900 is the required form that allows you to opt for either Loose-leaf Books or Computerized Accounting System. To apply for loose-leaf books, fill out all the basic taxpayer information and tick “A” under Section 5.

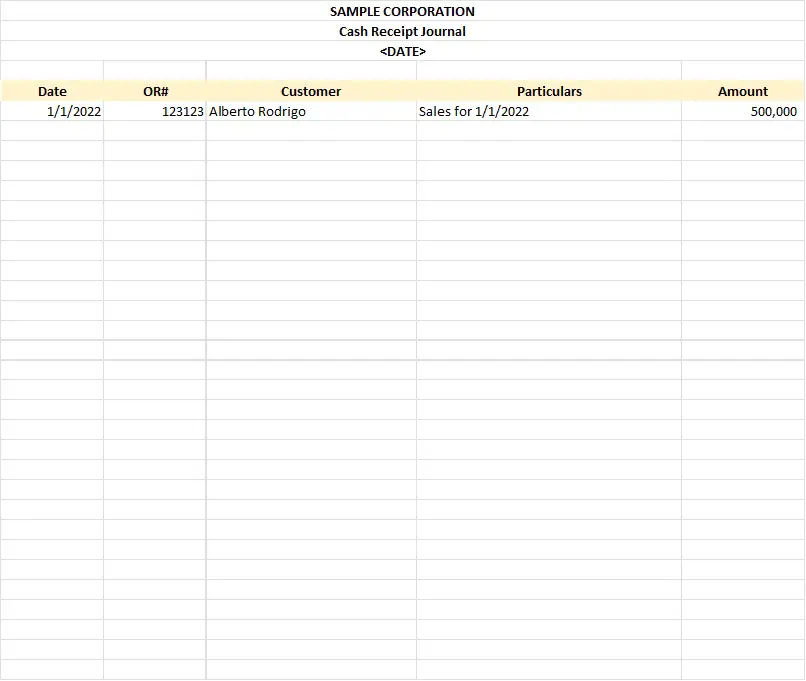

2. Printed Sample Formats of Journals and Ledgers

The BIR requires you to provide a sample of your printed-out transactions for each journal or ledger. Remember that the same journals and ledgers required under manual books are also required under loose-leaf books (i.e., General Journal, General Ledger, Cash Receipt Journal, Cash Disbursement Journal, Sales Journal, Purchase Journal).

If you are using an accounting system, you can generate the report and have this be the basis for the print-out with no major modifications. Just make sure that the sample print-out includes all the necessary information (i.e., company name, column headers, etc.) and is fitted inside your preferred paper size.

If you are not sure what to do, do not worry! Click here to download a sample template we’ve created for your reference.

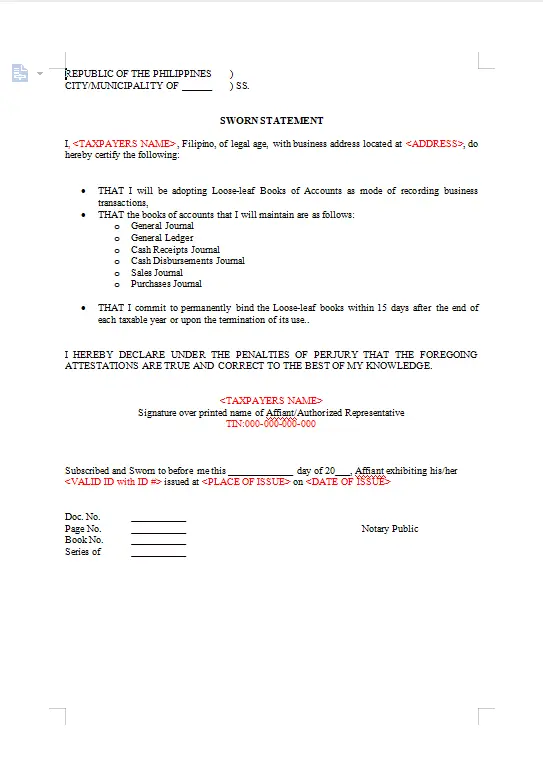

3. Sworn Statement for Application of Permit to Use Loose-leaf Books of Accounts

This is a legal document that testifies to the commitment of the taxpayer to record and file the books on the deadline prescribed by the BIR. Click here to download our free sample template so you won’t have to prepare it yourself.

4. Other Requirements

- Photocopy of BIR 2303 Certificate of Registration

- Photocopy of BIR 0605 filed for the current Annual Registration Fee (₱500)

- (Optional) Special Power of Attorney, in case a representative will apply on behalf of the taxpayer.

Step-by-Step Guide to Applying for Loose-Leaf Books of Accounts

1. Prepare the Requirements

For the complete list of requirements, please refer to the previous section

2. Go to the Revenue District Office (RDO) Where Your Business Is Registered

You can find the RDO in your Certificate of Registration issued by the BIR. Proceed to this RDO and submit all the requirements as enumerated in the previous section.

A BIR officer will check the documents submitted. Once everything has been reviewed and no major issues are found, the BIR will receive these documents.

3. Claim the Permit to Use

Once the PTU has been released to you, you may now use the loose-leaf books of accounts.

What Are Your Duties and Responsibilities in Maintaining Loose-Leaf Books of Accounts?

1. Preparation

To prepare the loose-leaf books, you must print out your transactions. Of course, you must have recorded your transactions electronically first before you can print anything.

Before printing, ensure the accuracy and correctness of the entries.

2. Hard Bounding

After printing, you must now have the printed pages hard bounded. Make sure that the hardbound cover has the taxpayer’s name, name of record, and date of coverage.

There are no limits on how many bound books you can prepare: you can do 1 bounded book per year, or you can split these per quarter. Your decision will be based on the volume of your transactions since these directly affect the number of pages you are going to print.

3. Submission

Fifteen days after the close of the year, you must be able to submit the hardbound loose-leaf books to your RDO, along with the following requirements:

- Permit to Use Loose-leaf Books of Accounts

- Sworn Statement attesting the completeness, accuracy, and correctness of entries in Books of Accounts (Click here to download our free template)

- BIR 1905 updating your registered books

Once the requirements are complete, the BIR will stamp the bound loose-leaf books.

4. Safekeeping

After stamping, you will be required to store these books, along with their attachments, at the registered business address of the taxpayer.

How Do I Update My Permit To Use for Loose-Leaf Books of Accounts?

Your PTU is only valid for the main office and branches declared upon initial registration. This means that all additional branches added after your application that would adopt loose-leaf books would require you to update your PTU2.

To update your PTU, you need to submit requirements similar to your initial submission. Specifically, the following must be submitted to the RDO:

- Original copy of Permit to Use Loose-leaf Books of Accounts

- BIR Form 1900

- Printed Sample Formats of Journals and Ledgers

- Sworn Statement for Application of Permit to Use Loose-leaf Books of Accounts

- BIR 2303 Certificate of Registration of the Branch

- BIR 0605 filed for the current Annual Registration Fee (₱500) of the branch

- (Optional) Special Power of Attorney, in case a representative will apply on behalf of the taxpayer.

The BIR will issue an updated version of your PTU once it is available.

Frequently Asked Questions

1. Am I required to have an accounting system to apply for Loose-leaf Books of Accounts?

No. If you want to save costs, you can use spreadsheet software (like MS Excel or Google Sheets) to record and print out your transactions, provided it follows the BIR-approved format. Loose-leaf Books of Accounts are still considered manual, so there is no need to have a formal accounting system. Only the manner of recording has been adopted to electronic mode.

2. If I apply for a Permit to Use (PTU) in the middle of the year, when do I start recording transactions using the Loose-leaf Books of Accounts?

Please refer to the issuance date of your Permit to Use Loose-leaf Books to determine the date when you should start recording the transactions via loose-leaf books. Any transactions that happened before the issuance date are required to be filed via manual books. However, to maintain the continuity of the records, you may include your transactions before the issuance date of the PTU in your loose-leaf books as long as the same had already been recorded in the manual books previously.

3. During tax mapping, what should I present to the BIR officer if I do not have manual books of accounts to avoid penalties?

During tax mapping procedures, one of the items which the BIR examiner will inspect is your books of accounts. Since by default taxpayers are registered to manual books of accounts, the examiner will most likely look for this one. However, if you are using loose-leaf books of accounts, you will need to present your Permit to Use Loose-leaf Books of Accounts instead. There is no need to immediately present your printed out books since the requirement is to print and submit these only 15 days after the taxable year ends.

4. Can I request an extension for the deadline for submission of Loose-Leaf Books of Accounts?

Yes. You just need to submit a letter to your RDO that requests an extension of the submission of loose-leaf books. The BIR normally provides a 30-day extension period upon request, but this may vary per branch.

5. Can I bind the books on a stapler or a folder instead of these being hardbound?

No. The books shall be hardbound; paper clips, folders, or staplers are not allowed to bind the book. It ensures that the records can be maintained for an extended period with minimal risk of physical degradation. The BIR mandates that books of accounts be kept safely in the principal address for 10 years.

References

- Bureau of Internal Revenue (BIR). (2019). Revenue Memorandum Circular No. 29-2019. Retrieved from https://www.bir.gov.ph/images/bir_files/internal_communications_2/RMCs/RMC%20Full%20Text%202019/RMC%20No.%2029-2019_copy.pdf

- Bureau of Internal Revenue (BIR). (2017). Revenue Memorandum Circular 68-2017. Retrieved from https://www.bir.gov.ph/images/bir_files/internal_communications_2/RMCs/RMC%20No%2068-2017.pdf

Written by Romeo Miguel Ginez, CPA

in Accounting and Taxation, BIR, Government Services, Juander How

Romeo Miguel Ginez, CPA

Romeo Miguel Ginez is a Certified Public Accountant who has helped different companies and individuals with their accounting and tax-related concerns since 2014. He currently runs an accounting firm that advocates automation and cloud-based accounting for SMEs. He is also an educator, and a gamer, and has a passion to debate important topics. To contact Romeo, send an email to [email protected], or reach out to his mobile number 09176529792 through SMS, Viber, or WhatsApp.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net