How To Compute Severance Pay Philippines (With FREE Calculator)

If the pandemic experience has taught us one thing: we cannot counter the economic threat brought by events beyond our control. However, we can prepare for that uncertain day by knowing employee rights and the statutory benefits we’re entitled to, such as separation or severance pay. Read on to know who is entitled to this benefit, the applicable conditions, and how to compute it.

Related: How to Apply for SSS Unemployment Benefit: An Ultimate Guide

Table of Contents

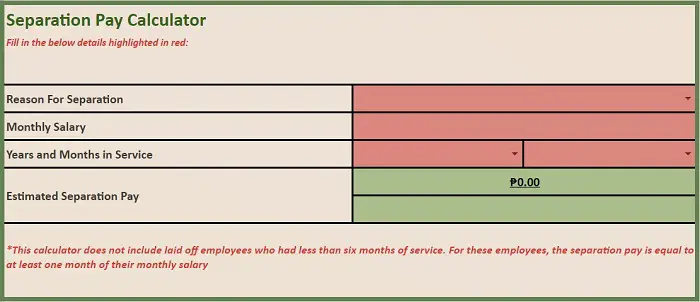

How To Compute Severance Pay Philippines Using Our Excel Calculator [FREE Download]

Looking for a quick way to calculate your separation pay? Here’s our free Separation Pay Calculator, created through an Excel spreadsheet to help you estimate how much you will receive after your dismissal. Simply click the link to download the file.

Please note that this tool does not account for employees with less than six months of service in their company. If the period of your employment is less than six months, your separation pay is equivalent to at least one month of your monthly salary.

What Is Separation Pay?

Separation pay, also known as severance pay, is the additional compensation given to employees at the time of their dismissal from the company. The purpose of the separation pay is to assist the employees financially during their adjustment period from termination until they find new employment.

However, there are underlying conditions that have to be met for an employee to receive such payments. These conditions are called authorized causes, which means the termination of employment must be for valid business reasons under the labor laws and not due to violations by the employee.

Who Qualifies for Severance Pay?

1. According to the Labor Code

The Labor Code lists the following authorized causes1 to justify an employee’s termination:

- Installation of labor-saving devices: There is the introduction of a new machine, equipment, or automation devices for economic reasons such as efficiency and cutting business costs, and termination of employees is the only option available.

- Redundancy: Some extra positions or services are unnecessary to operate the business.

- Retrenchment: There is a perceived or actual loss, and termination of employment is necessary to prevent future or further losses.

- Closing or cessation of business operations: There is a decision by the management to close or cease operations.

- Disease: The employee suffers from an incurable illness, and continued employment is detrimental to his/her health and other employees’ health.

2. According to the Supreme Court

The Supreme Court Decisions provide for the following authorized causes:

- Reinstatement is no longer possible: It is already impossible for a dismissed employee to retain his/her previous position because of the cessation of business, or the position no longer exists, and there is no other role to which he/she can be assigned.

- Strained relations: This is when separation pay is more favorable for the employee than being reinstated or restored to his/her previous position because the working environment is no longer desirable.

3. According to DOLE Regulations

The following are additional authorized causes provided by the DOLE Regulations2:

- Lack of service assignment of security guard for a continuous period of six months;

- Lack of service assignment of a security guard because of age; and

- Lack of reassignment of deployed personnel after three months.

Who Doesn’t Qualify for Separation Pay?

Just causes3, as opposed to authorized causes, are justified reasons for termination of employment due to an employee’s behavior or actions. If termination is due to these causes, separation pay is not necessary unless it is agreed in the employment contract, company policy, or collective bargaining agreement that separation pay will be given.

The Labor Code provides the following causes to terminate an employee:

- Serious misconduct

- Willful disobedience of a lawful order

- Gross and habitual neglect of duty

- Fraud

- Willful breach of trust

- Commission of a crime against the employer, his family, or authorized representatives

- Similar causes as the above

Voluntarily resigned employees are also not entitled to separation pay unless it’s clearly stated in their contract or company policy that they can receive such payments after leaving the company.

In addition, employers whose businesses ceased operations due to severe financial losses are not obligated to pay their employees’ separation pay, provided they can comply with the strict requirements proving they have closed their businesses due to this reason.

How To Compute Severance Pay Philippines: 2 Ways

There are two ways to compute separation pay. Note that a fraction of six months is considered one year:

1. If Dismissal is Due to Installation of Labor-Saving Devices and Redundancy

One-month salary, or one-month pay for every year of service, whichever is higher.

Formula: (One Month Pay) x (Years of Service) = Separation Pay

If your monthly salary is ₱20,000 and the years of service are 5, your separation pay will be ₱100,000.

20,000 x 5 = 100,000

Let’s say you’ve been with your employer for four years and six months. This will be considered five years since a fraction of six months is one year.

2. If Dismissal is Due to Retrenchment, Closing of Business, or Disease

One-month or half-month salary for every year of service, whichever is higher.

Formula: (One Month Pay / 2) x (Years of Service) = Separation Pay

With a monthly salary of ₱20,000 and 5 years of tenure, the separation pay will be ₱50,000.

(20,000 / 2) x 5 = 10,000 x 5 = 50,000

Tips and Warnings

1. Do your due diligence in determining the cause of your dismissal

Review the Labor Code of the Philippines and examine if the cause of your dismissal falls under the authorized causes to be eligible for separation pay. Also, determine if your employer followed the legal requirements for terminating you.

2. Do not allow the management or human resource department to deceive you into accepting less than what is due to you

If you have not received your final payment in full, you should not sign any affidavit of quitclaim, release, or waiver that may free your employer of their legal responsibilities. However, if you really need money, you may sign the document and write the words “UNDER PROTEST” to express your unwillingness to sign.

3. Do not immediately report your employer to DOLE

It is essential to settle things correctly with your employer before taking any action that would strain your relationship with them. Know your rights as an employee and file disputes as necessary.

4. At the same time, report if there is a clear violation of the Labor Code

Provided that your accusations are valid and no action was taken after you have raised your concern to the management, it’s time for you to escalate your case to the labor arbiter4.

5. The rules on separation pay may change based on the employment contract, company policy, or collective bargaining agreement

For termination due to reasons outside of the authorized causes, separation pay may not be necessary unless the employment contract or collective bargaining agreement says otherwise or it has been a common practice of the company to grant separation pay in similar cases.

6. Your employer cannot demand your resignation

As an employee, you have the right to voluntary resignation. However, it becomes illegal if you resign involuntarily or were pressured to do so as this becomes constructive dismissal5 or termination disguised as resignation.

7. File a labor case if you were constructively or illegally dismissed, regardless of whether you have already received your separation pay

If you were forced to resign for your employer to avoid paying separation pay or dismissed without due cause, you have the right to file a case against your employer. Accepting separation pay will not invalidate your claim because you just lost your source of income, and you have no choice but to accept the money offered to you.

Frequently Asked Questions

1. Who is entitled to separation pay?

Only terminated employees due to authorized causes are entitled to separation pay.

2. Is separation pay mandatory?

Yes. The Labor Code requires employers to grant separation pay, except for cessation of business due to severe financial losses.

3. Is it required for the business to incur losses before management decides to close down?

No, it is management’s prerogative6 if they want to cease operations. Even if the business is not incurring losses, it can close business as long as it is done in good faith and compliance with the Labor Code.

4. Can a terminated employee get separation pay?

If an employee was dismissed due to authorized causes in compliance with the Labor Code, he/she is entitled to separation pay. However, if the termination was due to violations committed by the employee, then he/she has no right to separation pay.

5. Is 13th-month pay included in separation pay?

The 13th-month pay is not included in the separation pay. Instead, it is part of the final pay or the totality of monetary benefits given to a terminated employee. This final pay also includes the separation pay.

6. Can I get severance pay if I resign?

No. Employees who voluntarily resign are not entitled to separation pay because the benefit is only given to dismissed employees.

7. Is back pay the same as separation pay?

Separation pay differs from back pay, which is the total benefits a terminated or resigned employee will get. Back pay is also known as final or last pay.

8. When will I receive separation pay?

Separation pay must be released within thirty days from the employee’s dismissal.

9. Is a probationary employee eligible for separation pay?

Yes, a probationary employee is eligible for separation pay regardless of tenure as long as the reason for termination is one of the authorized causes.

10. My previous employer sold the company. However, the new owners did not want to continue our employment contract because, according to them, there was no such agreement. Instead, they urged us to apply as new probationary employees. Is this legal?

Yes, it is legal on the part of the new owner. They had no obligation to continue your contract because they did not agree to absorb you. However, your previous employer must release your separation pay because you were dismissed due to the closure of the business after the company was sold.

11. My job contract says that separation pay will not be granted. Is this legal?

As long as the separation is due to authorized causes, employers are required by the Labor Code to grant separation pay to terminated employees. The only exception is when the business closes due to severe financial losses, in which case they must provide proof of the severe losses. Employers violating labor laws may be subject to fines and penalties or imprisoned for up to three years7.

12. I am being transferred to a different department but don’t want to. If I refuse the offer, will it cause termination, and am I eligible for separation pay?

Management’s prerogative is transferring an employee within the company8, provided that the transfer is reasonable and not prejudicial to the employee. If you refuse the offer, you may be terminated but not for any authorized causes under the Labor Code. Your refusal will fall under willful disobedience or insubordination, in which case you will not receive separation pay. The same is true if you voluntarily resign.

13. Will I receive separation pay if my contract ends as a Contractual Employee?

If termination is due to the expiration of your contract, you will not receive separation pay. However, if you were dismissed before the end of the contract and for authorized reasons provided by law, you are entitled to separation pay9.

14. Will I receive separation pay if my contract ends as a Project-Based Employee?

If your contract has ended due to the completion of the project you’re engaged in, you will not receive separation pay. However, for people working in a construction company, if the total period they have worked on a project is at least one year and the contract did not specify a date for the project’s completion10, they are considered regular employees and are therefore entitled to separation pay.

15. Will I receive separation pay if my freelance contract ends?

As a freelancer, you have no employee-employer relationship with your client; therefore, you will not receive separation pay.

16. Will I receive separation pay if I am in “Floating Status?”

If you are in floating status due to the temporary closure of the business, you are still considered an employee, so you will not be entitled to separation pay. However, if your floating status lasts for more than six months because your company closed down to prevent losses, your employer must follow the laws on retrenchment, and you must then receive separation pay.

17. Will I receive separation pay if my dismissal was due to the business being forced to close down by the government?

Since your employer did not inherently close the business and was forced to close down due to government policy, your employer is not required to release separation pay.

18. Is a retrenched employee’s separation pay subject to a tax?

No, it’s not. According to the amended National Internal Revenue Code, separation pay received by an employee due to reasons that are beyond his/her control is exempted from income tax11.

However, the retrenched employee must prove that he or she is eligible for this exemption first. To do so, he/she must present a Certificate of Tax Exemption (CTE) from Income and Withholding Tax. In addition, the employee must submit the following documents12 to the Revenue District Office where he is registered:

- A written notice to the DOLE Regional Office and the employee at least 30 days before termination. It must also indicate the ground/s for termination.

- A letter request from the employee or the employer for the tax exemption of the separation pay.

- In the case of a juridical entity (e.g., corporation), a board resolution that states the following: (i) the retrenchment is made in good faith and not to deprive the employee of his security of tenure; (ii) the retrenchment is necessary to prevent further losses; (iii) expected/incurred loss is severe and real, together with evidence that supports this; (iv) the employees’ termination is based on fair and justifiable criteria.

- If the business is a sole proprietorship, an affidavit or a sworn statement from the owner is required instead of a board resolution.

References

- : Official Gazette of the Philippines. Presidential Decree No. 442 (Labor Code) (1974).

- Department of Labor and Employment (DOLE). (2016). Department Order No. 150-16, Series of 2016 (Revised Guidelines Governing the Employment and Working Conditions of Security Guards and Other Private Security Personnel in the Private Security Industry). Intramuros, Manila.

- Del Puerto, J. Just Causes. Retrieved 20 September 2021, from https://www.laborlaw.ph/legal/just-causes-due-process-in-labor-law

- Frequently Asked Questions (FAQs). Retrieved 20 September 2021, from https://nlrc.dole.gov.ph/FAQS

- Termination of Employment. Retrieved 20 September 2021, from https://blr.dole.gov.ph/2014/12/11/termination-of-employment/

- Del Puerto, J. Management Prerogative. Retrieved 20 September 2021, from https://www.laborlaw.ph/legal/management-prerogative-employers-bundle-of-rights

- Palabrica, R. (2020). Issues on separation pay. Retrieved 20 September 2021, from https://business.inquirer.net/299993/issues-on-separation-pay

- Labor Laws of the Philippines (Part 3). (2006). [PDF] (p. 2). Retrieved from https://www.chanrobles.com/PART3.pdf

- Department of Labor and Employment (DOLE). (2002). Department Order No. 18-02, Series of 2002 (Rules Implementing Articles 106 to 109 of the Labor Code, As Amended). Manila.

- Department of Labor and Employment (DOLE). (1993). Department Order No. 19, Series of 1993 (Guidelines Governing the Employment of Workers in the Construction Industry).

- Sarmiento, R. (2021). Taxation of separation pay. Retrieved 12 February 2022, from https://www.bworldonline.com/taxation-of-separation-pay/

- Separation Pay of a Retrenched or Laid Off Employee Due to COVID-19, Not Subject to Tax. Retrieved 12 February 2022, from https://www.alburolaw.com/separation-pay-of-a-retrenched-or-laid-off-employee-due-to-covid-19-not-subject-to-tax

Written by Miriam Burlaos

Miriam Burlaos

Miriam is addicted to learning new things and constantly looks for brand new knowledge to be obsessed about. She currently works full-time as an underwriting assistant while pursuing her passion for writing on the side. Nowadays, she’s also learning how to code because she wants to see her ideas come to life.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net