How To Get a Certificate of Tax Exemption in the Philippines

This article has been reviewed and edited by Miguel Dar, a CPA and an experienced tax consultant who specializes in tax audits.

Isn’t it comforting to know that not everything you earn is taxed?

The Tax Code of the Philippines imposes tax exemption on certain incomes and transactions. Likewise, certain individuals and institutions are entirely exempted from paying taxes.

Equally important to knowing what taxes you should pay is knowing what tax exemption you’re entitled to. In this article, you will learn who is exempt from paying taxes, the requirements to obtain a Certificate of Tax Exemption, and the procedures in applying for this certificate.

Disclaimer: This article is for general information only and is not substitute for professional advice.

Table of Contents

- What Is a Tax Exemption?

- What Is a Certificate of Tax Exemption?

- BIR Tax Exemption Certificate Sample

- Who Are Qualified for Tax Exemption in the Philippines?

- Where To Get a Certificate of Tax Exemption?

- Certificate of Tax Exemption Requirements

- How To Apply for a Certificate of Tax Exemption in the Philippines

- Frequently Asked Questions

- 1. Can I apply for tax exemption online or via email?

- 2. Do I need to submit all the requirements listed above to obtain the Certificate of Tax Exemption?

- 3. How can I apply for tax exemption for a religious organization?

- 4. I’m a student applying for a scholarship. How can I apply for a tax exemption?

- 5. Is there a specific template for Certificate and Affidavit of Low/No Income?

- 6. How can I apply for tax exemption for scholarship purposes if my parents’ place of residence is far from mine?

- References

What Is a Tax Exemption?

Taxes are the lifeblood of the government and they are necessary to fund government services such as healthcare, education, and social security. However, there are instances where exemptions may be given, which allow the individual or organization to pay zero tax. A tax exemption refers to an individual’s or an organization’s legal right to exclude all or a percentage of income/transactions from taxation. If an income or transaction is tax-exempt or tax-free, it is not part of the tax computation. This results in either lower taxes or no tax at all.

What Is a Certificate of Tax Exemption?

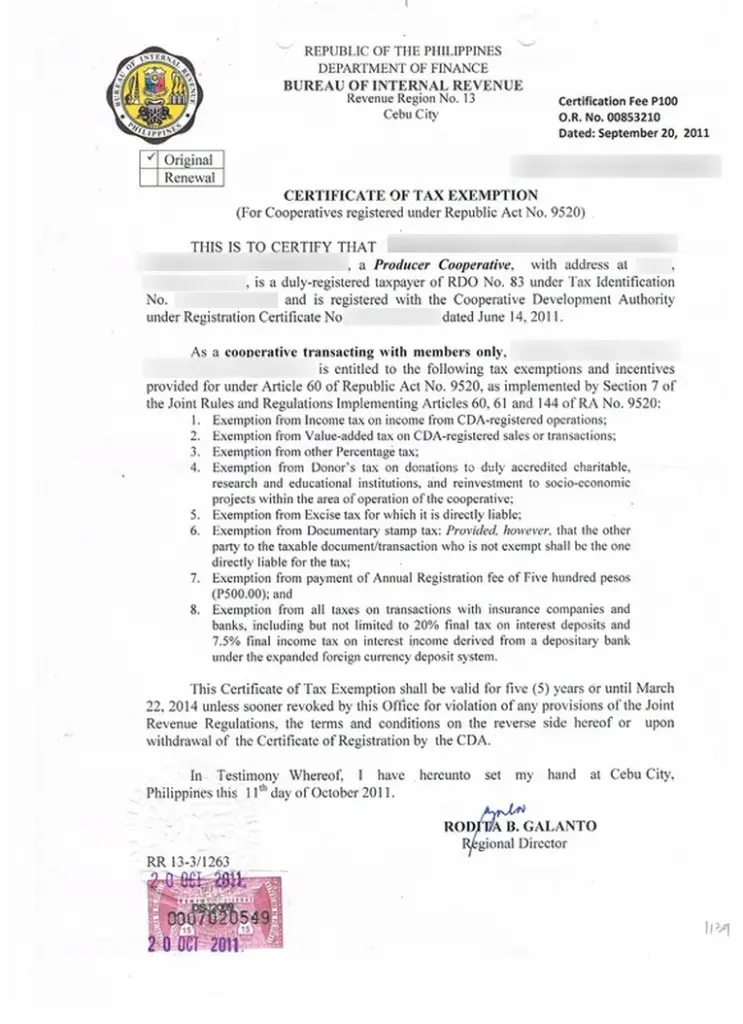

Certificate of Tax Exemption or CTE is issued to individuals or organizations who are exempt from tax. Exemption from taxation, as the name suggests, is when certain individuals, organizations, or institutions are free from taxes due to privileges granted by legislative grace. Because the government compels the citizens to pay taxes, exemptions are being analyzed strictly against the taxpayer.

BIR Tax Exemption Certificate Sample

Who Are Qualified for Tax Exemption in the Philippines?

According to the Tax Code1, the following are exempt from paying taxes and therefore may be issued Certificate of Tax Exemption:

- Individuals with no income, minimum wage earners, and those whose taxable income does not exceed PHP 250,000.

- Cooperatives registered in the Cooperative Development Authority (CDA) which transact business with members only.

- CDA-registered cooperatives which transact business with members and non-members, with accumulated reserves and undivided net savings of not more than PHP 10 million.

- Non-stock, nonprofit educational institutions.

- Non-stock, nonprofit corporations that fall under Section 30 of the National Internal Revenue Code.

Where To Get a Certificate of Tax Exemption?

The Certificate of Tax Exemption (CTE) is obtained from the Revenue District Office (RDO) having jurisdiction over the residence of the taxpayer or where the taxpayer is registered.

Certificate of Tax Exemption Requirements

1. For Scholarship and Job/Livelihood Programs

The BIR Citizen’s Charter of 20202 provides for the following documentary requirements:

- Certificate of Low Income or No Income signed by the Barangay Chairman of the place where the applicant resides

- Duly notarized Affidavit of Low Income or No Income from a notary public

- Proof of payment of PHP 100 Certification Fee and PHP 30 loose Documentary Stamp Tax from the Collection Section of your RDO

Additional documents if transacting through a representative:

- Special Power of Attorney executed by the applicant

- Government-issued ID of authorized representative

2. For Cooperatives

The Revenue Memorandum Circular No. 124-20203 lists the below requirements:

a. Requirements for New Application

- Certified True Copies of the Articles of Cooperation and By-Laws, as certified by the CDA;

- Certified True Copy of the New Certificate of Registration issued by the CDA under the new Cooperative Code, as certified by the CDA;

- Certified True Copy of the current Certificate of Good Standing issued by the CDA effective on the date of application;

- Certified True Copy of the BIR Certificate of Registration of the Cooperative; and

- Original Copy of Certification under Oath of the List of Cooperative Members with their respective Taxpayer Identification Number (TIN), if already available, and their capital contributions prepared by the authorized official of the Cooperative.

b. Requirements for Renewal

- Certified True Copies of the Latest Articles of Cooperation and By-Laws, as certified by the CDA;

- Certified True Copy of the new Certificate of Registration issued by the CDA under the new Cooperative Code, as certified by the CDA;

- Certified True Copy of the current Certificate of Good Standing issued by the CDA effective on date of application; and

- Certified True Copy of Latest financial statements of the immediately preceding year duly audited by a BIR-accredited independent Certified Public Accountant.

3. For Non-Stock, Nonprofit Educational Institutions

Revenue Memorandum Order No. 44-20164 provides the following requirements in the issuance of CTE:

- Original copy of the application letter for the issuance of Tax Exemption Ruling

- Certified True Copy of the Certificate of Good Standing issued by the Securities and Exchange Commission

- Original copy of the Certification under Oath of the Treasurer as to the amount of the income, compensation, salaries or any emoluments paid to its trustees, officers and other executive officers

- Certified True Copy of the Financial Statements for the last three years

- Certified True copy of government recognition/permit/accreditation to operate as an educational institution issued by the Commission on Higher Education (CHED), Department of Education (DepEd), or Technical Education and Skills Development Authority (TESDA);

- If the government recognition/permit/accreditation was issued five years prior to the application, an original copy of a current Certificate of Operation/Good Standing or other equivalent document issued by the appropriate government agency (CHED, DepEd, or TESDA) shall be submitted as proof that it is operating as non-stock and nonprofit educational institution

- Original copy of the Certificate of Utilization of Annual Revenues and Assets by the Treasurer or his equivalent of the non-stock and nonprofit educational institution

4. For Non-Stock, Nonprofit Corporations

Revenue Memorandum Order No. 38-20195 provides the following requirements in the issuance of CTE:

- Original application letter for issuance of Tax Exemption Ruling. The letter shall cite the particular paragraph of Section 30 of the NIRC upon which the application for exemption is being based;

- Certified true copy of the latest Articles of Incorporation (AOI) and By-Laws issued by the Securities and Exchange Commission (SEC)

- Original Certification under Oath by an executive officer of the corporation or association as to:

- full description of its past, present, and proposed activities,

- the sources and disposition of income,

- detailed description of all revenues which it seeks to be exempted from income tax, and

- amount of income, compensation, salaries or any emoluments paid by the corporation or association to its trustees, officers and other executive officers.

- Original Certification issued by the RDO where the corporation or association is registered, indicating the TIN of the corporation, and certifying that said corporation is not subject of any pending investigation, on-going audit, pending tax assessment, administrative protest, claim for refund or issuance of tax credit certificate, collection proceedings, or a judicial appeal; or if there be any, the Original Certification issued by the RDO on the status thereof; and

- Certified True Copies of the Income Tax Returns or Annual Information Returns and Financial Statements of the corporation or association for the last three (3) years.

How To Apply for a Certificate of Tax Exemption in the Philippines

For Scholarship and Job/Livelihood Programs

- Submit the requirements in the Administrative Section of your RDO.

- Pay Certification Fee and loose Documentary Stamp Tax at the Collection Section and present the proof of payment to the Administrative Section.

- Receive requested documents in the Administrative Section.

For Cooperatives

- Accomplish the BIR Form 1945 in three (3) copies, signed by the applicant who may either be the President or any responsible officer of the cooperative authorized to file the application for and on behalf of the cooperative.

- Submit the form to the BIR District Office where the cooperative is registered, along with all the necessary documents.

For Non-Stock, Nonprofit Educational Institutions

Non-stock, nonprofit educational institutions shall file their Applications for Tax Exemption with the Office of the Assistant Commissioner, Legal Service, Attention: Law Division.

For Non-Stock, Nonprofit Corporations

- File the request for Certificate of Tax Exemption with the RDO where the corporation is registered for pre-evaluation.

- If qualified based on pre-evaluation, the RDO officer shall prepare the CTE (Annex “B”), together with a memorandum stating the factual and legal basis for recommending the issuance of the CTE, and endorse the documents to the Office of the Regional Director.

- The Regional Director shall sign the CTE if he agrees with the RDO’s recommendation and issue the CTE to the requesting corporation, otherwise he shall return the documents to the RDO along with his findings/instructions.

- If not qualified based on pre-evaluation, the RDO shall notify in writing the applicant stating the factual and legal bases for the denial of CTE, and the corporation shall be held liable for income tax.

Frequently Asked Questions

1. Can I apply for tax exemption online or via email?

Currently, the BIR does not provide an online application for tax exemption. This can only be processed by physically going to your RDO to submit the requirements.

2. Do I need to submit all the requirements listed above to obtain the Certificate of Tax Exemption?

Yes. All requirements listed above for specific applicants are necessary to get CTE.

3. How can I apply for tax exemption for a religious organization?

Religious organizations shall follow the procedures of application for tax exemption under non-stock, nonprofit corporations.

4. I’m a student applying for a scholarship. How can I apply for a tax exemption?

You must complete the required documents for obtaining a CTE for scholarships and submit them to your RDO.

5. Is there a specific template for Certificate and Affidavit of Low/No Income?

The BIR did not provide a particular template in their current list of certificates6 available in the website. However, make sure you have specified the intended purpose of the application for Certificate of Tax Exemption.

6. How can I apply for tax exemption for scholarship purposes if my parents’ place of residence is far from mine?

For documents you are unable to procure, you may clarify it with the BIR by contacting their Customer Assistance Division (formerly BIR Contact Center) at Hotline No. 8538-3200 or sending an email to [email protected]. You may also inquire through submitting a request to the Electronic Freedom of Information Program or eFOI.

References

- National Internal Revenue Code (1997).

- Bureau of Internal Revenue (BIR). (2020). BIR Citizen’s Charter Handbook [Ebook] (2nd ed., pp. 112-113). Retrieved from https://www.bir.gov.ph/images/bir_files/downloadables/bir-files/BIR_Citizens_Charter_2020-2nd_Edition.pdf

- Bureau of Internal Revenue (BIR). (2020). Revenue Memorandum Circular No. 124-2020.

- Bureau of Internal Revenue (BIR). (2016). Revenue Memorandum Order No. 44-2016.

- Bureau of Internal Revenue (BIR). (2019). Revenue Memorandum Order No. 38-2019.

- Certificates. Retrieved 27 September 2021, from https://www.bir.gov.ph/index.php/bir-forms/certificates.html

Written by Miriam Burlaos

in Accounting and Taxation, BIR, Government Services, Juander How

Miriam Burlaos

Miriam is addicted to learning new things and constantly looks for brand new knowledge to be obsessed about. She currently works full-time as an underwriting assistant while pursuing her passion for writing on the side. Nowadays, she’s also learning how to code because she wants to see her ideas come to life.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net