How To Compute Night Differential in the Philippines (With Free Calculator)

Most BPO (Business Process Outsourcing) and Call Center companies in the Philippines operate on a shifting schedule. Some industries, like manufacturing and health care, have the same setup to have real-time communication with clients, investors, and customers.

While it’s good for business, working a night shift may affect your health since you’ll sacrifice sound sleep at night. A night differential pay should be given to compensate employees reporting to work from 10 PM to 6 AM. This should not be less than 10% of your hourly rate as mandated by the Department of Labor and Employment.

This article will teach you about night differential pay and how much you can get.

Table of Contents

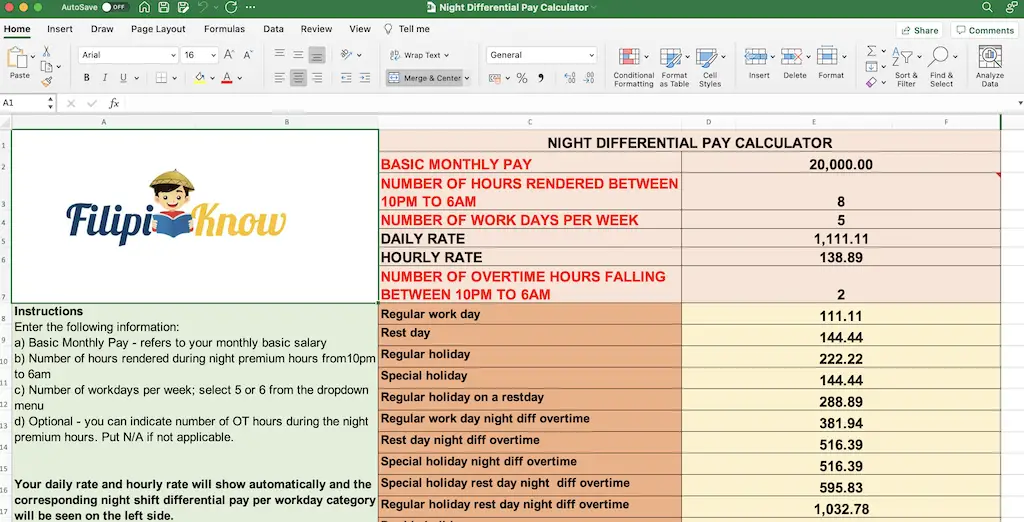

Free Download: Night Differential Philippines Calculator (Excel)

Do you want a quick way to compute your night differential pay? Simply download our free night differential pay calculator in Excel, read the instructions, and enter the requested information. Continue reading the article below to learn more about night differential pay and the formula/s used to compute it.

What Is Night Differential?

Night differential is the premium pay given to employees who work from 10 PM to 6 AM. It should not be less than 10% of your hourly wage per DOLE regulations. Some companies offer up to 20% night differential pay to attract more applicants and retain employees.

Employers must provide night differential pay as per Article 86 of Book III – Conditions of Employment of the Labor Code of the Philippines1, enacted by President Ferdinand Marcos in 1974. Meanwhile, Republic Act 117012 was signed by President Rodrigo Duterte into law in April 2022, granting night differential pay to government employees (permanent, contractual, temporary, and casual staff).

Who Is Eligible for Night Differential Pay?

The night differential pay applies to all employees with the following exclusions:

- Government employees not covered by RA 11701

- Employees of retail and service establishments with less than five workers

- Domestic helpers or kasambahays

- Managerial employees

- Field employees who are unsupervised upon execution of their work duties outside the office

- Employees of companies duly registered as Barangay Micro Business Enterprises (BMBEs)

It is important to note that your employment agreement or contract shall specify your compensation package, including your basic salary, overtime, night differential pay, holiday pay, and other allowances.

If you are unsure of your job grade or level, you may clarify your eligibility to your HR, as compensation packages differ from one company to another.

Expanding on the first item on the list of exclusions above, RA 11701 specifies the exclusions in the government sector as follows:

- Government employees whose services are needed 24 hours per day

- Uniformed personnel of the Armed Forces of the Philippines and the Philippine National Police

- Employees determined by the Civil Service Commission (CSC) and the Department of Budget and Management (DBM) are excluded from this benefit.

How To Compute Night Differential Pay

1. What Is the Formula for Night Differential Pay?

Night Differential Pay = Hourly Rate x Night Differential Rate per Hour x Number of Hours

Note that the government-mandated night differential rate is at a 10% minimum, but private organizations may offer a higher rate. Check your employment contract first to know your night differential rate.

Meanwhile, “Number of Hours” refers to the hours rendered between 10 PM to 6 AM.

2. How To Get the Daily Rate and Hourly Rate?

Daily Rate = (Monthly Basic Pay x 12 months) ÷ Total working days in a year

See samples below:

a. (₱20,000 x 12 months) ÷ 313 (if working 6x/week)

Daily rate: ₱766.78

b. (₱20,000 x 12 months) ÷ 261 (if working 5x/week)

Daily rate: ₱919.54

You must divide the daily rate by 8 hours to get the hourly rate.

a. Daily rate: ₱766.78 ÷ 8 hours

Hourly rate: ₱95.85

b. Daily rate: ₱1,111.11 ÷ 8 hours

Hourly rate: ₱138.89

3. Sample Night Differential Computation

For the scenarios below, we will use the following information:

| Monthly salary | ₱20,000 |

| Work Schedule | 5 times/week; 10 PM – 6 AM shift |

| Night differential hours | 8 hours |

| Night differential rate | 10% |

| Daily rate | ₱1,111.11 |

| Hourly rate | ₱138.89 |

a. Night Differential on a Regular Work Day

Night Differential Pay = Hourly Rate x Night Differential Rate per Hour x Number of Hours

₱138.89 X .10 X 8 hours = ₱111.11 night differential pay/shift

b. Night Differential on a Rest Day

Rest Day Night Differential Pay = Hourly Rate x 130% x Night Differential Rate per Hour x Number of Hours

₱138.89 X 1.30 X .10 X 8 hours = ₱144.44 rest day night differential pay

130% covers the 30% premium or additional pay on a rest day work as DOLE mandates under Article 93 of Conditions of Employment.

c. Night Differential During Regular Holiday

Regular Holiday Night Differential Pay = Hourly Rate x 200% x Night Differential Rate per Hour x Number of Hours

₱138.89 X 2 X .10 X 8 hours = ₱222.22 regular holiday night differential pay

200% covers the 100% premium or additional pay on regular holiday work as DOLE mandates under Article 93 of Conditions of Employment.

d. Night Differential During Special Holiday

Special Holiday Night Differential Pay = Hourly Rate x 130% x Night Differential Rate per Hour x Number of Hours

₱138.89 X 1.30 X .10 X 8 hours = ₱144.45 special holiday night differential pay

130% covers the 30% premium or additional pay on special holiday work as DOLE mandates under Article 93 of Conditions of Employment.

e. Night Differential During Regular Holiday on a Rest Day

Regular Holiday Rest Day Night Differential Pay = Hourly Rate x 260% x Night Differential Rate per Hour x Number of Hours

₱138.89 X 2.60 X .10 X 8 hours = ₱288.89 special holiday rest day night differential pay

260% covers the 160% premium or additional pay on a regular holiday rest day work as DOLE mandates under Article 93 of Conditions of Employment.

f. Night Differential With Overtime

In this section, you will see the multipliers for every type of night differential pay with overtime.

| Type of Work Day | Night Differential with Overtime |

| Regular Work Day | 1.375 |

| Rest Day | 1.859 |

| Special Holiday | 1.859 |

| Regular Holiday | 2.86 |

| Special Holiday Rest Day | 2.145 |

| Regular Holiday Rest Day | 3.718 |

| Double Holiday | 4.29 |

| Double Holiday Rest Day | 5.577 |

Say, for example, the regular working hours of an employee are 7 PM to 4 AM. He is entitled to the night differential pay for his regular shift from 10 PM to 4 AM. However, if he rendered overtime from 4 AM to 6 AM, the night differential with overtime on a regular workday will apply.

To illustrate, ₱138.89 X 1.375 X 2 hours = ₱381.95 night differential overtime pay

You can use the multipliers above according to the type of workday rendered.

How To Compute Night Differential for Philippine Government Employees

Signed by President Duterte on April 23, 2022, R.A. No. 11701 grants night shift differential pay for government workers who will render their service between 6 PM and 6 AM the following day.

So if you’re a government employee working during the aforementioned hours, you’re entitled to a night compensation premium, regardless of your appointment status (permanent, temporary, coterminous, contractual, substitute, or casual).

But how much night-shift differential pay will you receive?

According to the Implementing Rules and Regulations of RA No. 117013, the night-shift differential pay is at a rate not exceeding twenty percent (20%) of the employee’s hourly basic rate.

The basic hourly rate is computed this way:

Hourly Basic Rate = (basic monthly rate/22 working days)/8

For example, if your basic monthly rate is ₱15,000, your basic hourly rate would be:

Hourly Basic Rate = (15000/22)/8

Hourly Basic Rate = 85.227

According to the IRR, your night-shift differential pay must be lower than or equal to 20% of your hourly basic rate of 85.227. This means that your night-shift differential must not exceed ₱17.04.

Note that for healthcare workers, the night differential must not be lower than 10% of their hourly basic rate.

Tips and Warnings

- Make it a habit to check your employment contracts before signing to validate your eligibility for night differential pay and other benefits.

- Always check your payslip to know if you are getting paid correctly, and immediately file for disputes. Some companies have rulings on filing payroll disputes within a specific timeframe. If you fail to follow, your complaints may not be honored, or pay adjustment requests might be rejected.

- Read corporate announcements regarding upcoming holidays and stay informed.

Frequently Asked Questions

1. Is night differential pay mandatory in the Philippines?

As per Article 86 of the Labor Code of the Philippines, employees rendering night work duty shall be paid the night differential pay at a 10% minimum.

2. Is night differential pay taxable?

Yes, night differential pay is categorized as taxable income. Thus, it will be added to your net taxable income for the year.

3. Is there a minimum number of hours to be qualified for night differential pay?

There’s no minimum number of hours, but please note that this is being paid hourly, and the company will not pay for half an hour-night differential pay.

4. How can I get my night differential pay?

You are entitled to the night differential pay for every shift rendered. Thus, you shall receive the corresponding night differential payment for every payout, your primary salary, and other allowances.

5. Can my employer remove my night differential pay as a benefit?

Your employer may remove your night differential pay in case of a promotion to a managerial role. You can clarify this during the discussion of your promotion and compensation offer.

References

- Department of Labor and Employment (DOLE). Book III: Conditions of Employment, Title I: Working Conditions and Rest Periods, Chapter I: Hours of Works. Retrieved from https://blr.dole.gov.ph/2014/12/11/book-iii-conditions-of-employment/

- Tilo, D. (2022). Philippines grants night shift workers differential pay. Retrieved 7 June 2022, from https://www.hcamag.com/asia/specialisation/employment-law/philippines-grants-night-shift-workers-differential-pay/406370

- Implementing Rules and Regulations of Republic Act No. 11701 (An Act Granting Night Shift Differential Pay to Government Employees, Including Those in Government-Owned or -Controlled Corporations and Appropriating Funds Therefore). (n.d.). Retrieved from https://lawphil.net/statutes/repacts/ra2023/pdf/irr_11701_2023.pdf

Written by Elaine Joy Balajadia

Elaine Joy Balajadia

Elaine Joy "EJ" Balajadia is an HR professional with almost 12 years of work experience in different HR facets such as labor and employee relations, compensation and benefits, culture and engagement, talent management, and organizational development. She is a registered nurse in the Philippines but her heart leads her to HR where she can help both the employees and the company she is working for. She is currently the HR Deputy Manager for a global IT-BPO company. For inquiries, you may reach her via Facebook Messenger (https://m.me/bulletbalajadia) or email ([email protected]).

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net