How To Compute 13th Month Pay (With Free Calculators)

It is the time of the year. You anticipate receiving more money than your usual monthly salary because this is the period your company gives out the 13th month pay.

As you check your payslip and scan the entries and the total amount, you think something is off. Your 13th-month pay seems a little less than what you expected.

With a bit of disappointment, you wonder. How did the company compute your 13th-month pay? Did HR take into consideration your one-week leave of absence without pay?

In this article, we’ll discuss how to compute 13th-month pay and answer the most frequently asked questions about the 13th-Month Pay Law.

Related: How To Compute Back Pay in the Philippines (With FREE Calculator)

DISCLAIMER: This article has been written for general informational purposes only and is not legal advice or a substitute for legal counsel. You should contact your attorney to obtain advice with respect to any particular issue or problem. The use of the information contained herein does not create an attorney-client relationship between the author and the user/reader.

Table of Contents

At a Glance: Formula for 13th Month Pay Computation in the Philippines

Total basic salary earned during the year ÷ 12 Months = Your 13th-Month Pay

According to the most recent advisory issued by the Department of Labor and Employment (DOLE)19, the 13th-month pay required by law to be paid to all rank-and-file employees in the private sector shall not be less than one-twelfth (1/12) of the total basic salary earned by an employee within a calendar year.

Also, the 13th-month pay the employee will receive should be proportionate to the days he/she reported for work. So if the employee couldn’t work due to suspension brought about by the COVID-19 pandemic, for example, the amount of the 13th-month pay will be less. In other words,

Monthly Basic Salary ≠ 13th-Month Pay

To illustrate, here’s a sample computation provided by the DOLE using the basic wage (₱570/day) in the National Capital Region (NCR), a typical 6-day workweek which is equivalent to a basic monthly salary of ₱14,006.75, and various scenarios that most employees can find themselves in:

| January | No absence | ₱14, 867.50 |

| February | No absence | ₱14, 867.50 |

| March | No absence | ₱14, 867.50 |

| April | No absence | ₱14, 867.50 |

| May | No absence | ₱14, 867.50 |

| June | 5 days leave with pay | ₱14, 867.50 |

| July | No absence | ₱14, 867.50 |

| August | No absence | ₱14, 867.50 |

| September | 10 days leave without pay | ₱9,167.50 |

| October | No absence | ₱14,867.50 |

| November | 1 day leave without pay | ₱14,297.50 |

| December | No absence | ₱14,867.50 |

| Total basic salary earned for the year | ₱172,140.00 |

Using the formula above, we can determine that the amount of the 13th-month pay is:

₱172,140.00 ÷ 12 months = ₱14,345.00 (the proportionate 13th-month pay)

Free 13th-Month Pay Calculators

Do you prefer a quick way to compute your 13th-month pay? We’ve got you covered! Choose from any of the two free calculators we’ve created below, enter the required data, and get accurate results in no time.

1. Simple 13th-Month Pay Online Calculator (No Download Required)

13-Month Pay Calculator

My basic salary per month:Note: Do not put comma ( , ) when typing your salary

| Month |

Basic Salary In PHP |

Deduction Due to absences/late |

Salary Earned Salary earned for the month |

|---|---|---|---|

| January | ₱ | ₱ | ₱ |

| February | ₱ | ₱ | ₱ |

| March | ₱ | ₱ | ₱ |

| April | ₱ | ₱ | ₱ |

| May | ₱ | ₱ | ₱ |

| June | ₱ | ₱ | ₱ |

| July | ₱ | ₱ | ₱ |

| August | ₱ | ₱ | ₱ |

| September | ₱ | ₱ | ₱ |

| October | ₱ | ₱ | ₱ |

| November | ₱ | ₱ | ₱ |

| December | ₱ | ₱ | ₱ |

The online 13th-month pay calculator above requires no download and is an excellent alternative to your bulky calculator.

To obtain your 13th-month pay, enter your basic monthly salary in the fields provided in the first column.

Then, in the second column, enter the total amount of deductions in the field/s corresponding to the specific month/s during which you incurred the said deductions due to tardiness or absences. You may need to know your hourly and daily rates to compute the number of deductions.

Alternatively, you can enter how much you earned (minus all the deductions) during each specific month under the “Basic Salary” column. This way, you won’t have to enter anything in the “Deductions” column and get the result relatively quicker.

On the other hand, if your basic monthly salary is the same throughout the year (i.e., you haven’t incurred any deductions), enter your monthly salary in the field provided at the top (under “My basic salary per month”). Doing so will automatically insert the same amount into each month’s corresponding “Basic Salary” field.

Once you’ve entered all the required data, click the Calculate button, and our online calculator will automatically compute your 13th-month pay.

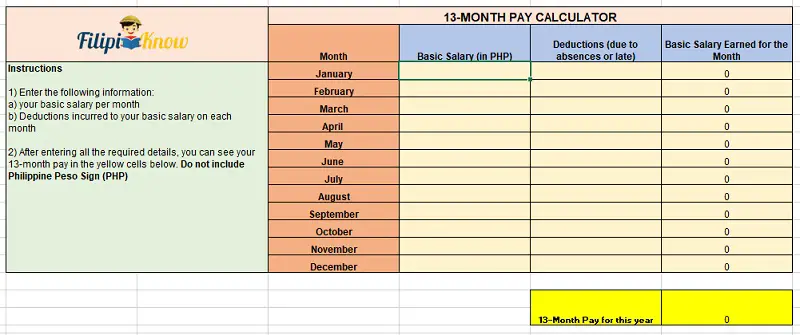

2. 13th-Month Pay Excel Calculator (FREE Download)

Do you prefer a 13th-month pay calculator that you can take anywhere and work perfectly without the internet? Then this free Excel calculator is right up your alley!

Download our free Excel template for 13th-month pay computation, click Enable Editing, and then follow the instructions to get an accurate computation of how much 13th-month pay you’ll get.

Please read further for a more detailed discussion of the 13th-month pay computation in the Philippines.

What Is the 13th-Month Pay?

Thirteenth-month pay is a benefit given to an employee comprising one-twelfth (1/12) of the employee’s basic salary within a calendar year.

The 13th-month pay should not be mistaken for a Christmas bonus or gift20. Do not consider it as companies’ gifts out of kindness or charity but in compliance with a legal requirement. Employers are obligated to give this benefit to entitled employees whether they want it or not.

What Comprises a “Basic Salary”?

It is essential to understand what constitutes a basic salary as the computation of the 13th-month pay depends on it.

Basic salary, for purposes of computing the 13th-month pay, includes all earnings of an employee paid by the employer for services rendered to the company. However, the following may NOT be included in the computation of the basic salary:

- Cost-of-living allowances;

- Profit-sharing payments;

- Cash equivalent of unused vacation and sick leave credits;

- Overtime pay;

- Premium pay;

- Night shift differential;

- Holiday pay;

- All allowances and monetary benefits, which are not considered or integrated as part of the regular or basic salary of an employee.

Please note, however, that if the above benefits and allowances are considered or treated as part of the basic salary, whether by the individual, collective bargaining agreement, company practice, or policy, then the same shall be included in the computation of basic salary.

Supposing in your employment contract, it is stated that your basic salary is ₱30,000 per month, broken down as ₱25,000 base pay, ₱3,000 representing your health insurance, and ₱2,000 representing your guaranteed share of the company profits. Ordinarily, health insurance and profit-sharing are considered non-wage benefits. However, because your contract treats these benefits as part of your salary, the computation of your 13th-month pay should factor in not just the ₱25,000 but also the ₱5,000 (health insurance and share of profits).

The same is true when these benefits (other standard perks like a dental package, paid vacation leave, stock options, and life insurance) are treated as salary per your company policy or in the Collective Bargaining Agreement (in case you are part of a company union and your union has an existing CBA with the company).

Given the above, you should pay attention to your payslip and check what includes your basic salary, as it will affect the computation of your 13th-month pay. Less basic salary means less 13th-month pay.

Is 13th-Month Pay Mandatory in the Philippines?

Regardless of their financial status, all employers in the private sector are mandated to pay their employees a 13th-month pay unless there are circumstances like business closure21 that will prevent them from paying. Although the Implementing Rules and Regulations of the Presidential Decree No. 851 (1975)22 states that distressed employers suffering substantial losses are exempted from paying the 13th-month pay, this was superseded by the Memorandum Order No. 2823 issued in 1986 by the late President Corazon Aquino. The said memorandum has made it official that all rank-and-file employees in the private sector will receive a 13th-month pay no later than December 24 every year, regardless of their employers’ economic situation.

Please note, however, that certain employers are legally exempted from paying the 13th-month pay under P.D. 851 and its Revised IRR.

Presidential Decree (P.D.) No. 851 or the “13th-Month Pay Law” and its Implementing Rules and Regulations (IRR)

P.D. No. 851 or the “13th Month Pay Law”24 is the enabling law that makes it mandatory for employers to pay their employees a 13th-month pay. Then-President Ferdinand Marcos passed the Decree on December 16, 1975.

Rules and Regulations Implementing P.D. 85125 and Supplementary Rules and Regulations26 was later issued for the law’s interpretation, application, and implementation. On 13 August 1986, President Corazon C. Aquino issued Memorandum Order No. 2827 revising some of the guidelines of P.D. 851.

Over the years, the Department of Labor and Employment (DOLE) has issued several Labor Advisories reminding covered employers to comply with the 13th-Month Pay Law.

To ensure employers are complying with the law, they are now required to file a declaration of compliance online through the DOLE Establishment Report System (reports.dole.gov.ph) on or before January 15 of the following year28.

Who Are Eligible for 13th-Month Pay?

1. Employees

All rank-and-file employees in the private sector, regardless of their position, designation, or employment status, and irrespective of the method by which their wages are paid given that they have worked for at least one month during the calendar year.

The 13th-month pay does NOT cover managerial employees, although some companies still choose to provide the benefit.

As defined by law, a managerial employee is “ vested with powers or prerogatives to lay down and execute management policies and/or hire, transfer, suspend, lay-off, recall, discharge, assign or discipline employees, or to effectively recommend such managerial actions. All employees not falling within this definition are considered rank-and-file employees.”

As long as the employee has no managerial power over the company and cannot exercise any prerogatives on the employment status of other employees, he/she is entitled to a 13th-month pay.

2. Employers

All employers must pay their rank-and-file employees’ 13th-month pay regardless of the number of employees they employ.

How Is the 13th-Month Pay Computed? A More Detailed Discussion

Amount

The amount of the 13th-month pay shall not be less than 1/12 of the total basic salary earned by the employee within a calendar year.

Again, certain types of earnings are not included as “basic pay” for purposes of computing the 13th-month pay (see definition of “basic salary”).

For example, if you receive holiday pay, sick benefits, vacation benefits, premium for work performed on rest days and holidays, pay for regular holidays, night differential, maternity leave benefits, overtime pay, or all allowances and monetary benefits which are NOT considered or integrated as part of the regular or basic salary, these earnings will be excluded in the computation of your basic salary.

Formula and computation

The formula is simple. You have to compute all your earnings (excluding earnings not considered part of your basic salary) within a calendar year and divide it by 12. The total is the corresponding 13th-month pay that must be paid to you by your employer.

Total basic salary earned during the year ÷ 12 Months = Your 13th-Month Pay

Thus, if you are working in NCR with a basic wage of ₱570 (current NCR minimum wage) or a monthly salary of ₱14,867.50 (assuming no deductions), then your 13-month pay will be ₱14,867.50 (₱570*313/12 = ₱14,867.50).

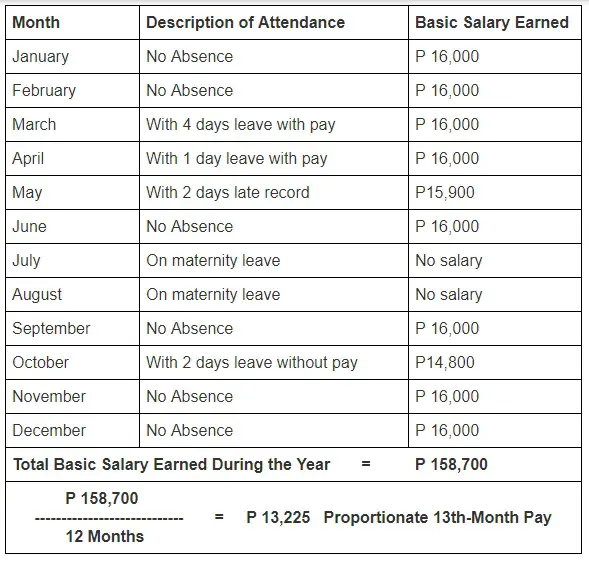

1. How To Compute 13th-Month Pay if You Have Absences Without Pay/Maternity Leave/Unpaid Leaves/Paid Leaves/Late Record

Please note that your 13th-month pay is not a fixed amount equivalent to 1/12 of your monthly basic pay. It is computed based on the actual number of days you worked, including leaves with pay.

To illustrate, the table below shows a sample computation of the 13th-month pay from the National Wages and Productivity Commission. This is a scenario where an employee incurred no absences, has leaves but with pay, has absences without pay, was on maternity leave without pay, and was also late. Let us assume his salary is ₱16,000 per month.

2. How To Compute 13th-Month Pay if There’s a Salary Increase or Salary Differential

The salary increase will be considered when calculating the 13th-month pay, provided that the additional amount is only applied in the first month the pay increase took effect and thereafter.

So, for example, in November, you got a salary increase of ₱1,000, your basic salary for November and December will be ₱17,000, respectively. This amount will be added to your total basic salary earned during the year.

3. How To Compute 13th-Month Pay for Resigned Employees or Separated/Terminated Employees

Resigned or separated employees are still entitled to the 13th-month pay.

Sec. 6 of the Revised Guidelines on the Implementation of the 13th-Month Pay Law provides that even if you have resigned from your job or were terminated, you are entitled to the 13th month’s pay in proportion to the length of time you worked during the year, reckoned from the time you started working during the calendar year up to the time you resigned or terminated from the service.

For example, you worked only from January to September. Your basic income during the said period will be added and thereafter divided into 12. The amount after dividing is your proportionate 13th-month pay.

4. How To Compute 13th-Month Pay for AWOL Employees or Employees With Indefinite Leave

AWOL employees and those under indefinite leave are entitled to the 13th-month pay provided these employees have worked for at least one month during a calendar year.

For example, if you worked for three months and went into indefinite leave, you will be entitled to a prorated 13th-month pay.

When Is the 13th-Month Pay Given?

The law mandates that the 13th-month pay must be paid not later than December 24 of every year. An employer, however, may give the employees one-half (½) of the 13th-month pay before the opening of the regular school year and the remaining half on or before December 24 of every year.

In most companies, the payment of 13th-month pay is split into two – one given around June and the other in December.

Can an Employer Hold Your 13th-Month Pay?

An employer can’t hold, defer, or postpone the issuance of the 13th-month pay unless the business is struggling financially and both parties have agreed to have the 13th-month pay postponed or be given in installments. According to Labor Secretary Silvestre Bello III29, companies can talk to their employees, especially if they’re unionized, to see if the latter agrees to postpone the release of the 13th-month pay or can opt for a prorated payment. As long as both parties agree, the release schedule of the 13th-month pay can be adjusted accordingly.

Does the Philippine Government Offer Financial Assistance to Employers Struggling To Pay the 13th-Month Pay?

Yes. The Philippine government, through its micro-financing arm, Small Business Corporation (SB Corp.), is offering soft loans (i.e., loans with zero interest) to help small businesses pay the mandatory 13th-month pay to their employees on time.

For 202130, for example, eligible businesses were the micro and small enterprises (with 20 employees or below) that had been included in the DOLE’s list of companies that availed of the flexible work arrangements during the COVID-19 pandemic (from March 20, 2020, to October 15, 2021). To help more struggling businesses, the coverage was eventually increased31 from 20 employees to a maximum of 40 employees per company.

A total of ₱500 million has been allotted for the loan program, and qualified businesses can avail of the standard amount of ₱12,000 per employee for a total loan of anywhere between ₱50,000 and ₱200,000.

To apply, eligible businesses only need to present their mayor’s permit (for loans higher than ₱50,000) or barangay business permit (for loans up to ₱50,000). Upon the filing of the SB Corp. application form online, the loan will be processed within 7 to 10 days. The loan carries no interest and is payable in 12 months with a 3-month grace period32.

Tips and Warnings

- For employees, ensure your 13th-month pay is correctly computed by understanding what comprises your basic pay and its inclusions and exclusions. Your HR should know the rules, and you could safely assume that the pay is computed correctly, but there is no harm in double-checking.

- The 13th-month pay must be paid in cash and not in kind. Hence, your employer can not give you vouchers, free membership in a gym, a Christmas food basket, free hotel accommodation, freebies, etc., instead of cash.

- Benefits in the form of food and year-end rewards for loyalty and service are not a proper substitute for the 13th-month pay

Frequently Asked Questions

1. Are yayas and house helpers entitled to 13th month pay?

Yes. The “Domestic Workers Act” or the “Batas Kasambahay” and its Implementing Rules and Regulations33 provide that kasambahay, whether on a live-in or live-out arrangement, shall be entitled to rights and privileges including mandatory benefits under the law such as the 13th-month pay.

“Kasambahay” as defined under the law shall include, but not be limited, to:

*General househelp;

*Yaya;

*Cook;

*Gardener;

*Laundry person; or

*Any person who regularly performs domestic work in one household on an occupational basis.

The following, however, are NOT included in the coverage of the law:

*Service providers;

*Family drivers;

*Children under a foster family arrangement; and

*Any other person who performs work occasionally or sporadically and not on an occupational basis.

Family drivers aren’t entitled to the 13th-month pay, provided they’re not listed as an employee of your company or business. They’re also different from drivers and conductors of public utility buses who are now mandated to receive benefits including 13th-month pay under a new DOLE Order.

2. I have a gardener who comes to work twice a week. Is he entitled to 13th-month pay?

Yes. Under the “Domestic Workers Act” or the “Batas Kasambahay,” a gardener is included under the definition of “kasambahay.” The said law provides that “kasambahays” are now entitled to receive a 13th-month pay.

According to Sec. 2, Rule I of the Implementing Rules and Regulations of the said Kasambahay Law, the following types of househelp, whether on a live-in or live-out arrangement, are entitled to receive a 13th-month pay:

*General household;

*Yaya;

*Cook;

*GARDENER;

*Laundry person;

*Any person who regularly performs domestic work in one house or on an occupational basis.

Even if your gardener reports to work only twice a week, it appears that he performs the work in your household regularly; thus, he comes within the definition of “kasambahay.”

3. Are government employees entitled to 13th-month pay?

Government employees are not entitled to the 13th-month pay contemplated under P.D. 851. The IRR ( Sec. 3 [b]) specifically excludes government employees.

Moreover, employees of Government-Owned and Controlled Corporations (GOCCs) are not entitled to 13th-month benefits unless the corporation acts as a private government subsidiary34.

However, under Sec.8 of Republic Act No. 11466 or the “Salary Standardization Law of 2019”35, government employees are entitled to the following:

a. Mid-Year Bonus equivalent to one (1) month basic salary as of May 15 of a given year. The employee must have rendered at least four (4) months of satisfactory service and remain in the service as of May 15. Mid-Year bonus is given no later than May 15 of every year;

b. Year-End Bonus, equivalent to one (1) month of salary, every November. This is considered the counterpart of the 13-month pay given to employees in the private sector;

c. Cash Gift amounting to Five Thousand Pesos (₱5,000) is also given every November of every year.

In essence, although the enabling laws and the term used differ, government employees are entitled to up to 14th-Month Pay plus a cash gift.

On the other hand, contractual and Job Order government employees might be entitled to 13th-month pay in the future. If passed, Senate Bill 152836 will grant these employees the same 13th-month benefits as those of regular employees.

In particular, the bill includes Contract of Service (COS) and Job Orders (JO) for government employees that the Civil Service Commission (CSC) defines as

*COS: individuals rendering service as consultants, learning service providers, or technical experts that undertook special projects within a particular period.

*JO: also known as pakyaw; intermittent or emergency jobs including clearing road debris, canals, waterways, etc., and other manual and craft services (e.g., carpentry, plumbing, electrical, etc.) for a short duration or a piece of work.

The bill also mandates that the minimum benefit that the contractual government employees should receive shall be more than half of his/her monthly salary as reflected in his/her contract37.

4. Are seafarers entitled to the 13th-month pay?

No, seafarers are not entitled to the 13th-month pay. In one case38, the Supreme Court held that seafarers are considered contractual employees governed by the Rules and Regulations of the Philippine Overseas and Employment Administration (POEA).

The employment is based on a contract with a fixed period and with fixed compensation and benefits. The standard employment contract of the POEA for seafarers does not provide for the payment of the 13th-month pay.

As can be gleaned from P.D. 851, the law contemplates land-based workers, not seafarers who earn more than domestic land-based workers.

5. Are private school teachers entitled to 13th-month pay?

Yes, private school teachers are entitled to the 13th-month pay. Sec 5 (c) of the Revised Guidelines on the Implementation of the 13th-Month Pay Law provides explicitly that private school teachers, including faculty members of universities and colleges, are entitled to receive the 13th-month pay, regardless of the number of months they teach or are paid within a year. However, the teacher must have rendered service for at least one (1) month within a year.

6. Are drivers entitled to 13th-month pay?

Drivers under the “boundary system” are NOT entitled to the 13th-month pay. Sec 2 (d) of the Revised Guidelines on the Implementation of the 13th-Month Pay Law provides that employers paying their employees on a “boundary system” are exempted from the law’s coverage.

Under the “boundary system,” a driver does not receive a fixed salary; instead, he is engaged in driving a vehicle, and on each trip, the driver is required to remit a “boundary.” Whatever the excess, the amount is considered his income. This is usually the case for public utility jeepneys and taxis.

Family drivers are likewise not entitled to 13th-month pay because they’re not covered by the Labor Code, the Kasambahay Law, and P.D. 851 or the 13th-Month Pay Law. Please note that family drivers are different from those listed as employees of a company or business.

However, a different rule applies to drivers and conductors working in the public utility bus transport industry. To ensure road safety, DOLE issued an Order39 effectively abolishing the “boundary system” and prescribing a part-fixed and part-performance wage system for bus drivers and conductors as well as mandating the payment of minimum benefits required to be given under the law such as holiday pay, rest day, overtime pay, night shift pay, paid service incentive leave, and 13th-month pay, among other things.

Because of the above DOLE Order, bus drivers, and conductors are now entitled to the 13th-month pay.

7. Are employees with two or more employers entitled to the 13th-month pay?

Yes, employees with multiple employers are entitled to the 13th-month pay from all employers.

Sec 5 (b) of the Revised Guidelines on the Implementation of the 13th-Month Pay Law is clear that those with multiple employers (e.g., you are a government employee but you are also working part-time in a private company including a private educational institution; or you are an employee working in two or more private companies, whether in full-time or part-time basis) are also entitled to the 13th-month pay from all of their private employers, regardless of their total earnings from each or all of these employers.

8. Am I entitled to the 13th-month pay if I am paid on a commission basis?

Generally, a person paid purely on a commission basis is not entitled to the 13th-month pay. This is stated in Sec. 2 (d) of the Revised Guidelines on the 13th-Month Pay Law, which says that employers paying their employees on a commission basis are exempted from the law’s coverage.

However, if you are paid a guaranteed fixed salary plus commission, you are entitled to receive a 13th-month pay. In this scenario, should the commission be considered part of your basic salary, thus, included in computing your 13th-month pay?

In one case40, the Supreme Court ruled that only the guaranteed fixed salary shall be considered the “basic salary” for computing the 13th-month pay. The commission, given for extra efforts in making sales or other transactions, is considered additional pay, which does not form part of the basic salary.

9. Are workers doing piece-rate or “pakyaw” entitled to the 13th-month pay?

Yes, they are entitled to the 13th-month pay under Sec. 2 (e) of the IRR41, which says explicitly that workers who are paid on piece rate shall be entitled to the 13th-month pay.

Piece-rate workers are paid a standard amount for every piece or unit of work produced that is more or less regularly replicated without regard to the time spent producing the output. In one case42, the Supreme Court ruled that even if the mode of compensation of workers is not fixed but on a “per piece basis,” the status and nature of their employment were that of regular employees for the following three reasons:

*The nature of the workers’ task of repacking snack food was necessary or desirable in the usual business of the employer who was engaged in the manufacturing and selling of such food products;

*Workers worked for the employer throughout the year and were not dependent on a particular project or season;

*The length of time that workers worked for the employer.

10. Do freelancers get 13th-month pay in the Philippines?

No. If you are hired as a freelancer or independent contractor, there is no obligation under the law for the hiring party to give you a 13th-month pay.

Freelancer43 is defined as “any natural or entity composed of no more than one natural person, whether incorporated under the Securities and Exchange Commission (SEC), registered as a sole proprietorship under the Department of Trade and Industry (DTI), or registered as self-employed with the Bureau of Internal Revenue (BIR), that is hired or retained as an independent contractor by a hiring party to provide services in exchange for compensation.”

A freelancer or independent contractor is hired to do a specific task for a fixed amount. Under 2 (d) of the Revised Guidelines on the Implementation of the 13th-Month Pay Law, an employer is not required to pay such a type of worker a 13th-month pay.

11. Are contractual employees entitled to the 13th-month pay?

Yes, contractual employees are entitled to receive 13th-month pay. Contractual or contractor’s employees refer to a person employed by a contractor to perform or complete a job, work, or service under a Service Agreement. It may be for a definite or predetermined period. Common examples of contractual employees are those in the security and janitorial industry.

The rights of contractual employees are now fully protected under the law. Under Sec 8 of DOLE Department Order No. 18-A44 as reiterated in D.O. No. 17445, all contractor’s employees, whether deployed or assigned as a reliever, seasonal, week-ender, or temporary, or promo jobbers shall be entitled to all the rights and privileges provided under the Labor Code including the 13th-month pay, among others.

12. Are project-based employees entitled to 13th-month pay?

Yes, they are entitled to the 13th-month pay. Project employees are those hired for a specific project and the duration of employment is terminated upon the completion of the project. The employment is for a specific undertaking, the completion or termination of which has been determined at the time of the engagement of the employee.

The most common examples of project employees are those working in the construction industry. They are employed in connection with a particular construction project or phase and whose employment is co-terminus with each project or phase of the project to which they are assigned.

Sec. 3.5 of DOLE Department Order No. 19 (s.1993)46 provides that during the period of their employment, these types of employees are entitled to statutory benefits which include the 13th-month pay.

13. Are probationary employees entitled to the 13th-month pay?

Yes, probationary employees are entitled to the 13th-month pay as long as he or she rendered work for at least one month.

Probationary employment47, as opposed to regular employment, means the employee shall undergo a probationary period of not exceeding six (6) months from the date the employee started working.

In an apprenticeship agreement, the six-month period may be extended upon the stipulation of the parties. The services of an employee under probation may be terminated for a just cause or if he or she fails to qualify as a regular employee (e.g., the probationary employee fails to meet the standard set by the employer).

An employee who is allowed to work after the probationary period shall be considered a regular employee. Should the probationary employee be terminated for the causes mentioned above, he or she is still entitled to the 13th-month pay, the amount of which is prorated.

14. Are consultants entitled to the 13th-month pay?

Generally, consultants are not entitled to the 13th-month pay as they are not considered rank-and-file employees.

In consulting services48, consultants are hired for their technical and professional expertise to render technical services or special studies, such as advisory and review services, pre-investment or feasibility studies, design, etc.

However, in one case49, a consultant was awarded benefits including 13th-month pay because he was considered a regular employee of the company. Although he was hired as a consultant and was designated as Consultant-Engineer, the description of his duties is that of an ordinary technical staff employee.

The Supreme Court ruled that “[t]he term ‘consultant’ is merely more of nomenclature as he is required under the contract to observe regular office hours. It, therefore, precludes the hiring of a mere ‘consultant’ who is supposed to render part-time service to the principal employer.”

However, if you are a consultant by a government contract, chances are you will receive a 13th-month benefit if Senate Bill 1528 is passed. This bill will entitle Contractual and Job Order government employees, including consultants, to 13th-month pay.

15. Is the 13th-month pay taxable under the TRAIN law?

It depends. Under the TRAIN Law50, the 13th-month pay and other benefits received by an employee not exceeding ₱90,000 are excluded from the computation of gross income, and thus, exempt from taxation. Hence, if you receive a 13th-month pay amounting to more than ₱90,000, the excess of said amount is included in your gross income and shall be taxable.

16. Is the 13th-month pay the same as the Christmas bonus?

No. The basic difference between the 13th-month pay and the Christmas bonus is that the latter is not mandatory while the former is mandatory to be given to the employees. The two are not the same.

The 13th-month pay is a demandable right. Employers are mandated by law to give it to their qualified employees. Christmas bonus, on the other hand, is given as a premium for good performance or simply from the generosity or benevolence of the employer. It may or may not be given to employees.

Therefore, if your employer refers to the 13th-month pay as a “Christmas bonus”, it’s incorrect and misleading.

17. Are there employers exempted from paying 13th-month pay?

Yes, certain employers are exempted from paying 13th-month pay. Under P.D. 851 and its Revised IRR, the following employers are exempt from paying the 13th-month pay:

a. The Government and any of its political subdivisions, including government-owned and controlled corporations (except those operating essentially as private subsidiaries of the government). The salary and benefits of government employees are governed by a different law;

b. Employers already paying their employees a 13th-month pay or more in a calendar year or equivalent. For example, if an employer is already giving employees Christmas bonuses, mid-year bonuses, cash bonuses, and other payments amounting to not less than /12 of the basic salary, then the employer is no longer required to pay the 13th-month pay;

c. Employers of those who are paid purely on commission, boundary, or task basis, and those who are paid a fixed amount for performing specific work, irrespective of the time consumed in the performance of the task.

18. What happens if my employer refuses to pay the 13th-month pay?

You may file a complaint against your employer at the Regional Arbitration Branch of the Department of Labor and Employment having jurisdiction over your workplace, for violation of P.D. 851.

Non-payment of the 13th-month pay is treated as a money claim case. Employers found to have violated the law will be meted penalty including damages.

Employers are required to submit Proof of Compliance of P.D 851 at the nearest Regional Office of the DOLE no later than 15 January of every year.

19. Can I apply for deferment or exemption of the 13th-month payment?

According to DOLE Labor Advisory No. 23, Series of 2023, employers are not allowed to request for deferment or exemption of 13th-month payment.

References

- Implementing Rules and Regulations of Republic Act No. 10361, An Act Instituting Policies for the Protection and Welfare of Domestic Worker

- 13th Month pay. (2019, December 20). Retrieved February 5, 2023, from https://www.divinalaw.com/dose-of-law/13th-month-pay/

- Official Gazette of the Republic of the Philippines. Republic Act No. 11466, An Act Modifying the Salary Schedule for Civilian Government Personnel and Authorizing the Grant of Additional Benefits, and for Other Purposes (2019).

- Abasola, L. (2022, December 20). 2nd Senate Bill Eyes 13th-month pay for contractual gov't workers. Retrieved February 5, 2023, from https://www.pna.gov.ph/articles/1191161

- Tolentino, M. (2022, December 9). Bill seeks 13th month pay for contractual workers. Retrieved February 5, 2023, from https://www.manilatimes.net/2022/12/09/news/national/bill-seeks-13th-month-pay-for-contractual-workers/1869631#:~:text=%22The%20minimum%20amount%20of%20the,the%20House%20Committee%20on%20Appropriations

- Petroleum Shipping Limited and Trans-Global Maritime Agency, Inc. v. National Labor Relations Commission and Florello Tanchico, G.R. No. 148130 (Supreme Court of the Philippines 2006).

- Department Order No. 118-12, Rules and Regulations Governing the Employment and Working Conditions of Drivers and Conductors in the Public Utility Bus Transport Industry (2012).

- Boie-Takeda Chemicals, Inc. vs. DOLE, G.R. No. 92174 (Supreme Court of the Philippines 1993).

- Rules and Regulations Implementing Presidential Decree No. 851 (1975).

- Labor Congress of the Philippines vs. NLRC, G.R. No. 123938 (Supreme Court of the Philippines 1998).

- Senate Bill No. 351 or an Act Providing Protection and Incentives for Freelancers (2016)

- Department Order No. 18-A, Rules Implementing Articles 106 to 109 of the Labor Code, as Amended (2011).

- Department Order No. 174, Rules Implementing Articles 106 to 109 of the Labor Code, as Amended (2017).

- Department Order No. 19, Guidelines Covering the Employment of Workers in the Construction Industry (1993).

- The Labor Code of the Philippines, Art. 296 (1974)

- Republic Act No. 9184, An Act Providing for the Modernization, Standardization, and Regulation of the Procurement Activities of the Government and for Other Purposes, Sec. 5 (f) (2002)

- Ferrochrome Phils., Inc. vs NLRC, G.R. No. 105538 (Supreme Court of the Philippines 1994).

- Republic Act 10963, “Tax Reform for Acceleration and Inclusion (TRAIN)” (2017).

- Department of Labor and Employment (DOLE). (2021). Labor Advisory No. 18, Series of 2021 (Guidelines on the Payment of Thirteenth Month Pay). Manila.

- Abellanosa, R. (2022, December 12). Abellanosa: 13th Month pay: A few thoughts. Retrieved February 5, 2023, from https://www.sunstar.com.ph/article/1948444/bacolod/opinion/abellanosa-13thmonth-pay-a-few-thoughts

- Patinio, F. (2021). DOLE studying options to help firms comply with 13th-month pay. Retrieved 2 November 2021, from https://www.pna.gov.ph/articles/1156257

- Rules and Regulations Implementing Presidential Decree No. 851 (1975), Section 3 (a).

- Office of the President. (1986). Memorandum Order No. 28, series of 1986. Manila: Official Gazette of the Republic of the Philippines.

- Official Gazette of the Republic of the Philippines. Presidential Decree No. 851, s. 1975 (1975).

- Rules and Regulations Implementing Presidential Decree No. 851 (1975).

- Supplementary Rules and Regulations Implementing P.D. No. 851 (1976).

- Revised Guidelines on the Implementation of the 13th Month Pay Law (1986).

- Lim, A. (2021). 10 things to know about your 13th-month pay. Retrieved 15 December 2021, from https://news.abs-cbn.com/blogs/business/11/22/21/10-things-to-know-about-your-13th-month-pay

- Bajenting, J. (2021). 13th month pay to depend on days of actual work. Retrieved 2 November 2021, from https://www.sunstar.com.ph/article/1911377/Cebu/Local-News/13th-month-pay-to-depend-on-days-of-actual-work

- 13th-month pay loan application window starts Nov. 2. (2021). Retrieved 2 November 2021, from https://www.bworldonline.com/13th-month-pay-loan-application-window-starts-nov-2/

- Desiderio, L. (2021). DTI unit hikes worker coverage for 13th-month loan. Retrieved 15 December 2021, from https://www.philstar.com/business/2021/11/13/2140878/dti-unit-hikes-worker-coverage-13th-month-loan

- Cahiles-Magkilat, B. (2021). SB Corp hikes 13th-month loan facility to P500 M. Retrieved 2 November 2021, from https://mb.com.ph/2021/10/28/sb-corp-hikes-13th-month-loan-facility-to-p500-m/

- Implementing Rules and Regulations of Republic Act No. 10361, An Act Instituting Policies for the Protection and Welfare of Domestic Worker

- 13th Month pay. (2019, December 20). Retrieved February 5, 2023, from https://www.divinalaw.com/dose-of-law/13th-month-pay/

- Official Gazette of the Republic of the Philippines. Republic Act No. 11466, An Act Modifying the Salary Schedule for Civilian Government Personnel and Authorizing the Grant of Additional Benefits, and for Other Purposes (2019).

- Abasola, L. (2022, December 20). 2nd Senate Bill Eyes 13th-month pay for contractual gov’t workers. Retrieved February 5, 2023, from https://www.pna.gov.ph/articles/1191161

- Tolentino, M. (2022, December 9). Bill seeks 13th month pay for contractual workers. Retrieved February 5, 2023, from https://www.manilatimes.net/2022/12/09/news/national/bill-seeks-13th-month-pay-for-contractual-workers/1869631#:~:text=%22The%20minimum%20amount%20of%20the,the%20House%20Committee%20on%20Appropriations

- Petroleum Shipping Limited and Trans-Global Maritime Agency, Inc. v. National Labor Relations Commission and Florello Tanchico, G.R. No. 148130 (Supreme Court of the Philippines 2006).

- Department Order No. 118-12, Rules and Regulations Governing the Employment and Working Conditions of Drivers and Conductors in the Public Utility Bus Transport Industry (2012).

- Boie-Takeda Chemicals, Inc. vs. DOLE, G.R. No. 92174 (Supreme Court of the Philippines 1993).

- Rules and Regulations Implementing Presidential Decree No. 851 (1975).

- Labor Congress of the Philippines vs. NLRC, G.R. No. 123938 (Supreme Court of the Philippines 1998).

- Senate Bill No. 351 or an Act Providing Protection and Incentives for Freelancers (2016)

- Department Order No. 18-A, Rules Implementing Articles 106 to 109 of the Labor Code, as Amended (2011).

- Department Order No. 174, Rules Implementing Articles 106 to 109 of the Labor Code, as Amended (2017).

- Department Order No. 19, Guidelines Covering the Employment of Workers in the Construction Industry (1993).

- The Labor Code of the Philippines, Art. 296 (1974)

- Republic Act No. 9184, An Act Providing for the Modernization, Standardization, and Regulation of the Procurement Activities of the Government and for Other Purposes, Sec. 5 (f) (2002)

- Ferrochrome Phils., Inc. vs NLRC, G.R. No. 105538 (Supreme Court of the Philippines 1994).

- Republic Act 10963, “Tax Reform for Acceleration and Inclusion (TRAIN)” (2017).

Atty. Kareen Lucero

Kareen Lucero is a lawyer previously doing litigation before working for different agencies in the government and for a multinational corporation. She has traveled to 52+ countries including a 3-month solo backpacking in South East Asia and more than 1 year of solo traveling across four continents in the world. As part of giving back, she is passionate about sharing her knowledge of law and travel. She is currently doing consulting work for a government agency. For inquiries, you may reach her via Facebook Messenger (https://m.me/kareen.lucero.77) or email ([email protected]).

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net