TRAIN Law Tax Table 2025: Guide To Computing Your Income Tax

When computing your income tax due, do your due diligence. If you’re not careful enough, you’ll end up paying penalties to the BIR for a mistake in your income tax computation.

Before getting to the hows of tax calculation, it’s crucial to understand gross and taxable income—the two terms often used in income tax calculation.

Disclaimer: This article is for general information only and is not substitute for professional advice.

Go back to the main article: How to Compute Income Tax in the Philippines: An Ultimate Guide

Table of Contents

What Is Gross Income?

Gross income is the starting point of computing a taxpayer’s income tax due.

Under the tax code6, gross income means all income derived from whatever source.

While that definition appears too generic, the BIR website provides specific examples of what constitutes gross income:

a. Compensation income – Earnings from an employer-employee relationship, including salaries (plus any overtime pay, holiday pay, or night differential pay), fees, commissions, honoraria, taxable bonuses and allowances, and other benefits

b. Business and professional income – Earnings from running a business or practicing a profession, including profits from the sale of assets, commissions, service fees, professional fees, rental income, and other incomes not covered by compensation income

c. Passive income – Earnings from sources in which the taxpayer is not actively involved, including the following:

- Profits from the sale of real properties or shares of stock

- Interest earned on bank deposits

- Interest and dividends earned on investments

- Annuities (e.g., income streams for retirees)

- Pensions

- Rents

- Royalties

- Prizes and winnings

- A partner’s share from the net income of a general professional partnership

If you’re earning one or more of these types of income, all of them are included in your income tax computation.

What Is Excluded From Gross Income?

According to the tax code7, the following income types are NOT included in a taxpayer’s gross income computation (and are therefore tax-exempt):

- SSS, GSIS, Pag-IBIG, PhilHealth, and other government-mandated contributions

- 13th-month pay and other benefits (e.g., Christmas bonus, performance-based incentives, etc.) worth Php 90,000 and below

- De minimis benefits (e.g., paid vacation leave, medical/meal/clothing allowance, rice subsidy, Christmas gifts and achievement awards given to employees, etc.) not exceeding the prescribed maximum amount

- Union dues from legitimate labor organizations

- Retirement benefits, pensions, gratuities, etc., which have met the requirements of the law

What Is Taxable Income?

Taxable income is the taxpayer’s gross income less allowable deductions. It determines how much income tax must be paid in a given year.

If you’re a self-employed or mixed-income taxpayer, subtract the deductions allowed by the BIR from your gross income to get your taxable income.

The basic formula for income tax purposes is:

Gross Sales/Receipts/Fees

Less:

- Sales Discounts/Allowances

- Sales Returns

Equals: Net Sales/Receipts/Fees

Less: Cost of Sales

Equals: Gross Income from operations

Add: Other income not subject to final tax or tax exemption

Equals: Total Gross Income

Less: Itemized Deductions or OSD

Equals: Taxable Income

What Can Be Deducted From Gross Income?

Self-employed and mixed-income taxpayers can choose between two methods of deduction: itemized deduction and optional standard deduction.

1. Itemized deduction

Itemized deduction8 involves deducting from gross income all legitimate business expenses incurred during the taxable year. The BIR requires these expenses to be directly related to the operation, management, and development of the taxpayer’s business or professional practice.

Learn More: Itemized Deductions: A Comprehensive Guide for Philippine Taxpayers

Itemized deductions include the following:

- Business or professional expenses such as salaries, overhead expenses, and costs of production, travel, entertainment, etc.

- Research and development

- Interest on debts related to the taxpayer’s business or profession

- Tax payments related to the taxpayer’s business or work, except for the income tax, estate tax, donor’s tax, etc.

- Losses from the regular operation of the business, sale of capital assets, etc.

- Donations to the Philippine government, charitable institutions, religious groups, educational/cultural organizations, etc.

- Actual bad debts (receivables from customers or loss on securities held as capital assets that cannot be collected or recovered)

- Depreciation (decrease in value of property used in business such as vehicles, equipment, etc.)

- Pension trust fund for employees

- Depletion of oil and gas wells and mines

On the other hand, taxpayers CANNOT deduct the following expenses from their gross income9:

- Living, personal, or family expenses

- Expenses for construction, improvement, or renovation of a property to increase its value

- Expenses for property restoration

- Life insurance premium payments covering any employee

- Losses from the sale of property under certain conditions

2. Optional standard deduction

The Optional Standard Deduction (OSD)10 is 40% of Gross Income.

OSD for corporations is in all respects similar to the OSD available to an individual earning business income or income from a profession, EXCEPT that the basis of the 40% OSD is the gross income, which is net of the cost of sales or services (similar to Minimum Corporate Income Tax or MCIT), while for individuals, the basis is gross sales or receipts, before any such costs.

Likewise, Gross Income for OSD purposes does not include income items already subjected to Final Tax or Capital Gains Tax.

The election of the OSD must be communicated in the 1st quarter return. If the corporation used the OSD instead of the itemized deduction in its 1st quarter return, it could not later use the itemized deductions for the Annual Income Tax Return. (RR No. 2-2010)

The tax base of OSD is Gross Income under Sec. 32 of NIRC (National Internal Revenue Code) and Gross sales/receipt for corporations and individuals, respectively.

Gross income under Section 32 of the NIRC as amended:

- Gross Income from operations

- Sale of ordinary assets

- Distributive share of a partner in GPP

- Rent

- Annuities

- Pension

- Royalties

- Interest

- Prizes and winnings

- Dividends

Provided that items 7 to 10 are not subject to FWT.

Note that net gains on the sale of capital assets are not part of OSD computation but form part of gross income for other purposes.

Applicability: This is available to all types of taxpayers except non-resident aliens and non-resident foreign corporations

TRAIN Law Tax Table 2023

Graduated rates, which increase as the taxable income increases, apply to the following types of income:

a. Compensation income of local and foreign employees (mandatory)

b. Compensation income of mixed-income earners (mandatory)

c. Business and/or professional income of mixed-income earners and self-employed individuals

- Mandatory for those whose gross sales or receipts are above Php 3 million

- Optional for those whose gross sales or receipts are equal to or less than Php 3 million

The Tax Reform for Acceleration and Inclusion (TRAIN) Act has lowered the personal income tax since the 2018 taxable year. The tax reform law introduced a new tax structure, resulting in higher take-home pay for employees in the Philippines.

Income taxes are expected to go down further with the new graduated rates starting January 1, 2023.

Graduated income tax rates for January 1, 2023 and onwards:

| Annual Taxable Income | Tax Rate |

| Php 250,000 and below | 0% |

| Over Php 250,000 but not over Php 400,000 | 15% of the excess over Php 250,000 |

| Over Php 400,000 but not over Php 800,000 | Php 22,500 + 20% of the excess over Php 400,000 |

| Over Php 800,000 but not over Php 2 million | Php 102,500 + 25% of the excess over Php 800,000 |

| Over Php 2 million but not over Php 8 million | Php 402,500 + 30% of the excess over Php 2 million |

| Over Php 8 million | Php 2,202,500 + 35% of the excess over Php 8 million |

However, the Philippines is still among the countries with the highest income tax in Southeast Asia.

An ASEAN Briefing report11 notes that the Philippines, Thailand, and Vietnam have the highest maximum tax rate of 35%, as opposed to Cambodia’s and Singapore’s 20% rates.

How To Compute Your Income Tax Based on Graduated Rates

You can calculate your income tax independently, whether you’re curious about how your employer computes it, or you need to file and pay your tax by yourself.

Here’s a simple formula for the manual computation of income tax:

Income tax due = Taxable income (Gross income – Allowable deductions) x Tax rate – Tax withheld

Sample income tax computation (for the taxable year 2020)

Scenario 1: Employee with a gross monthly salary of Php 30,000 and receiving 13th-month pay of the same amount.

1. Get the annual salary: Php 30,000 x 12 months = Php 360,000.

2. Compute the total annual contributions (employee’s share only):

- SSS – Php 800 x 12 months = Php 9,600

- PhilHealth – Php 450 x 12 months = Php 5,400

- Pag-IBIG – Php 100 x 12 months = Php 1,200

Total annual contributions: Php 16,200

3. Get the taxable income by deducting the total annual contributions from the annual salary: Php 360,000 – Php 16,200 = Php 343,800.

4. Refer to the BIR’s graduated tax table above to find the applicable tax rate. The taxable income of Php 343,800 falls under the second bracket, which means the tax rate is 15% of the excess over Php 250,000.

5. Compute the annual income tax due.

a. Subtract the non-taxable Php 250,000 from the taxable income: Php 343,800 – Php 250,000 = Php 93,800.

b. Multiply the difference by 15%: Php 93,800 x 0.20 = Php 14,070.

If the income tax due is the same as the employer’s total amount withheld from the employee’s salary (Php 18,760 during the taxable year or Php 1,172.50 per month), then the employee doesn’t have to pay and file an ITR by the end of the year.

Scenario 2: Employee with a gross monthly salary of Php 100,000 and receiving 13th-month pay of the same amount.

1. Get the annual salary: Php 100,000 x 12 months = Php 1,200,000.

2. Since the 13th-month pay is higher than the tax-exempt Php 90,000, the excess of that amount is taxable. Deduct the tax-exempt Php 90,000 from Php 100,000: Php 100,000 – Php 90,000 = Php 10,000. Then add the difference to the annual salary to get the gross income: Php 10,000 + Php 1,200,000 = Php 1,210,000.

3. Compute the total annual contributions (employee’s share only):

- SSS – Php 800 x 12 months = Php 9,600

- PhilHealth – Php 900 x 12 months = Php 10,800

- Pag-IBIG – Php 100 x 12 months = Php 1,200

Total annual contributions: Php 21,600

4. Get the taxable income by deducting the total annual contributions from the gross income: Php 1,210,000 – Php 21,600 = Php 1,188,400.

5. Refer to the BIR’s graduated tax table above to find the applicable tax rate. The taxable income of Php 1,188,400 falls under the fourth bracket, which means the tax rate is Php 102,500 + 25% of the excess over Php 800,000.

6. Compute the annual income tax due.

a. Subtract the non-taxable Php 800,000 from the taxable income: Php 1,188,400 – Php 800,000 = Php 388,400.

b. Multiply the difference by 25%: Php 388,400 x 0.25 = Php 97,100.

c. Add Php 102,500: Php 102,500 + Php 97,100= Php 199,600.

Since the annual tax due of an employee earning Php 100,000 monthly is Php 199,600, the employer should have withheld Php 16,633.33 from the monthly salary. If the yearly income tax due is the same as the total amount withheld for the year, the employee is not required to file an ITR on his/her own.

Scenario 3: Freelance web developer with total gross receipts worth Php 840,000 who opted to use the graduated rates and the 40% optional standard deduction in computing his income tax.

1. Determine the standard deduction by multiplying the gross income by 40%: Php 840,000 x 0.40 = Php 336,000.

2. To get the taxable income, subtract the OSD from the gross income: Php 840,000 – Php 336,000 = Php 504,000.

3. Refer to the BIR’s graduated tax table for the applicable tax rate. The taxable income of Php 504,000 falls under the third bracket, which means the tax rate is Php 22,500 + 20% of the excess over Php 400,000.

4. Compute the annual income tax due.

a. Subtract the non-taxable Php 400,000 from the Php 504,000 taxable income: Php 504,000 – Php 400,000 = Php 104,000.

b. Multiply the difference by 20%: Php 104,000 x 0.20 = Php 20,800.

c. Add Php 22,500: Php 20,800 + Php 22,500 = Php 43,300

The self-employed taxpayer must declare Php 43,300 as income tax due when paying and filing an ITR.

Related: How to File and Pay Taxes: An Ultimate Guide to Philippine Tax

Frequently Asked Questions

1. Which should I choose: itemized deduction or optional standard deduction?

When filing your first quarterly ITR, you must choose between itemized deduction and optional standard deduction (OSD) if you’ll avail of the graduated tax rates.

It’s an important decision, as your choice takes effect the entire year, and you can’t change it until the start of the next tax year.

To help you decide, here are the pros and cons of each deduction method:

Option 1: Itemized Deduction

Advantages.

*It can result in higher deductions (as long as you have supporting documents) than what you can claim with the OSD method, especially if you have large business expenses.

*You have control over your taxable income. The more receipts, invoices, bills, and other supporting documents you can collect, the better your chances of lowering your income tax.

*Under itemized deduction, you won’t be required to pay income tax if you incur losses during the taxable year.

Disadvantages.

*You must list your every business expense and keep the corresponding receipt (up to 10 years) or proof of the deductible expense. This, in itself, is a tedious task that requires a lot of time and patience.

*You should be meticulous in auditing your records to avoid errors in your tax computation.

*You can hire an accountant if you don’t want to track and itemize your business expenses. You must get a certified public accountant (CPA) to audit and manage your books of accounts if your gross annual sales or receipts exceed Php 3 million. Either way, it can cost you money.

Option 2: Optional Standard Deduction (OSD)

Advantages.

*Because the deduction is fixed at 40% of gross sales or receipts, the OSD is more straightforward to compute than the itemized deduction.

*The tax due is more predictable because the taxable income is automatically 60% of your gross sales/receipts.

*It doesn’t require listing, tracking, and computing your expenses (However, keeping records of business expenses is still needed).

*No need to submit the BIR Form 1701 AIF (Account Information Form) or Financial Statements.

*You’re not required to hire a CPA.

*The BIR hardly audits the expenses of OSD filers.

Disadvantages.

*If your business expenses exceed your income, filing under OSD will result in higher tax due than an itemized deduction.

*You may lose more money because 60% of your gross sales or receipts are automatically taxed, whether or not you made a profit for the year.

*You must still pay income tax even if you incur losses during the taxable year.

Itemized Deduction vs. OSD: Which Is the Better Method for You?

Filing income tax under itemized deduction is a good idea if you can keep records of all your business expenses and the expenses are higher than 40% of your gross receipts or sales.

If you’re a non-resident foreigner earning income from a business in the Philippines, you can use only the itemized deduction.

On the other hand, choose the optional standard deduction method under any of these circumstances:

*You incur low business expenses, ideally less than 40% of your gross sales or receipts.

*You hate getting audited and prefer a simpler, more straightforward way to compute your income tax.

*You’re not confident about keeping accurate books of accounts.

*You’re a freelancer without regular business expenses.

2. What is Minimum Corporate Income Tax (MCIT), and how to compute it?

Generally, the Minimum Corporate Income Tax or MCIT is a tax imposed on corporations instead of the regular income tax (RCIT) when both conditions are present/met:

1. RCIT is lower than MCIT and;

2. The corporation is in its 4th year of operations following the year of the start of the business.

The tax code allows the government to tax most domestic and resident foreign corporations whether or not they earn taxable income.

When Can a Corporation Be Subject to MCIT?

A corporation may be subject to MCIT if the RCIT is lower than the computed MCIT.

How Do I Compute for MCIT?

The MCIT is 2% of Gross Income, which is Net Sales or Revenue (Gross sales or revenue less discounts, returns, or allowances) less Cost of Sales or Services;

Cost of Sales or Services is directly incurred in bringing about the revenue or sales.

For a trading or merchandising concern, the ‘cost of goods sold’ shall include the invoice cost of the goods sold, import duties, and freight in transporting the goods to the place where the goods are sold, including insurance while the goods are in transit.

For a manufacturing concern, the ‘cost of goods manufactured and sold’ shall include all costs of production of finished goods, such as raw materials used, direct labor and manufacturing overhead, freight cost, insurance premiums, and other costs incurred to bring the raw materials to the factory or warehouse.

For taxpayers engaged in the sale of service, ‘gross income’ means gross receipts less sales returns, allowances, and discounts12.

Note, however, that specific industries have different components of the Cost of Sales or Services, as provided under RMC No. 4-2003.

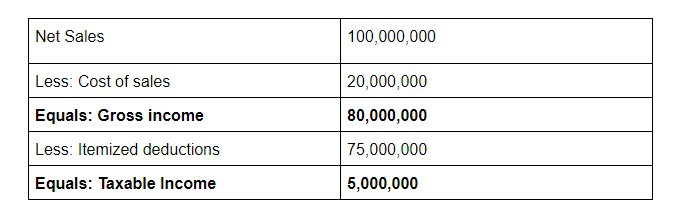

Sample Computation:

XYZ is a domestic corporation in its 10th year of business. The following is the company’s income statement for the current taxable year:

Based on the above, the RCIT shall be 1,500,000 (5,000,000*0.3), while the MCIT shall be 1,600,000 (80,000,000*.02). Therefore, the company shall pay the higher income tax, which is the MCIT amounting to 1,600,000 for the current taxable year.

When Does a Corporation Start To Be Covered by MCIT?

A company is liable for MCIT starting the 4th year immediately following the year it commenced its operations. Suppose the Company began operating in 2016 (regardless of the month). In that case, it will be liable for MCIT, provided it is higher than RCIT, starting 2020, the 4th year from 2017 (the year following the year in which it commenced operations).

The MCIT does not apply to non-resident foreign corporations. However, resident Foreign Corporations are also liable for MCIT under Sec. 28(A)(2) of the Tax Code.

Related: How to Claim Foreign Tax Credit to Lower Your Tax Liabilities

When To Pay MCIT?

The tax due shall be equivalent to the MCIT whenever it is higher than RCIT. Accordingly, its computation is done quarterly, the same as RCIT, on a cumulative basis (i.e., the income from and expenses from the first quarter are included in preparing the 2nd quarter return and so on).

Thus, if in a taxable quarter, the MCIT is higher than the RCIT, the former shall be the amount due for payment, less any available tax credits.

Carry-Forward Provision of MCIT

Any excess of the MCIT over the RCIT shall be carried forward13and credited against normal tax (RCIT) for the three (3) immediately succeeding taxable years.

In the period it is to be credited, the RCIT should be higher than the MCIT. Thus, if in the three succeeding taxable years, the MCIT is higher than the RCIT, the excess MCIT carry-over would expire and would no longer be creditable beyond that period.

Accounting entry: the accounting entry for excess MCIT carry-over would be:

Debit: Provision for income tax/Income Tax Expense

Debit: Deferred Charge – MCIT/MCIT Carry-over

Credit: Income Tax Payable/Cash

The provision for income tax or the income tax expense would be equivalent to the normal tax (RCIT), while the Income Tax Payable/Cash would be equivalent to the MCIT. The difference is treated as an asset that may be creditable against the RCIT in the succeeding three years when RCIT is higher.

Suspension of MCIT

The Secretary of Finance is authorized to suspend the imposition of the MCIT14 on any corporation which suffers losses on account of:

1. Prolonged labor disputes: losses arising from a strike staged by the employees which lasted more than six months within a taxable period and which has caused the temporary shutdown of business operations;

2. Because of force majeure: a cause due to irresistible force by an “act of God” like lightning, earthquake, storm, flood, and the like. This term shall also include armed conflicts like war or insurgency.

3. Legitimate business reverses: include substantial losses due to fire, robbery, theft or embezzlement, or other economic reasons as determined by the Secretary of Finance.

Which corporations are not subject to MCIT?

The MCIT applies only to corporations subject to the RCIT. Accordingly, the following are not subject to MCIT:

1. Propriety educational institutions subject to the tax of 10%;

2. Non-profit hospital subject to 10% tax;

3. Depository banks under the expanded foreign currency deposit system (Foreign Currency Deposit Units [FCDUs]) for offshore income exempt from income tax and onshore income subject to 10% final tax;

4. Offshore banking units similarly taxed as FCDUs;

5. International carriers subject to 2.5% tax on Gross Philippine Billings;

6. ROHQs are subject to 10% tax;

7. PEZA registered entities’ income subject to ITH or the 5% preferential GIT;

8. BOI registered entities for income subject to ITH;

9. REITs. The only corporation that is subject to RCIT but not MCIT16[/efn_note]

References

- National Internal Revenue Code (1997), Sec. 27(A)

- National Internal Revenue Code (1997), Sec. 27[E][2]

- National Internal Revenue Code (1997), Sec. 27[E][3]

- 4The Real Estate Investment Trust (REIT) Act of 2009, Section 1, Rule 10

- National Internal Revenue Code (1997), Section 32 (A)

- National Internal Revenue Code (1997), Section 32 (B)

- National Internal Revenue Code (1997), Section 34

- National Internal Revenue Code (1997), Section 36

- National Internal Revenue Code (1997), Section 34 (L)

- Comparing tax rates across ASEAN. (2018, July 26). Retrieved April 15, 2023, from https://www.aseanbriefing.com/news/comparing-tax-rates-across-asean/

- National Internal Revenue Code (1997), Sec. 27(A)

- National Internal Revenue Code (1997), Sec. 27[E][2]

- National Internal Revenue Code (1997), Sec. 27[E][3]

- 15The Real Estate Investment Trust (REIT) Act of 2009, Section 1, Rule 10

Written by Venus Zoleta

in Accounting and Taxation, BIR, Government Services, Juander How

Last Updated

Venus Zoleta

Venus Zoleta is an experienced writer and editor for over 10 years, covering topics on personal finance, travel, government services, and digital marketing. Her background is in journalism and corporate communications. In her early 20s, she started investing and purchased a home. Now, she advocates financial literacy for Filipinos and shares her knowledge online. When she's not working, Venus bonds with her pet cats and binges on Korean dramas and Pinoy rom-coms.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net