New PhilHealth Contribution Table 2025

PhilHealth contribution is the lifeblood that keeps the government’s health insurance provider running. In this guide, you’ll learn how much you need to pay to reap the full benefits of PhilHealth and indirectly help others who need medical care.

Disclaimer: This article has been published for educational purposes only. Neither the author nor FilipiKnow is affiliated with PhilHealth, so specific queries about your membership and insurance benefits must be forwarded to the proper authority.

Related: How to Register in PhilHealth Online: A Complete Guide for New Members

Table of Contents

Who Are Exempted From Paying PhilHealth Contribution?

Before paying PhilHealth contributions, know whether you’re required or exempted from doing so.

Members of the following categories don’t have to contribute to PhilHealth.

1. Persons With Disability (PWDs)

PWD members don’t need to pay anything to PhilHealth; the national government (and employer for employed members) shoulders their contributions.

2. Unemployed Senior Citizens

Senior members with no or irregular source of income are exempted from paying PhilHealth contributions. Their contributions are paid by excise taxes collected from alcohol and cigarette sales under the Sin Tax law.

However, senior citizens who are formally employed or earn a regular income should still pay their contributions under the applicable PhilHealth membership category.

Learn More: How to Avail of PhilHealth Discount and Benefits for Senior Citizen

3. Lifetime Members

Retirees with at least 120 contribution payments registered as lifetime members no longer need to remit to PhilHealth.

However, lifetime members who become employees in the Philippines or abroad must resume making PhilHealth contribution payments until they resign or get terminated.

4. Sponsored and Indigent Members

Filipino families in poor communities registered with PhilHealth as sponsored or indigent members enjoy exemption from PhilHealth contribution payment. Their contributions are paid for by another person, their LGU, a government agency like the DSWD, or a private organization.

How Much Is the Monthly Contribution to PhilHealth? (Updated for 2023)

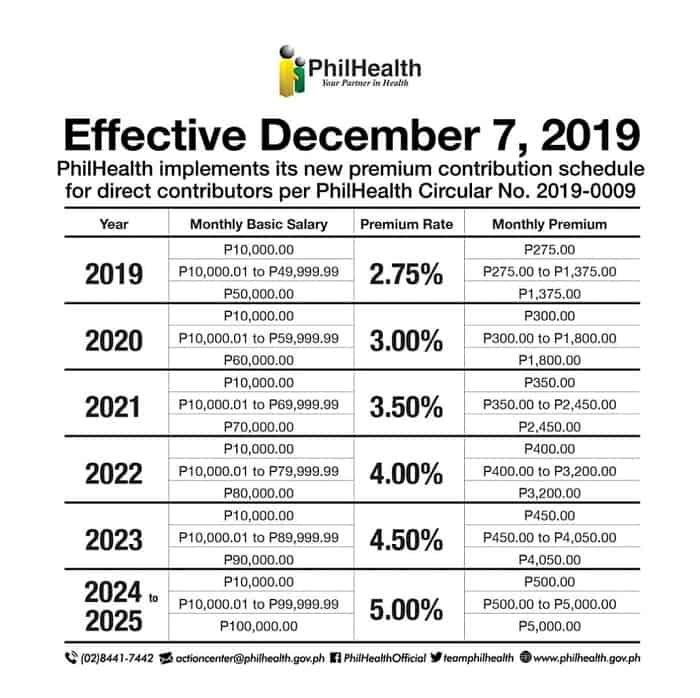

President Ferdinand Marcos Jr. ordered the suspension of the scheduled PhilHealth contribution hike for 20235. This is in light of the ongoing health and economic challenges due to the global pandemic. Thus, the 2023 premium rate remains at 4% instead of the expected 4.5% rate.

The scheduled increase in income ceiling will also not commence and will remain at ₱80,000.

This is the second time the scheduled increase in the PhilHealth premium rate has been deferred. Last January 2021, former President Duterte also suspended the increase in the premium rate that was supposed to increase contribution from 3.5% to 4%. The contribution hike was resumed last June 20226.

If the 2023 contribution hike had been continued, the minimum contribution would have increased to ₱450 from ₱400 (for those who earn ₱10,000 and lower). Meanwhile, the maximum contribution would have grown to ₱4,050 from ₱3,200 (for those who make higher than the applicable income ceiling).

Shown below is the effectivePhilHealth premium contribution table starting January 2023:

| Monthly Basic Salary | Premium Rate | Monthly Premium |

| ₱10,000 and below | 4% | ₱400 |

| ₱10,000.01 to ₱79,999.99 | 4% | ₱400 to ₱3,200 |

| ₱80,000 and above | 4% | ₱3,200 |

1. PhilHealth Contribution Table for Employees and Employers

| Monthly Basic Salary | Total Monthly Contribution | Employee Share | Employer Share |

| ₱10,000 and below | ₱400 | ₱200 | ₱200 |

| ₱10,000.01 to ₱79,999.99 | ₱400 to ₱3,200 | ₱200 to ₱1,600 | ₱200 to ₱1,600 |

| ₱80,000 and above | ₱3,200 | ₱1,600 | ₱1,600 |

The monthly premium will continue to be shared equally between employees and employers.

With a premium rate of 4%for 2023, the monthly contribution for employees earning ₱10,000 and below is fixed at ₱400. Meanwhile, those making ₱80,000 and above have a fixed monthly contribution of ₱1,600

Take note that the salary ceiling of ₱80,000 is still applicable in 2023 but will continue to increase by an increment of ₱10,000 a year until it reaches ₱100,000 in the upcoming years.

For those in between, use this formula to compute your PhilHealth contribution:

Employee or employer share = (Monthly basic salary x 0.04) / 2

Here’s a sample computation for an employee with a salary of ₱25,000:

₱25,000 x 0.04 = ₱1,000 (Total monthly contribution) / 2 = ₱500 (Employee or employer share)

The PhilHealth contribution of employees on extended leave without pay is equivalent to that of voluntary or individually paying members.

2. PhilHealth Contribution Table for Voluntary/Self-Employed or Direct Contributors

| Monthly Income | Total Monthly Contribution |

| ₱10,000 and below | ₱400 |

| ₱10,000.01 to ₱79,999.99 | ₱400 to ₱3,200 |

| ₱80,000 and above | ₱3,200 |

Like the previous category, voluntary/self-employed members will follow the new PhilHealth premium rate. Unlike salaried employees, however, they don’t have employers who will shoulder half of their monthly premium.

Therefore, members in this category will remit the full 4% of their declared monthly income to PhilHealth. For example, a voluntary member who earns ₱35,000 a month will pay a monthly premium of ₱1,400 (₱35,000 x 0.04).

The current income floor and income ceiling for voluntary members are also fixed at ₱10,000 and ₱80,000, respectively. This means that those with a declared monthly income of ₱10,000 and below will pay a fixed monthly premium of ₱400, while those who earn ₱80,000 and above a month will pay the same monthly premium of ₱3,200.

This income ceiling will likewise increase by ₱10,000 every year until it reaches ₱100,000 in the upcoming years.

The premium can be paid monthly or quarterly by the member.

For PhilHealth to come up with an accurate computation, they may require members to submit financial records like a duly-notarized affidavit of income declaration or the latest income tax return received by the Bureau of Internal Revenue.

Otherwise, their contributions will be based on the highest computed rate.

3. PhilHealth Contribution Table for Land-Based Migrant Workers and OFWs

| Monthly Basic Salary (in Philippine pesos) | Total Annual Contribution (Monthly premium x12) |

| ₱10,000 and below | ₱4,800 |

| ₱10,000.01 to ₱79,999.99 | ₱4,800 to ₱38,400 |

| ₱80,000 and above | ₱38,400 |

Land-based OFWs are also affected by the recent contribution hike, and their premiums will be computed based on their monthly earnings (see table above).

The premium rate for OFWs for 2023 is still 4%. The computation only applies to Philippine pesos, so you must first convert your monthly salary based on the current exchange rate before proceeding.

For example, if you earn $500 monthly and convert it to Philippine pesos based on the exchange rate as of this writing ($1 = ₱55), you’ll have a basic monthly salary of ₱27,500.

Since the 2023 premium rate is 4%, your monthly PhilHealth premium based on your salary is ₱1,100 (₱27,500 x 0.04). Multiply your monthly premium by 12, and you have a total annual contribution of ₱13,200.

You don’t have to pay this in total, though. You can shell out the required initial payment of ₱2,700 before leaving the country and pay the remaining balance by installment every three months, every six months, or after twelve months 7. PhilHealth may require land-based OFWs to present their overseas employment contract as proof of income to ensure accurate computation. Otherwise, their premiums will be automatically based on the highest computed rate.

Land-based migrant workers may see this as a burden. Still, PhilHealth assures them that the increase in contributions is intended to “guarantee fund sustainability and to effectively implement the Universal Health Care (UHC)”8.

Seafarers have a different contribution rate and table, similar to employed members (see Table 1 above). The seafarers’ share of contribution is deducted from their monthly salary, and their manning agencies shoulder the employer’s share.

4. PhilHealth Contribution Table for Kasambahays

| Monthly Basic Salary | Total Monthly Contribution | Kasambahay Share | Employer Share |

| ₱4,999.99 and below | ₱400 | None | ₱400 |

| ₱5,000 to ₱79,999.99 | ₱ 200 to ₱3,200 | ₱100 to ₱1,600 | ₱100 to ₱1,600 |

| ₱80,000 and above | ₱3,200 | ₱1,600 | ₱1,600 |

Kasambahays have the same PhilHealth contribution rate and computation as formally employed members. For household workers receiving a monthly salary of lower than ₱5,000, their employers are required to pay their total monthly contribution in full to PhilHealth. However, kasambahays earning more than ₱5,000 and above should share half of their monthly contribution payment.

5. PhilHealth Contribution Table for Foreigners

| Types of Foreign Members | Quarterly Contribution | Semi-annual Contribution | Annual Contribution |

| Foreign retirees | ₱3,750 | ₱7,500 | ₱15,000 |

| Other Foreigners | ₱4,250 | ₱8,500 | ₱17,000 |

Foreigners pay the highest contribution amount among all PhilHealth membership types.

Retirees in the Philippines pay ₱15,000 per year, while expats, exchange students, and other foreigners pay ₱17,000. Alternatively, they may remit their contributions every quarter or twice a year.

6. PhilHealth Contribution for Filipinos With Dual Citizenship

Dual citizens are also encouraged to pay their contribution yearly based on the 2023 PhilHealth premium rate (4%).

They can make advanced payments for up to two consecutive years only. The contributions can be remitted to any PhilHealth office or any PhilHealth-accredited collecting agent here or abroad.

Dual citizens refer to those who have retained and re-acquired their Filipino citizenship under the Citizenship Retention and Re-acquisition Act of 2003 (Republic Act 9225).

Under the National Health Insurance Act of 2013 (R.A. 7875, as amended by R.A. 10606), Filipinos with dual citizenship can now register with PhilHealth to avail of its benefits. For a list of membership requirements, click here.

Tips and Warnings

1. PhilHealth members shall incur interests/penalties for missed payments

Starting January 2020, PhilHealth members who lack contributions will now be billed for their unpaid monthly premiums with interests (compounded monthly).

Employers, kasambahays, and sea-based OFWs shall incur interest of at least 3% monthly for a missed payment.

Meanwhile, land-based migrant workers/OFWs, professional practitioners, and voluntary/self-earning members will be charged a maximum interest of 1.5% for the missed payment every month.

2. Higher Philhealth contribution means more added benefits

The increased monthly premium aligns with the full implementation of the Universal Health Care (UHC) Law, which began in January 2020.

Under this law, members can access preventive, primitive, curative, rehabilitative, and palliative care. In addition to these, they will also get outpatient benefits, including drug and emergency services.

The additional benefits will also cover mental, medical, and dental services.

3. Regular paying members will not fund the benefits of non-paying PhilHealth members

These non-paying members exempted from paying Philhealth contributions include senior citizens and indirect contributors or sponsored members/indigents.

Their benefits will be funded by the sin tax and the government’s shares from the Philippine Amusement and Gaming Corporation (PAGCOR) and the Philippine Charity Sweepstakes Office (PCSO).

Frequently Asked Questions

1. Where can I pay my PhilHealth contribution?

You can pay your PhilHealth contributions at PhilHealth offices, over-the-counter collecting partners, online payment channels, and overseas collecting partners (for OFWs). Check out this article for the complete list of payment channels.

2. I want to make sure that my payments are remitted. How can I check my PhilHealth contributions?

PhilHealth’s online service allows members to conveniently access their posted contributions and membership records. Follow the instructions in this article for creating an account and checking your membership contributions.

3. How many contributions should I pay to avail of PhilHealth benefits?

Only active members can receive PhilHealth benefits. Active membership means meeting both of these two requirements:

a. Qualifying contributions – Paid at least three monthly contributions within six months before the first day of availing/confinement

b. Sufficient regularity of payment – Paid at least six monthly contributions preceding the three-month qualifying contribution payments within the 12 months immediately before the first day of availing/confinement.

Therefore, to be eligible for PhilHealth benefits, you should have paid at least nine monthly contributions within the 12 months immediately before the first day of confinement. The 12-month period includes the confinement month.

For example, if you’re confined from October 20 to 22, 2019, you should have paid PhilHealth contributions for at least nine months from November 2018 to October 2019 before being admitted to the hospital.

However, you won’t be allowed to claim PhilHealth benefits if you pay your contribution for the ninth month (within the 12 months) on October 23 onwards (on the day of discharge or after confinement). This is due to the failure to comply with the three-month qualifying contribution rule before the first day of confinement.

As long as you meet both the qualifying contribution rule and sufficient regularity of payment rule, you may qualify for coverage even if you’ve skipped contribution payments for up to three months within the 12 months. But it’s better not to miss any payment. You’ll never know when you’ll be hospitalized anyway.

The rule on sufficient regularity of payment doesn’t apply to all types of PhilHealth members. The following members are exempted:

a. OFWs

b. Senior citizens

c. Lifetime members

d. Kasambahays

e. Women about to give birth

f. Indigent members

g. iGroup Program members

h. Point of Service (POS) members, whether financially incapable or capable

Senior citizens and lifetime members can avail of PhilHealth benefits anytime, while OFWs and other member types listed above are covered within their membership validity period.

PhilHealth members newly registered for less than nine months must only pay at least three monthly contributions within six months before the first day of confinement.

4. Can I pay PhilHealth contribution for the months that I missed?

PhilHealth allows retroactive contribution payment if the member has paid nine consecutive monthly contributions before the unpaid months/missed quarter. In addition, you must pay retroactively within one month after the unpaid months. Read this article to learn more.

5. I stopped paying my PhilHealth contributions years ago. How do I continue making payments?

You must renew your membership by submitting an updated PMRF (PhilHealth Member Registration Form). Fill out the areas of the form that need to be modified from the last time you made a payment by checking the box next to the amendment. Update your income information as well. For more information, please go to this article.

6. There’s a discrepancy between my posted and actual contributions. What should I do?

If you’re an employee whose PhilHealth contributions are paid via salary deduction, coordinate immediately with your company HR or employer to report about the months with no posted contribution.

If your employer still doesn’t remit the contributions deducted from your salary, call the PhilHealth hotline at (02) 441-7442 to ask for the procedure to file a complaint.

Delinquent employers are fined ₱50,000 for every affected employee, jailed for six to 12 months, or both, according to the court’s discretion.

In addition, check the official receipts of your contribution payments to verify if there’s an inconsistency in your posted vs. actual payments.

Then call the PhilHealth hotline to report the discrepancy. Ask what you must do to correct your contribution payment history on PhilHealth’s database. You’ll most likely be asked to present your ORs as proof of payment to any PhilHealth office and request an update of your contribution records.

7. Is PhilHealth free for senior citizens?

Yes. Thanks to Republic Act No. 10645, all senior citizens, indigent or not, are now automatically covered by PhilHealth.

8. Can I pay my PhilHealth contributions in advance?

It depends on your membership type. For example, employed private and government sector members cannot have their PhilHealth premiums deducted from their salary in advance.

If you belong to any of the following PhilHealth members, you can pay your contribution in advance to ensure your continuous health insurance coverage.

1. PhilHealth Membership Type: OFW9

Maximum Period for PhilHealth Contribution Advance Payment: Equivalent to the number of years stated in the employment contract

2. PhilHealth Membership Type: Filipino with dual citizenship10

Maximum Period for PhilHealth Contribution Advance Payment: Two consecutive years

3. PhilHealth Membership Type: Kasambahay11

Maximum Period for PhilHealth Contribution Advance Payment: Two calendar years

4. PhilHealth Membership Type: Voluntary members/Self-employed individuals/Freelancers

Maximum Period for PhilHealth Contribution Advance Payment: Three calendar years (36 months)

When making an advance payment for your PhilHealth contribution, indicate the correct period you’re paying for so that your payment will be appropriately posted in PhilHealth’s records.

9. Can a student apply for PhilHealth and pay for the contributions?

Yes. PhilHealth benefits are accessible to everyone, including students. All Filipinos are automatically entitled to PhilHealth benefits under the Universal Health Care Law. However, you must register to avail of them. Learn more about PhilHealth for students by reading this article.

10. How many times can I use my PhilHealth?

PhilHealth members are entitled to a maximum of 45 days of confinement per calendar year12. The qualified dependents of the member share another set of 45 days of coverage per calendar year. However, the 45 days allowance shall be shared among them.

A patient should be confined for at least 24 hours in a PhilHealth-accredited hospital to be able to claim the PhilHealth compensation. PhilHealth also follows the Single Period of Confinement (SPC) Rule when approving claims. It states that admissions and readmissions due to the same illness or procedure within a 90- calendar day period shall only be compensated with one (1) case rate benefit.

In other words, more than 90 days must lapse between your first and subsequent admission for the same illness or procedure before you can be qualified for a new benefit.

Note: Certain conditions requiring multiple treatment sessions (e.g., hemodialysis) in the hospital are entitled to more than 45 days of confinement per calendar year. Ensure to properly check the package to be availed to stay informed of the allowable limit.

11. How many percent does PhilHealth cover?

The percentage of hospital expenses that PhilHealth will cover depends on your case/disease. PhilHealth has a search portal that the public can use to determine the case rate for every condition/procedure. This can help you make an accurate estimate as to how much you will be paying the hospital. Read this for more info.

12. How many contributions do I need to avail of PhilHealth maternity benefits?

Every PhilHealth member about to give birth is immediately eligible for maternity benefits as per the Universal Health Care Act, regardless of the number of contributions. However, members are advised to continue paying their monthly premiums to avoid penalties. Learn more about PhilHealth maternity benefits in this article.

References

- PhilHealth Circular No. 2020-0014. (2020). [PDF]. Retrieved from https://www.philhealth.gov.ph/circulars/2020/circ2020-0014.pdf

- Filipinos with dual citizenship are now covered by PhilHealth. (2017). Retrieved 22 October 2020, from https://www.philhealth.gov.ph/news/2017/dual_covered.html

- PhilHealth Circular No. 016-2015. (2015). [PDF]. Retrieved from https://www.philhealth.gov.ph/circulars/2015/TS_circ016-2015.pdf

- PhilHealth Circular No. 2020-007 (Guidelines on the Provisions of Special Privileges to those Affected by a Fortuitous Event). (2020). [PDF]. Retrieved from https://www.philhealth.gov.ph/circulars/2020/circ2020-0007.pdf

- Bajo, A. (2023, January 02). Marcos orders Philhealth to Suspend Premium Rate Hike -Palace. Retrieved January 4, 2023, from https://www.gmanetwork.com/news/money/companies/856097/marcos-orders-philhealth-suspend-premium-rate-hike-palace/story/

- Magsambol, B. (2022, May 05). Filipinos to pay Higher Philhealth Rate starting June 2022. Retrieved January 4, 2023, from https://www.rappler.com/nation/filipinos-pay-higher-philhealth-rate-starting-june-2022/

- Philippine Health Insurance Corporation (PhilHeath). (2020, April 16). PhilHeath Circular No. 2020-0014 [Press release]. Retrieved January 1, 2023, from https://www.philhealth.gov.ph/circulars/2020/circ2020-0014.pdf

- Premium Increase and PACC Report. (2019). Retrieved 7 May 2020, from https://www.philhealth.gov.ph/news/2019/prem_increase.php

- PhilHealth Circular No. 2020-0014. (2020). [PDF]. Retrieved from https://www.philhealth.gov.ph/circulars/2020/circ2020-0014.pdf

- Filipinos with dual citizenship are now covered by PhilHealth. (2017). Retrieved 22 October 2020, from https://www.philhealth.gov.ph/news/2017/dual_covered.html

- PhilHealth Circular No. 016-2015. (2015). [PDF]. Retrieved from https://www.philhealth.gov.ph/circulars/2015/TS_circ016-2015.pdf

- PhilHealth Circular No. 2020-007 (Guidelines on the Provisions of Special Privileges to those Affected by a Fortuitous Event). (2020). [PDF]. Retrieved from https://www.philhealth.gov.ph/circulars/2020/circ2020-0007.pdf

Venus Zoleta

Venus Zoleta is an experienced writer and editor for over 10 years, covering topics on personal finance, travel, government services, and digital marketing. Her background is in journalism and corporate communications. In her early 20s, she started investing and purchased a home. Now, she advocates financial literacy for Filipinos and shares her knowledge online. When she's not working, Venus bonds with her pet cats and binges on Korean dramas and Pinoy rom-coms.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net