How To Get Professional Tax Receipt (PTR): An Ultimate Guide

Did you know that professionals in the Philippines have a duty to pay an annual tax to practice their profession? In this guide, we will walk you through the payment of this tax, and how to obtain a Professional Tax Receipt.

Table of Contents

- What Is a Professional Tax Receipt (PTR)?

- Who Is Required To Obtain a PTR?

- Who Is Exempted From Obtaining a PTR?

- What Are the Requirements for Obtaining PTR?

- Where Do You Go To Apply for a PTR?

- How Much Does It Cost To Apply for a PTR?

- When Shall You Pay for the PTR, and What Is Its Validity?

- How To Get PTR: A Step-by-Step Guide

- Frequently Asked Questions

- 1. What is the expiration of a professional tax receipt?

- 2. If I got my PTR from City A, and I moved to City B, where shall I pay my PTR?

- 3. Is PTR required for local business and BIR applications?

- 4. If I practice two or more professions, how many times shall I pay for the PTR?

- 5. What is the difference between Professional Tax Receipt (PTR) and Occupational Tax Receipt (OTR)?

- References

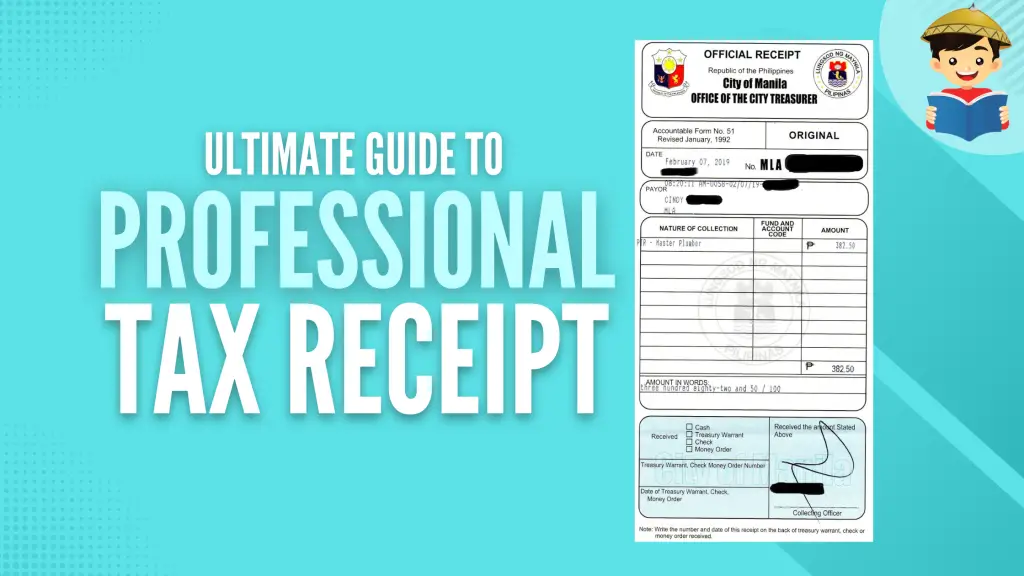

What Is a Professional Tax Receipt (PTR)?

The Professional Tax Receipt (PTR) is proof of payment of the professional tax to the province where they practice their profession. For the purposes of this article, we will refer to this professional tax as PTR.

Its legal basis is Section 139 of the Local Government Code1 of the Philippines, which mandates the provincial government to charge an annual professional tax to a person engaged in the exercise or practice of their profession requiring government examination. This means that professions that are under the Professional Regulations Commission’s (PRC) authority are required to pay this tax annually.

PTR is required for self-employed professionals to practice their profession and to renew their business registration requirements, while it is required for employers of professionals as a requirement of the law.

The PTR number, which can be found in the PTR, shall be written in deeds, receipts, prescriptions, reports, books of account, plans and designs, surveys, and maps, as the case may be, to be a proof that the professional indeed is licensed and is permitted to practice his profession.

Who Is Required To Obtain a PTR?

All professionals under the authority of the PRC2 are required to pay PTR. This means that you must at least have a valid PRC ID since this is proof that you have passed a licensure examination given by the commission.

Lawyers who are members of the Integrated Bar of the Philippines are also required to pay for the PTR.

Who Is Exempted From Obtaining a PTR?

On the other hand, licensed professionals who are employed exclusively by the government or any government agency are exempted from paying the PTR.

What Are the Requirements for Obtaining PTR?

For first-time applicants, you will need a PRC ID as a requirement to pay for the PTR. You also need to obtain an Authorization Letter/Special Power of Attorney if you are going to apply through a representative.

If your PRC ID is not available, a Certification issued by the PRC or any proof of license with the PRC may be accepted, but this depends on the Local Government Unit (LGU). Check with your LGU first. If the LGU does not accept this, apply for issuance of PRC ID instead.

You need to present a copy of the previously issued PTR for renewals.

Where Do You Go To Apply for a PTR?

Professionals may go to the City/Municipal Treasury Department of the City/Municipal Office with jurisdiction over the professional’s principal office to apply and pay for the PTR. Note that while a professional pay for the PTR at the LGU, he shall be entitled to practice his profession in any part of the Philippines without being subjected to any other national or local tax, license, or fee for the practice of such profession.

Some Local Government Units have offered online applications and payments for PTR amidst the COVID-19 pandemic. Check your local city/municipal treasurer if they provide the option and their specific procedures on how to apply.

How Much Does It Cost To Apply for a PTR?

The PTR may vary with different LGUs, but the Local Government Code mandates that the amount shall not exceed ₱300.00.

Penalties, surcharge, and interest on top of the basic tax may be charged for years during which the professional did not pay for the PTR. So, remember to renew your PTR annually to avoid penalties!

When Shall You Pay for the PTR, and What Is Its Validity?

The PTR shall be paid at the beginning of every year on or before January 31, which covers the current year on when it is paid. For example, a professional must pay the tax on or before January 31, 2022, to be able to practice their profession.

Professionals must pay this tax before practicing their profession for the year.

How To Get PTR: A Step-by-Step Guide

1. Present the Requirements

Present the PRC ID (or any alternative proof of profession), previous PTR (if applying for renewal), and Authorization Letter/Special Power of Attorney (if you will apply through an authorized person) to the City/Municipal Treasurer’s Office. Look for the booth or section that processes PTR.

2. Pay the Tax

Pay for the tax, and the PTR will be issued to you.

Frequently Asked Questions

1. What is the expiration of a professional tax receipt?

The professional tax receipt expires on December 31st of the year it is issued. A PTR must be acquired immediately at the start of the year to immediately practice their profession for the whole year since a professional cannot practice without it.

2. If I got my PTR from City A, and I moved to City B, where shall I pay my PTR?

The Local Government Code mandates that the PTR be paid at the LGU where the professional’s principal office is covered. Therefore, it should be where the professional is primarily practicing his profession. Do not worry since LGUs accept PTRs issued by other LGUs as a renewal requirement for the PTR.

3. Is PTR required for local business and BIR applications?

Yes, if the nature of the business being registered is related to the practice of a profession.

4. If I practice two or more professions, how many times shall I pay for the PTR?

The payment for the PTR is on a per profession basis, which means that individuals with multiple professions need to pay for PTR for each qualified profession.

5. What is the difference between Professional Tax Receipt (PTR) and Occupational Tax Receipt (OTR)?

An Occupational Tax Receipt is for non-licensed professionals, mostly those who are not under the authority of the PRC. Freelancers, writers, and graphic artists are some of the examples who are required to obtain an OTR. Individuals usually get an OTR from their LGU similar to the process on how professionals obtain PTR, which is by going to their City/Municipal Treasurer’s Office to pay the tax.

References

- Official Gazette. Local Government Code of 1991 (1991).

- Professional Regulatory Boards. Retrieved 13 June 2022, from https://www.prc.gov.ph/professional-regulatory-boards

Written by Romeo Miguel Ginez, CPA

Romeo Miguel Ginez, CPA

Romeo Miguel Ginez is a Certified Public Accountant who has helped different companies and individuals with their accounting and tax-related concerns since 2014. He currently runs an accounting firm that advocates automation and cloud-based accounting for SMEs. He is also an educator, and a gamer, and has a passion to debate important topics. To contact Romeo, send an email to [email protected], or reach out to his mobile number 09176529792 through SMS, Viber, or WhatsApp.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net