How To Compute Your Income Tax Using Online Tax Calculator: An Ultimate Guide

This article has been reviewed and edited by Miguel Dar, a CPA and an experienced tax consultant who specializes in tax audits. He provides tax advice to various start-up enterprises and clarified tax concerns of individual taxpayers. This includes assisting clients in registering their businesses, tax and bookkeeping training for start-up businesses, settling open cases, tax planning for future tax compliance and answering tax-related inquiries.

Manual computation can be an accurate way to compute income tax, as long as you do it right. The problem, however, is the tedious and oftentimes confusing process, especially if you have no background in finance or accounting.

A simpler method of determining your tax due is to use an online tax calculator, ideally one from an official government source like the BIR. Errors are minimized because you don’t have to refer to a tax table (which may look convoluted for the mathematically challenged) when computing your tax.

Currently, three tax calculators from the government are available online for taxpayers who wish to perform DIY tax computation minus the hassle.

Go back to the main article: How to Compute Income Tax in the Philippines: An Ultimate Guide

Table of Contents

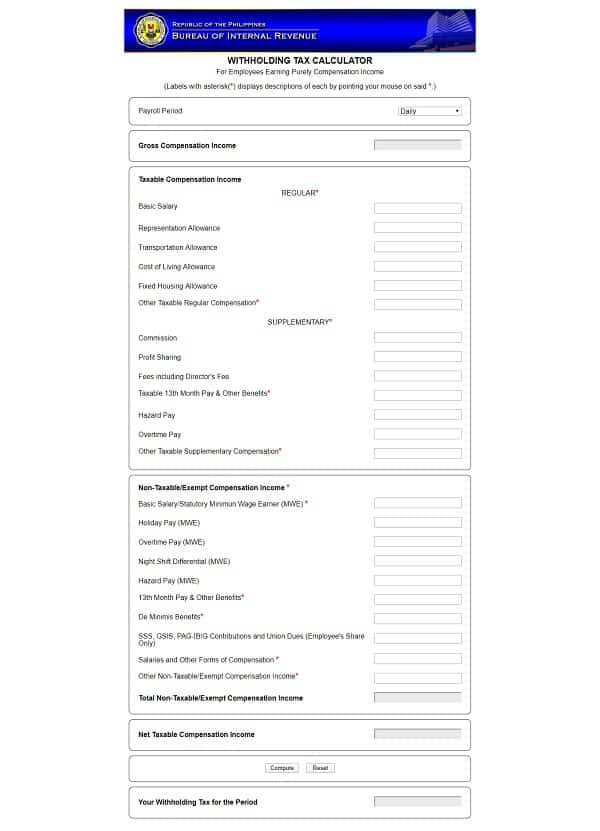

1. BIR Withholding Tax Calculator

The official BIR tax calculator is available on the government agency’s website. This browser-based application automates the tax computation of employees who earn solely compensation income.

The BIR Withholding Tax Calculator helps employees know if their employer is correctly deducting withholding tax from their salary. However, according to the BIR, taxpayers cannot use the online calculator’s computation as a basis of complaints against employers for incorrect tax withheld.

As the name implies, this online tool calculates only withholding tax—it’s not for computing the annual income tax. Your tax withheld might turn out to be different from your annual income tax by the end of the year.

For example, your employer suddenly gives you a huge Christmas bonus by the year-end. This could increase your taxable income and thus, adjustments have to be made in your annual income tax computation (as your employer might have withheld a lower total tax amount for the year than your supposed annual income tax due).

How To Use the BIR Withholding Tax Calculator

The BIR’s online tax calculator looks intimidating and overwhelming, what with the many fields to fill out. But it’s actually straightforward to use. Here’s how:

- Select your payroll period (how often you receive your pay). Pick “Semi-Monthly” if you receive your salary twice per month.

- Proceed to the Taxable Compensation Income section. Skip the Gross Compensation Income field because this figure is automatically generated based on the income details you enter.

- Under “Regular Compensation,” type your basic salary and allowances (if any) as indicated in your payslip.

- Under “Supplementary Compensation,” enter the amount of commission, overtime pay, and any other applicable benefits you’ve received for the year regardless of the payroll period. Skip the “Taxable 13th Month Pay & Other Benefits” field.

- If you’re not a minimum wage earner (MWE), skip the fields with “MWE” under the Non-Taxable/Exempt Compensation Income section.

- On the “13th Month Pay & Other Benefits” field, enter your total amount of benefits, including 13th-month pay, Christmas bonus, performance incentives, loyalty award, etc., if any. Based on the data you enter, the “Taxable 13th Month Pay & Other Benefits” field will be automatically filled out with the excess amount of the Php 90,000 tax exemption.

- Fill out the rest of the remaining fields, whichever applies to you.

- Click the Compute button at the bottom of the page. Underneath, you’ll see your withholding tax.

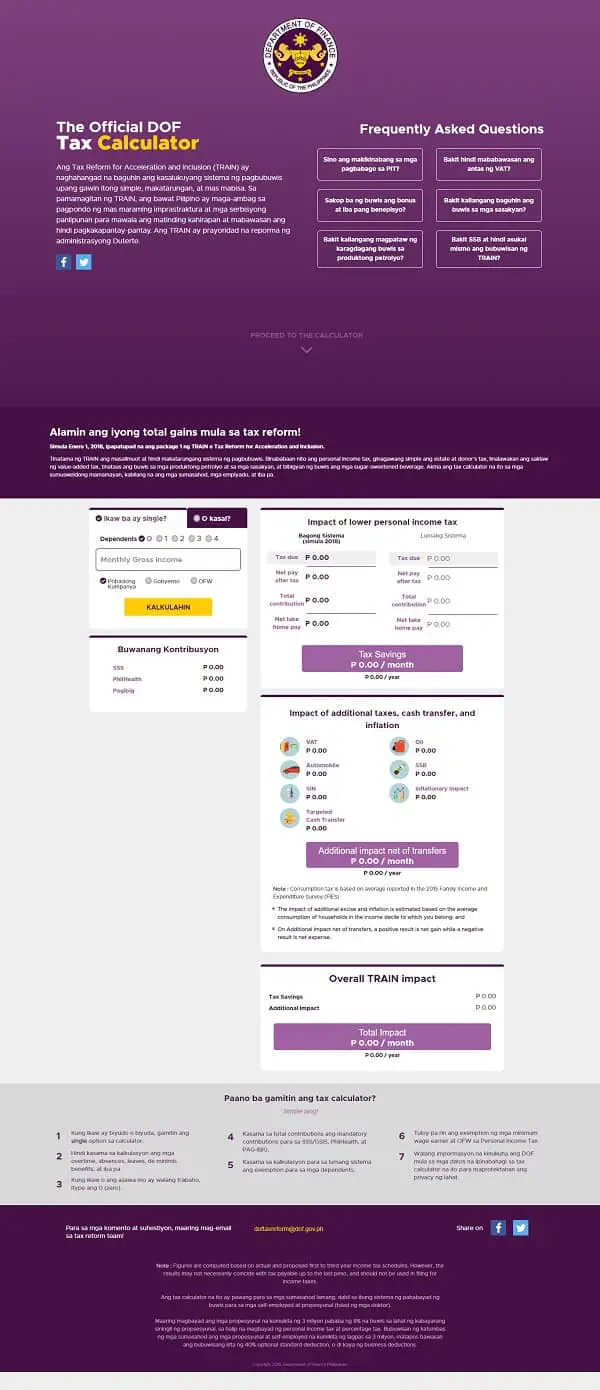

2. DOF Tax Calculator

When the government began implementing the TRAIN Act in 2018, the Department of Finance (DOF) released an online tax calculator to educate taxpayers on how the tax reform law would affect their personal income tax.

Like the BIR’s tax calculator, the official DOF Tax Calculator is made for employees in the private or government sector.

This online calculator computes your monthly income tax due and net take-home pay (under the TRAIN law vs. the old tax system) based on your monthly gross income. It also shows how much you’ll save on taxes per month and per year.

Convenient as it may be, the DOF’s online tax calculator doesn’t yield 100% accurate results. While it automatically generates the SSS, PhilHealth, and Pag-IBIG contributions based on the monthly income, the contributions don’t reflect the current rates (It still uses the contribution rates of the three agencies as of 2018) and are thus outdated.

Particularly, the SSS contribution computation is not up-to-date with the latest data (based on 2019 contribution hike). PhilHealth has also increased contribution rates starting in 2020. The Pag-IBIG contribution rate will increase in 2021, too.

Nevertheless, the DOF Tax Calculator is a good way to estimate your withholding tax.

How To Use the DOF Tax Calculator

- Select your civil status, whether you’re single or married. If you choose the married option, your spouse’s income will be combined with yours in computing your tax due.

- Enter your monthly gross income.

- Select whether you’re working for a private company or the government. If you choose the OFW option, using the tax calculator would be pointless because your income from abroad is not taxable.

- Click the Kalkulahin button. The system will automatically generate your monthly contributions, tax due, take-home pay, and tax savings.

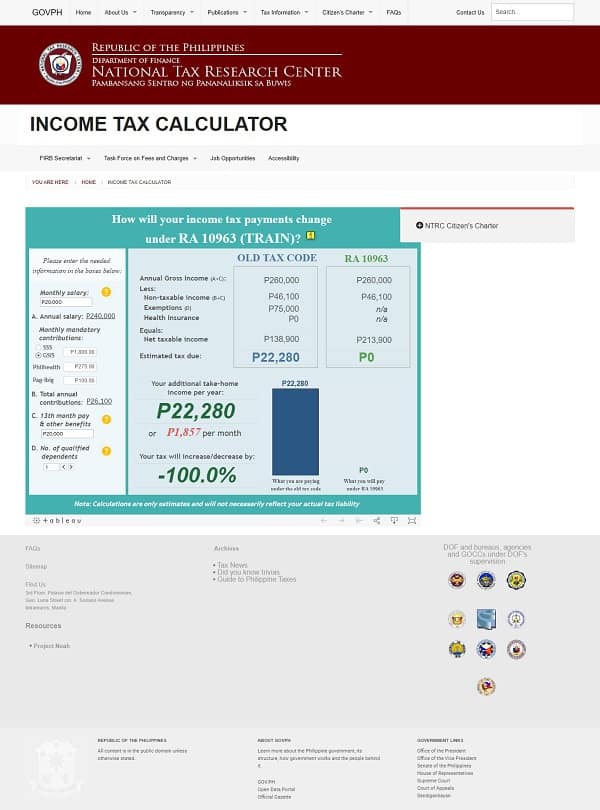

3. NTRC Income Tax Calculator

The National Tax Research Center (NTRC) is an agency under the DOF that conducts research in taxation to improve the tax system in the Philippines. Its online income tax calculator is quite similar in terms of features and functions to the DOF tax calculator, except that the former provides more detailed information.

Also, the NTRC Income Tax Calculator computes the annual income tax due, unlike the DOF calculator that shows the monthly tax due.

The NTRC’s tax calculator uses old rates to compute SSS, PhilHealth, and Pag-IBIG contributions, so don’t expect to get accurate and updated results. Use it only to estimate your income tax.

How To Use the NTRC Income Tax Calculator

- Enter your gross monthly salary.

- Under Monthly Mandatory Contributions, choose SSS if you’re a private employee or GSIS if you’re a government employee.

- Enter the total amount of 13th-month pay and other benefits you’ve received in a year.

- The NTRC tax calculator will automatically generate your annual gross income, taxable income, and estimated annual income tax due. Refer to the figures under “RA 10963” (the TRAIN Act) for the more updated data.

Related: How to File and Pay Taxes: An Ultimate Guide to Philippine Tax

Written by Venus Zoleta

in Accounting and Taxation, BIR, Government Services, Juander How

Venus Zoleta

Venus Zoleta is an experienced writer and editor for over 10 years, covering topics on personal finance, travel, government services, and digital marketing. Her background is in journalism and corporate communications. In her early 20s, she started investing and purchased a home. Now, she advocates financial literacy for Filipinos and shares her knowledge online. When she's not working, Venus bonds with her pet cats and binges on Korean dramas and Pinoy rom-coms.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net