How To Invest in Mutual Funds in the Philippines: A Complete Beginner’s Guide

Investing, when done right, can be quite rewarding. Aside from the financial rewards, it can also be an engaging “side hustle,” like a profitable hobby. However, the downside of retail investing is that it can also be a high-maintenance endeavor. It requires thoughtful research, diligent monitoring, and disciplined execution. Many retail investors may not have the time or expertise to commit to such a routine, so mutual funds were created.

Like how you hire lawyers to oversee your legal affairs or hire doctors to manage your health, you can also hire fund managers to handle your investments. Mutual funds are an efficient and popular way to do this.

DISCLAIMER: This article is for information purposes only. No portion of this work should be interpreted as an offer, solicitation, or recommendation to buy or sell the investment securities or vehicles referenced herein. The information in this article is as of the date of publication and may have changed following said date.

Table of Contents

- What Is a Mutual Fund?

- How Are Mutual Funds Different From Other Investments?

- Are Mutual Funds Beginner-Friendly?

- How Do You Make Money From Mutual Funds?

- Is There a Risk of Loss?

- Who Can Invest in Mutual Funds?

- How Much Money Do You Need To Invest in Mutual Funds?

- Pros and Cons of Investing in Mutual Funds

- What To Consider When Choosing a Mutual Fund

- How To Invest in Mutual Funds

- Tips and Warnings

- Frequently Asked Questions

- References

What Is a Mutual Fund?

A mutual fund is a way for individual investors to pool their money and have it managed by an expert known as the fund manager. Similar to how you can deposit your money in a bank for safekeeping, you can also “deposit” your money in a mutual fund for growing. (In mutual fund investing, a deposit is referred to as a subscription.)

Mutual funds are structured as companies. Investors who wish to make a subscription to a mutual fund do so by buying shares in the company that manages the fund, in effect being part-owner. The company’s fund manager then invests the money it receives from investors in investment securities like stocks and bonds.

You can “withdraw” at any time as well. This is done by selling your shares back to the company, which then gives you your money back, along with any profits (or losses, if any) that you earned while it was under the fund manager’s care. (In mutual fund investing, a withdrawal is referred to as a redemption.)

Mutual funds are regulated by the Securities and Exchange Commission (SEC), similar to how banks are regulated by the Bangko Sentral. Thus, there are legal repercussions for fund managers who mismanage investor funds. This is why investors can trust the fund manager to handle their money responsibly.

How Are Mutual Funds Different From Other Investments?

1. Mutual Funds vs. Stocks

Stocks are an investment, whereas mutual funds are a way to invest in stocks. You can invest in stocks directly through a brokerage account, or you can also invest in stocks by subscribing to a mutual fund specializing in stocks.

Investing in stocks directly is often called active investing while investing in stocks through vehicles like mutual funds is called passive investing.

2. Mutual Funds vs. Unit Investment Trust Funds (UITFs)

Mutual funds and UITFs only differ with respect to their legal characteristics1. UITFs are offered and managed by banks, while mutual funds are offered and managed by non-bank investment companies.

Unlike in mutual funds, subscribing to a UITF does not make you part-owner of the bank. To invest in a UITF, you need to purchase “units” from the offering banks, while investing in a mutual fund requires buying shares in the mutual fund company.

Apart from these legal differences, mutual funds and UITFs work essentially the same way: they pool investor funds and have them managed by a professional.

3. Mutual Funds vs. Exchange Traded Funds (ETFs)

ETFs are a kind of mutual fund; they only differ with respect to how one can gain access to the fund.

Both mutual funds and ETFs require you to buy shares in the investment company to invest in the fund. With mutual funds, you can only buy the shares directly from the company. With ETFs, in contrast, you can buy or sell the shares via the Philippine Stock Exchange (PSEI), similar to how you would buy the stock of other PSE-listed companies. Currently, First Metro ETF ($FMETF) is the only ETF in the Philippines.

Are Mutual Funds Beginner-Friendly?

The quick answer is yes. The better answer is that it depends.

Beginner-friendliness depends on your goals as an investor. Mutual funds allow you to learn about investing through a top-down approach: professional fund managers can manage your money while you get comfortable with the big picture of the markets. This is valuable because it allows you to ride the learning curve without falling victim to common beginner pitfalls of active investing.

As you learn about the big picture and gradually familiarize yourself with the details, you can eventually expand your portfolio to include active investing (i.e., investing directly in specific stocks or bonds yourself).

Mutual funds are the easier and more efficient option for investors who only want exposure to certain asset classes and a working knowledge of financial markets.

On the other hand, investors who wish to build a lifelong competence and become savvy in the markets might be better off approaching investing through a bottom-up approach. Active investing allows you to do this. A bottom-up approach to learning about investing is like working on a jigsaw puzzle: you start small, perhaps at random, but eventually uncover the big picture.

How Do You Make Money From Mutual Funds?

1. Capital Gains

Mutual funds invest in securities whose prices fluctuate. If those securities increase in price, the mutual fund’s net asset value (NAV) increases as well.

A mutual fund’s NAV is the aggregate market value of the fund. It is the sum of all investor subscriptions in the mutual fund and the net profits generated by the fund manager, less any liabilities and expenses, like debts.

Because you are part-owner of the fund, the value of your shares increases with the increase in the fund’s NAV. Thus, when you redeem (“withdraw”) your investment from the fund, you can receive a sum that is greater than your original investment.

2. Dividends

Because you are part-owner of the mutual fund company, you are entitled to your share of the company’s investment profits. The mutual fund may elect to retain and reinvest these profits into more securities or distribute this to its investors in the form of dividends. When mutual funds declare a dividend, they often do this by automatically issuing you new shares in the fund instead of an outright cash dividend.

Note the difference between a mutual fund dividend and a dividend from other stocks. If the mutual fund invests in stocks, the dividend income it receives from those stocks are treated as investment profits, which the fund could retain for reinvestment or declare as dividends to its investors. For example, if the fund invests in PLDT stock ($TEL), it does not mean that you will receive a dividend when PLDT declares a dividend. The interest income it receives from its bond investments is treated the same way.

Is There a Risk of Loss?

Yes. As with any other investment, mutual fund investing is not risk-free. Because mutual funds invest in securities whose prices fluctuate, the fund’s NAV can fluctuate as well, and it can decline to a level lower than it was when you invested in the fund. If you redeem your fund shares while the NAV is lower, you may receive a sum that is less than your original investment.

Who Can Invest in Mutual Funds?

Philippine citizens of legal age are eligible to invest in mutual funds. Minors can also invest in mutual funds through an arrangement known as an “in-trust-for account,” where parents or legal guardians serve as the trustee of the account with the minor named as the beneficiary.

Non-citizens are also eligible but may be subject to foreign ownership restrictions.

How Much Money Do You Need To Invest in Mutual Funds?

The minimum initial amount required to invest ranges from PHP 1,000 to 5,000, depending on the mutual fund. Additional investments thereafter may be made in increments of PHP 100 – 1,000, depending on the mutual fund’s policies.

Pros and Cons of Investing in Mutual Funds

1. Pros

a. Professional Management

The investment strategies of mutual funds are formed and executed by investment experts, typically with advanced degrees and years of experience. Mutual funds often appoint top-notch fund managers because the fund manager is a key selling point with which these companies compete for your business. This is advantageous to retail investors who may not have the expertise to invest by themselves. In essence, mutual funds enable you to hire the best of the best to manage your money.

b. Diversification

Because of their sheer size, mutual funds are often invested in a broad range of securities and therefore reap the benefits of a well-diversified portfolio. Diversification is important because it provides a buffer for the standalone risks of individual securities. Unfortunately, this type of portfolio is nearly impossible to replicate for a retail investor. With mutual funds, you can replicate the performance of billion-peso funds with a starting capital of only PHP 1,000 – 5,000.

2. Cons

a. Lack of Control

When you invest in a mutual fund company, the implicit agreement is that you accept that the fund manager knows best and that you trust them. Although you can revoke that trust by withdrawing from the fund while you’re invested, that agreement remains. Thus, you cannot tell the fund manager what to do. For example, if you are excited about a particular stock, you cannot simply demand that the fund manager buys more of that stock.

A workaround to this is adding active investments in your portfolio on top of your investments in mutual funds. Of course, this comes with its own risks, which we discuss in detail in our beginner’s guide to stock investing.

b. Added Fees

Mutual funds typically charge standard fees for your initial investment, early exit, and ongoing management services. This varies depending on the fund, but the said fees can come to roughly 3-7% of your initial investment, and about 1-1.5% per year on your ongoing investment with the fund.

The transaction fees with mutual funds can be higher compared to active investing, which is why mutual funds are better suited for investors with a longer-term horizon. As you invest more with your chosen fund and ensure that you stay with them beyond the minimum holding period, the fees you incur become smaller as a percentage of your total investment.

What To Consider When Choosing a Mutual Fund

Because of the fees that come with mutual fund investing, the best way to get the most value for money is to select the mutual funds you want to invest in carefully, and stick with them for the long haul. However, there are many types and providers of mutual funds, and the funds that suit one investor may not be optimal for another.

To go about your shopping, the most important factors to consider include the following.

1. Information Sources

Before evaluating any mutual fund, you first need to ensure that you can access valuable information on those funds. There are two key sources of information that are readily available on a mutual fund’s website; you don’t need to be a client to access the following:

a. Fund Fact Sheet

A fund’s fact sheet is a standard 1-3 page document summarizing the fund’s strategy, historical performance, and market outlook. It also summarizes the terms it sets out to clients, such as the fees it charges and any minimum holding periods.

Fact sheets are usually updated by the fund monthly and are a quick and easy way to compile information on funds you are interested in. For illustration, you can take a peek at a sample fact sheet2 by one of Sun Life’s mutual funds.

b. Prospectus

Unlike the fact sheet, a fund’s prospectus can be as thick as a textbook and better considered a legal reference. A fund’s prospectus is a comprehensive document elaborating on the terms of the relationship between itself and its clients. It discusses, among others, how the fund will manage its fund assets, who will oversee this management, and how profits are to be distributed to investors.

2. Risk Appetite

Although all mutual funds invest in various investment securities, they differ with respect to the riskiness of the securities they focus on. Some mutual funds specialize in investing in riskier assets like stocks, believing that with higher risk comes higher reward. Other mutual funds focus on less volatile assets such as government bonds, letting go of higher returns in exchange for a more stable NAV.

As an investor, you should be aware of the level of risk you are comfortable with. This is called your risk appetite or risk tolerance. Understanding your risk appetite will help narrow down the types of funds you should focus on during your selection.

The following factors generally determine a person’s risk appetite.

a. Age

Younger investors are likely to have a higher appetite for risk because they have more time to recover if the risk is realized. In contrast, older investors have a lower risk appetite, especially as they approach retirement age. Any financial hit from a risky investment could be disastrous to retirees because their income opportunities are limited, so they have less capacity to recoup their losses.

In other words, younger investors focus on building their wealth, so they tend to accept more risk in exchange for higher rewards. Meanwhile, older investors focus on preserving the wealth they’ve already built, so they prefer less risky investments, even if that means lower returns.

b. Relative Wealth

For two people of the same age, the relatively wealthier one will tend to have a higher appetite for risk because they have deeper pockets to draw from in case of a loss. In contrast, a relatively lacking person has a lower appetite for risk because the same loss could spell financial ruin.

c. Personality

Your personality also factors into your risk appetite, but this generally doesn’t take precedence compared to your age and relative wealth. Naturally, aggressive investors tend to have higher risk appetites, while naturally prudent investors tend to have a lower risk appetite.

Mutual fund companies typically require you to answer a questionnaire to determine your risk appetite, which you can use to confirm your own assessment. However, for your own selection purposes, it helps to make your own assessment beforehand, so you can use this to narrow down your choices.

3. Types of Mutual Funds

Based on Types of Assets

Mutual funds are usually categorized based on the types of assets they focus on. The two broad types of assets (also called “asset classes”) are fixed income securities and equity securities.

a. Fixed Income Securities

These are basically debt or debt-like instruments and include corporate bonds and government bonds. If you are a holder of a government bond, the government owes you money equivalent to the “face value” of the bond. The government will pay back that amount at the bond’s maturity date (i.e., its due date), and it will pay periodic interest before the maturity date. Bonds are an alternative to borrowing from banks. In this case, you, the bondholder, take the bank’s place.

b. Equity Securities

These include common shares and preferred shares. Equity securities represent partial ownership of the issuing company. All the company’s profits accrue to the shareholders, but so do any losses.

Based on the Investor’s Risk Appetite

Depending on your risk appetite, the following types of mutual funds may appeal to you:

a. Money Market Funds

Money market funds are mutual funds that invest exclusively in short-term fixed-income securities. Such securities typically have maturities (due dates) of less than 6 months or 12 months–in any case less than a year. However, this doesn’t mean you have to hold on to the fund for as long. If you run into an emergency and have to withdraw from the fund in less than 6 months, you are free to do so. If you have exceeded the minimum holding period, you will not incur any fees for redeeming.

Money market funds are best thought of as a better alternative to a savings account or a time deposit. It is a relatively very low risk because the fund invests in very short-term instruments. Because of their short-term nature, and because creditworthy institutions issue them, there is a low probability of sizable losses. While this means that returns are likely to be low as well, they are often better than the rates you could earn from a typical savings account or time deposit.

b. Bond Funds

Bond funds are similar to money market funds in that they also focus on fixed-income securities. However, bond funds do not limit themselves to short-term securities. They also invest in bonds with maturities of 3, 5, or 10 years, and others in between. These bonds are issued either by the government or by corporations.

Bond funds are relatively riskier than money market funds because of the longer maturities in the bonds they invest in. Longer-term bonds are generally riskier because it’s harder to predict what can happen in 5 years than it is to predict what will happen in 6 months. Moreover, bond funds can also be more heavily exposed to the corporate sector, which is generally riskier than the government. This notwithstanding, bond funds are still relatively less risky in the universe of mutual funds and are still well-suited for more conservative investors.

c. Equity Funds

Equity funds focus on investing in equity securities. There are two common types of equity mutual funds.

i. Index Funds

Index funds focus only on stocks that are part of the Philippine Stock Exchange Index (the “PSEi”). In the investment industry, certain circles believe that outperforming a broad market index like the PSEi is virtually impossible and not worthwhile. This is why index funds have become popular.

The PSEi is composed of 30 of the largest and most popular stocks on the Exchange. This often represents the largest and most recognizable companies in the country, and are often referred to as “blue chips.”

ii. Discretionary Funds

In contrast to index funds, discretionary funds do not limit themselves to stocks with membership in the PSEi. Not all good stocks in the Philippine Stock Exchange are necessarily part of the PSEi. For example, Cebu Pacific ($CEB), one of the more recognizable brands in the Exchange, is not part of the PSEi. Discretionary funds rely on the insight and stock-picking prowess of the fund manager to deliver better returns than your average index fund.

Discretionary funds also tend to focus on certain niches within the broader stock market. For instance, dividend yield funds focus on stocks that pay high dividends.

Index funds are best suited for moderately aggressive investors. Such investors are comfortable with the risk and volatility of equity investing but may not be as comfortable giving the fund manager too much control. Discretionary funds are best suited for investors with an aggressive risk appetite.

d. Balanced Funds

Balanced funds invest in both equity and fixed income instruments, seeking to achieve a higher return than money market or bond funds, with less risk than equity funds. Balanced funds are best suited for investors with a moderately aggressive risk appetite.

e. Feeder Funds

Instead of investing in bonds or stocks, feeder funds invest in other mutual funds that, in turn, specialize in either bonds or equities. A feeder fund typically invests in one mutual fund that may not be widely marketed locally. For example, Philippine feeder funds often invest in foreign funds to provide Philippine investors access to mutual funds abroad. By subscribing to a feeder fund, you can diversify geographically and by asset class.

Feeder funds typically invest in a single fund, called the “target fund.” A fund that invests in more than one fund is called a fund-of-funds.

4. Fund Manager Profile

Another key consideration when selecting a mutual fund is the competence of the fund manager. Your investment returns or losses depend heavily on the talents and integrity of the fund manager.

The name of the fund manager for any specific fund you may be interested in is often disclosed on the mutual fund company’s website, or the fund’s fact sheet (also usually available on the company’s website). For example, ATR Asset Management discloses the names3 of its fund managers for each mutual fund it offers.

Once you have the fund manager’s name, assessing them thoroughly can be done based on the following:

a. Experience

Experience is important because being a fund manager requires an in-depth understanding of complex current events like central bank policies and how they may affect asset prices. The best fund managers in the country often have experience spanning decades, often as research analysts or investment bankers. They also usually possess advanced degrees from reputable institutions.

b. Relative Performance

Fund managers often seek to deliver above-average returns. To determine if the fund is indeed above-average, its performance can be compared to the performance of similar funds. If the mutual fund consistently underperforms its peers, this suggests that it is not, in fact, above-average. Thus, you would be better off investing in the better-performing funds. Since fund fact sheets present their historical returns, making such a comparison among different funds is relatively straightforward.

Mutual funds are also compared to their benchmark, which is best thought of as your low-cost alternative. For example, if a discretionary equity fund consistently underperforms the PSEi, you would be better off investing in an index fund and enjoy lower fees versus the discretionary fund. The fund’s benchmark is also disclosed in its fact sheet.

c. Expense Ratio

Although this is not often disclosed in fact sheets, it can be a useful measure. The expense ratio is the fund’s operating expenses and fees as a percentage of the fund’s assets. You can get this information from the fund’s prospectus, but the computation is done manually.

Between two funds with equal historical performance, the one with a lower expense ratio gives you more value for money; for the same return, you’re essentially spending less direct and indirect fees on that fund.

5. Fees

As with any other financial transaction, subscribing to a mutual fund entails paying fees that may be charged at the start, annually, or when you leave. It is akin to commission fees in stock trading, or fund transfer fees in banking.

Mutual funds are often standard in the types of fees that they charge but differ in the level of those fees. The most common fees charged by mutual funds include the following:

a. Management Fees

This fee is typically charged annually. The management fee is basically the fund manager’s “salary,” charged as a percentage of the fund’s assets.

Management fees are typically charged regardless of whether the fund turns a profit for the year. Thus, a lower management fee is ideal for investors, but this also has to be weighed against the fund’s performance. Investors are willing to pay a higher management fee for a consistently stellar fund manager.

b. Early Exit Fees

Also called an early redemption fee, exit fees are charged once you redeem your shares before the minimum holding period is up. The minimum holding period is set by the fund and can range from 3-6 months if any, although many funds do not have a minimum holding period. If you redeem your shares after the minimum holding period, no exit fees are charged.

c. Front-end/sales Load

This is charged at the start of your investment in the fund and is akin to a commission. The sales load, if charged, is usually netted against your initial investment. That is, if your initial investment is PHP 10,000 and the sales load is 1%, then only PHP 9,900 of your money is actually invested in the fund.

How To Invest in Mutual Funds

Investors may invest in mutual funds either directly or indirectly. The direct method involves placing a subscription through the mutual fund company itself. In contrast, the indirect method involves opening an account with “middlemen” companies. The indirect method is simpler and more convenient, but we discuss both methods here.

1. How To Invest Directly

Step 1: Select a Fund

According to data from the Philippine Investment Fund Association4, the best-performing mutual fund companies (as of this writing) include the following:

| Company | Best Performing Fund | 1-year Return (%) |

| Philequity Management | Philequity Alpha One Fund | 9.6% |

| Sun Life Asset Management | Sun Life Prosperity Dynamic Fund | 9.3% |

| First Metro Asset Management | First Metro Exchange Traded Fund | 8.9% |

| ALFM Mutual Funds | Philippine Stock Index Fund | 8.5% |

| BPI Investment Management | PAMI Equity Index Fund | 7.9% |

| ATR Asset Management | ATRAM Philippine Equity Opportunity Fund | 7.5% |

Although the above companies’ best-performing funds are mostly equity funds, they usually offer a full suite of fund types, including money market, bond, and balanced funds.

Selecting a fund simply involves scoping out your options per mutual fund company, and gradually narrowing down options based on the criteria discussed above.

Step 2: Open an Account and Fund Your Investment

Once you’ve selected the mutual fund you’re interested in, the subscription process is relatively straightforward. Although the process may differ slightly depending on the mutual fund company, the requirements to open an account are similar, and the process is often designed to be as convenient as possible. For illustration, we will use PhilEquity Management’s Philequity Alpha One Fund as an example.

a. Get Started

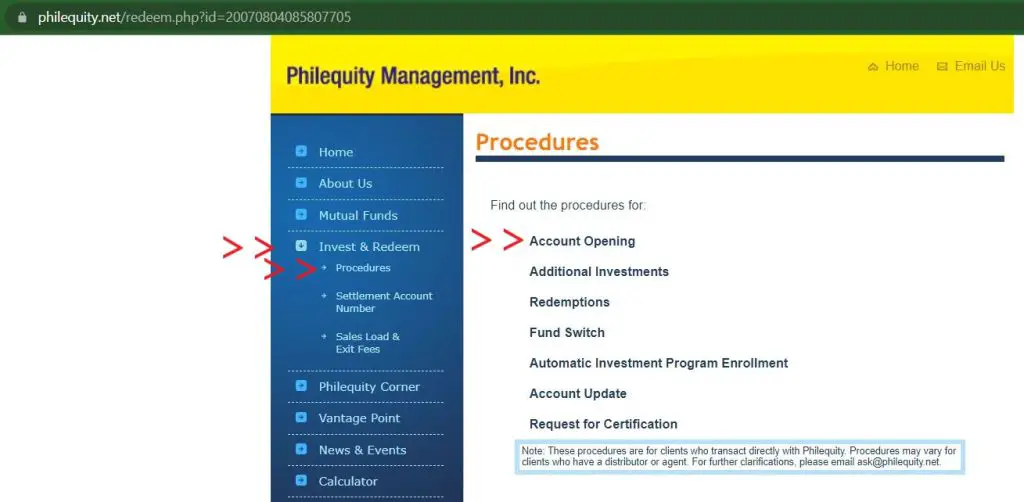

Visit their website and navigate to the ‘Procedures’ page under ‘Invest & Redeem’. Then, navigate to ‘Account Opening’.

b. Fill Out Forms and Prepare Requirements

Once you navigate to the ‘Account Opening’ page, step-by-step instructions are provided much like this one. The key requirements to take note of include the following:

i. Account Opening Form (AOF)

The AOF requires you to disclose basic information regarding your identity, contact information, income sources, and bank information. It also includes a questionnaire that assesses your risk appetite.

The AOF allows you to open an individual account, a joint account, or an in-trust-for account (ITF). Joint accounts may be either “OR” accounts or “AND” accounts. With “OR” accounts, only one signatory is needed to sign any future instructions to the company (e.g., subsequent redemptions or fund switches). In contrast, “AND” accounts require the signatures of both investors for future instructions.

An ITF account allows you to open an account on behalf of someone, like your children.

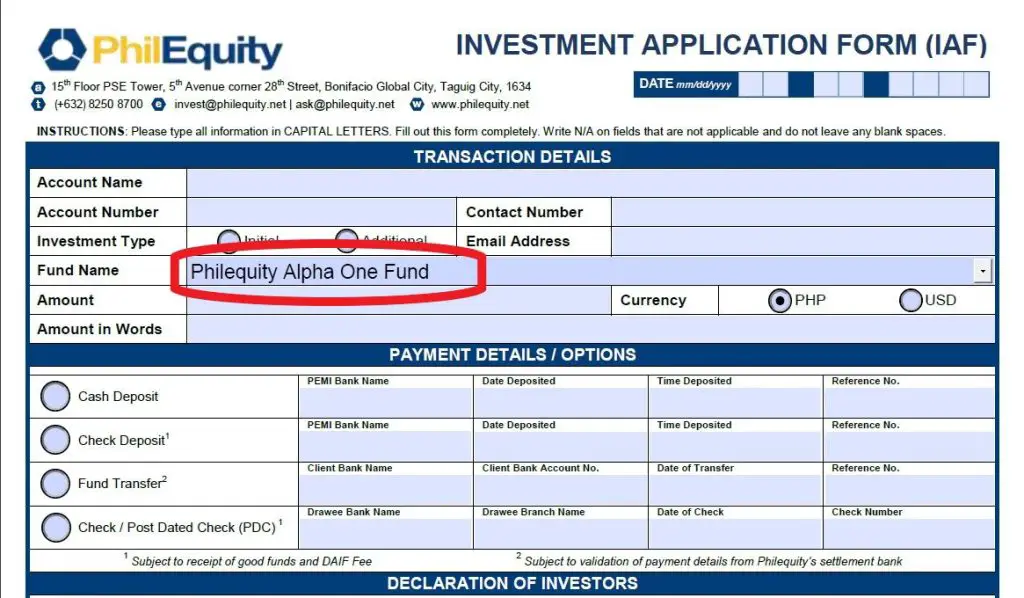

ii. Investment Application Form (IAF)

While the AOF allows you to open an account with the mutual fund company, the IAF allows you to specify which fund you want to invest in.

In this example, you will use the IAF to specify that you wish to subscribe to PhilEquity’s Alpha One Fund.

iii. Valid ID

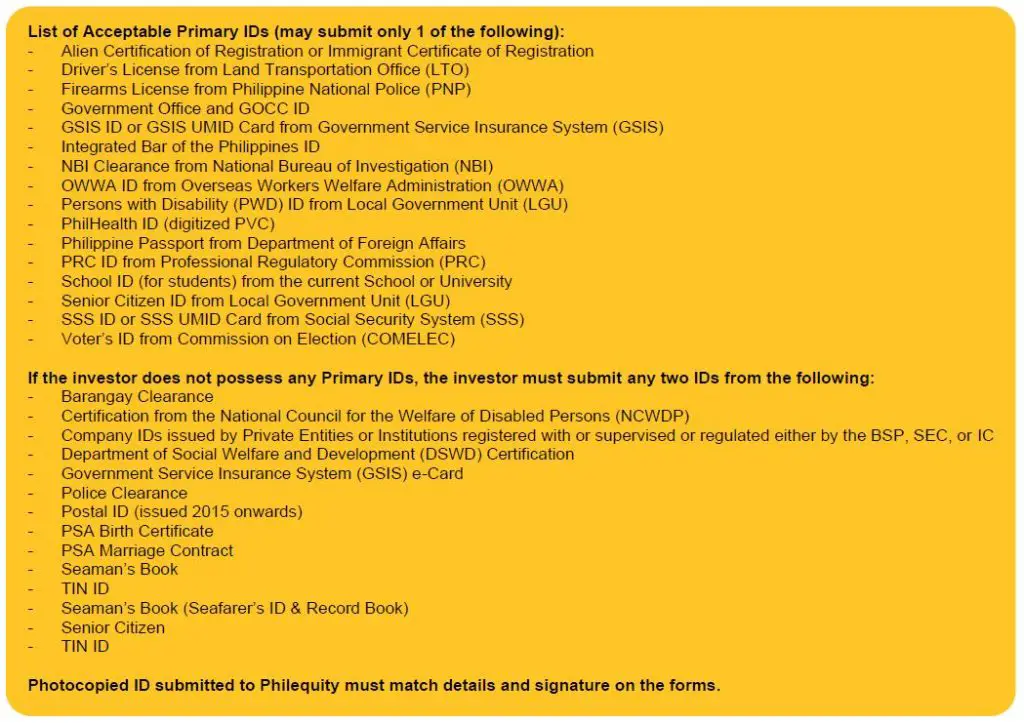

PhilEquity only requires 1 government-issued ID with a signature. If not available, 2 secondary IDs may be submitted as an alternative.

iv. Proof of Residence and Bank Account

Finally, PhilEquity requires a recent utility bill and a proof of bank account to verify the details you entered in the AOF.

c. Fund Your Account

Before submitting the requirements, you must deposit your investment into your selected fund’s bank accounts5. Note that each mutual fund has different bank account numbers, even if they all have accounts with the same banks. Ensure that you are depositing your investment in the bank account of the fund you wish to invest in.

PhilEquity currently accepts investments via cash deposits, checks, or bank transfers.

d. Submit Requirements

Once your requirements and forms are complete and you’ve completed the deposit, submit requirements to PhilEquity’s office in BGC6 in Taguig or via any eBiz branch7 nationwide.

Step 3: Manage Your Investment

Once your account has been opened, there are three things you can do to adjust your exposure later on:

a. Add to Investment

Additional investments8with PhilEquity can be additions to your investment in your chosen fund or new investment in its other mutual funds.

b. Redeem Investments

You can cash out by requesting a redemption9. Redemptions can either be partial or full redemptions.

c. Switch Funds

If one of Philequity’s other funds catches your attention, transferring your investment10 into that fund and away from your original fund can be done with a fund switch application.

Additional investments, redemptions, or fund switch requests can all be done via email.

2. How To Invest Indirectly

An easier and more efficient alternative to directly investing in a mutual fund is to invest via fund “supermarkets.”

Fund supermarkets are online services that make available a broad array of mutual funds on their platforms. In essence, you only have to open an account with the supermarket instead of opening a separate account with each mutual fund you are interested in. This can drastically reduce the inconvenience if you are looking to invest in mutual funds that are managed by different companies.

Aside from their time efficiency, fund supermarkets also charge a 0% sales load, making it cost-efficient as well.

Currently, there are only two such supermarkets available in the Philippines: COL Fund Source pioneered the service in 2015, and First Metro’s Fundsmart11 followed suit. Both supermarkets are run by stock brokerage firms, so you only need to open an account with the brokerage of your choice.

Tips and Warnings

1. Don’t “Trade” Mutual Fund Shares

For mutual funds that are available via a fund supermarket, beginner investors sometimes make the mistake of actively trading mutual fund shares like they would other shares in the stock market. That is, they buy and sell the mutual fund shares on the same day or over a few days. Not only is this harmful, but it is also unnecessary.

Trading mutual fund shares can incur high fees when you sell them before the minimum holding period is up. Early exit fees can reach as high as about 5%—certainly much higher than the average commission rate for simply trading stocks.

Trading mutual funds are also unnecessary because there are plenty of trading opportunities in the stock market already. Moreover, the trader community does not speculate on the value of mutual funds like they do with stocks, so there is likely no profitable trading opportunity with mutual funds.

Mutual funds are designed for and are best suited to investors with a longer-term horizon.

2. Avoid Scams

Some scams can be structured like legitimate mutual funds. These are often called “Ponzi schemes.”

With legitimate mutual funds, your profits as an investor come only from the price appreciation of the fund’s assets and any income (dividends or interest) that may come from those assets. In contrast, in a Ponzi scheme, your profits as an investor come from other investors’ money. Ponzi schemes can only survive if more and more people subscribe to the fund. They are unsustainable because the scheme eventually runs out of new investors. And they are dangerous because you can never know if you will be the last investor.

If you are unsure about whether an investment opportunity is legitimate or a scam, check the SEC registry12 for their name. Mutual funds are regulated by the SEC and cannot operate without the SEC’s green light. Any other fund that purports to be legitimate but is not recognized by the SEC is likely a scam.

Frequently Asked Questions

1. Are mutual funds taxable in the Philippines?

No. Although mutual fund investments are technically shares in a company, mutual fund gains are not subject to capital gains taxes, unlike gains from the sale of shares in non-mutual fund companies.

2. Can I withdraw mutual fund profits in the Philippines?

Yes. When you redeem your mutual fund shares, the mutual fund deposits your proceeds in your nominated bank account. If you invested in the mutual fund through a fund supermarket, the proceeds from your redemption will remain in the cash balance of your brokerage account, which you can then withdraw into the bank account you enrolled with your broker.

3. What is an open-ended fund?

Mutual funds often term themselves as “open-ended.” This simply means that the mutual fund company can accept new investments from new investors on an ongoing basis.

4. What is asset allocation?

Also called the investment mix, the asset allocation of a mutual fund’s assets is the percentage breakdown of the fund according to the types of assets it invests in. For example, a balanced fund may have an asset allocation of 50% bonds and 50% stocks.

5. What is the difference between cumulative and annualized performance?

Mutual funds often discuss their performance in terms of cumulative and annualized performance. Cumulative performance represents the total performance over a period of time. For example, a 5-year return of 200% means that if you invested in the fund five years ago, your starting capital would have grown by 200% today.

Annualized performance transforms cumulative performance into an equivalent annual rate. It shows you what you effectively earned every year on your multi-year investment. For example, a cumulative return of 200% over 5 years annualizes to about 25%. It’s as if you were able to lend your starting capital and charged 25% interest per annum.

Annualized returns make it easier to make apples-to-apples comparisons between other instruments that quote returns in annual terms, like time deposits. Moreover, since management fees are quoted on a per-annum basis, annualized returns help you better understand what you’re getting for what you’re paying.

6. What is standard deviation?

Mutual funds often disclose the standard deviation of their returns in their fact sheets. The layman’s interpretation of standard deviation is “more or less.” For instance, if a fund reports an annualized return of 5% over five years and a standard deviation of 1%, a quick way to interpret this is that over the past five years, the fund turned a profit of 4-6% per year.

Standard deviation is a measure of risk, specifically the volatility of a fund’s performance. It’s important to keep this in mind when comparing historical performance because standard deviation can color your understanding of the fund’s true performance.

For instance, a mutual fund might report an annual return of 7% whereas its peers only make 3%. This might look attractive, but if it also reports a standard deviation of 10%, that means that the fund’s true average return actually ranges from a loss of 3% or a gain of 17%. If you were a conservative investor, this lack of consistency may be uncomfortable.

7. What is tracking error?

Tracking error applies to index funds and it measures how closely they are able to replicate their benchmark. The lower the tracking error, the better. This measure is of special interest to index fund investors because these investors often don’t like discretionary funds. Thus, when they decide to invest in the index, they want the fund to replicate the index as closely as possible, otherwise, it might as well be a discretionary fund.

References

- Mutual Funds and UITFs. (2011). Retrieved 13 June 2022, from https://www.pseacademy.com.ph/LM/investors~details/id-1316488470519/Mutual_Funds_and_UITFs.html

- Mutual Funds and UITFs. (2011). Retrieved 13 June 2022, from https://www.pseacademy.com.ph/LM/investors~details/id-1316488470519/Mutual_Funds_and_UITFs.html

- ATRAM Corporate Bond Fund Inc. (2022). Retrieved 13 June 2022, from https://www.atram.com.ph/funds/mf/PRUFLIX

- Philippine Mutual Fund. (2022). Retrieved 13 June 2022, from https://www.bworldonline.com/markets/philippine-mutual-funds/

- Settlement Account Number. (2022). Retrieved 13 June 2022, from https://www.philequity.net/redeem.php?id=20070804085846790

- Contact Us. (2022). Retrieved 13 June 2022, from http://www.philequity.net/contact.php

- Philequity Management, Inc. Brunch Directory. Retrieved from https://www.philequity.net/UserFiles/File/BRANCH%20DIRECTORY-%20Final!!!(1).pdf

- Additional Investments. (2022). Retrieved 13 June 2022, from https://www.philequity.net/redeem.php?id=20070804085807705#additional

- Redemptions. (2022). Retrieved 13 June 2022, from https://www.philequity.net/redeem.php?id=20070804085807705#redemption

- Automatic Investment Program Enrollment. (2022). Retrieved 13 June 2022, from https://www.philequity.net/redeem.php?id=20070804085807705#fundswitch

- What is FundsMart?. Retrieved 13 June 2022, from https://www.firstmetrosec.com.ph/fmsec/45-FundsMart

- Registered Capital Market Participants. Retrieved 13 June 2022, from http://cmprs.sec.gov.ph/

Garie Ouano, CFA

Garie Ouano is an investment professional with 8+ years of research experience covering local and international equities and bonds. He has also been a CFA® charterholder since 2018. As an advocate for financial literacy, he regularly volunteers for the CFA Society Philippines. He has recently shifted from research to corporate finance and is doing work for a leading logistics company. In his spare time, he is preoccupied with Pinoy food, the horror genre, and cats. For inquiries, you may reach him via email ([email protected]).

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net