How To Start Investing in the Philippine Stock Market: A Complete Beginner’s Guide

Saving without investing is just as bad as not saving at all. This is a fact of life because of inflation. Specifically, inflation decreases the value of your savings over time.

For example, the average annual inflation rate in the Philippines1is 5.0%. If this keeps up, the cost of living will already triple in less than thirty years. If you’re a 30-year-old saving for retirement and you had PHP 100,000 in the bank today, the real value of that sum will dwindle to about PHP 22,000 by the time you retire. In other words, in about 35 years, the purchasing power of a hundred thousand will be equivalent to the purchasing power of PHP 22,000 today. If your money isn’t growing with inflation, you are basically spending that money–the net effect is the same.

To preserve the purchasing power of your money, your idle funds must grow by a rate at least equal to inflation. To achieve this goal, financially savvy Pinoys typically look at investments in stocks. The largest stocks in the Philippine stock market have generated an average annual return2 of 8% over the past 16 years.

DISCLAIMER: This article is for information purposes only. No portion of this work should be interpreted as an offer, solicitation, or recommendation to buy or sell the investment securities referenced herein. The information in this article is as of the date of publication and may have changed following said date.

Table of Contents

- What Is a Stock?

- How Do You Make Money From Stocks?

- How Much Money Do You Need To Start Investing in Stocks?

- Who Can Invest in the Stock Market?

- How To Pick a Stock To Buy?

- What Are the Risks and How Can They Be Avoided?

- Step-by-Step Guide to Buying and Selling Your First Stock

- Tips & Warnings

- Frequently Asked Questions: A Guide To Stock Market Jargon

- References

What Is a Stock?

Stocks (a.k.a. shares, equities) represent partial ownership in the underlying company. For example, owning shares in Jollibee Foods Corporation makes you part-owner (“shareholder”) of the iconic fast-food chain. Being a part-owner means that you are entitled to your proportionate share of the company’s profits and net worth–in principle. Although the reality is much more complicated, it is not inconsistent with this basic principle.

Stocks are identified on the stock exchange by a shorthand known as their ticker symbol. Jollibee’s ticker symbol is JFC. Though memorizing your stocks’ ticker symbols is not required, it can be handy. For example, suppose you want to search for financial buzz about Jollibee on social media. In that case, you can input $JFC in the search box (the dollar sign functions like a hashtag, except it narrows down your search to finance-related posts).

Another important aspect of a stock is its price. Jollibee’s share price is currently about PHP 220.00 per share. This represents the amount you must pay to purchase one share in Jollibee. In other words, if you wanted to invest PHP 100,000 in Jollibee, you would be able to buy about 450 shares at its current price.

How Do You Make Money From Stocks?

There are two main ways to make money from stocks:

1. Capital Appreciation

When the share price of a stock that you own increases (so-called “price appreciation”), the total value of your holdings increases (“capital appreciation”). Basically, if you choose your stock investments wisely, you can sell them at a nice mark-up later. For example, Unionbank’s ($UBP) share price increased by about 70% over the past year alone. If you invested PHP 100,000 in $UBP a year ago and decided to sell it today, you would profit PHP 70,000.

2. Cash Dividends

A cash dividend is the equivalent of interest income when it comes to stock investing. For instance, $UBP recently paid out PHP 2.80 in dividends per share. If you invested PHP 100,000 in UBP a year ago, this is like investing in a one-year time deposit that paid 5.6% in interest. (In stock investing, that 5.6% is referred to as the dividend yield.)

The combination of the two returns above is called a total return. This is the total of your profit from price appreciation and dividend income. If you invested PHP 100,000 in UBP a year ago, you would have gained a total return of about 75.6% today–70% from price appreciation and 5.6% from dividends–for a total profit of PHP 75,600.

This is why stock investing is considered attractive relative to other investment options. If you simply kept the same amount in a time deposit, you would have profited only about PHP 250–before taxes.

How Much Money Do You Need To Start Investing in Stocks?

Individual investors’ most widely used brokers usually require an initial balance of PHP 5,000 – 10,000 to open an account.

Who Can Invest in the Stock Market?

Broker services are generally available to Filipino adults residing in the Philippines. However, minors, students, resident and non-resident foreigners, and non-resident citizens can still open accounts with select brokers, subject to additional documentary requirements. Self-employed and unemployed Filipino adults can also invest in the stock market as long as they comply with the documentary requirements to open an account; there is no minimum net worth to open a brokerage account.

How To Pick a Stock To Buy?

There are nearly 300 stocks to choose from in the Philippine stock market alone. However, experts advise that owning less than 10 stocks is optimal3 . Therefore, you need to be able to narrow down your choices.

There are two main ways to go about this process:

1. Fundamental Analysis

This entails selecting your favorites based on the company’s ability to grow its bottom line profits, usually referred to as net income. Stock market investors pay attention to the bottom line because a company’s stock price usually grows with the company’s profits, especially over the long term. Thus, the key to selecting stocks that will likely rise in price is selecting the companies whose profits will likely grow over time.

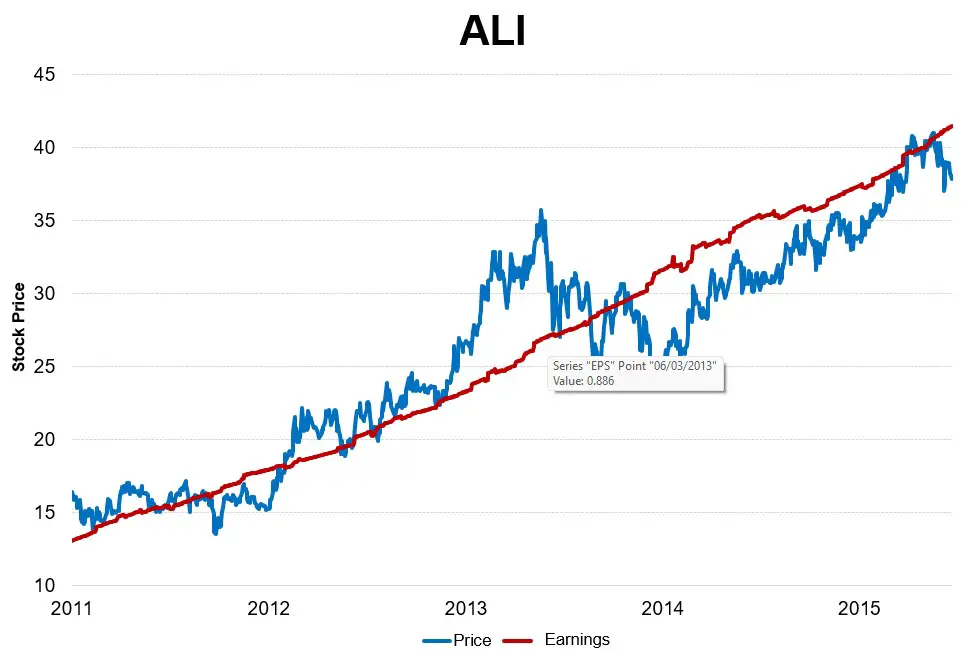

For example, Ayala Land’s ($ALI) stock price from 2011 to 2015 closely tracked the trend in its earnings growth.

2. Technical Analysis

This entails selecting stocks based on trends in their stock price. Stock prices fluctuate over time. If, for example, the price of a stock has been increasing over the past few months, the technical analysis aims to decipher whether that trend is likely to continue, stop, or reverse. If you are successfully able to predict a trend continuation, you can ride that trend and profit by selling when the trend stops.

For beginners, there is no need to build expertise in fundamental or technical analysis to start investing in stocks. The broker you open an account with usually helps with this. As part of their service, most stockbrokers usually provide expert recommendations for select stocks to aid you in deciding which stocks to start investing in. These recommendations are based on fundamental or technical analysis.

What Are the Risks and How Can They Be Avoided?

In stock investing, with high reward comes high risk. Although it is rare for investors to lose everything they invest in a stock, there is still a risk of loss. Because stock prices fluctuate, there will be times that you will see the value of your holdings decline. The realistic worst-case scenario is that you sell your stocks at a loss, i.e. you sell them at a price that is lower than your purchase price. Instances that lead to a decline in the stock price are generally brought about by a few key things.

1. Company-Specific Negatives

Many investors buy a stock because they believe the company will grow profits in the future, and they expect that the stock price will grow along with it. When that belief is challenged by negative news, they may change their mind about the stock, and the stock price usually declines. This is simply demand-and-supply at work. When news about a company is negative, stockholders of the company become nervous and are quick to sell their shares, while potential buyers of the stock may be reluctant because of the bad news. Thus, there is not enough demand from buyers to absorb the supply from selling shareholders, so the stock price dips until demand and supply return to balance.

2. Economy- or Industry-Specific Negatives

Even if a company is doing well, its stock price may still decline when bad news breaks about its place of business. Emperador Inc. ($EMP) is a good example. When the first lockdown was declared in the Philippines in March 2020, $EMP’s stock price declined by a whopping 35% in the following days. $EMP holders would have seen a third of their capital evaporate. Investors were nervous about the economy in general because no activity means no sales for many Philippine companies. For $EMP specifically, no nightlife meant no sales. However, when investors realized that $EMP may not be as affected, its stock price recovered to close the year at PHP 10.10 per share, 68% up from its low.

Although stock investing can be risky, there are easy ways to minimize the risks that experts often recommend.

- Diversification. Spreading your capital across a few unrelated stocks can insulate your portfolio from the company- or industry-specific risks. Even if one stock performs poorly, better names in your portfolio may compensate for that. You can also diversify across economies. For instance, you can have a portion of your funds invested in U.S. stocks instead of just Philippine stocks. Our guide to investing in U.S. stocks discusses this in greater detail.

- Long-term investing. The risks of stock investing manifest themselves in short-term price volatility. However, this volatility won’t matter in the long term if the company’s profits are in an uptrend. The long-term trend in the stock price will blur out any short-term volatility.

Step-by-Step Guide to Buying and Selling Your First Stock

1. Select a Broker

The Philippine Stock Exchange authorizes stockbrokers to trade on your behalf. Having a broker is a must4 . The most popular way of investing in the stock market is through online brokers. Online brokers function much like Shopee or Lazada for stocks: for all stocks, you can see their price, the number of shares available to buy, and even read “reviews” in the form of your broker’s research reports.

There are key criteria to use when narrowing down your search:

- Commission fees charged. In the same way interbank transfers come with a fee, buying and selling stocks also come with their own transaction fees. This is usually quoted as a percentage of the transaction value. Specifically, brokers vary with respect to the commission fees they charge. Commission fees vary between 0.25% to 1.5%, depending on the broker. Low commission fees are more favorable because they eat less into your gains.

- Track record. This has to do with the broker’s experience running an online brokerage service and how reliable it is. How long have they been online? Based on social media complaints, how often is their system down during trading hours? A track record is important because your transactions may be time-sensitive. If terrible news about a stock you own suddenly breaks, the stock price can decline rapidly. If you decide you want to sell but your broker’s system is down, you might incur a larger loss than you would have if your broker were more reliable.

- User-friendliness. This pertains to the online broker’s user interface. Especially for beginners, a user-friendly platform can be quite helpful. Many brokers offer the option to open a trial account.

- Research capabilities. As with many online purchases, reviews help you decide whether a stock is worth buying. Brokers conduct these reviews through their research teams. It’s important to know how many stocks they monitor and how long they’ve been doing so. You can get an idea of the extent of your broker’s research through a trial account.

- The minimum amount required. Brokers commonly require a minimum initial investment of PHP 5,000 to 10,000 to open an account. Some may require more, so it is important to check if a broker’s minimum requirement matches your available funds.

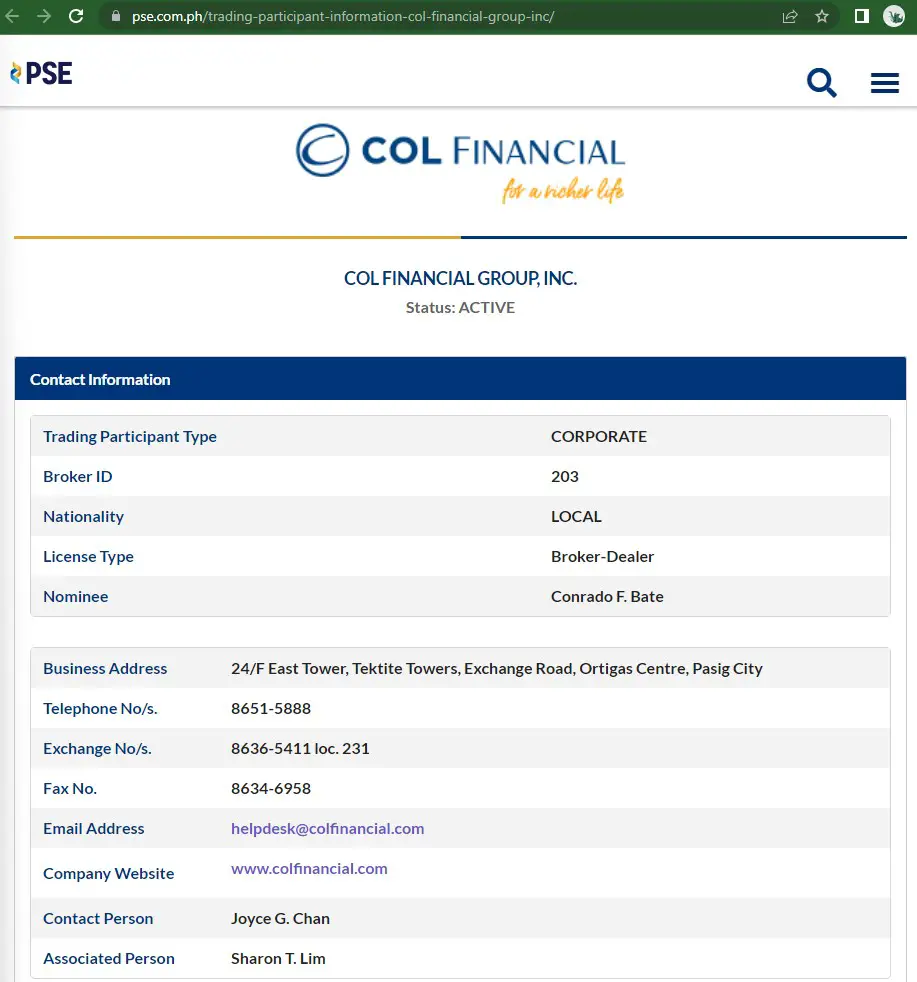

The Philippine Stock Exchange has an official list5 of authorized brokers, so make sure to transact only with these names. This list is a good way to start your scan. By clicking on the names of any broker on the directory, you can get an overview of their services, including the minimum investment needed to open an account, how frequently they provide research reports, and whether they cater to retail investors (i.e., individual investors). The broker’s website and contact number are also indicated on this page, which you can use to find information for your criteria.

For illustration, below is the information page for COL Financial Group, Inc. It has long been one of the most popular online options for retail investors. For April 2022, it is also ranked third on the Exchange for trading activity and is top-ranked among those brokers available to retail investors.

The Exchange also has a list of online brokers6specifically. Although some of the country’s biggest banks (e.g. BDO, BPI, Metrobank) have in-house online stock trading services, it is not necessary to start trading with them if you are already their banking client (nor is it necessarily more convenient).

There are also more traditional options if you prefer to place your buy or sell orders over the phone instead of online. This is called a broker-assisted trade, and it may cost you a higher commission charge than if you place your orders online yourself.

2. Warm-Up With a Demo Account

After narrowing down your choices, it’s time for a test drive. Demo or trial accounts allow you to fully experience a broker’s services for 5 to 7 days without risking your money. Though not all brokers offer trial accounts, many popular ones do. These are also among the most competitive brokers in terms of commission, research capability, and system reliability.

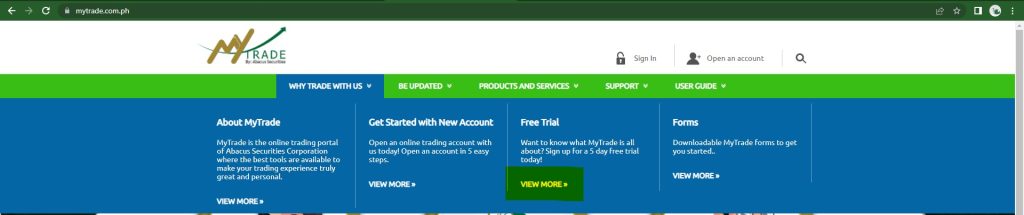

For this illustration, we will use MyTrade, the online platform of Abacus Securities Corp. MyTrade is also one of the more prominent online platforms that retail investors use. Abacus Securities ranked in the top 20 brokers by trading activity this month.

Step 1: Visit the web page. Go to mytrade.com.ph and click on the Free Trial under ‘Why Trade With Us’.

Step 2: Enter basic information. The Free Trial link will take you to a form that asks you about basic identifying information and contact details. It will also ask you for your preferred username and password.

Step 3: Confirm your registration. After submitting the online form, you will receive an email from [email protected] prompting you to click on a link to confirm your registration. Make sure to verify the sender’s email address to avoid falling prey to phishing scams.

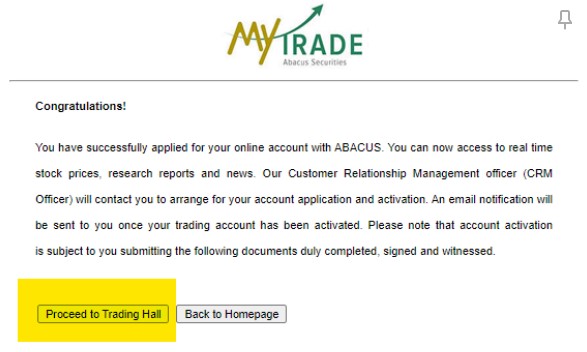

Step 4: Proceed to the platform. After clicking on the confirmation link, input your password. After logging in, click Proceed to Trading Hall.

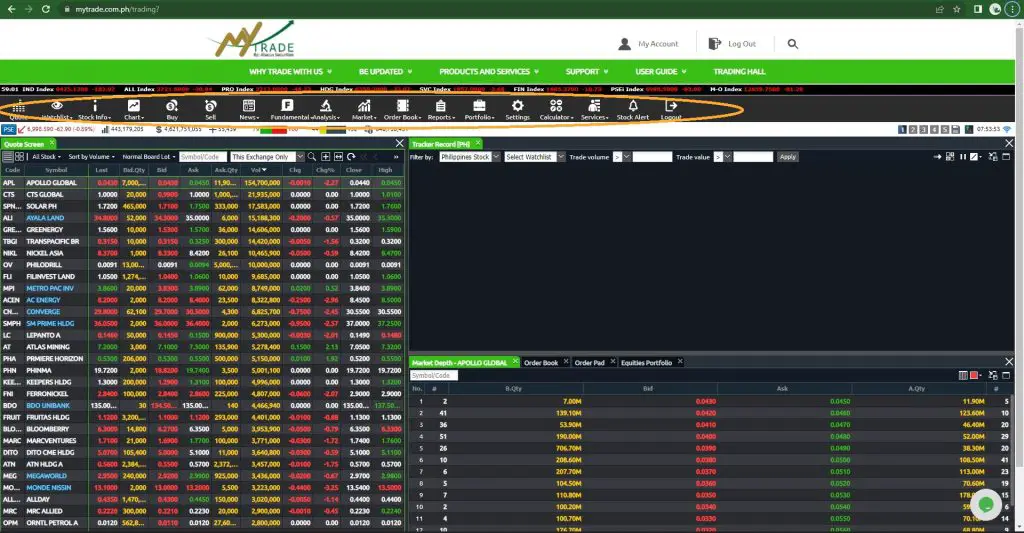

The button will take you to MyTrade’s trading platform, what it calls the “Trading Hall”. The interface may look both exciting and intimidating for beginners, so feel free to experiment, especially with the menu encircled in orange below. Since this is a demo account, there is no risk.

3. Open Your Account

Once you’ve decided on a broker, open an account with them. For online brokers, the account opening is generally done online as well. There is no need to visit their office to submit the requirements, although it is still an option.

The requirements may differ slightly depending on your chosen broker, but the common requirements for account opening include:

- 1 valid government-issued ID with signature

- 1 secondary ID with signature (e.g., company ID)

- Tax identification number

- Proof of mailing address (e.g., utility bills)

- Bank account details (this is where your broker will deposit your money when you want to withdraw cash from your broker after selling stocks)

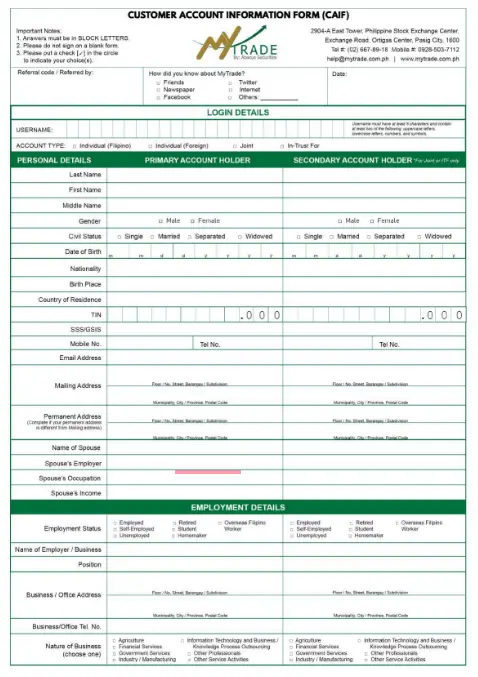

- Filled-out application form. This is called the Customer Account Information Form (“CAIF” for short) and it is required for all brokers.

The above requirements are generally for employed Filipino adults. Other investors with a different profile (self-employed or unemployed, minors or students, and foreigners) may still open accounts subject to additional documentary requirements:

- Birth certificate (for minors)

- Student ID (for students)

- 2 IDs (for resident foreigners). Apart from the basic requirements, foreigners residing in the Philippines may be required to submit 2 of the following IDs: Passport, ACR or Alien Employment Permit, and resident visa.

- 2 consularized IDs (for non-resident applicants). For non-resident Filipinos, acceptable IDs include passports, UMID, driver’s license, PRC ID, Postal ID, Voter’s ID, and senior citizen’s ID. For non-resident foreigners, acceptable IDs include passports and other government-issued IDs.

4. Fund Your Account

If you open a trading account with your bank, funding your account can be straightforward. Your bank may ask you to fill out additional forms that allow them to debit your bank account to fund your trading account.

If you open a trading account with a non-bank broker (e.g., COL, MyTrade), funding your account is still relatively easy. Often, you can fund your account as a bills payment or fund transfer (online or over-the-counter) to your broker, the same way you might use your online banking app to pay bills for utilities or transfer funds to friends. This option is often available to account holders with bigger banks (e.g., BDO, BPI, Metrobank, Unionbank) and mobile wallets (e.g., Gcash for COL, Coins.ph for MyTrade).

5. Select a Stock

For beginners, it is advisable to start with stocks that have established names. Since owning a stock represents partial ownership of the company, it is best to start off focusing on the stocks of companies that are most unlikely to go bankrupt in the foreseeable future. These companies, so-called “blue chips,” tend to be household names that are larger, more mature, and have dominant positions in growing industries. For a more in-depth guide to selecting such stocks, please refer to our article about investing in blue-chip stocks.

6. Buy the Stock

Once you’ve decided on the first stock you want to buy, the next step is to place your order. Generally, you can only place orders to buy a stock when the stock market is open. The market is open on weekdays (except holidays) from 09:30 AM to 12:00 PM for the morning session and from 01:00 PM to 03:30 PM for the afternoon session.

The process for entering a buy order generally follows the following steps:

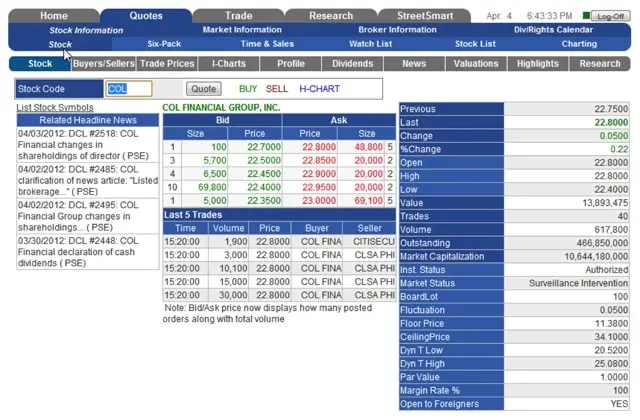

Step 1: Get a quote for the stock. Regardless of the broker you choose, they will typically have a dedicated tab/link for a quote screen. The quote screen for stock shows you the price at which you can buy the stock you want. Below is an example of a quote screen.

The quote screen can be confusing for beginners since multiple prices are displayed for one stock. The key information to know is as follows.

- Bids and Asks: The quote screen shows the best prices you can get for the stock under the Bid-Ask board. A bid price is a price at which a buyer is willing to pay to own a stock. In the example above, 1 buyer is willing to pay PHP 22.70 per share for 100 shares in COL Financial Group. ($COL). An ask price is the price at which a seller is willing to sell their shares. In the example above, 5 sellers are offering to sell a total of 48,000 shares for PHP 22.80 per share. If you want to buy $COL shares and PHP 22.80 per share is an acceptable price for you, you can place an order to buy up to 48,000 (you don’t have to fill the whole order).

- Previous price: In the example above, the first price displayed on the right panel is the previous price. Also called the previous close, this is the price at which $COL shares closed on the previous trading day.

- Last price: This is the price at which the most recent trade of the day in $COL shares occurred. When the market closes, the last price indicates the price at which the stock closed for the day.

- Change: This indicates how different the last price is from the previous close. A positive change means the stock is up for the day. In the example above, $COL’s stock price is up 0.22%, or PHP 0.05 per share for the day.

- Open, high, and low: This indicates the price at which the stock opened the day, as well as the highest and lowest prices it traded during the day. In the example above, $COL shares opened the day at PHP 22.80 per share, slightly up from their previous close of PHP 22.75 per share. Throughout the day, it didn’t trade higher than PHP 22.80 thereafter, and it traded to as low as PHP 22.40 per share before closing at PHP 22.80, the same price it opened.

- Value, trades, and volume: This indicates the level of trading activity for the stock during the day. In the example above, there were 40 transactions in $COL shares during the day. A total of 617,800 $COL shares changed hands, equivalent to PHP 13.9 million.

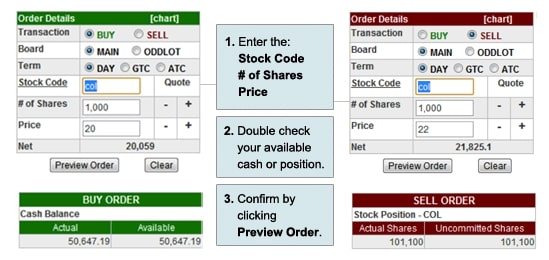

Step 2: Place an order. Like the quote screen, there is usually a dedicated button/link to place an order, usually named ‘Trade’ or ‘Order’. Below is an example of an order screen for a COL client. The image on the left is what you will see when you want to buy, and on the right is the screen for a sell transaction.

Entering orders via online platforms is generally user-friendly, but there are still some things to clarify for beginners:

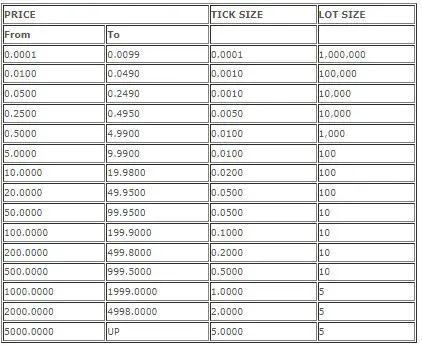

- Board: The minimum number of shares that you can buy depends on the price of the stock. The exchange specifies this. In this example, if you’re considering buying $COL shares, based on the board lot table below, the minimum you can buy is 100 shares because $COL shares are priced in the PHP 20.00 – 49.95 per share range.

An order quantity that doesn’t comply with this minimum number is called an odd lot. It is still possible to trade odd lot orders but the market for odd lots can be illiquid (e.g. if you’re looking to buy, there may not be sellers that can fill your order) and the prices quoted can be unfavorable.

- Term: You have several options for when or how long you want to post your order.

A day order will be posted for the entire day. If that order isn’t filled by the time the market closes, your order will be canceled.

A GTC order is short for “good ‘til canceled”. If your GTC order isn’t filled within the trading day, it will still be posted in the following trading days until the order is filled or you cancel the order.

An ATC order is short for “at the close”. The order will only be posted when the market nears its closing time. Your order will be filled at the closing price.

7. Monitor the Stock

Once you place an order, your broker will notify you if the order has been filled. If it was filled, you now own the stock. For your own safety, it is good practice to monitor how your holdings are doing regularly. After all, as a shareholder, you are the owner of the business.

How much time you can dedicate to monitoring depends on you and your style. If you are big-picture-oriented, you can opt to do this quarterly or annually. If you bought the stock with the expectation of a quick profit, you can monitor the stock daily, weekly, or monthly. Regardless of how frequently you choose to monitor your holdings, there is key information to keep track of:

a. General news. As mentioned before, even if the company whose shares you own is doing fine, the stock price might decline temporarily if there is something negative occurring in the broader industry or economy. Your broker’s daily reports and strategy reports are usually a good resource for such monitoring. The best brokers have dedicated teams monitoring the daily news and filtering that information to only the stories that matter. These teams are often headed by prominent research heads whom you might even see on TV occasionally. This makes general monitoring easier for you because it prevents information overload.

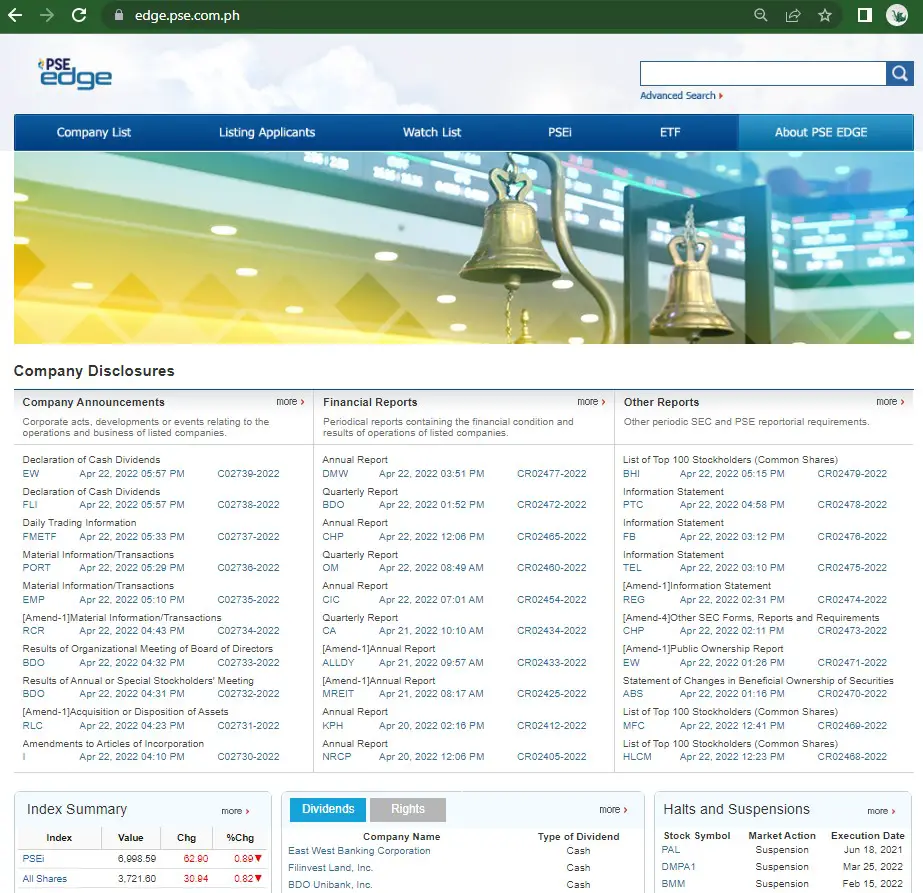

b. Company-specific news. As mentioned before, company-specific events are the primary source of risk and reward for the stock that you own, so it is necessary to regularly update your knowledge of the company. Your broker’s research team is also a great resource for this. Aside from that, you can also monitor mandatory disclosures.

As a requirement for listing their shares on the stock exchange, the Philippine Stock Exchange requires companies to disclose to investors any event that may have an impact on the stock price. Such disclosures are available in PSE Edge. Below is a snapshot of what the PSE Edge homepage looks like. From there, you can type the name of your stocks in the search bar to see their latest disclosures. This is a good alternative way of gaining access to information without waiting for your broker’s research team to produce their reports.

c. Price charts. It is also good practice to monitor how the stock price has trended recently. This is best done by looking at the stock’s chart. Online brokers often have this capability built into their platforms, but there are also many online services that are dedicated to stock monitoring. Locally, Investagrams or Tsupetot are examples of such services. They come with free and paid options, and they allow you to monitor your stocks’ price charts and set up alerts when your stocks reach a certain price level.

Below is an example of a price chart for SM Prime Holdings, the SM Group’s property development arm. Stock charts differ from regular charts in a few respects:

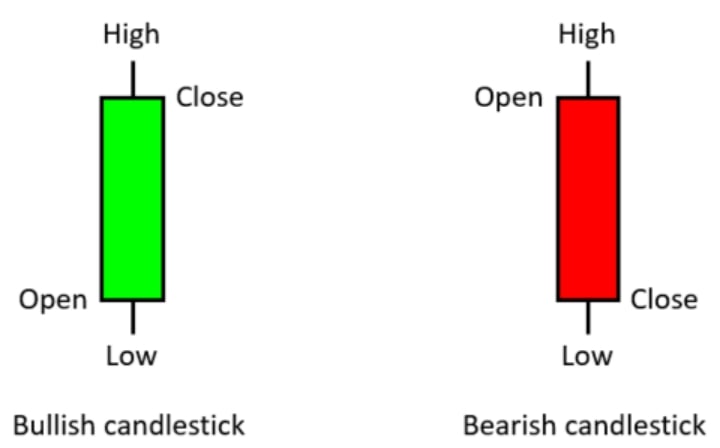

- Candlestick formats. Instead of using a line to track a stock’s prices, stock charts are often presented in candlestick formats. The candlestick format is better suited to stock investors because it conveys more relevant information. Below is a quick introduction to the candlestick (also called the bar).

Each candlestick corresponds to one trading day, and it shows you what happened during that day. The “wicks” (the thin lines at each end of the bar) show the highest and lowest traded price during the day, and the ends of the body show the opening and closing price of the stock for that day. A green bar indicates that the stock closed higher than its previous close (it was up for the day), and a red bar indicates the opposite.

As you advance in your investing journey, this format will become even more useful because some traders (or technical analysts) believe that a single candle can predict what happens next based on how the bar looks.

- Volume indicators. The vertical bars at the bottom of the chart indicate volume levels for each trading day. I.e., they show how actively traded the stock was on any given day. Volume indicators generally help you discern whether a move in the stock price is to be taken seriously. For example, if your stock’s chart shows that the stock price has been rising rapidly over the past few days but the volume bars show no such trend, you might conclude that the uptrend in the price is temporary.

8. Sell the Stock

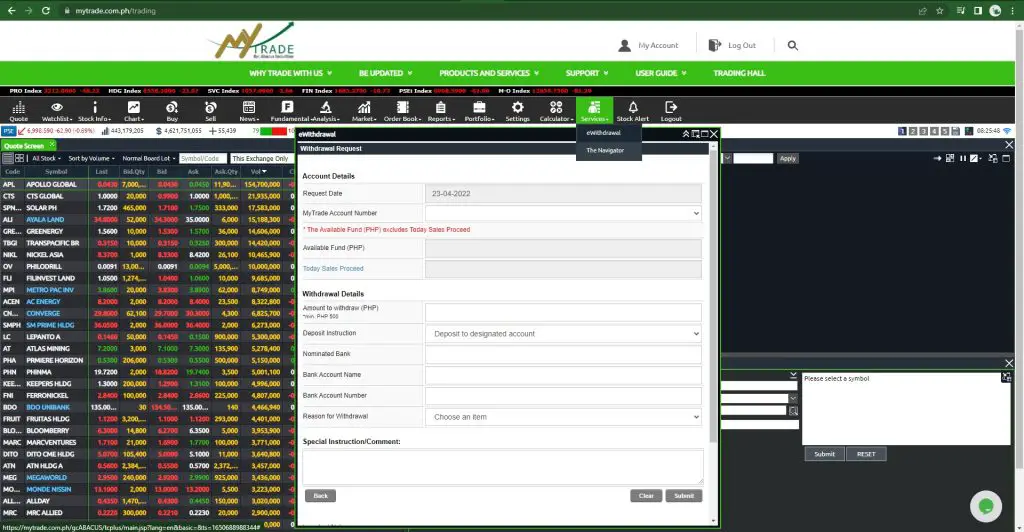

If you are satisfied with your profits or no longer willing to tolerate your losses, or if you simply need cash for personal reasons, you may decide to sell your stocks. The process of selling a stock is the same as buying a stock. When your sell order is filled, the proceeds from that sale remain in your account as a cash balance. From there, you may opt to do either of two things:

- Buy another stock. If you see better profit opportunities in other names, you may repeat the process of placing a buy order for your chosen stock.

- Withdraw your cash. You may also choose to withdraw funds from your broker account. Online brokers generally have this function built into their platforms. An example of MyTrade’s withdrawal form is below. Once you fill out the form and send the request, your broker will deposit the funds into the bank account you specified when you opened your account.

Note that you can only withdraw the proceeds from a stock sale after 3 working days following the sale. This is because the sale goes through the settlement process before the actual proceeds are available for withdrawal.

Tips & Warnings

- Start off with the money you don’t depend on. Because stock investing comes with considerable risk, starting slow and experimenting with funds you can afford to lose is advisable. Although it is rare to lose everything in one transaction, a sizable loss is still possible.

- Beware of the pump-and-dump scheme. The retail investing scene in the Philippines can be very active on Facebook pages and other online communities. Be cautious about any “analysis” you may hear online. This may only be investors who are hyping up a stock so they can sell at a better price. This is known as a pump-and-dump, and it can happen in any stock market in the world.

- Take advantage of free resources from your broker. One key way brokers compete for your business is through their research and knowledge-sharing activities. For example, MyTrade has live-streamed before featuring its Chairman. Resources and events such as this are more accessible now because they’re mostly done online, and are a great opportunity to ask experts your questions.

- Invest in what you know. Since it is advisable to hold only a number of stocks in your portfolio, it’s best to focus on the companies you know and whose products you use. This way, you get the advantage of knowing how their customers feel about the state of their products because you are a customer yourself.

- Is there a right time to buy? Common myths about timing a stock purchase include the adage “sell in May and go away.” Locally, the ghost month is also regarded as a time to stay away from the market. Though there may be anecdotal evidence supporting this, there is weak evidence from research to confirm the trend. Incidentally, the PSEi was up 4.0% last May.

Frequently Asked Questions: A Guide To Stock Market Jargon

1. What is the difference between stock trading and investing?

In terms of orientation, traders focus on quick short-term gains (a matter of only weeks, days, or hours) while investors focus on longer-term profits (months or years). Traders rely on technical analysis for their decision-making, while investors focus on fundamental analysis.

2. What is an ex-date?

If you buy a stock on its ex-date, you are not entitled to receive a recently declared dividend. Stock prices usually dip slightly during their ex-dates.

3. What is an IPO?

This is short for initial public offering. Note that not all Philippine companies are listed on the exchange. When a previously private company decides to list on the stock exchange, it does so via an IPO.

4. What is par value?

This is the value of the company’s shares in its books. The par value is simply an accounting value and has no bearing on the stock price.

5. What are preferred shares?

Preferred shares are shares that promise to offer a set dividend yield. The price of preferred shares does not fluctuate, so the only way to make money from preferred shares is via the dividends.

6. What is a margin facility?

This is a way for you to borrow more money from your broker to fund a stock purchase. Buying shares with borrowed money is called a leveraged trade, and it offers the opportunity to magnify your gains because all the profit from the trade goes to you. However, it also magnifies the risk. The absolute worst-case scenario in stock investing is to lose 100% of your capital. However, in a leveraged trade, you can lose more than 100% because some of your capital is borrowed.

References

- Statistics – Prices. Retrieved 30 April 2022, from https://www.bsp.gov.ph/SitePages/Statistics/Prices.aspx?TabId=1

- Statistics – Statistics Metadata Search. Retrieved 30 April 2022, from https://www.bsp.gov.ph/SitePages/Statistics/StatisticsMetadataDisp.aspx?ItemId=45

- Warren Buffett: 3 to 6 Stocks Is Enough. (2021). Retrieved 30 April 2022, from https://finance.yahoo.com/news/warren-buffett-3-6-stocks-131512554.html

- Investing at PSE. Retrieved 30 April 2022, from https://www.pse.com.ph/investing-at-pse/

- Trading Participants – Directory. Retrieved 30 April 2022, from https://www.pse.com.ph/directory/#tp2

- Trading Participants – Online Brokers. Retrieved 30 April 2022, from https://www.pse.com.ph/directory/#tp1

Written by Garie Ouano, CFA

Garie Ouano, CFA

Garie Ouano is an investment professional with 8+ years of research experience covering local and international equities and bonds. He has also been a CFA® charterholder since 2018. As an advocate for financial literacy, he regularly volunteers for the CFA Society Philippines. He has recently shifted from research to corporate finance and is doing work for a leading logistics company. In his spare time, he is preoccupied with Pinoy food, the horror genre, and cats. For inquiries, you may reach him via email ([email protected]).

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net