How To Register With BIR as a Self-Employed/Mixed-Income Individual: A Guide to BIR Form 1901

This article has been reviewed and edited by Miguel Dar, a CPA and an experienced tax consultant who specializes in tax audits.

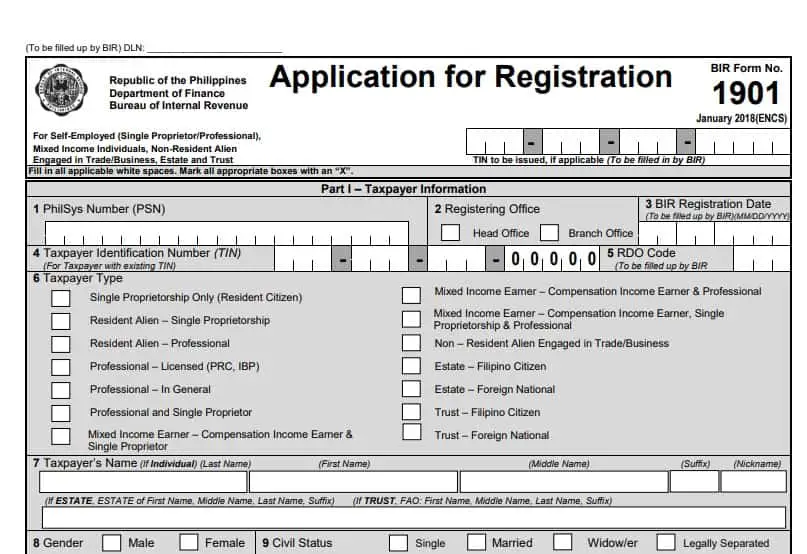

Are you a self-employed or a mixed-income individual? Filing an estate tax return? If so, you can apply for TIN and register as a taxpayer using the BIR Form 1901. This guide will show you how.

Disclaimer: This article is for general information only and is not substitute for professional advice.

Download the latest copy of BIR Form 1901 here (PDF format)

Table of Contents

- What Is the Purpose of BIR Form 1901?

- Who Should File BIR Form 1901?

- How Much Is the Registration Fee?

- How To File BIR Form 1901 as a Self-Employed or Mixed-Income Individual

- How To File BIR Form 1901 for Estates and Trusts

- Frequently Asked Questions

- References

What Is the Purpose of BIR Form 1901?

The BIR Form 1901 is the tax form that self-employed and mixed-income individuals use to register before starting or while running a business, or when opening a new branch.

This is also the application form used for registration of estates and trusts before paying any tax due or filing an estate tax return.

Who Should File BIR Form 1901?

These taxpayers are required to use the BIR Form 1901:

- Sole proprietors, whether Filipinos or foreigners (resident/non-resident)

- Professionals who are practicing their profession

- Freelancers

- Professionals/employees who are also sole proprietors

- Employees who are also professionals

- Taxpayers who are employees, sole proprietors, and professionals at the same time

- Individuals who are earning income regularly other than payments from their employer. This includes home-based service providers to foreign entities and crypto currency dealers

- Estates, whether Filipinos or foreigners

- Trusts, whether Filipinos or foreigners

How Much Is the Registration Fee?

Individual taxpayers who are required to file the BIR Form 1901 pay the Php 500 annual registration fee (ARF) plus Php 15 documentary stamp tax (DST) and Php 15 certification fee on or before January 31 every year.

Although the ARF is paid every year, the registration is done only once.

How To File BIR Form 1901 as a Self-Employed or Mixed-Income Individual

Where to register

RDO having jurisdiction over the place of business (head office or branch office).

Those who conduct their business in various locations, such as mobile store operators, should register at the RDO having jurisdiction over the place of residence.

Basic Requirements for Filing BIR Form 1901

- Two copies of accomplished BIR Form 1901

- Birth certificate, community tax certificate, or any valid ID (such as passport and driver’s license) indicating the applicant’s name, birth date, and address

- For sole proprietors: Photocopy of Mayor’s Permit (or duly received application form for Mayor’s Permit if it’s still being processed) or DTI Certificate of Business Name Registration

- For professionals: Professional Tax Receipt or Occupational Tax Receipt from the LGU

- For those with an existing personal TIN who are registering their business: Proof of Payment of Annual Registration Fee (ARF)

- If the ARF is not yet paid: Two copies of accomplished BIR Form 0605 (Payment Form)

- Accomplished BIR Form 1906 (Application for Authority to Print Receipts and Invoices)

- Final and clear sample of principal receipts or invoices

- Barangay clearance

- President’s referral (for villagers and homeowners inside subdivisions)

Additional Requirements (if Applicable)

- For authorized representative transacting on the taxpayer’s behalf: Special Power of Attorney (SPA) and valid ID of the representative

- For franchise businesses: Franchise documents (e.g., Certificate of Public Convenience for operators of transport network services such as Grab)

- For Barangay Micro Business Enterprises (BMBE)-registered entities: Certificate of Authority

- For PEZA/BCDA/SBMA-accredited businesses: Proof of Registration/Permit to Operate

Steps to filing BIR Form 1901 for self-employed and mixed-income individuals

1. Submit all the requirements to the New Business Registrant Counter of the RDO

The registration officer will then check if your forms and supporting documents are complete. Expect to be asked some questions that will determine if you’re registering for the correct taxpayer type and to compute the penalty fee in the case of late registration.

Your information will also be checked against the BIR database to verify if you’re issued a TIN before. If not, the officer will encode your data, generate your TIN, and write down the TIN on the BIR Form 0605 for the ARF payment.

However, if you have an existing TIN, you won’t be issued a new one. The officer will just update your taxpayer records using the documents you provided.

2. Pay the fees

Go to the RDO’s authorized agent bank and pay the registration fee. Wait for the teller to issue the proof of payment, which is an official receipt along with the machine-validated BIR Form 0605.

Note: If you’re previously issued a TIN, save time by paying the ARF in advance before you register with the BIR. Just fill out the BIR Form 0605 and pay through the AAB, the bank’s online banking facility, or GCash.

Return to the RDO and submit your proof of payment. You should also pay the DST and certification fee at the RDO.

3. Attend the taxpayer’s briefing

Attend the briefing for new business registrants. The briefing will inform you of your rights and duties as a taxpayer. Attendance is required before you’re issued the BIR Form 2303 and other registration papers.

4. Receive your BIR registration documents

After the briefing, return to the registration officer to claim the following registration documents:

- BIR Form 2303 (Certificate of Registration)

- “Ask for a Receipt” Notice (ARN)

- Authority to Print (ATP)

- BIR-printed receipt/invoice (if applicable)

- eReceipt as proof of payment

What to do after your BIR registration

Display your BIR Certificate of Registration, together with the “Ask for a Receipt” Notice, in a visible area in your office or place of business. You may also use the BIR Form 2303 as your reference guide for the tax returns you must file, taxes you have to pay, and the deadlines for those.

Also, if applicable, you must issue invoices or receipts for every payment received that is worth more than Php 1001.

You’ll also be required to keep books of accounts and submit a yearly account information return or financial statements. However, if your gross annual sales or receipts are higher than Php 3,000,000, your books of accounts must be audited and examined yearly by independent Certified Public Accountants and their income tax returns accompanied with a duly accomplished Account Information Form (AIF)2.

Before that, you need to apply for the registration of books of accounts at the RDO where your business is registered. Present your journal, ledger, or any equivalent books of accounts for stamping by the same RDO.

How To File BIR Form 1901 for Estates and Trusts

Where to register

- For estate: RDO having jurisdiction over the deceased person’s place of residence at the time of death or RDO where the administrator or executor is registered (in the case of foreign deceased persons)

- For trust: RDO having jurisdiction over the trustee’s registered address

Basic requirements

- For estate under the judicial settlement: Photocopy of the deceased’s death certificate

- For trust: Photocopy of the Trust Agreement

Additional requirements (if applicable)

- Marriage certificate (for estate only)

- DTI Certificate of Business Name Registration (if the business name will be used)

- Certificate of Authority (for BMBE-registered entity)

- Proof of Registration/Permit to Operate (for PEZA/BCDA/SBMA-accredited business)

- Franchise documents

Procedure in filing BIR Form 1901 for estates and trusts

BIR registration for estates and trusts is simple. Getting a TIN only involves submitting all the requirements to the assigned RDO and paying the ARF of Php 500 to the RDO’s authorized agent bank.

Go back to the main article: Tax in the Philippines: An Ultimate Guide to Filing and Paying Taxes

Frequently Asked Questions

1. What is the difference between a one-person company and sole proprietorship? Which business classification should I choose?

References

Written by Venus Zoleta

in Accounting and Taxation, BIR, Government Services, Juander How

Last Updated

Venus Zoleta

Venus Zoleta is an experienced writer and editor for over 10 years, covering topics on personal finance, travel, government services, and digital marketing. Her background is in journalism and corporate communications. In her early 20s, she started investing and purchased a home. Now, she advocates financial literacy for Filipinos and shares her knowledge online. When she's not working, Venus bonds with her pet cats and binges on Korean dramas and Pinoy rom-coms.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net