How To Get ITR in the Philippines: Online and Offline Methods

Do you have an urgent need to have a copy of your ITR or Income Tax Return? Whether you’re applying for a business loan or a credit card, this comprehensive and easy-to-understand guide will help you learn how to obtain a copy of your ITR.

Table of Contents

- What Is an ITR?

- Part I. Filing Your ITR

- Part II. Getting a Copy of Your ITR

- Tips and Warnings

- Frequently Asked Questions

- 1. What is BIR Form 2316 and why is it important?

- 2. Are ITR and BIR Form 2316 the same?

- 3. Who can receive a BIR Form 2316?

- 4. When and how often can I get my BIR Form 2316?

- 5. I’ve lost the latest copy of BIR Form 2316 and I need it for credit card/visa/loan application. What should I do?

- 6. My employer refuses or forgets to issue the BIR Form 2316/does not file my income tax. What should I do?

- 7. I’m a freelancer/professional/consultant rendering services to a Philippine-based company. How can I get a copy of my ITR?

- 8. How much does it cost to get an ITR?

- 9. Who can get a copy of their ITR online?

- 10. What is the difference between eFPS and eBIRForms?

- 11. Can I use the BIR eAppointment System to schedule a request for getting a copy of ITR through the concerned RDO?

- 1. Can I use BIR’s chatbox (Chat with Revie) to request a copy of my ITR online?

- 13. Are OFWs required to file an ITR?

- References

What Is an ITR?

An Income Tax Return (ITR) is a document that summarizes your tax-related transactions within a given period (i.e., calendar year). After deducting allowable expenses and exemptions, it reflects your tax due to the government.

Do you still remember the kind of ITR form you’re looking for?

The form you have used depends upon the category of taxpayer you were classified into (self-employed, mixed-income earner, corporation, etc.). Aside from that, the ITR today can also be manual or electronic.

Regardless of form, however, an ITR is a requirement by law and serves various purposes both to the government and the taxpayer concerned.

Part I. Filing Your ITR

Who Needs To File an ITR?

1. Individual Taxpayers

- Citizens of the Philippines with income from within and outside the country

- Non-resident Filipinos earning income within the country

- Aliens (resident or non-resident) who are receiving income from within the Philippines

2. Non-individual Taxpayers

- Corporations (including partnerships)

- Domestic corporations with income within and outside the country

- Foreign corporations with income within the Philippines

- Estates and trusts engaged in trade or business

Who Is Not Required To File an ITR?

- An individual taxpayer who is earning purely compensation income not exceeding PHP 250,000

- An employee whose income has been completely withheld by one employer

- A person whose sole income has been subjected to final withholding tax

- A minimum wage earner

- An individual who is qualified under “substituted filing”

What Conditions Should Be Met for an Employee To Qualify for Substituted Filing?

- The employee has received purely compensation income.

- The employee has received the income from only one employer.

- The amount of tax due from the employee at the end of the year is equal to the amount of tax withheld by the employer.

- The employee’s spouse has also complied with all the conditions previously stated.

- The employer has filed the annual information return.

- The employer has issued BIR Form No. 2316 to his employees.

What Forms Do You Use in Filing an ITR?

- BIR Form 1700 – annual ITR for individuals earning purely compensation income

- BIR Form 1701 – annual ITR for self-employed individuals, mixed-income earners, estates, and trusts

- BIR Form 1701A – annual ITR for individuals earning income from business/profession only

- BIR Form 1701Q – quarterly ITR for self-employed individuals, mixed-income earners, estates, and trusts

- BIR Form 1702-RT – annual ITR for corporation, partnership, and other non-individual taxpayers (this is for those subject only to the REGULAR Income Tax Rate)

- BIR Form No. 1702-MX – annual ITR for corporation, partnership and other non-individual taxpayers with mixed income (this is for those subject to Multiple Income Tax Rates or with income subject to SPECIAL/PREFERENTIAL RATE)

- BIR Form 1702-EX – annual ITR for corporation, partnership and other non-individual taxpayers EXEMPT under the Tax Code and other special laws, with no other taxable income

- BIR Form 1702Q – quarterly ITR for corporations, partnerships and other non-individual taxpayers

Click here to read more about the tax forms and requirements needed when filing an ITR

What Are the Methods Used in Filing an ITR?

1. Manual Method

This includes manually filling out the BIR Form (with the number of copies required) and submitting it together with the attachments needed to the relevant RDO/Tax Filing Center.

2. Electronic Through eBIRForms

This includes installing the computer software, filling out the necessary fields in the BIR Form, printing it, and paying your tax due at the nearest Authorized Agent Bank (AAB).

Click here to read more about eBIRForms

3. Electronic Through eFPS

This includes registering an account with the eFiling and Payment System or the eFPS and then filling the necessary fields in the BIR Form before proceeding to pay your tax due electronically.

Click here to read more about eFPS

Part II. Getting a Copy of Your ITR

Why You Need To Obtain Your ITR

The importance and function of ITR don’t end upon paying your taxes. It serves a variety of purposes that you may only realize once you need it urgently.

Here are just some of the reasons and occasions for obtaining an ITR:

1. Compliance With the Law

An ITR is proof that you have complied with the government’s law on taxation. It shows your good faith as a citizen and is ready evidence for those who may question you later if you are fulfilling your duty to pay your taxes.

2. Proof of Income-Earning Capacity in Various Events

The government is not the only one who is interested in seeing your ITR. There are also various entities that may suddenly need a copy of your ITR for the following purposes:

a. Loan applications

You may have finally decided to get that car or housing loan. But without your ITR, you’d find it hard to prove your financial capacity.

Banks and other loan institutions need a copy of your ITR to verify that you are earning enough to pay them back in due time.

This is also true for credit card applications. Your credit card dues may not be as big as your housing debt, but they need a copy of your ITR also to allow you to have that credit line. Unlike banks, credit card companies don’t require their clients to present any real property as a mortgage for their loan.

b. Investment opportunities

Are you looking into investing in stocks? Your ITR is as much a requirement as the cash you’re willing to invest.

c. Applying for a foreign visa

You may only want to apply for a tourist visa, but you need an ITR just the same. A copy of your ITR is proof not only that you are earning enough to pay for your travel but that you have a steady source of income in the Philippines and you would return to your country instead of leaving permanently.

Related: How To Apply for Schengen Visa: An Ultimate Guide for Philippine Passport Holders

d. Applying for scholarships

Instead of proving that you have sufficient income, other institutions may need you to prove that you are earning less. This is what happens when some educational or charitable institutions may require a copy of your ITR as proof that you need their assistance in the form of a scholarship.

3. Business Needs

Will you be proposing a project to another business? Or will your business be involved in a bidding project with the government? You will be required to present the latest copy of your ITR.

4. Change of Employment

Regular employees don’t usually have much trouble with their ITR. That’s because it is their employers who file the ITR for them to the BIR.

But what if you need to change your employer within the year? That’s when you need to present your new employer with your previous Form 2316, a document also considered an ITR in cases of substituted filing.

Why is it important to give your previous BIR Form 2316 to your new employer? This is to help your new employer compute and withhold the right amount of tax from your salary. In addition, it will also ensure that your whole income for the year is considered when presenting your new Form 2316 to other parties.

Questions To Ask Before You Get a Copy of Your ITR

Before we proceed to the exact steps you could take to obtain a copy of your ITR, you need to familiarize yourself with some questions that could give you an idea of what to do next.

1. Who Filed Your ITR? (Self or Employer?)

If you’re a regular employee, it’s most likely that your employer filed the ITR on your behalf. This is what you call “substituted filing”.

If you’re a corporation, a mixed-income earner, or a self-employed individual, you would have filed the ITR yourself (or in the case of a large company, an officer or an authorized employee filed it for you.)

Why is this important?

The question would give you a clue as to the next information you need before you get a copy of your ITR.

First, it would reveal the kind of ITR form you are looking for. If you’re a regular employee qualified for substituted filing, the form you would be looking for is BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld). Your employer should have already given you a copy of BIR Form 2316.

When stamped “received” by the BIR, this is already a substitute for your ITR. To get a copy of this type of document, you may need to request one from your employer.

On the other hand, if you’re not a regular employee qualified for substituted filing, you may need to request other types of BIR Forms (BIR Form 1700, BIR Form 1701, etc.) depending on your category as a taxpayer.

2. How Was Your ITR Filed? (Manually or Through Electronic Means?)

The second thing to consider is whether you have filed your ITR manually or electronically. If you have filed it electronically using eFPS, then it is easy to find a copy of your ITR. Simply log in to your eFPS account and follow the instructions on the relevant topic below.

If you have filed it manually or using eBIRForms, you have the option of requesting a copy of your ITR offline or online. Continue to read below for the specific steps you can take to get a copy of your ITR.

Methods of Getting a Copy of Your ITR

1. How To Get ITR in the Philippines Offline

a. Ask your employer directly

This specifically pertains to those who need a copy of BIR Form 2316. If you are a regular employee, this form is usually what you’d look for as also discussed previously in this article.

As required by law1, you should have received a copy of this from your employer at the start of the year or after your last salary (in the event of resignation).

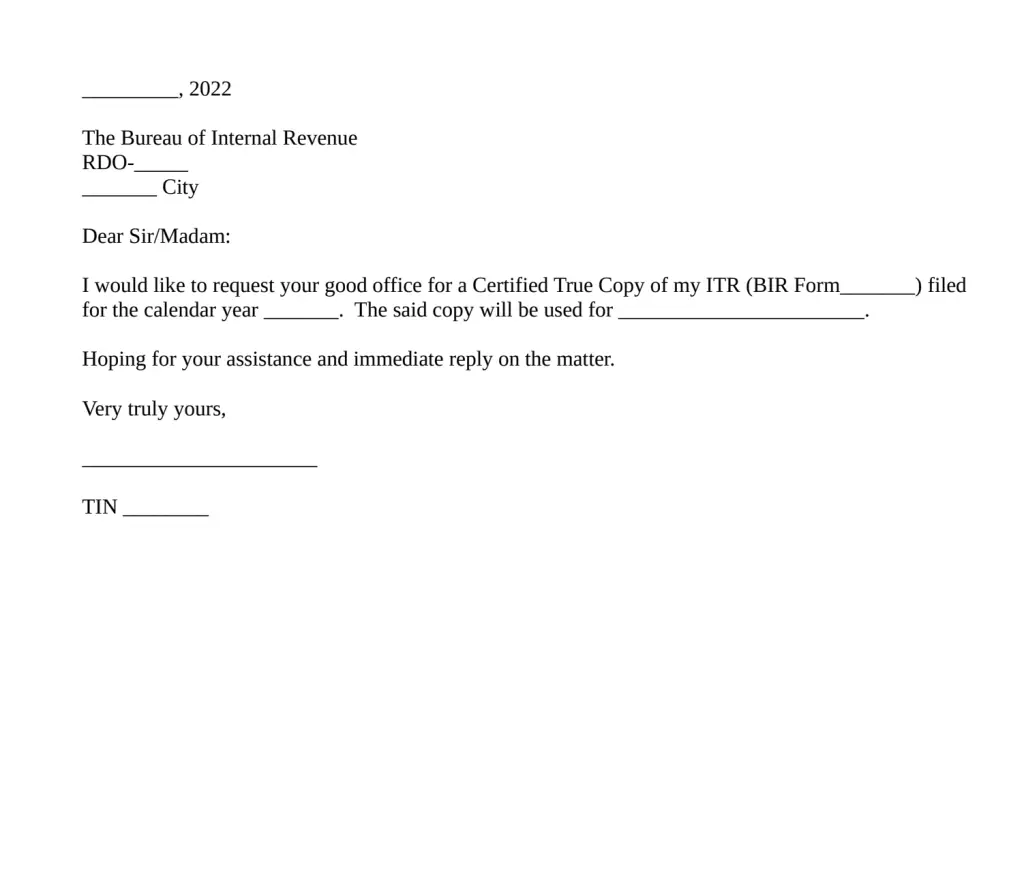

b. Walk-in with a letter of request to the RDO where the taxpayer is registered

According to the BIR website, you can request a true copy of your ITR at the RDO where you are registered. To do this, submit a letter of request to the said RDO and attach photocopies of the ITR to be certified together with the BIR Form 0605 for the Certification fee and loose documentary stamps.

Click here to download a free sample Letter of Request to RDO template

2. How To Get a Copy of Your ITR Online

a. Send a formal request to the BIR

You may contact the Customer Assistance Division2 of the BIR through the following:

- Trunkline: 8981-7000 ; 89297676

- Hotline: 8538-3200

- Email: [email protected]

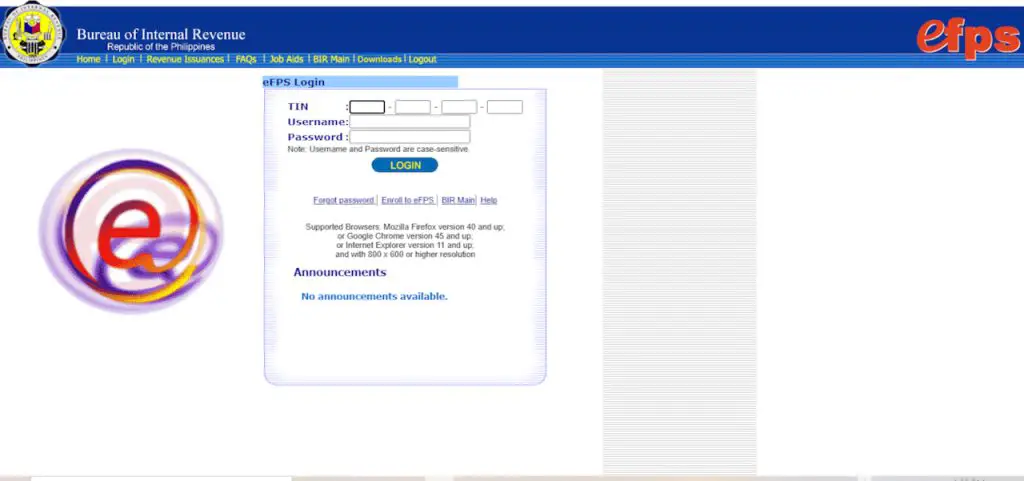

b. Get a copy by logging in to your eFPS account

The eFPS3 is an electronic method that can be used in filing and paying your taxes. It is a system offered by the BIR for specific types of taxpayers like top corporations and other large taxpayers.

If you’re fortunate enough to have access to eFPS, then it would also be easy for you to get a copy of your ITR online. You can consider this option if you have registered for eFPS before and have used it to file your ITR.

How To Get a Copy of Your ITR Online Through eFPS

- Go to the main website of BIR and look for the eFPS facility or simply type the following URL in your browser’s address bar: https://efps.bir.gov.ph/

- Log in to your eFPS account by entering your TIN, username, and password in the dialog box. Take note that the username and password are case-sensitive. This means that you must use capital letters and small letters correctly. For example, if you used Txpys12345 as your password, you must enter the letter “T” correctly as a capital letter. After entering the required information, click the LOGIN button.

- Enter your answer to the challenge question, making sure it’s in correct case as the answer is also case-sensitive.

- Go to the eFPS User Menu Page. From the dropdown list that you will see from your User Menu Screen, choose the ITR form you’d like to find and then click the button Tax Return Inquiry.

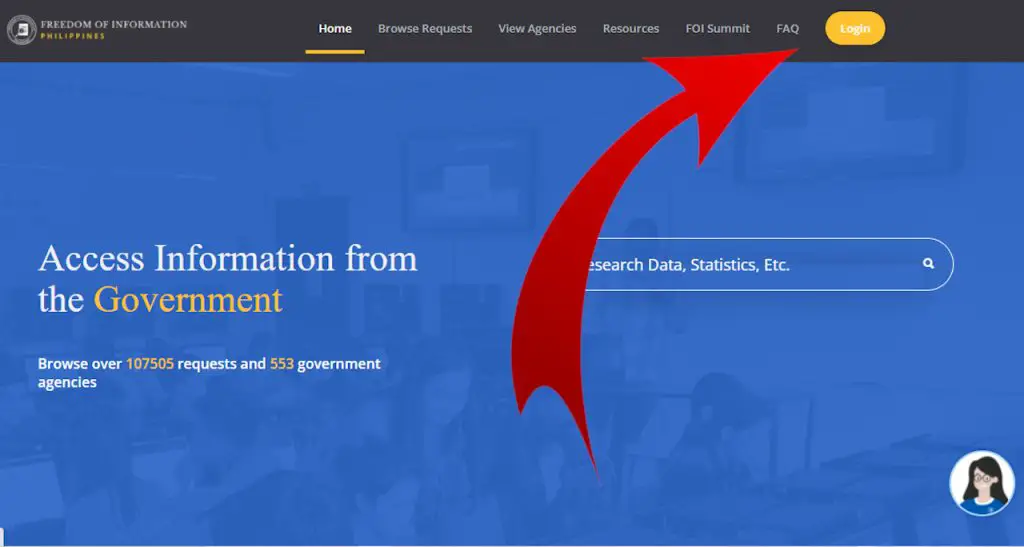

c. Request a copy through the Freedom of Information Program (FOI) website

The FOI is the government’s platform to address the need for transparency and disclosure of information. As such Filipinos can request a document from the FOI like a copy of one’s ITR.

How To Get a Copy of Your ITR Online Through FOI

- Type the URL of the FOI in your browser’s address bar: https://www.foi.gov.ph/.

- Log in or create an account. To create an account, click the Login button in the upper right-hand corner of the screen. When a new screen opens, click Create an account under the Login button.

- Fill out the required information including your full name, email address, password, country, complete address, mobile number, landline, and affiliation (CSO/NGO, Business, Academe, Media, Government, or Private Citizen). You will also be required to upload a copy of your valid ID as proof of identity.

- Click on the checkbox beside the statement “I’m not a robot”.

- Once your registration is approved, you will receive a verification email. If you fail to see it in your Inbox, you may check if it landed in your SPAM folder.

- After you’re logged in, you’ll be taken to the Dashboard. From there, click the Make Request Button.

- Select the relevant Agency to your request. In this case, the BIR. To find the BIR, you may need to go first to the Department of Finance. This is because the BIR is an attached agency to the DOF. You will then be taken to the “Make a Request” Page.

- Fill out the following needed information: Title of the Document, Coverage or Time Period, Intended Purpose of Use, and Your Message.

- After reviewing your information, click on the checkbox next to the statement “I Agree to the Terms and Conditions”.

- Finally, click the Send My Request button.

Your request will be forwarded to the Receiving Officer of the concerned agency (BIR).

Tips and Warnings

1. When Logging In to eFPS

- Disable your browser’s pop-up blocker when you need to log in to eFPS.

- Make sure you don’t stay idle on screen for too long to prevent being logged out.

2. When Requesting a Copy Through the FOI

a. On the privacy of information given

Everything that you write on the page will be publicly available and displayed on the website, including your name.

b. The importance of making your request as specific as possible

If you are requesting a copy of your ITR, provide relevant information such as:

- The type of ITR you filed (e.g., 1700, 1701, etc.)

- Place where you filed your ITR

- Date of filing of your ITR and applicable tax period

- Tax Return Confirmation Receipt (for ITRs filed online)

Note that the ITRs FOI can provide from their files are only those filed and paid over-the-counter through AABs. For no-payment returns filed through eBIRForms and eFPS, FOI cannot provide hard copies on file4.

3. Time Period To Wait for a Response From the Agency

You may need to wait for 15 working days before you see the related response on your dashboard. In some cases, the related Agency may need an extended duration of time to process your request. In no case, however, should this be more than 20 working days.

4. Reference for Additional Information in Requesting From the FOI

If you need more information about the FOI Program, you may download a PDF copy of their FOI Manual from their website.

5. Fee for Any Request Made

The Agency should not charge any fee for your request except for reasonable costs related to printing, delivery, and/or reproduction.

Frequently Asked Questions

1. What is BIR Form 2316 and why is it important?

The BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld) is an official document that indicates an employee’s gross income and the corresponding taxes withheld by the employer during the year.

This certificate is enough proof that an employee’s income was subjected to income tax during a particular year.

Aside from being proof of income and tax withheld, the BIR Form 2316 is also used for other purposes:

- Proof of financial capacity for a credit card, loan, visa, scholarship, and other applications

- Financial document to meet the requirements of government offices and private institutions

- A pre-employment requirement that employees submit to their new employer for accurate computation of their annual income tax for the year

- Reference for employees to verify if their employer has withheld their taxes correctly and paid to the BIR

- Proof of tax payment for availing of tax credits by expats in their home country

2. Are ITR and BIR Form 2316 the same?

No. Although the income tax return (ITR) and the BIR Form 2316 are often used interchangeably, they are two different tax forms.

The ITR is a tax return, while the BIR Form 2316 is a certification of an employee’s income and taxes withheld. Employers must attach Form 2316 to the annual ITR (BIR Form 1700 for employees receiving purely compensation income or BIR Form 1701 for mixed-income earners) when filing their employees’ income tax.

However, for employees under the substituted filing system, the BIR Form 2316 with the BIR’s “received” stamp serves as their ITR.

3. Who can receive a BIR Form 2316?

Employers accomplish and file the BIR Form 2316 with the BIR and then issue a copy to each employee.

Particularly, the following people can expect to receive a copy of the BIR Form 2316 from their employers:

- Employees who receive purely compensation income and are qualified for substituted filing

- Mixed-income earners who are qualified for substituted filing

- Minimum wage earners, even if their income is tax-exempt and they’re not required to file an ITR

4. When and how often can I get my BIR Form 2316?

The Tax Code requires all employers in the Philippines to issue the BIR Form 2316 to their employees on or before January 31 every year and submit a copy to the BIR by February 28.

You should receive a copy of this BIR certificate just once per year. But if you resign or get terminated from your current job, you’ll receive your BIR Form 2316 along with your Certificate of Employment on the day your backpay is released (typically one month after the resignation/termination effectivity date).

When you change jobs, make sure to get the last copy of your BIR Form 2316 from your previous employer and that you submit it to your new employer. This document will be your new employer’s basis for computing your annual income tax for the year.

5. I’ve lost the latest copy of BIR Form 2316 and I need it for credit card/visa/loan application. What should I do?

You won’t be able to get another copy from your employer. It’s because employers have only one original copy per employee, and they’re required to distribute it only on two occasions: by January 31 of every year and on the day of release of separation pay to the resigned/terminated employee.

Can I get Form 2316 from the BIR, you might ask. Unfortunately, the BIR won’t be able to grant such a request because copies submitted to the agency go straight to its warehouse.

Lesson learned: Each time your employer issues your BIR Form 2316, keep your copy somewhere safe that you can easily remember.

6. My employer refuses or forgets to issue the BIR Form 2316/does not file my income tax. What should I do?

Talk to the HR staff or approach your employer directly to raise your concern about your BIR Form 2316.

If your employer still fails to provide you with a copy, call the BIR hotline to report the violation and ask about the right course of action.

Erring employers are subject to a penalty fee of PHP 1,000 for each failure to file or submit a BIR Form 2316. If the violation goes on for at least two consecutive years, the employer will be held liable and fined PHP 10,000 and jailed for at least one year, in addition to paying a penalty fee of PHP 1,000 for each failure.

7. I’m a freelancer/professional/consultant rendering services to a Philippine-based company. How can I get a copy of my ITR?

Because you’re not an employee of the company, don’t expect to receive a BIR Form 2316 from your client, even if it has withheld taxes from your pay.

If you wish to check if your client pays your expanded withholding tax properly to the BIR, you should request the BIR Form 2307 (Certificate of Creditable Tax Withheld at Source) if you’re not receiving one yet. Your client should send you a copy of this tax form on or before the 20th day of the following month after every quarter.

If you need an ITR for loan/credit card/visa purposes, you should prepare, compute, file, and pay your income tax using the appropriate tax return (BIR Form 1701 or 1701A). Don’t forget to deduct from your income tax the amount withheld by your client, and then attach your copy of BIR Form 2307 to your ITR when filing it with the BIR.

Your receiving copy of BIR Form 1701 or 1701A with a “received” stamp is the one you must submit as an ITR for your loan/credit card/visa application.

Related: How To Pay Taxes and Get an ITR if You’re a Freelancer: An Ultimate Guide

8. How much does it cost to get an ITR?

If you are requesting a copy from the FOI, it should be free of charge except for reasonable costs related to printing, delivery, and/or reproduction. If you are accessing the eFPS to get an online copy, it would also cost you nothing.

9. Who can get a copy of their ITR online?

Only those who are not regular employees and looking for BIR Form 2316 can request a copy of their ITR online.

10. What is the difference between eFPS and eBIRForms?

While eFPS is usually used and mandated for large taxpayers, eBIRForms can be used by almost every taxpayer. The eFPS allows you to file and pay your taxes online while eBIRForms can be used both online or offline.

11. Can I use the BIR eAppointment System to schedule a request for getting a copy of ITR through the concerned RDO?

As of the time of writing this article, BIR’s eAppointment System has no facility to include scheduling a request for a copy of your ITR.

1. Can I use BIR’s chatbox (Chat with Revie) to request a copy of my ITR online?

No. The “Chat with Revie” feature of the BIR website only contains limited information and cannot be used in making a request to obtain a copy of your ITR. It can, however, help answer some of your basic questions such as how you can request your ITR from the relevant RDO.

13. Are OFWs required to file an ITR?

An OFW is exempt from paying taxes for income earned from one’s employer abroad. However, if the OFW earns income from other sources within the Philippines (such as when the OFW has a sari-sari store that earns from selling goods), the OFW would still be required to pay and file an ITR for that income from the Philippines.

References

- Revenue Regulation No. 11-2018 (2018).

- Contact Us. Retrieved 8 April 2022, from https://www.bir.gov.ph/index.php/contact-us.html

- eFPS Frequently Asked Questions. Retrieved 8 April 2022, from https://efps.bir.gov.ph/eFPSFAQ.html#overview01

- Request for a copy of ITR Form 2316. (2021). Retrieved 8 April 2022, from https://www.foi.gov.ph/requests/aglzfmVmb2ktcGhyHQsSB0NvbnRlbnQiEEJJUi05Njg0MzMyNDg4MDgM

Written by Jocelyn Soriano, CPA

in Accounting and Taxation, BIR, Government Services, Juander How

Jocelyn Soriano, CPA

Jocelyn Soriano is a CPA and a previous risk-based auditor for 11 years in a government agency exercising complementary supervision of banks. She graduated Summa Cum Laude with a degree in Accounting. She has published more than 15 books, developed several Android apps and is currently a freelance writer and blogger who is experienced in creating websites, writing SEO-optimized posts, managing newsletter subscriptions, and social media marketing. She is also a poet and dreams of publishing her Filipino epic high-fantasy novel.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net