How To Transfer RDO Online: An Ultimate Guide

Employees rarely stay in one job.

They either jump to another company that offers better opportunities or leave the rat race altogether to start a business.

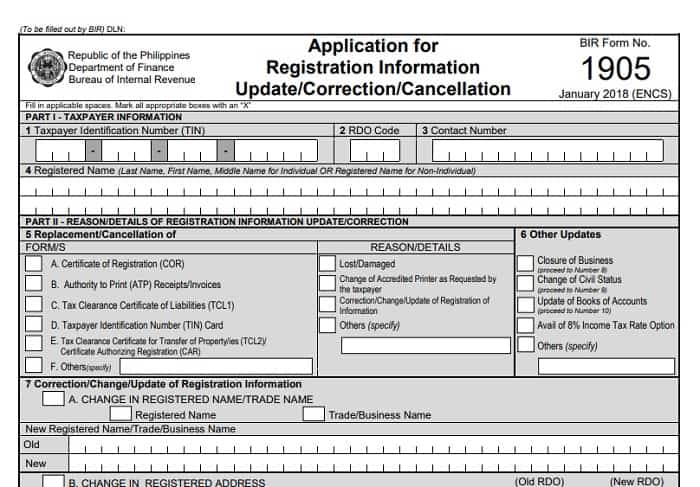

Whatever the case, this type of change always entails transferring RDO (Revenue District Office)–from your employer’s RDO to your new one. You can update your RDO by filing the BIR Form 1905, the same tax form used to update your other registration information like civil status and registered business/trade name and apply for the closure of a business.

You can accomplish many things with BIR Form 1905, but for the sake of brevity, we’ll only focus on the purposes I’ve just mentioned. If you’re filing this tax form for other reasons not discussed here, visit the BIR website or inquire at the nearest BIR office.

Disclaimer: This article is for general information only and is not substitute for professional advice.

Download the latest version of BIR Form 1905 here (PDF format)

Table of Contents

What Is the Use of BIR Form 1905?

The BIR Form 1905 is the form that taxpayers use to request the BIR to update, correct, or change their registration information, including any of the following:

- Registered address (transfer within the same RDO or to another RDO)

- Registered name/trade name

- Civil status (from single to married or vice versa)

- Accounting period (applies to corporate taxpayers only)

- Registered activity/line of business

- Facility type/details

- Incentive details/registration

- Tax type details

- Contact information type (landline number/mobile number/fax number/email address)

- Contact person/Authorized representative

- Name of stockholders/members/partners

This BIR tax form is also filed each time taxpayers need to replace or cancel any of the following documents:

- Certificate of Registration (BIR Form 2303)

- Authority to Print (ATP) Receipts/Invoices

- Tax Clearance Certificate of Liabilities (TCL1)

- Tax Clearance Certificate for Transfer of Property/ies (TCL2)/ Certificate Authorizing Registration (CAR)

- TIN card

Related: How to Replace Lost/Damaged TIN Card

Lastly, the BIR Form 1905 is a requirement for applications for the closure of business, an update of the book of accounts, and the 8% income tax rate option.

How To Transfer RDO Using BIR Form 1905

There are different instances when you’ll be required to transfer from an old RDO to a new RDO. The four sections below provide specific instructions on how to complete this process depending on what taxpayer category you belong to and the purpose of the RDO transfer.

You must first know your old and new RDO codes for this transaction. If you don’t have them, this guide will teach you different ways to know under which RDO code you’re currently registered and which RDO code you should transfer.

1. BIR Form 1905 filing for RDO transfer of one-time taxpayers/persons registered under EO 98/employees registering a new business

Who should file for RDO transfer:

- One-time taxpayers and persons registered under EO 98 who will register their new business or as a professional

- Employees who will register as a business taxpayer or professional in another RDO

Where to file for RDO transfer request: Old RDO where the applicant is currently registered

Where to transfer TIN registration: RDO having jurisdiction over the new business address (or home address for those without a fixed business location)

Requirements for filing BIR Form 1905:

- Two copies of accomplished BIR Form 1905

- Two copies of accomplished BIR Form 1901

- Photocopy of DTI Certificate of Registration of Business Name, if applicable

- Photocopy of Mayor’s Permit (or duly received application form for Mayor’s Permit if it’s still being processed)

- Photocopy of Contract of Lease for the new business location, if applicable

- For professionals: Professional Tax Receipt/Occupational Tax Receipt

- For applicants filing via email or fax: Valid government-issued ID

Steps to filing BIR Form 1905 for transfer of RDO:

Step 1: Download and fill out the BIR Form 1905.

a. Provide all the required details under Part I (Taxpayer Information).

- Under the RDO Code field, write down the RDO code where you’re currently registered.

- Under the Registered Name field, write down your surname, first name, and middle name if you’re registering as a self-employed taxpayer. If registering as a corporate taxpayer, indicate your business name.

b.Proceed to Part II (Reason/Details of Registration Information Update/Correction). Mark an “X” on the box that says “Correction/Change/Update of Registration of Information.”

c. Mark the Change in Registered Address box in Number 7B.

d. Mark the Transfer to another RDO box.

e. Under “From (Old RDO),” write down the RDO code where you’re currently registered.

f. Under “To (New RDO),” write down the RDO code having jurisdiction over your new business address. If your business is mobile or transient, indicate the RDO code having jurisdiction over your home address.

g. Provide the complete address of your new business location.

h. Skip to Number 12 (Declaration). Please write your full name and sign above it.

Step 2: Submit all the requirements personally, through email, or by fax.

The old RDO will immediately transfer your BIR registration records to the new RDO upon receiving your documents.

2. BIR Form 1905 filing for RDO transfer of employees with a new employer

Who should file for RDO transfer: Employees moving to a new employer or from head office to branch office or vice versa of the same employer

Where to file for RDO transfer: Old RDO where the employee is currently registered

Where to transfer TIN registration: RDO having jurisdiction over the employee’s place of residence (not the employer’s RDO, per Revenue Memorandum Order No. 37-20193)

Requirements for filing BIR Form 1905:

- Two copies of accomplished BIR Form 1905

- Valid company ID, certificate of employment, or any proof of current employment

- For applicants filing via email or fax: Valid government-issued ID

Steps to filing BIR Form 1905 for transfer of RDO:

Step 1: Download and fill out the BIR Form 1905.

a. Provide all the required details under Part I (Taxpayer Information).

- Under the RDO Code field, write down the RDO code where you’re currently registered.

- Under the Registered Name field, write down your surname, first name, and middle name.

b. Proceed to Part II (Reason/Details of Registration Information Update/Correction). Mark an “X” on the box that says “Correction/Change/Update of Registration of Information.”

c. Mark the Change in Registered Address box in Number 7B.

d. Mark the Transfer to another RDO box.

e. Under “From (Old RDO),” write down the RDO code where you’re currently registered.

f. Under “To (New RDO),” write down the RDO code having jurisdiction over your home address.

g. Provide your complete home address.

h. Skip to Number 12 (Declaration). Indicate your name and title/position, and then affix your signature.

Step 2: Submit all the requirements personally.

You can fax or email your documents if the old RDO is too far from your current location. Within 24 hours of receiving the complete requirements, the old RDO will process the transfer of your BIR registration records to the new RDO.

3. BIR Form 1905 filing for RDO transfer of employers transferring to a new RDO

Who should file for RDO transfer: Employers moving to a new business address under a different RDO

Where to file for RDO transfer: Old RDO where the employer is currently registered

Where to transfer TIN registration: RDO that has jurisdiction over the employer’s new business location

Requirements for filing BIR Form 1905:

- Two copies of accomplished BIR Form 1905 per active employee (currently employed with the company)

- Two copies of BIR Form 1905 accomplished by the employer

- List of employees to be transferred to the new RDO

Steps to filing BIR Form 1905 for transfer of RDO:

Step 1: Require all your existing employees (except those whose home address is under the same old RDO where the employer is currently registered) to accomplish the BIR Form 1905 with the following instructions:

a. Provide all the required details under Part I (Taxpayer Information).

- Under the RDO Code field, write down the RDO code where the employer is currently registered.

- Under the Registered Name field, write down the employee’s surname, first name, and middle name.

b. Proceed to Part II (Reason/Details of Registration Information Update/Correction). Mark an “X” on the box that says “Correction/Change/Update of Registration of Information.”

c. Mark the Change in Registered Address box in Number 7B.

d. Mark the Transfer to another RDO box.

e. Under “From (Old RDO),” write down the RDO code where the employer is currently registered.

f. Under “To (New RDO),” write down the RDO code having jurisdiction over the employer’s new business address.

g. Provide the employer’s new office address.

h. Skip to Number 12 (Declaration). It should have the employee’s printed name, signature, and title/position.

Step 2: The employer or his/her authorized representative (e.g., HR officer, admin officer, etc.) should also fill out the BIR Form 1905.

Step 3: Handle the mass transfer of your employees’ registration records by submitting all the requirements to your old RDO.

4. BIR Form 1905 filing for RDO transfer of corporate and self-employed taxpayers

Who should file for RDO transfer: Self-employed taxpayers and corporate taxpayers with a new business address

Where to file for RDO transfer: Old RDO where the taxpayer’s business is currently registered

Where to transfer TIN registration: RDO having jurisdiction over the new business location (or home address for those without a fixed business location)

Requirements for filing BIR Form 1905:

- Two copies of accomplished BIR Form 1905

- Photocopy of Amended SEC/DTI Certificate bearing the taxpayer’s new business address

- Photocopy of Mayor’s Permit (or duly received application form for Mayor’s Permit if it’s still being processed)

- Photocopy of Contract of Lease for the new business location, if applicable

- Board Resolution approving the transfer of business address, if applicable

- For professionals: Professional Tax Receipt/Occupational Tax Receipt

Steps to filing BIR Form 1905 for transfer of RDO:

Step 1: Download and fill out the BIR Form 1905.

a. Provide all the required details under Part I (Taxpayer Information).

- Under the RDO Code field, write down the RDO code where your business is currently registered.

- Under the Registered Name field, write down your surname, first name, and middle name if you’re a self-employed taxpayer. If you’re a corporate taxpayer, indicate your registered business name.

b. Proceed to Part II (Reason/Details of Registration Information Update/Correction). Mark an “X” on the box that says “Correction/Change/Update of Registration of Information.”

c. Mark the Change in Registered Address box in Number 7B.

d. Mark the Transfer to another RDO box.

e. Under “From (Old RDO),” write down the RDO code where you’re currently registered.

f. Under “To (New RDO),” write down the RDO code having jurisdiction over your new business address. If your business is mobile or transient, indicate the RDO code having jurisdiction over your home address.

g. Provide the complete address of your new business location.

h. Skip to Number 12 (Declaration). Please write your full name and sign above it.

Step 2: Submit all the requirements personally to the old RDO.

You’ll be issued the receiving copy of the BIR Form 1905.

Step 3: Go to your new RDO and submit the receiving copy.

Processing request for RDO transfer takes five to 10 working days from the date of complete submission of requirements. It takes time because the old and new RDOs must conduct their respective ocular inspections of the old and new business locations.

Before approving the RDO transfer, they must determine if the taxpayer’s business address is accurate, existent, and occupied.

How To Change Your Civil Status and Your Name (From Maiden to Married Name and Vice Versa) Using BIR Form 1905

Who should file for a change of civil status with the BIR:

- Married women who wish to use their married name in their BIR registration records

- Women granted annulment who want to revert to their maiden name

Where to file for civil status change: RDO where the taxpayer is currently registered

Requirements for filing BIR Form 1905:

- Two copies of accomplished BIR Form 1905

- Marriage certificate or Court Order (declaration of nullity of marriage)

- For business taxpayers: Letter of request for temporary use of old receipts/invoices

- Accomplished BIR Form 0605 (for payment of TIN card replacement fee)

- Original and photocopy of old TIN card (for the replacement to a new card bearing the married name)

Steps to filing BIR Form 1905 for change of civil status:

Step 1: Download and fill out the BIR Form 1905.

a. Provide all the required details under Part I (Taxpayer Information). Under the Registered Name field, write down your full maiden name (surname, first name, and middle name) as registered with the BIR.

b. Proceed to Part II (Reason/Details of Registration Information Update/Correction).

c. Under Number 5 (Replacement/Cancellation of Forms), mark the Taxpayer Identification Number (TIN) Card box with an “X.”

d. Under Number 6 (Other Updates), mark the Change of Civil Status box.

e. Skip to Number 9 (Change of Civil Status). Mark the appropriate box whether you’re changing your civil status from single to married or married to single.

f. Fill out the required fields under Number 9 with your maiden name, married name, spouse’s name, and employment information. You’ll also need to provide your spouse’s and employer’s TIN.

g. Proceed to Number 12 (Declaration), write your name, and sign over it.

Step 2: Submit all the requirements to the COR Update window in your RDO.

Inform the BIR officer that you’re also applying for a TIN card replacement (your card will reflect your new married name).

Step 3: Proceed to the Payment window to submit your accomplished BIR Form 0605 for verification.

Step 4: Pay the Php 100 TIN card processing fee at your RDO’s authorized agent bank.

Step 5: Return to the RDO and submit your payment receipt, machine-validated BIR Form 0605, and original and photocopy of your old TIN card to the COR Update window.

Step 6: Wait for the BIR officer to issue your receiving copy of the BIR Form 1905.

The officer may issue your new TIN card after a few minutes or give you a TIN Card Claim Slip if your card is released on a different date.

How To Change Your Registered Name/Trade Name Using BIR Form 1905

Who should file for a change of registered name with the BIR:

- Self-employed and corporate taxpayers with a new registered business name or trade name

- Taxpayers who want to file for correction of their misspelled/incorrect name (first name, middle name, surname, or the entire name)

Where to file for a change of registered name: RDO where the taxpayer is registered

Requirements for filing BIR Form 1905:

- Two copies of accomplished BIR Form 1905

- SEC Registration/DTI Certificate bearing the new business/trade name

- Original Certificate of Registration (BIR Form 2303)

Steps to filing BIR Form 1905 for change of registered name:

Step 1: Download and fill out the BIR Form 1905.

a. Provide all the required details under Part I (Taxpayer Information). Under the Registered Name field, write down your current name/business name/trade name as registered with the BIR.

b. Proceed to Part II (Reason/Details of Registration Information Update/Correction). Mark an “X” on the box that says “Correction/Change/Update of Registration of Information.”

c. Mark the Change in Registered Name/Trade Name box in Number 7A.

d. Mark the appropriate box, whether you’re changing your Registered Name or Trade/Business Name.

e. Fill out the required fields with your old and new registered names or trade/business names.

f. Proceed to Number 12 (Declaration), write your name, and sign over it.

Step 2: Submit all the requirements to the RDO.

Step 3: Wait for the BIR officer to issue your receiving copy of the BIR Form 1905.

How To Apply for Closure of Business Using BIR Form 1905

Who should file for business closure with the BIR:

- Taxpayers who will change their status from self-employed to employee

- Corporate taxpayers who have stopped their business operations permanently or whose business has dissolved due to a merger or consolidation

- Heirs who will request for cancellation of the deceased taxpayer’s TIN

Where to file for business closure: RDO where the taxpayer is currently registered

Requirements for filing BIR Form 1905:

- Two copies of accomplished BIR Form 1905

- Notice of closure or cessation of business

- List of ending inventory of goods and supplies, including capital goods

- Inventory of unused sales invoices/official receipts

- Unused sales invoices/official receipts, vouchers, debit/credit memos, delivery receipts, purchase orders, and all other unused accounting forms (should be physically submitted to the RDO where the head office is registered or where the Authority to Print was obtained)

- All business notices and permits

- Original Certificate of Registration (BIR Form 2303)

- Death certificate, in case of death of the taxpayer

- Estate tax return of the deceased taxpayer, if applicable

Related: How to Close a Business in the Philippines: An Ultimate Guide

Steps to filing BIR Form 1905 for the closure of business:

Step 1: Download and fill out the BIR Form 1905.

a. Provide all the required details under Part I (Taxpayer Information). Under the Registered Name field, write down your business name registered with the BIR.

b. Proceed to Part II (Reason/Details of Registration Information Update/Correction). Under Number 6 (Other Updates), mark the Closure of Business box.

c. Skip to Number 8 (Closure of Business/Cancellation of Registration).

- Under 8A, mark the Cancellation of TIN box with an “X” if you’re closing your business under any of these circumstances: death/failure to start a business (for corporate taxpayers)/permanent closure of a branch/dissolution of corporation or partnership/merger or consolidation. Mark the appropriate box that indicates the reason for your business closure. Then indicate the effective date of cancellation.

- Under 8B, mark the De-Register/Cessation of Registration box if you’re a self-employed taxpayer whose business is closing permanently. Mark the Permanent Closure of Business of an Individual box (or the Others box if there’s a different reason for the closure). Write down your trade/business name and the effective date of cessation.

d. Proceed to Number 12 (Declaration), write your name, and sign over it.

Step 2: Submit all the requirements to the RDO.

The concerned BIR office will immediately investigate to determine any tax liability. The RDO will issue a tax clearance ten days after the investigation ends or after the tax liabilities have been settled.

Go back to the main article: Tax in the Philippines: An Ultimate Guide to Filing and Paying Taxes

Frequently Asked Questions

1. I will move to a new employer but still live in the same place. Do I still need to submit BIR Form 1905 even if my residence address and RDO code haven’t changed?

No. Revenue Memorandum Order No. 37-2019 states that employees moving to a new employer must transfer to the RDO with jurisdiction over their residence. But since your tax records are already in the same RDO as your place of residence and therefore don’t need transferring, you no longer have to submit BIR Form 1905.

2. If a company changes office location and RDO, should all its employees subsequently apply for a transfer of RDO? If so, who should file for the RDO transfer–the employer or the employees?

Yes, employees with the same RDO as their employer, except those whose residence address and employer’s old business address are both under the jurisdiction of the same old RDO of the transferring employer, must transfer their records to the new RDO. The eligible employees must fill out their personal BIR Form 1905, but their employer shall be the one to facilitate the mass transfer4. For example, employee A lives in Taguig, under RDO 44, while employee B lives in North Makati, under RDO 49. Their employer is currently under RDO 44. If the employer decides to transfer to RDO 51, employee A is exempt from filling out the BIR Form 1905, while employee B must fill out the form with RDO 49 as the transferee RDO.

3. Can I file for two or more requests (e.g., RDO transfer and change in civil status) simultaneously?

Yes, you can do that so you can save time and effort.

4. Our business office address has moved to a different floor level within the same building under the same RDO. What are the process and requirements for updating business addresses in this situation?

Complete the requirements below and submit them to the RDO where your business is located:

a. 2 original copies of the completed BIR Form No. 1905;

b. 2 photocopies of the Certificate of Registration (present the original copy at the counter);

c. 2 photocopies of the Mayor’s Permit/DTI Certificate or SEC Certificate (whichever is applicable) bearing the new business address;

d. 2 photocopies of the paid annual registration fee (BIR Form No. 0605);

e. Letter request for temporary use of old receipts/invoices (for business taxpayers), if applicable;

f. If transacting through a representative: Photocopy of any valid government ID of the representative, Special Power of Attorney (if the taxpayer is an individual), and Board Resolution or Secretary Certificate (if the taxpayer is a corporation)

Please note that the BIR officer may reserve the right to request additional documents and that the address change will trigger a tax audit from the assessment division5.

5. Should I file for an RDO transfer before moving to the new company or after officially starting to work for the new company?

The requirement for RDO transfer is not exhaustive, i.e., employees can provide proof of employment, like their employment contract or a letter stating the same. Also, upon calling several RDOs, we found that some offices only require the filled-out BIR Form 1905. Hence, it doesn’t matter when you file for an RDO transfer, although it is advisable to contact your current RDO and the RDO where your residence is located before collating the requirements.

6. A new employer has hired me, so I will file for an RDO transfer. However, one of the requirements is a valid company ID. Should I bring my company ID from my new or former company?

Kindly use your current company ID. If not available, you can provide a copy of the employment contract. See the above answer.

7. Who is exempted from filing BIR Form 1905 upon transferring to a new employer?

Employees who are already under the RDO of his/her residence. As per Revenue Memorandum Order No. 37-2019, employees moving to new employers should transfer to the RDO with jurisdiction over their residence. So if your tax records are already in the same RDO as your place of residence, you’re exempted from filing the BIR Form 1905.

8. What happens if I don’t update my RDO? Will my current employer be able to remit my withholding tax even if my RDO has not been updated/transferred?

Employers must request proof of transfer, e.g., BIR Form 1905, if applicable, before the employee’s start date. Concerning the withholding taxes, your employer will still remit your taxes to the RDO where you are currently registered. However, please note that out-of-district payments of taxes are still considered as “non-payment” in the event of a tax audit, although the risk of getting audited as an employee is shallow.

9. I first registered with BIR under EO 98 (unemployed). I now want to change my taxpayer category to a local employee. Should I use BIR Form 1905 to do it?

10. I currently live/work abroad and want to change/update my taxpayer information. Can I ask a representative in the Philippines to file the request on my behalf? Or is it possible to file an appeal online via email?

Change in taxpayer information requires submission of hard copies to the RDO where you are registered. We have yet to experience the submission of requests via email. Please note that transactions through a representative require submission of a Special Power of Attorney (if the taxpayer is an individual) or Secretary Certificate (if the taxpayer is a Corporation), authorizing the representative to act on behalf of the taxpayer.

References

- Revenue Memorandum Circular No. 37-2019

- Revenue Memorandum Circular No. 57-2020

- Revenue Memorandum Circular No. 37-2019

- Revenue Memorandum Circular No. 37-2019

- Revenue Memorandum Circular No. 57-2020

Written by Miguel Antonio Dar II, CPA

in Accounting and Taxation, BIR, Government Services, Juander How

Miguel Antonio Dar II, CPA

Miguel Dar is a CPA and an experienced tax adviser specializing in tax audits. He gives tax advice to different start-ups and clarifies tax concerns of individual taxpayers. This includes helping clients register their businesses, training in tax and bookkeeping for start-up businesses, settling open cases, tax planning for future tax compliance, and responding to tax-related inquiries.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net