How To Build Emergency Fund in the Philippines: An Ultimate Guide

Every Filipino has experienced or knows someone close to them who has experienced an emergency.

A natural disaster that took almost everything they own and have built. An accident or a sudden medical expense. Or an unexpected job loss during a worldwide pandemic.

During these times of hardship, a lot of Filipinos are forced to do one or all of the following:

- Take out a loan that has high-interest rates;

- Approach family and friends to borrow money;

- Go to local government or government institutions like PCSO to ask for financial assistance.

But what if the next time you encounter an emergency, you finally have the money to fund it? What if you do not have to borrow money to pay for medical expenses or to replace a broken appliance?

That is what an emergency fund is for. And this article will teach you how to build one.

Table of Contents

- What Is an Emergency Fund?

- Why Do You Need an Emergency Fund?

- What Is NOT an Emergency Fund?

- How Much Money Should You Put in Your Emergency Fund?

- Where Should You Put Your Emergency Fund?

- Where NOT To Put Your Emergency Fund?

- How To Start Building Your Emergency Fund: 5 Tips

- When Can I Use My Emergency Fund?

- Frequently Asked Questions

- 1. Who needs to build an emergency fund?

- 2. I’m a student who still lives with my parents. Should I build my own emergency fund?

- 3. When should I start building my emergency fund?

- 4. What should I prioritize – emergency fund, savings, insurance, or investments?

- 5. I have existing debts that aren’t fully paid yet. Can I still start building my emergency fund?

- 6. Won’t I lose money with my emergency fund due to inflation?

- 7. I’m an OFW. Where should I keep my emergency fund?

- 8. Does keeping an emergency fund in a digital bank safe?

- 9. I want to travel or get a new gadget. Should I use my emergency fund?

- 10. How long should it take me to build my emergency fund?

- 11. My relative or close friend just had an emergency and is asking if I can help. Can I use my emergency fund to help them because IT IS an emergency?

- References

What Is an Emergency Fund?

An emergency fund is a money set aside to be used for large unexpected expenses. These sudden expenses include payment for unforeseen medical emergencies, home appliance repair or replacement, immediate car repair, and loss of a job, among other things.

After eliminating debt, the second most important thing to do is build your emergency fund to have a solid financial portfolio.

Why Do You Need an Emergency Fund?

Think of an emergency fund as a safety net for the curveballs that life throws at you. It gives you peace of mind that whatever happens, you have money set aside to deal with it financially.

An emergency fund can also help you avoid getting high-interest loans, like credit cards. These unsecured loans will be even harder to pay off if you already have existing loans to pay.

Lastly, having an emergency fund during hard times means you don’t have to liquidate assets or investments you’ve worked so hard to build.

What Is NOT an Emergency Fund?

1. Difference between an emergency fund and savings & time deposit

Although emergency funds are normally kept in a savings account, their intended use is quite different. An emergency fund is for unexpected expenses, while you use your savings for things you know you will buy soon (like a new phone, a new laptop, a new action figure, etc.)

The keyword here is “unexpected.” So if it is something you’ve been wanting, like a new car, new appliance, or a new gadget, get it from your savings or save for it.

Meanwhile, a time deposit is a place to park your money for a specific period of time in hopes that it will grow more compared to your money in your savings account.

2. Difference between emergency funds and investments

In financial terms, an investment is an asset you buy to get profitable returns in the future in the form of income, interest, or appreciation in value. You invest to generate wealth while you build an emergency fund so that you won’t go into debt paying for unexpected expenses.

3. Difference between an emergency fund and insurance/VUL

Insurance is normally used for death claims or critical illness claims. It replaces income if the main breadwinner (you) suddenly dies, becomes disabled, or gets sick with a critical illness.

Related: How to Get Life Insurance with Investment: An Ultimate Guide to VUL Insurance

Although insurance does help with unexpected financial issues due to illness or death, it cannot help with other emergencies like the car breaking down or an appliance needing replacement.

How Much Money Should You Put in Your Emergency Fund?

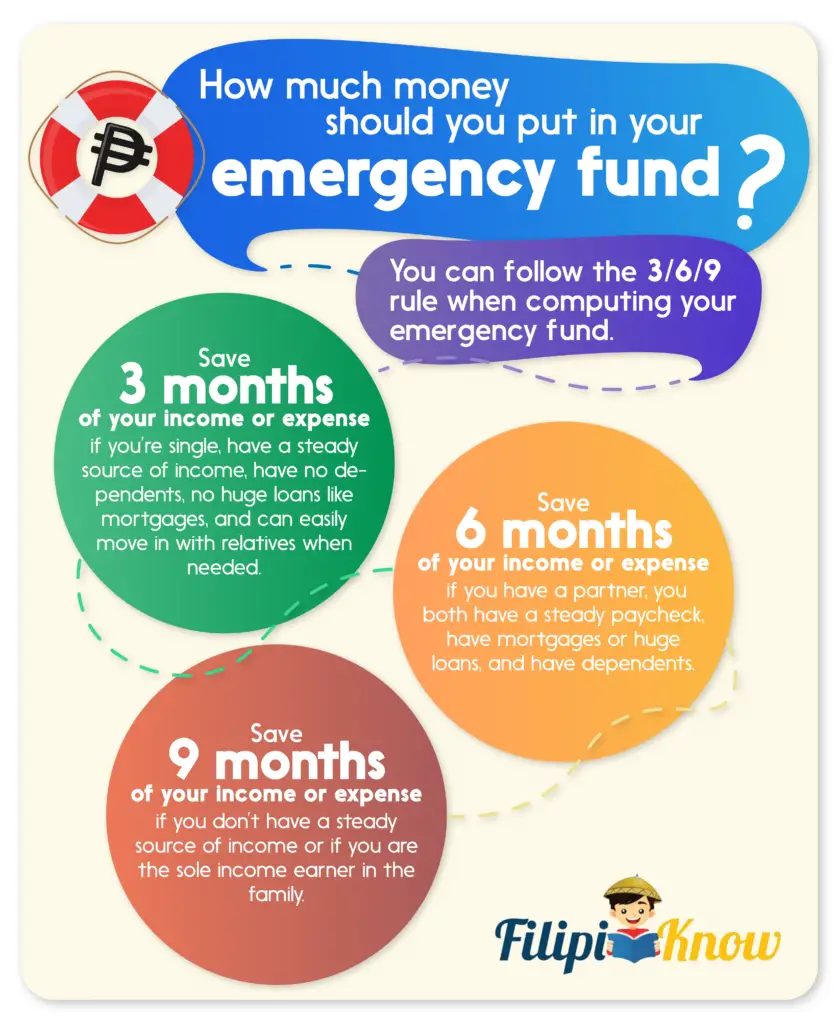

You can follow the 3/6/9 rule when computing your emergency fund1. Save three months of your income or expense if you’re single, have a steady source of income, have no dependents, no huge loans like mortgages, and can easily move in with relatives when needed. Six months of income or expense if you have a partner, you both have a steady paycheck, have mortgages or huge loans, and have dependents. Meanwhile, nine months of income or expense is suggested for those without a steady source of income or those who are the sole income earner in the family.

As you may have noticed, you can determine how much you’ll save up on your emergency fund based on either your monthly income or expenses.

Saving 3, 6, or 9 months’ worth of your monthly income works best for salaried, regular employees. This is because they have an idea roughly how much they will get and when they will receive the money each month.

For business owners, self-employed professionals, freelancers, those who rely on commissions, or simply those who have no fixed income, it is advisable to base your emergency fund on your expenses. Following the 3/6/9 rule mentioned above, your emergency fund should be equivalent to 9 months’ worth of your monthly living expenses.

Think of all the things that you spend on in a month. These include mortgage payments, loan payments, credit card payments, bills, utilities, children’s tuition, food, and transportation. You should also add to your computation the small irregular expenses like LPG, drinking water, and cellphone load, among others. Here’s a short guide to the different expenses you should consider when computing your emergency fund.

Where Should You Put Your Emergency Fund?

The safest place to put your emergency fund is in a savings account with an ATM card. With this type of bank account, the money can easily be withdrawn in any ATM should there be a need for it. In this digital age, aside from brick and mortar banks, you can park your emergency fund in digital banks as the money can easily be transferred to any account, anytime.

Some advise always having a small amount of cash in the house so that there is some money readily available when it is needed.

Where NOT To Put Your Emergency Fund?

Since an emergency fund needs to be easily accessible, it should never be placed in an instrument that will lock the money for a set period of time like a time deposit, VUL (Variable Unit Linked) life insurance policy, Pag-IBIG MP2, or UITF (Unit Investment Trust Fund).

Money in a time deposit can only be accessed by going to a bank. A VUL insurance policy has a negligible fund value (investment returns) in the first few years of the policy, so it is not a great emergency fund. It also takes a few days to withdraw money from a VUL account.

Meanwhile, the money you’ll save and invest in Pag-IBIG MP2 will be locked in your account for five years. Therefore, you should only put in this investment vehicle the amount of money you won’t mind touching within the said time frame.

As for UITF accounts, it’s a rule of thumb to never put your emergency fund in this investment instrument for two reasons. First, it takes the usual 2-3 business days before the funds get transferred to the account. Investment in stocks is also very volatile, especially if you’re investing in pure equities. So, if you invest your PHP 500,000 emergency fund, don’t be surprised if the amount drops to PHP 300,000 or lower by the time you decide to withdraw the money.

How To Start Building Your Emergency Fund: 5 Tips

After getting your target emergency fund amount, it is time to divide it into monthly achievable savings goals. Follow the tips below to get started.

- Decide how much you want to set aside for your emergency fund every month. As soon as you get your income, treat the emergency fund like a monthly bill and pay it. Make sure the amount is something you’re comfortable with so you can still set aside part of your income for travel and recreation.

- Whenever you get a bonus or cash incentive, make sure to also set aside a part of the extra money for your emergency fund.

- For those with online bank accounts, it’s worth noting that some banks have features wherein they can automatically take part of your income and deposit it into another account. You can set how much it can deduct and when it should be deducted.

- The main emergency fund amount can be divided into smaller, more achievable amounts for those without a fixed income. You can then set deadlines to achieve those amounts. For example, an emergency fund of PHP 500,000 may sound intimidating. But if you divide it into multiple milestones, with each one worth PHP 100,000, PHP 50,000, or PHP 25,000, then the journey towards achieving your goal won’t feel and look as intimidating.

- Celebrate milestones. Pat yourself on the back or treat yourself to a milk tea each time you achieve the smaller targets.

When Can I Use My Emergency Fund?

There are three questions2 you have to ask yourself before you can use your emergency fund.

1. Is it unexpected?

Mother’s day, your anniversary, or your birthday happens on the same day every year. It is not unexpected.

Your kid’s tuition is also not unexpected, as you roughly have an idea of when enrollment starts and how much you’re expected to pay.

Unexpected events can include a sudden job loss due to retrenchment, pay cut, car accidents, emergency medical expenses, or a sudden breakage of a home appliance.

2. Is it absolutely necessary?

Most adults know how to differentiate a want and a need, but sometimes we justify our expenses just to get what we want.

When your four-year-old phone finally gives up on you, and you can’t work without it since it is how you contact your clients, it is necessary. However, getting the latest, high-end iPhone or Android phone might not be necessary, especially if you use it only to call or email your clients.

3. Is it urgent?

Is it something that is important to you and cannot be delayed? A nice example is having your only mode of transportation – a motorbike or a car – break down. If this is the case, it will need to be repaired immediately.

On the other hand, the 4-4, 5-5, and subsequent monthly online sales are not urgent, no matter how big the discounts they give.

Frequently Asked Questions

1. Who needs to build an emergency fund?

If you have a job, bills to pay, earn your own money, or have dependents, you need an emergency fund. Even if you are single and still live with your parents, an emergency fund is still advisable as it is still much better to be able to handle emergencies like unexpected medical bills, or an unexpected laptop repair or replacement, without having to ask your parents for additional funds.

2. I’m a student who still lives with my parents. Should I build my own emergency fund?

If you’re a student who is still completely dependent on your parents and only has an allowance as your source of funds, an emergency fund is not necessary. It is nice to start building the habit of saving, but the responsibility of having an emergency fund is on your parents, not you as the dependent.

3. When should I start building my emergency fund?

The best time to start building your emergency fund is as soon as you get your first paycheck. For those who were not able to start then, the first thing to do is to assess your current financial standing. Do you have credit card debts, loans, or mortgages? Do you have savings? Are you investing? Do you have insurance? These questions will need to be answered first to know where you stand financially.

4. What should I prioritize – emergency fund, savings, insurance, or investments?

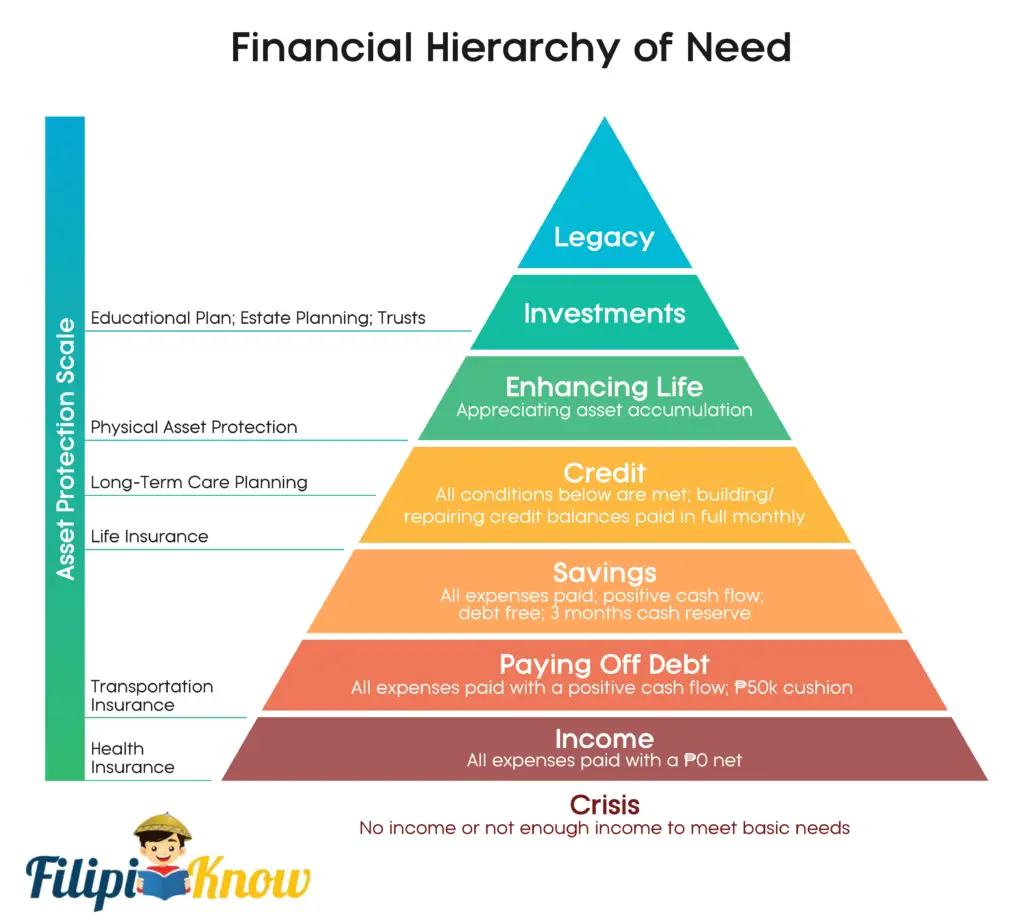

As seen from the financial freedom pyramid below, the third most important thing in your financial journey is to make sure that you have enough savings and emergency funds to maintain a positive cash flow. Both life insurance and investments only come once you’ve built a safety net. The good news is that you do not have to do this one step at a time. If your current cash flow allows you to pay off your debt, start building your emergency fund, and even let you buy insurance or invest a little all at the same tie, you can do so.

5. I have existing debts that aren’t fully paid yet. Can I still start building my emergency fund?

The best-case scenario is that you can do both: pay off your debts while building your emergency fund. In this way, you are eliminating your debt, and at the same time, you are making sure that in the next emergency, you will not have to get another loan.

If your current cash flow can only let you pick one, prioritize paying off your debt. If you let the interest on your debt accumulate, it will skyrocket and become harder to manage. Most banks do offer refinancing or easier payment terms on your loans if you request it from them.

6. Won’t I lose money with my emergency fund due to inflation?

At its core, an emergency fund is money set aside and immediately accessible to be used when there’s a huge and unexpected expense. Since money should always be available when needed, it should not be used to accumulate wealth or grow your money.

You will lose money with your emergency fund because of inflation, but your investments should help you make up for it.

These days, there are also a few savings accounts that have a higher interest rate, so it is also good to look into putting your emergency fund in those accounts so that you won’t lose too much due to inflation.

7. I’m an OFW. Where should I keep my emergency fund?

If you do not have any dependents, it is best to keep your emergency fund in a bank where you live. This way, you have access to it anytime you need it. However, if you do have dependents here in the Philippines, it might be prudent to have two separate emergency funds: half for you and another half for your dependents in the Philippines. Divide your emergency fund budget and deposit it equally in both of your bank accounts.

8. Does keeping an emergency fund in a digital bank safe?

Generally, yes, it’s safe to keep your emergency fund in a digital bank like CIMB. They’re regulated by the BSP and insured by the PDIC like regular banks. But just like their brick-and-mortar counterparts, digital banks also go through regular maintenance, so their apps may become temporarily inaccessible at a short notice. They’re also vulnerable to hackers, just like traditional banks, but it has more to do with the user’s carelessness in giving their OTP to strangers than the integrity of the digital banks themselves.

For these reasons, it’s only wise to never put all your eggs in one basket.

Should you decide to keep your emergency fund in more than one account, put 50% of it in traditional savings account with an ATM and another 50% in a digital bank which is just as liquid. However, it’s still up to you how much you’ll put in each account. So, if you’re leery of digital banks, you can put as little as 40% (or lower) of your emergency fund in your digital bank account, and the rest goes to traditional savings or the vault you keep in your house.

9. I want to travel or get a new gadget. Should I use my emergency fund?

One of the most important things you need to remember is that your emergency fund is not your savings. Unless the expense is unexpected, absolutely necessary, and urgent (see “When can I use my emergency fund?”), then it is not something that you’ll touch your emergency fund for.

10. How long should it take me to build my emergency fund?

Everyone is at a different stage in life. A fresh graduate with no debts, no dependents, and has a decent entry-level job, would find it much easier to build an emergency fund than someone who is currently in debt and has a few dependents. It does not, and it should not matter how long it takes you to build your emergency fund. What is important is that during times of emergencies, you have the fund to help you get through them financially.

11. My relative or close friend just had an emergency and is asking if I can help. Can I use my emergency fund to help them because IT IS an emergency?

The intention is good and commendable, but you have to remember that the emergency fund that you are building is for when you or your dependents are the ones who encounter an emergency. You might very well be tempted to touch your emergency fund to help a relative or a close friend in need, especially when you know you have the money set aside, but touching your emergency fund would go against what you set it up for: to help yourself when you need it most.

If you want to help, you can set aside a budget that you can use primarily for that purpose: a help fund.

Have a specific amount that you will set aside every month for this “help fund” so when a relative or friend comes to you asking for help, you can get money from that budget to give to them. This way, you can help without putting yourself and your family at risk.

References

- Shain, S. (2020). How to Find the Right Emergency Fund Formula For You. Retrieved 11 March 2021, from https://www.chime.com/blog/how-to-find-the-right-emergency-fund-formula-for-you/

- Cruze, R. (2020). A Quick Guide to Your Emergency Fund. Retrieved 11 March 2021, from https://www.daveramsey.com/blog/quick-guide-to-your-emergency-fund

Written by Reggie Sison, RFC, REP

Reggie Sison, RFC, REP

Reggie Sison is a Registered Financial Consultant (RFC) and a Registered Estate Planner (REP) from the International Association of Registered Financial Consultants (IARFC). She is a freelance writer and a frustrated relationship guru. To destress, she likes to create flowers from recycled ribbons and paper, and read fantasy and horror novels.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net