How To Get a Government Loan for Small Businesses in the Philippines

From OFWs to small businesses, many are in danger of losing their livelihood due to the pandemic. That’s why the government has extended many kinds of loan opportunities to help Filipinos get back on track. One such program is Bayanihan CARES, under the Department of Trade and Industry (DTI) and Small Business Corporation (SB Corp), which aims to help MSMEs, OFWs, hospitals, and others affected by the pandemic.

As of December 31, 20211, the number of approved loans under the Bayanihan CARES program amounted to PHP 6.59B for 39,242 MSMEs. The program has also extended PHP 48.4M in loans for unemployed OFWs to start their own businesses under the CARES HEROES program.

If you have been struggling due to the pandemic, then this guide is for you. Read on to find out the different loan options that you can take advantage of according to your situation.

Related: Best Business Loans for Startups and SMEs in the Philippines

Table of Contents

- At a Glance: Best Government Loans for Small Business in the Philippines

- How Are Government Loans Different From Loans From Private Institutions?

- List of Philippine Government Loans for Micro, Small, and Medium Enterprises (MSMEs)

- 1. Bayanihan CARES 2 Program (COVID-19 Assistance to Restart Enterprises) by DTI & SB Corp

- 2. P3 Program (Pondo sa Pagbabago at Pag-Asenso) by DTI & SB Corp

- 3. CARES for TRAVEL (CARES for Tourism Rehabilitation and Vitalization of Enterprises and Livelihood) by DTI & SB Corp

- 4. HEROES (Helping the Economy Recover Thru OFW Enterprise Start-ups) by SB Corp

- 5. MCGP (MSME Credit Guarantee Program) by Philippine Guarantee Corporation (PhilGuarantee)

- 6. RESPONSE (Rehabilitation Support Program on Severe Events) by the Development Bank of the Philippines (DBP)

- 7. SURE COVID-19 (Survival and Recovery) by Agricultural Credit Policy Council (ACPC)

- 8. I-RESCUE (Interim Rehabilitation Support to Cushion Unfavorably Affected Enterprises by COVID-19) by Land Bank of the Philippines

- 9. Other Government Loans by SB Corp

- How To Get a Government Loan for Small Businesses: 5 Steps

- Tips & Warnings

- Frequently Asked Questions

- References

At a Glance: Best Government Loans for Small Business in the Philippines

| Government Loan | Loan Amount | Loan Term | Interest Rate |

| Bayanihan CARES 2 Program | PHP 10,000.00 to PHP 5 million | 1 to 4 years | 0% |

| P3 Program | PHP 5,000.00 to PHP 200,000.00 | 18 to 30 months | 2.5% |

| CARES for TRAVEL | PHP 10,000.00 to PHP 5 million | 1 to 4 years | 0% |

| HEROES | PHP 30,000 to PHP 100,000 | 24 to 36 months | 0% |

| MCGP | PHP 50,000,000 | 1 to 5 years | As required by the bank. |

| RESPONSE | Up to 95% of the project requirement or minimum cash requirement. | For private institutions, up to 10 years inclusive of a 3-year grace period. For permanent working capital, up to 5 years inclusive of a 1-year grace period. | Based on the applicable benchmark rate at the time of drawdown plus the applicable credit spread. |

| SURE COVID-19 | PHP 10,000,000 | Up to 5 years | 0% |

| I-RESCUE | Up to 85% of actual need provided the total loan. | Up to 5 years | 5% |

How Are Government Loans Different From Loans From Private Institutions?

As its name suggests, a government loan is offered by the government as a means to help certain sectors of the Philippines. Government loan programs are not always available and can change according to the needs of the country. Recently, many of the loan programs are targeted to help people get through the pandemic and its effects on the economy.

Due to their nature, most government loans are interest and collateral-free. But they do still charge a service fee.

Unlike government loans, the primary objective of private institutions is to protect and grow their capital. This is why their loans have stricter requirements and higher interest rates. However, loans from private institutions, such as banks and private lenders, are always available and have a much larger variety.

So, if there is currently no government loan program that addresses your needs, then you should explore getting a loan from these private institutions.

List of Philippine Government Loans for Micro, Small, and Medium Enterprises (MSMEs)

1. Bayanihan CARES 2 Program (COVID-19 Assistance to Restart Enterprises) by DTI & SB Corp

a. Best For: MSMEs affected by the pandemic and quarantines.

b. Overview: Originally launched in May 2020, Bayanihan CARES is an interest and collateral-free loan program geared toward the recovery of MSMEs hit by the pandemic. The loan is only subject to a one-time service fee.

Update: With the need to expand the original CARES program, the CARES 2 program was introduced in October 20202 to also accommodate medium-sized businesses. Through the Bayanihan 2 Act, PHP 10 billion was allocated to SB Corp. for the continuation of the CARES program.

c. Loan Amount: PHP 10,000.00 to PHP 5 million depending on the asset size, annual sales of the business, as well as the submission of BIR-filed financial statements.

- Micro: up to PHP 600,000

- Small: up to PHP 3 million

- Medium: up to PHP 5 million

d. Grace Period: Up to 6 months for regular business and up to 12 months for certain industries (this is the period where you don’t have to pay anything towards the loan).

e. Loan Term: 1 to 4 years depending on the loan amount.

f. Interest Rate: Zero interest rate, no collateral.

g. Repayment Terms: A service fee of 4% to 8% depending on the loan term and amount borrowed.

h. Application Process: All applications must be done online through SB Corp’s Borrower Registration System or BRS website. Through the website, you must upload all the documents required for the loan. After completing the application, you just need to wait for an email from SB Corp for the next steps.

i. Requirements:

☑ Duly-accomplished online application form through BRS

☑ Proof of legitimate micro, small or medium-sized business (such as local government permits) running for at least one year before March 2020

- Micro: asset size of not more than PHP 3 million

- Small: asset size of PHP 3 million up to PHP 15 million

- Medium: asset size above PHP 15 million up to PHP 100 million

☑ Proof of permanent business address

☑ Must have a bank account or electronic money account (EMA) like GCash

☑ Must not have any unresolved negative credit dealings

☑ If sole proprietorship, co-borrower’s ID is required

☑ If corporation or partnership, corporate secretary certificate is required

☑ If with BIR filed financial statements:

- BIR 1701 for sole proprietorships or BIR 1702 for corporations

- Income statement

- Balance sheet

☑ If without BIR filed financial statements,

- Mayor’s permit (or barangay permit)

- Photos of inventory, assets, and property

- One-minute video of owner/president explaining the loan purpose, monthly sales, number of employees, and major business assets

2. P3 Program (Pondo sa Pagbabago at Pag-Asenso) by DTI & SB Corp

a. Best For: Existing micro-businesses with assets of PHP 3 million or below and employees of 9 and less.

b. Overview: The P3 program aims to assist the Philippine microentrepreneurs, which comprise the bulk of MSMEs, through easy, accessible, and affordable loans. The goal of the program is to provide an alternative financing option to usurious informal lending practices, commonly known as 5-6 lending.

c. Loan Amount: PHP 5,000.00 to PHP 200,000.00, depending on the size of the business and ability to pay.

d. Grace Period: Maximum of 6 months.

e. Loan Term: Maximum of 18 months for loans below PHP 50,000 and a maximum of 30 months for loans over PHP 50,000.

f. Interest Rate: 2.5% monthly interest rate.

g. Application Process: The applicant can visit a DTI Negosyo Center, a DTI local office, or an accredited microfinancing institution to apply for the P3 program.

h. Requirements:

- Duly-accomplished P3 loan application form

- Proof of micro-entrepreneur with a legitimate business running for at least one year

- Proof of one year of residence

- Valid government ID

- ID picture

- Barangay Clearance issued in the past three months

- For loans over PHP 50,000: DTI Business Name Registration Certificate

3. CARES for TRAVEL (CARES for Tourism Rehabilitation and Vitalization of Enterprises and Livelihood) by DTI & SB Corp

a. Best For: MSMEs in the tourism industry hit by the COVID-19 pandemic.

b. Overview: CARES for TRAVEL is part of the Bayanihan CARES program that is focused on the recovery of the tourism industry. SB Corp, in partnership with the DOT, will provide tourism MSMEs with zero interest, no collateral loans.

c. Loan Amount: PHP 10,000.00 to PHP 5 million depending on the asset size, annual sales of the business, as well as the submission of BIR-filed financial statements.

- Micro: Up to PHP 600,000

- Small: Up to PHP 3 million

- Medium: Up to PHP 5 million

d. Loan Term: 1 to 4 years depending on the loan amount.

e. Interest Rate: Zero interest rate, no collateral

f. Repayment Terms: A service fee of 4% to 8% depending on the loan term and amount borrowed

g. Application Process: Same application process as Bayanihan CARES 2.

h. Requirements: Same requirements as Bayanihan CARES 2

4. HEROES (Helping the Economy Recover Thru OFW Enterprise Start-ups) by SB Corp

a. Best For: OFWs who have lost their job and have come back to the Philippines due to the COVID-19 pandemic.

b. Overview: Due to the effect of the global pandemic, more than 300,000 OFWs have been repatriated and are currently unemployed. The HEROES program aims to help these OFWs by providing loans to help them start a business.

Related: Best Business Ideas in the Philippines

c. Loan Amount: PHP 30,000 to PHP 100,000

d. Grace Period: Up to 12 months

e. Loan Term: 24 months to 36 months (inclusive of grace period).

f. Interest Rate: No interest, no collateral.

g. Repayment Terms: 6% to 8% service fee depending on the loan amount.

h. Application Process: Applicants must undergo a free three-day online training with the PTTC by registering at this link. After completing the training, the applicant must prepare the requirements listed below and then submit them to the BRS website.

i. Requirements:

- Valid government-issued ID

- OWWA certification

- DTI Registration

- Video of business presentation (guidelines from the PTTC training)

- For Loans PHP 50,000 and up: Mayor’s permit

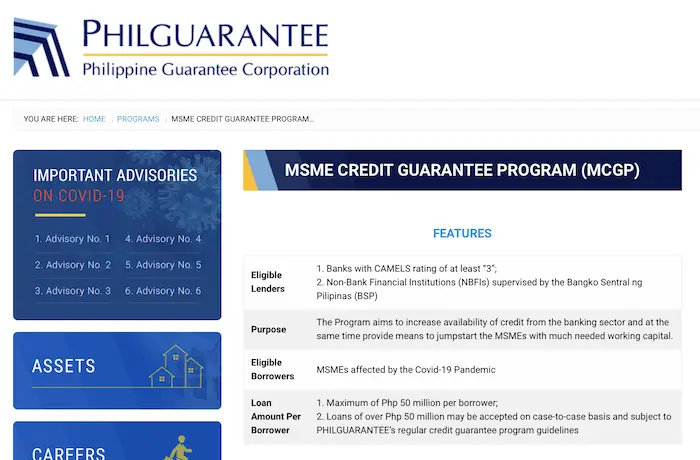

5. MCGP (MSME Credit Guarantee Program) by Philippine Guarantee Corporation (PhilGuarantee)

a. Best For: MSMEs affected by the COVID-19 pandemic who need bank loans for the purpose of their working capital.

b. Overview: PhilGuarantee, in partnership with the banking sector, acts as an ordinary guarantee for loans provided to MSMEs, meaning they can cover some of the loss of the lender if the borrower defaults. Through this, PhilGuarantee can help MSMEs gain access to bank loans that they might not have otherwise gotten.

c. Loan Amount: Maximum of PHP 50 million per borrower. Loans above PHP 50 million may be accepted on a case-to-case basis.

d. Loan Term: 1 to 5 years.

e. Interest Rate: Interest and collateral are as required by the bank.

f. Guarantee Coverage: 50% of the principal.

g. Guarantee Rate: 1% guarantee fee per year and PHP 5,000 amendment fee.

h. Guarantee Term: 1 year subject to review on anniversary date.

i. Application Process: Ask a PhilGuarantee partner bank for their specific application process and requirements for the MGCP.

j. Requirements: Based on the requirements of the partner bank.

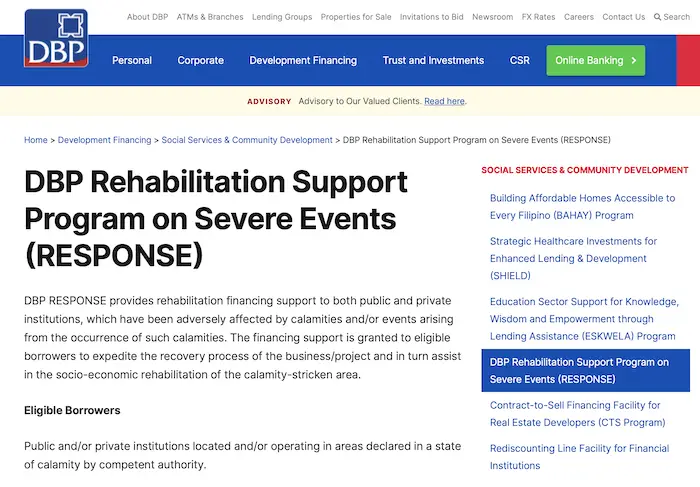

6. RESPONSE (Rehabilitation Support Program on Severe Events) by the Development Bank of the Philippines (DBP)

a. Best For: Public or private institutions affected by calamities (including health threats such as the pandemic3).

b. Overview: RESPONSE is a rehabilitation program providing financial support for both private and public institutions that have been hit by calamities. The program aims to expedite their recovery through a simple loan application process.

c. Loan Amount: Up to 95% of the project requirement or minimum cash requirement.

d. Loan Term: For private institutions, up to 10 years inclusive of a 3-year grace period. For permanent working capital, up to 5 years inclusive of a 1-year grace period.

e. Interest Rate: Based on the applicable benchmark rate at the time of drawdown plus the applicable credit spread.

f. Collateral: For Non-LGU Borrowers: Real Estate Mortgage (REM) or Chattel Mortgage (CHM) or hold-out on deposits equivalent to one quarter of amortization or other acceptable collateral as per DBP assessment.

g. Repayment Terms: Term loans are payable on a monthly or quarterly basis according to your business or project’s cash flows.

h. Application Criteria:

☑ Public or private institutions operating in areas declared to be in a state of calamity by a competent authority (such as those affected by Typhoon Odette)

☑ For existing borrowers:

- You must have been in good standing at the time of the calamity

- Agricultural projects are required to be insured under the appropriate insurance package, such as the PCIC

☑ For new borrowers:

- Your business or project must have a high development impact for the community or region

- Your business or project is financially viable and properly capitalized

- Your business or project must have been in operation for at least 1 year before the calamity

- There must be no adverse findings from banks or suppliers

i. Application Process: Contact a DBP representative for the details on the application process.

j. Requirements:

☑ DBP application form

☑ Customer information file form with loan record form

☑ Latest 3 years (if applicable) financial statements

☑ DBP form: Authority to conduct inquiry and provide credit information to or from credit bureaus and other banks and creditors

☑ Board resolution or secretary’s certificate authorizing the loan

☑ Project details

☑ Business Registration Documents

- DTI or SEC registration

- Business or mayor’s permit

- Company profile

- Latest GIS (General Information Sheet)

- For corporations: article of incorporation

☑ Collateral documents

7. SURE COVID-19 (Survival and Recovery) by Agricultural Credit Policy Council (ACPC)

a. Best For: Small farmers and fisherfolk affected by disasters.

b. Overview: The SURE COVID-19 program by the ACPC, an expansion of the original SURE program4, provides working capital loans to micro and small agri-fishery enterprises. SURE is a zero-interest loan program available for sole proprietorships, cooperatives, partnerships, and corporations.

c. Loan Amount: Up to PHP 10 million for working capital.

d. Loan Term: 5 years to pay.

e. Interest Rate: Zero interest.

f. Application Criteria:

- Must be duly registered with the required government registering institutions

- Operational for at least one year before the pandemic

- With proven management capacity to implement the project

- With readily available agri-fishery products from farmers or fisherfolk

g. Application Process: Email all documentary requirements to [email protected] or [email protected] for evaluation.

h. Requirements:

- Letter of intent (must include project description)

- Business registration documents (e.g. SEC certificate, DTI certificate)

- Financial statements

8. I-RESCUE (Interim Rehabilitation Support to Cushion Unfavorably Affected Enterprises by COVID-19) by Land Bank of the Philippines

Update: I-RESCUE applications for 2021 closed on Dec 31, 20215. Please inquire with Land Bank regarding 2022 applications.

a. Overview: As part of the efforts under the Bayanihan to Heal as One Act, Land Bank offers funds and loan restructuring in more flexible conditions under the I-RESCUE program. The program is open to SMEs, cooperatives, and microfinance institutions.

b. Loan Amount: Up to 85% of actual need provided the total loan.

c. Loan Term: Up to 5 years with a maximum of 2 years grace period on the principal payment depending on the borrower’s cash flow.

d. Interest Rate: 5% per year for 3 years. After 3 years, the loan is subject to annual repricing not less than a 5% interest rate.

e. Collateral: Any collateral acceptable by the bank.

f. Repayment Terms: Flexible (monthly, quarterly, semi-annually, or annually) based on cash flow.

g. Application Process: Contact a Land Bank representative for the application process and updated documentary requirements.

h. Requirements:

- Duly-accomplished loan application form

- DTI or SEC registration

- Board resolution or secretary’s certificate authorizing the loan

- Other permits/licenses from concerned government agencies (e.g. BIR)

- Audited financial statements of the last 3 years (if applicable)

- List of the business’s key officers

- Valid government ID

- Client signature specimen card

- TIN

9. Other Government Loans by SB Corp

- 13th Month Pay Loan Facility is for micro and small enterprises who need help in financing the 13th month pay of their employees. You can get up to PHP 12,000 per employee.

- Exporters’ Shipping Cost Lending Facility is for existing small and medium export businesses that are having trouble with the increase of freight rates.

- STAPLES (Sustaining Trade Access to Primary Food and Link to Enterprises) is for MSMEs in the retail food market and are part of the supply chain of accredited FMCGs6. It’s an interest and collateral-free loan program for FMCG suppliers, such as food producers or repackers, and retailers or wholesalers, such as sari-sari stores, groceries, and bakeries.

Related: How To Get a Loan for Your Franchise Business

How To Get a Government Loan for Small Businesses: 5 Steps

1. List Down Your Business’s Needs

Before you apply for a government loan, you should do a review of your business’s needs so you can choose the best government loan that fits your current situation. It’s crucial that you know the following:

- What you’ll use the business loan for

- How much you’ll need

- How long it will take you to pay back the interest and principal

By listing down your needs, you’ll be able to create a sound plan (and backup plans) on how you can earn back the money you need to pay the loan back.

Remember, businesses that want to apply for government loans will be meticulously reviewed. For example, CARES 2 and HEROES have a video presentation requirement where you’ll need to present your plans for the loan.

2. Do Your Research & Choose Which Government Loan Fits Your Need

Not all government loans are available for everyone. For example, the Bayanihan CARES 2 program prioritizes MSMEs hit by the pandemic, while the HEROES program is only available for OFWs. So, you should make sure to do your research and prepare accordingly.

When choosing a government loan, make sure that the loan amount, loan term, interest rate, and other pertinent details match your plan.

3. Prepare the Documents Necessary for the Government Loan Application

Every government loan has different pre-qualification criteria and documentary requirements. You should prepare everything together so that your application will proceed smoothly.

4. Apply for the Government Loan

For government loans under the Small Business Corporation, they will usually require you to apply through their BRS website. However, the other government loans available have different application processes. Make sure to contact the respective institutions to ensure that you are following the latest application guidelines.

5. Claim Your Approved Loan & Plan for Repayment

Once your loan is approved, follow the guidelines from the government institution on how to get your funds. Each institution has different modes of fund release. For example, Land Bank releases the loan amount in lump sum or staggered release through the borrower’s bank account.

Lastly, if you did Step 1 correctly, you should have a plan on how to pay the loan on time. Make sure to follow through on your repayment plan and have a backup plan as necessary.

Tips & Warnings

- Take advantage of the grace period. During the grace period, you don’t have to pay anything towards the loan. This is the best time to get your business in order and earn as much as you can to be able to pay back your loan.

- Keep a record of every transaction related to the government loan. With proper accounting, you’ll know how much is being used and for what, so you can adjust your plan accordingly.

- Don’t use your government loan for anything other than for the business. It might be tempting to use it for personal expenses especially due to the hardships of the pandemic, but it will only make it more difficult for you to pay back the loan. Instead, get your business back on track first so that you can use its earnings to pay for your personal needs.

Frequently Asked Questions

1. Which government loan is the best for me?

The best government loan for you is the one where you fit the qualification criteria and the one that can provide the funds necessary for your business’s needs. You can go through the ones listed above and cross out any that do not apply to you. If there are multiple options available afterward, then you can cross out any that do not meet your business’s requirements.

2. I’m starting a new business. Is there a business loan from the government available for me?

If you are a repatriated and unemployed OFW, you can get a loan from the government under the HEROES program to start a new business. However, this is currently not available for non-OFWs.

3. My government loan application was denied. What can I do next?

There are a few things that you can try:

- Apply for reconsideration. Some loans allow applicants to apply for reconsideration if an unmet requirement has now been met. For example, under the Bayanihan CARES 2 program, part of the requirements is “Must not have any unresolved negative credit dealings”. If you were previously denied but can now show proof that all negative credit dealings have been resolved, then you can reapply.

- Consider other government loans available. If there are other government loans available that fit you and your requirements, then you can apply to them next.

- Check out your business loan options from banks and private lenders. For example, Radiowealth Finance Co. has flexible loan options due to their low loan limit of PHP 10,000.

References

- Desiderio, L. (2022). Government extends P6.6 billion loans to pandemic-hit small firms. Retrieved 24 January 2022, from https://www.philstar.com/business/2022/01/09/2152600/government-extends-p66-billion-loans-pandemic-hit-small-firms

- Crismundo, K. (2020). Medium firms now included in CARES 2 loan program. Retrieved 24 January 2022, from https://www.pna.gov.ph/articles/1119737

- DBP offers assistance to distressed businesses and LGUs. (2020). Retrieved 24 January 2022, from https://www.dbp.ph/newsroom/dbp-offers-assistance-to-distressed-businesses-and-lgus/

- ACPC’s Survival and Recovery (SURE) Loan. Retrieved 24 January 2022, from https://acpc.gov.ph/acpcs-survival-and-recovery-sure-loan/

- Valencia, C. (2021). Landbank releases loans to pandemic-hit businesses. Retrieved 24 January 2022, from https://www.philstar.com/business/2021/05/25/2100528/landbank-releases-loans-pandemic-hit-businesses

- Monde Nissin signed as first partner for SBCorp STAPLES. Retrieved 25 January 2022, from https://sbcorp.gov.ph/news/monde-nissin-signed-as-first-for-sbcorp-staples/

Written by Rod Michael Perez

Rod Michael Perez

Rod Michael Perez is a freelance writer with over 7 years of experience in writing long-form articles, ad copy, and SEO content for local and foreign clients. He is also an aspiring startup founder and believes that the Philippines could be the next hub for startup culture. He takes care of his dog, a poodle-Shih Tzu hybrid, in his spare time.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net