How To Update SSS Contribution Online: A Step-by-Step Guide

Do you want to increase or decrease your monthly SSS contribution?

Fortunately, you can easily update your SSS contribution on your own if you’re a Voluntary, Self-employed, OFW, or Non-working spouse member. Changing your SSS contribution only takes a few clicks in your My.SSS or SSS mobile app account. There’s no need to visit the nearest SSS branch nor present your proof of income.

On the other hand, employees don’t have the same freedom as their SSS contribution is dictated by the fixed monthly salary indicated on their contracts. Only their employers have the power to update the employees’ contributions inside the My.SSS account.

This article is written for the non-formally employed SSS members as well as employers who want to know how to change the amount of SSS contribution online from any device, any time.

Related: How to Change, Correct, or Update Your SSS Membership Data

Table of Contents

- Can you change the amount of your SSS contribution? (Quick Answer)

- Who Can Change Their Monthly SSS Contribution?

- How To Update SSS Contribution Online Through Your My.SSS Account

- How To Update SSS Contribution Online Through SSS Mobile App

- 1. Log In to the SSS Mobile App With Your User ID and Password

- 2. Select Generate PRN at the Bottom of the App Dashboard

- 3. Click CREATE on the Upper Right Corner of the App

- 4. Select Your Membership Type, the Applicable Period You Want To Pay for, and Your New SSS Contribution Amount

- 5. Click SUBMIT

- 6. Double-Check the Information You’ve Entered and Click OK To Close the Dialog Box

- 7. Copy the PRN on Your Statement of Account (SOA) and Use It To Pay Your New Contribution Amount

- How To Update SSS Contribution of Employee: A Quick Guide for Employers

- 1. Log In to Your My.SSS Employer Account

- 2. Click Payment Reference Number on the Main Menu

- 3. Cancel the Existing Electronic Contribution Collection List (E-CCL), Provided You Haven’t Paid for It Yet

- 4. Select Collection List Details

- 5. Edit the employee’s Monthly Compensation

- 6. Click Prepare Collection List to generate a new Electronic Contribution Collection List

- 7. Download or Print the Updated E-CCL Then Proceed to Payment Using the PR

- References

Can you change the amount of your SSS contribution? (Quick Answer)

Yes. You may change your contribution amount or MSC (Monthly Salary Credit) as a voluntary, self-employed, or OFW member when your monthly income has increased or decreased. The same is true for non-working spouse members, although the basis of their contribution is their spouses’ declared monthly income.

You can do this an unlimited number of times and number of salary brackets within a year, as long as you don’t go below the minimum MSC. No need to present proof of actual income to the SSS. This rule applies only to members below 55 years old.

Voluntary, self-employed, and OFW members aged 55 and above can increase their contribution only once a year and increase by one salary bracket from their last recorded MSC.

Non-working spouse members can change the MSC based on 50% of their spouse’s current MSC. No need to submit proof of the spouse’s monthly income.

To change your contribution, just choose a different contribution amount when generating a PRN through your My.SSS account. Then click the Submit Request button and click the OK tab to get a new PRN.

Employees, on the other hand, can’t directly change their SSS contribution amount. Their employers are the ones who have access to the My.SSS facility and therefore have the power to change or update each employee’s contribution and employment status.

Who Can Change Their Monthly SSS Contribution?

According to SSS Circular No. 2015-0071, the following SSS members can change their monthly SSS contributions:

| Member Type | Age | Frequency of Change |

| Voluntary/Self-Employed/OFW | Below 55 years old | Unlimited |

| Voluntary/Self-Employed/OFW | 55 years old and above | Contribution can be increased only once a year and by one salary bracket from the last posted payment |

| Non-working Spouse | N/A | Depends on how often the working spouse’s declared monthly income changes |

1. Voluntary/Self-employed/OFW Members Below 55 years old

- Members who belong to this category can increase or decrease the amount of their monthly SSS contributions as many times as they want within a year. This is advantageous for most of these members because their montly income may come from diverse sources and is never fixed.

- Since income of these members are not fixed, they are allowed to jump from one salary bracket to another and pay any amount they can afford. In other words, they can select their Montly Salary Credit (MSC) and amount of contribution based on how much they earn for any particular month. Let’s say you own a business that has earned Php 100,000 this month. Based on this table, the income falls in the maximum salary bracket which means you’ll be paying for the maximum contribution amount of Php 3,250. If the business slows down the following month, you can simply decrease your contribution amount to match the income you generate during the given period.

- Members can decrease their contribution any time but it should never be lower than the current minimum Monthly Salary Credit (MSC) for self-employed, voluntary, or OFW members. If you’re a voluntary member, for example, the prevailing minimum MSC for your membership category is 3,000 which is equivalent to a monthly contribution amount of Php 390. You can decrease your monthly contribution any time so long as it’s never lower than Php 390.

- Members can change their monthly SSS contribution online. Submission of a proof of income or a written request of declaration of earnings is no longer required.

2. Voluntary/Self-Employed/OFW Members Who Are 55 Years Old and Above

- Members under this category are only allowed to INCREASE their Monthly Salary Credit (MSC) once a year and by only one salary bracket from the last posted payment. Say you’re a 58-year-old voluntary member who has been consistently paying Php 1,430 a month. Based on the table for voluntary members here, that contribution amount is assigned for members with MSC of 11,000 and whose monthly income falls in the 10,750 – 11,249.99 salary range. Following the rule indicated in the SSS Circular, you’re only allowed to increase your contribution amount by one salary bracket. This means that from your current bracket, you can only jump to the next higher salary range (i.e., 11,250 – 11,749.99) which is equivalent to a monthly contribution of Php 1,495. Since you can only increase your monthly contribution only once in a year, you’ll be basically stuck with the same contribution amount until the following year, when you can decide whether to keep paying the same amount or further increase it by one salary bracket.

- There are members who are exempted from the preceding rule. These include members who have changed their membership type for the first time from Employed/Self-employed to Voluntary or Employed/Self-employed/Voluntary/Non-working Spouse to OFW member. These members are allowed to increase their MSC without limit. Meanwhile, members who have been paying for the maximum MSC every month or who paid for the maximum MSC in their last posted payment are allowed to increase their MSC to the new maximum limit assigned to the new calendar year. For example, the maximum MSC for 2020 is 20,000. By the time 2021 arrived, this was increased to 25,000. If your last posted payment in 2020 corresponds to the maximum MSC of 20,000, you are free to adjust your contribution amount anytime to start paying for the new maximum MSC.

- Members can decrease their contribution anytime as long as they don’t pay anything lower than the current minimum MSC for self-employed, voluntary, and OFW members. Say you’re a voluntary member who pays Php 585 per month which corresponds to a MSC of 4,500. You can shift to a lower MSC and change your contribution amount accordingly but you should never pay anything lower than Php 390 which is the amount equivalent to the prevailing minimum MSC of 3,000.

3. Non-working Spouse Members

Non-working spouses’ monthly contributions depend on how much salary their other halves take home. This means that if their working spouses’ monthly incomes decrease or increase, they can adjust their contributions accordingly. As of this writing, non-working spouses’ contribution is equivalent to 50% of the working spouses’ declared monthly income.

How To Update SSS Contribution Online Through Your My.SSS Account

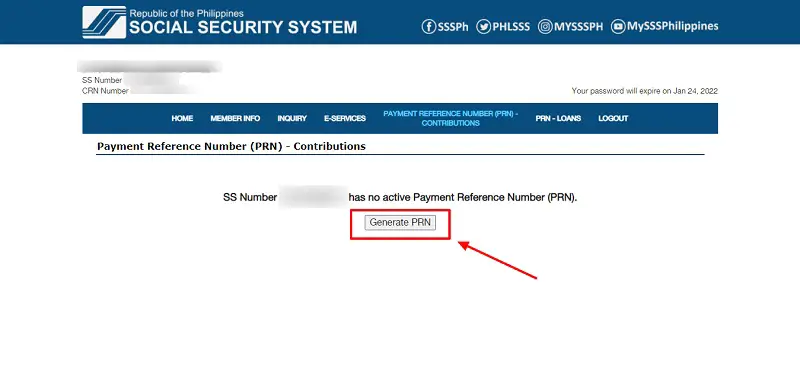

You can change your SSS contribution amount shortly before you make your next payment. As you generate a PRN (Payment Reference Number), which is required whether you’re paying for a regular contribution or a salary loan, you can set the new amount you prefer to pay. For more information, please follow the steps below.

1. Log in to your My.SSS account

In case you’ve forgotten your SSS username, password, or both, you can follow this guide to recover your login credentials.

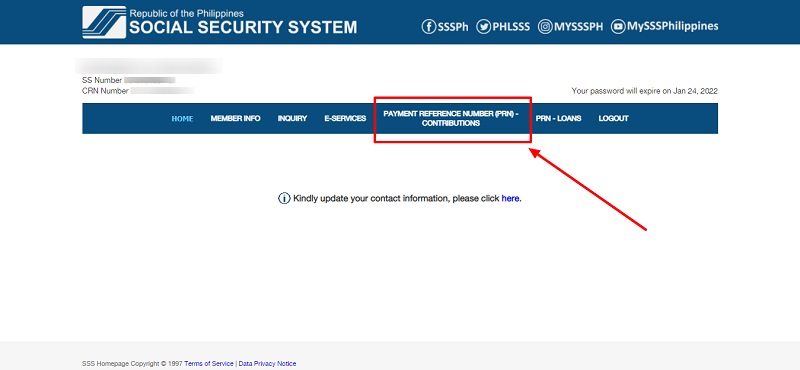

2. Select Payment Reference Number (PRN) – Contribution on the Main Menu

3. Click Generate PRN

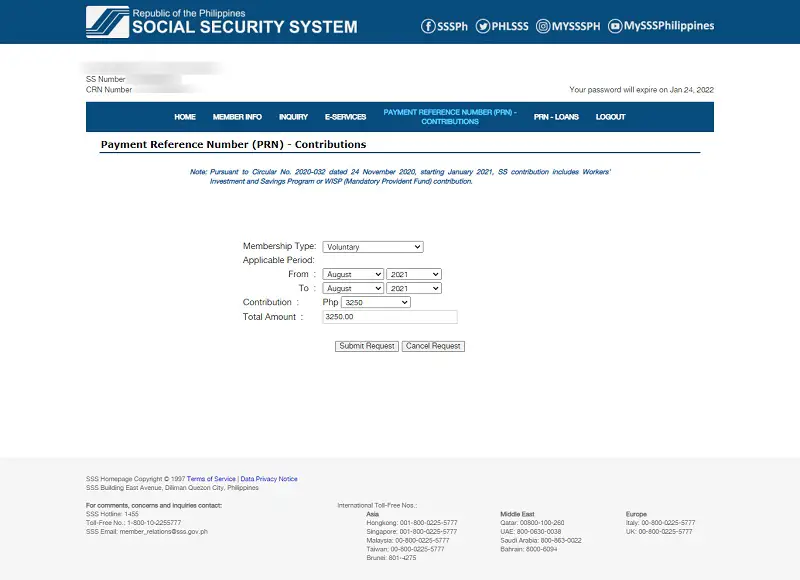

4. Select Your Membership Type, Applicable Period You Want To Pay for, and Your New SSS Contribution Amount

Membership type can either be Voluntary or OFW. Take note that should you decide to change your current membership type to a different one, it will only automatically update once you pay the contribution amount.

For the applicable period, you can select the specific month you want to pay for or multiple months if you want to pay your contributions in advance.

Finally, choose your new contribution amount. It can either be more or less than the previous amount you paid depending on your current income.

If you’re all set, click Submit Request.

A dialog box will then appear asking you to confirm the data you’ve just entered. Click OK.

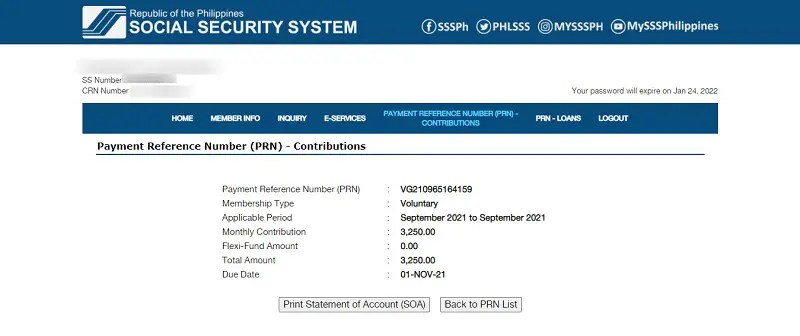

5. Copy the Payment Reference Number (PRN)

You also have the option to print the Statement of Account (SOA) for record-keeping purposes. Should you want to obtain the same PRN at a later time, you can log in to your account and go back to Payment Reference Number (PRN) – Contributions on the main menu. Here, you can see the list of PRNs you have generated.

6. Make a Payment

Choose from any of these payment channels. Pay using the generated PRN and then check your My.SSS account to see if the payment has already been reflected.

How To Update SSS Contribution Online Through SSS Mobile App

If you prefer to stay on your mobile device, you can also change your contribution amount directly from the SSS mobile app.

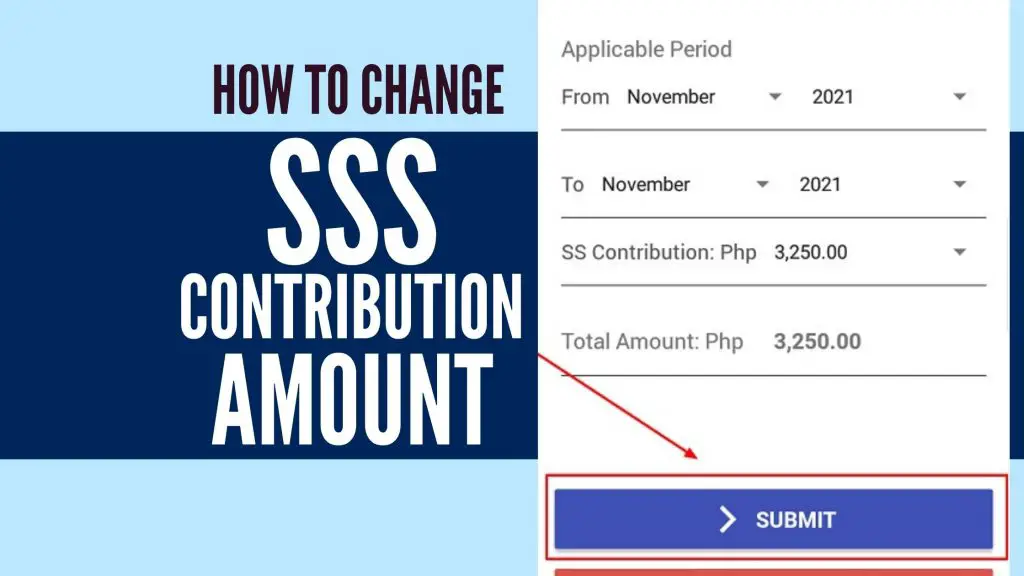

The process is almost the same as above and the only difference is the user interface you’ll be interacting with. Changing your SSS contribution amount can be done when generating a Payment Reference Number (PRN) for your next scheduled payment. Please follow the steps discussed below for more information.

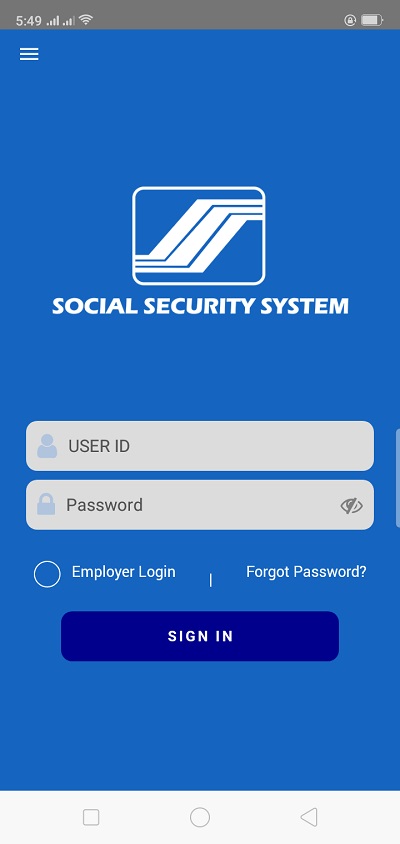

1. Log In to the SSS Mobile App With Your User ID and Password

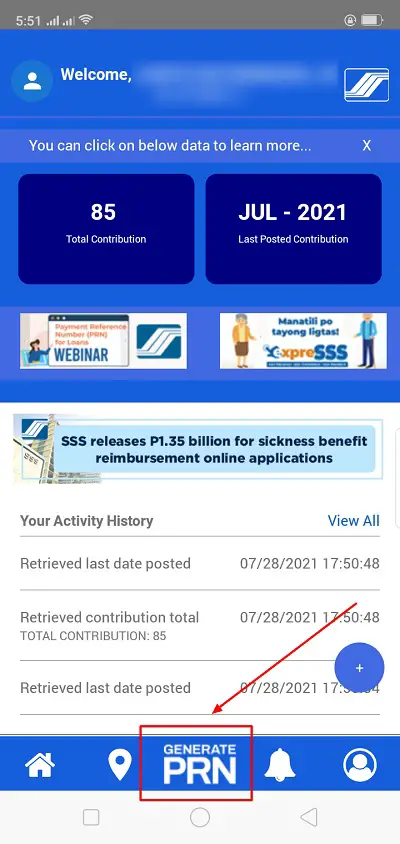

2. Select Generate PRN at the Bottom of the App Dashboard

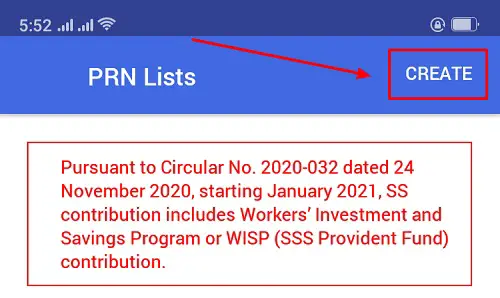

3. Click CREATE on the Upper Right Corner of the App

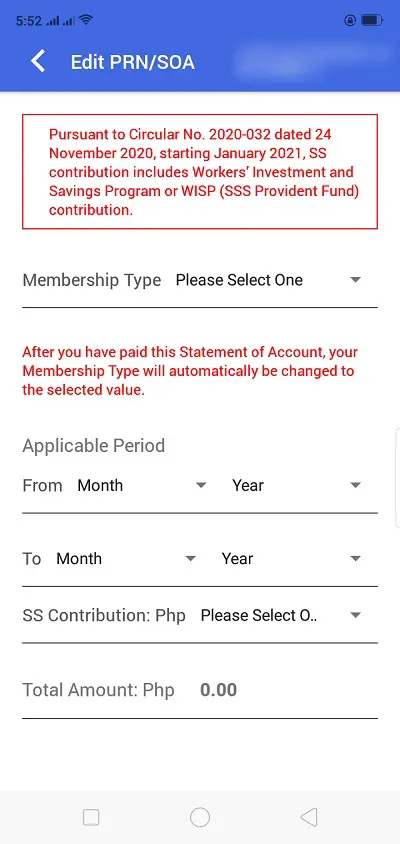

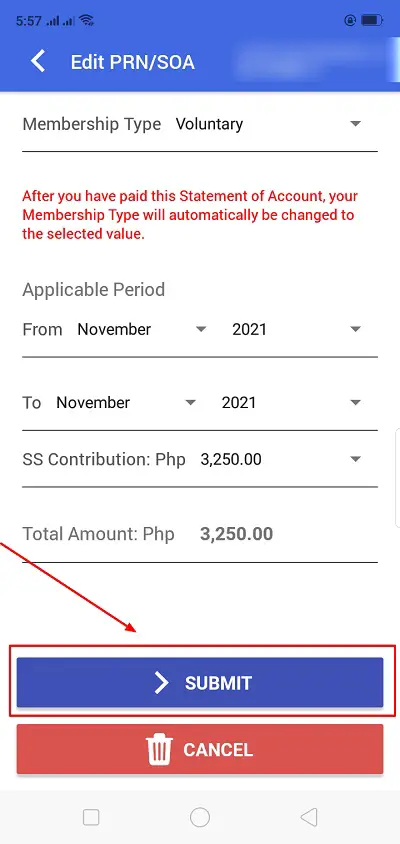

4. Select Your Membership Type, the Applicable Period You Want To Pay for, and Your New SSS Contribution Amount

5. Click SUBMIT

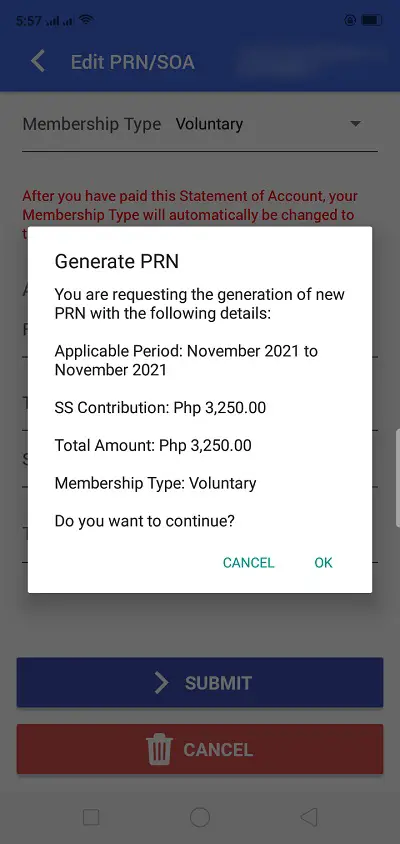

6. Double-Check the Information You’ve Entered and Click OK To Close the Dialog Box

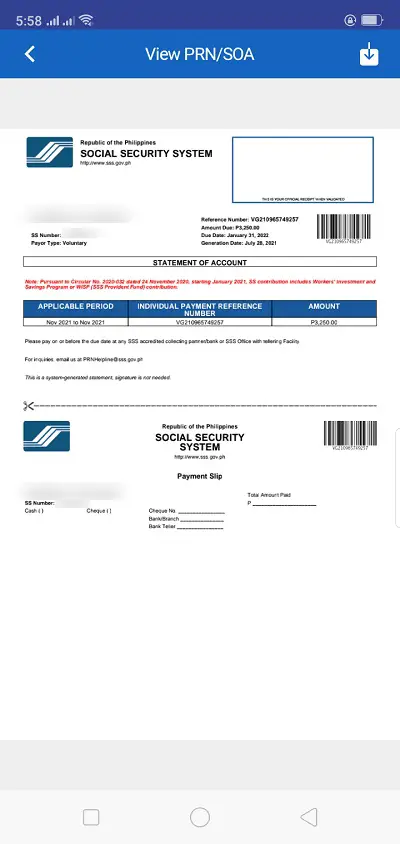

7. Copy the PRN on Your Statement of Account (SOA) and Use It To Pay Your New Contribution Amount

How To Update SSS Contribution of Employee: A Quick Guide for Employers

Employees aren’t allowed to change or update their SSS contributions on their own. Instead, their employers can do it on their behalf through the My.SSS employer portal.

It is the responsibility of employers to deduct monthly SSS contributions from their employees’ salaries and remit them to SSS through the use of Payment Reference Number (PRN)2. This PRN can be generated via the employer’s My.SSS account after the confirmation of the electronic Contribution Collection List or e-CCL. Once generated, the list will serve as the Contribution Collection List (SSS Form R-3) of employees so hard copies of the R-3 form no longer need to be submitted.

In this guide, I’ll show you how employers can easily update or change their employees’ SSS contributions online via the My.SSS facility.

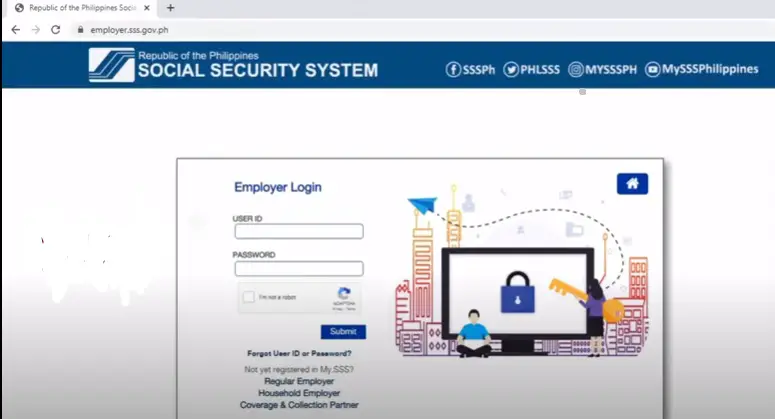

1. Log In to Your My.SSS Employer Account

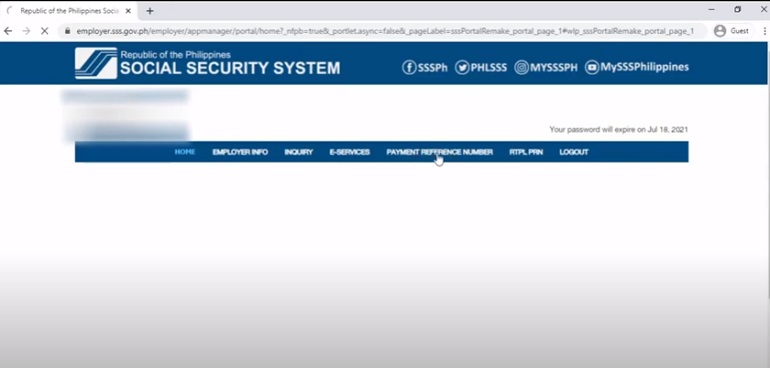

2. Click Payment Reference Number on the Main Menu

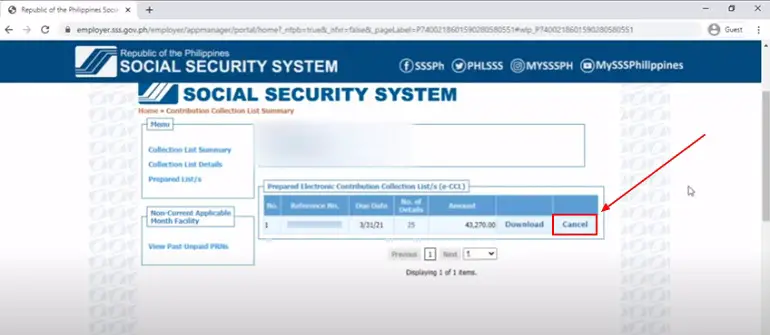

3. Cancel the Existing Electronic Contribution Collection List (E-CCL), Provided You Haven’t Paid for It Yet

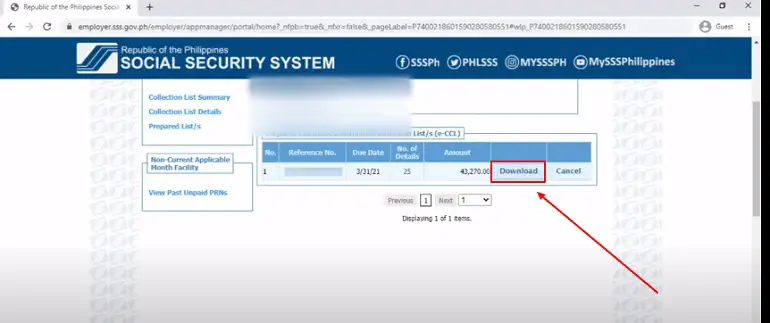

The Electronic Contribution Collection List contains the list of all your employees, their respective SSS contributions, and the Payment Reference Number (PRN) you need to remit the said contributions to SSS.

You can no longer edit the employee contributions in an existing e-CCL so you have to generate another one.

As long as you haven’t made any payment yet, you can cancel the existing e-CCL by clicking the corresponding Cancel button.

A dialog box will then appear warning you that the action can’t be undone so you have to make sure you haven’t made a payment yet. If you’re all set, click Yes.

Enter the reason for the cancellation in the dialog box provided. Your reason should contain at least 10 characters (e.g. “Update Salary” or “Edit Contribution”). Click Submit to proceed to the next step.

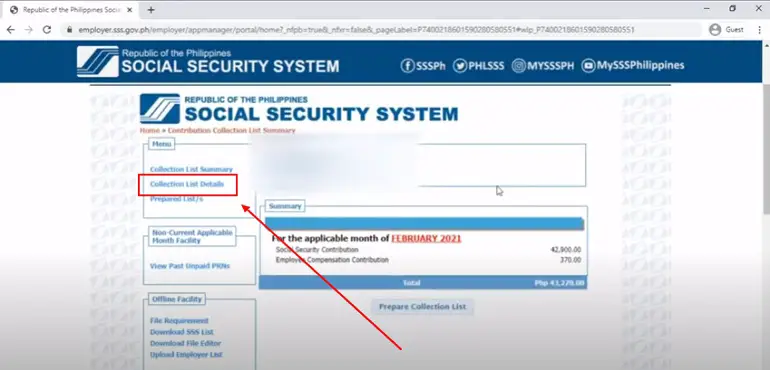

4. Select Collection List Details

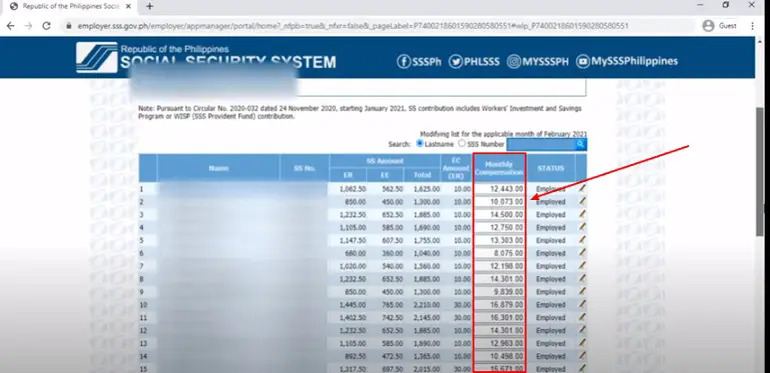

5. Edit the employee’s Monthly Compensation

As discussed in this article, an employee’s SSS contribution is shouldered by both the employee and employer. The amount of the said contribution will be based on the employee’s monthly salary. Hence, updating the employee’s Monthly Compensation will automatically change his/her SSS contribution amount.

To edit the Monthly Compensation, simply look for the employee’s name and change the amount indicated under the column Monthly Compensation. You can filter the search result by employee’s last name and SSS number to help you save time.

Aside from Monthly Compensation, you can also update the employee’s employment status. Under the column STATUS, click on the edit icon beside the current employment status and select from three options: Employed, No Earnings, or Terminated.

Choosing No Earnings will automatically reset the Monthly Compensation to zero which means no SSS contribution will be remitted for that employee. Meanwhile, if you select Terminated, you will be asked to enter the date of separation and the Monthly Compensation will then be likewise set to zero.

Once you’re done making the changes, click Save Changes.

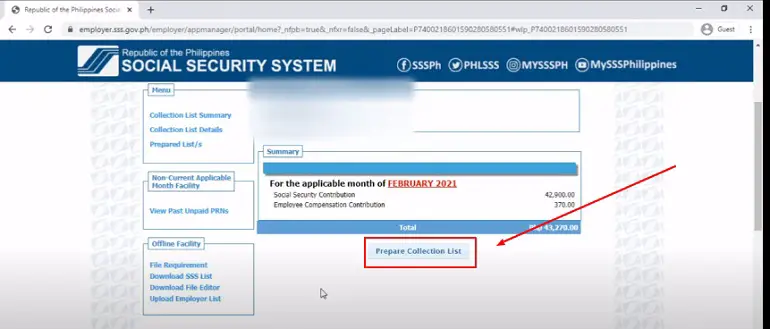

6. Click Prepare Collection List to generate a new Electronic Contribution Collection List

7. Download or Print the Updated E-CCL Then Proceed to Payment Using the PR

Go back to the main article: How to Compute Your SSS Contribution: An Ultimate Guide

References

- Social Security System (SSS). (2015). SSS Circular No. 2015-007 (Changes in Policies on SE/VM/OFW/NWS Contributions) (pp. 1-2). Quezon City, Philippines.

- Compulsory Coverage of Employers. Retrieved 29 July 2021, from https://www.sss.gov.ph/sss/appmanager/pages.jsp%3Fpage%3Demployerduties

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net