How To Pay SSS Salary Loan: An Ultimate Guide

The SSS salary loan works like any other: You borrow money and repay it according to an agreed-upon schedule and interest rate.

The money you borrow may have come from your contributions, but at the end of the day, it’s still a loan, so you must pay it on time.

Not paying your loan on time or at all will prevent you from enjoying benefits from the Social Security System when you need them the most (e.g., SSS unemployment insurance for members who have lost their jobs).

In this guide, you’ll learn everything you need to know about how to pay SSS salary loan on time and what happens if you fail.

Go back to the main article: How to Apply for SSS Salary Loan Online

Table of Contents

The SSS Salary Loan Is Payable in How Many Years?

The SSS salary loan is payable within two years or in 24 monthly installments.

When Does Repayment of the SSS Salary Loan Start?

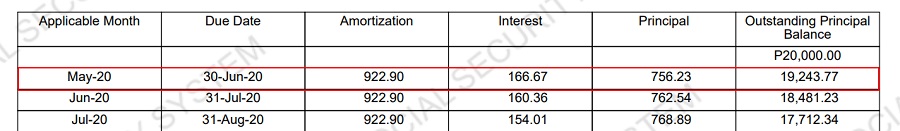

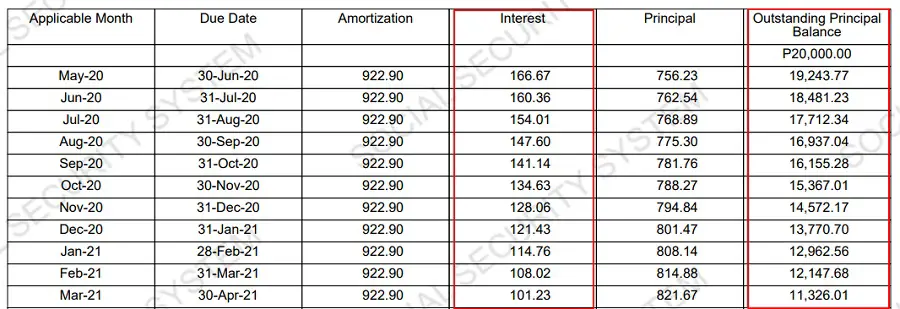

The payment starts on the 2nd month following the date of the loan. For example, if your SSS salary loan is approved and released in March (as shown in the image below), the monthly amortization starts two months later (i.e., May).

On the other hand, the due date is on the last day of the month following the applicable month (if the deadline falls on weekends or holidays, the payment can be made on the next business day).

Using the example above, the first applicable month or month you’re scheduled to pay your first monthly amortization is May. If you fail to make a payment this month, you still have until June 30 to settle the amount due. The same applies to all the succeeding months until your loan is fully paid.

How Much Is SSS Salary Loan Interest?

The salary loan is payable in 24 months with an interest rate of 10% per annum based on a diminishing principal balance. This means that the interest you’ll pay each month will be based on the outstanding principal balance for that particular month until your loan is fully paid.

Using the table below as an example, the interest for your first monthly amortization can be determined by getting the 10% of the loan proceeds and dividing it by 12.

Php 20,000 x 0.10 = Php 2,000

Php 2,000/12 = Php 166.67

After paying your first monthly amortization, your outstanding principal balance is only Php 19,243.77. Based on this balance, you can now compute the interest for your second monthly amortization:

Php 19,243.77 x 0.10 = Php 1,924.377

Php 1,924.377/12 = Php 160.36

Now use the new outstanding principal balance to compute the interest for your third monthly amortization until your loan is fully paid.

How To Pay SSS Salary Loan: A Step-by-Step Guide

Employed members can pay their loans through automatic salary deductions.

Meanwhile, members of other categories (i.e., OFWs, voluntary, and self-employed) must pay the loans themselves.

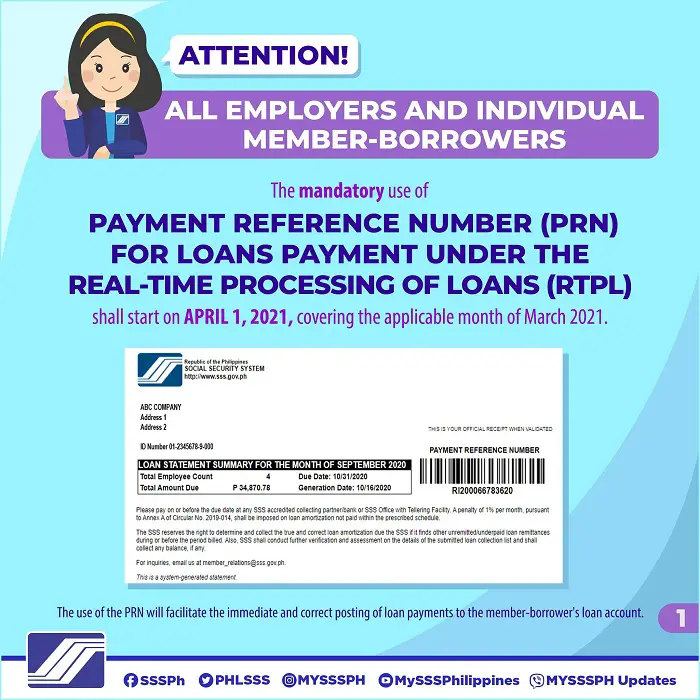

Starting April 1, 2021, SSS members must secure a payment reference number (PRN) before paying their loans. This guide will focus on how employers and individual member-borrowers can pay their loans using the new system.

1. Obtain a Payment Reference Number (PRN)

As mentioned earlier, you can no longer pay your SSS salary loan without a PRN1. This recent change is part of the Real-Time Processing of Loans (RTPL) program of SSS which seeks to enhance and speed up the process of receiving and posting SSS loan payments.

Short for a payment reference number, the PRN is a system-generated number corresponding to your billing statement.

The use of PRN facilitates the real-time posting of payments. However, PRN for contribution payments is different from PRN for loan payments. Hence, the process of obtaining the latter is different as well.

You can get PRN in four ways:

- Over the counter – If you have time and patience to go outside, you can obtain the PRN the old-fashioned way. You can proceed to the nearest SSS branch and inquire over the counter about getting PRN for your SSS salary loan. Or, you can go to a self-service express terminal (SSS-ExT) at select SSS branches and get the PRN in a few clicks.

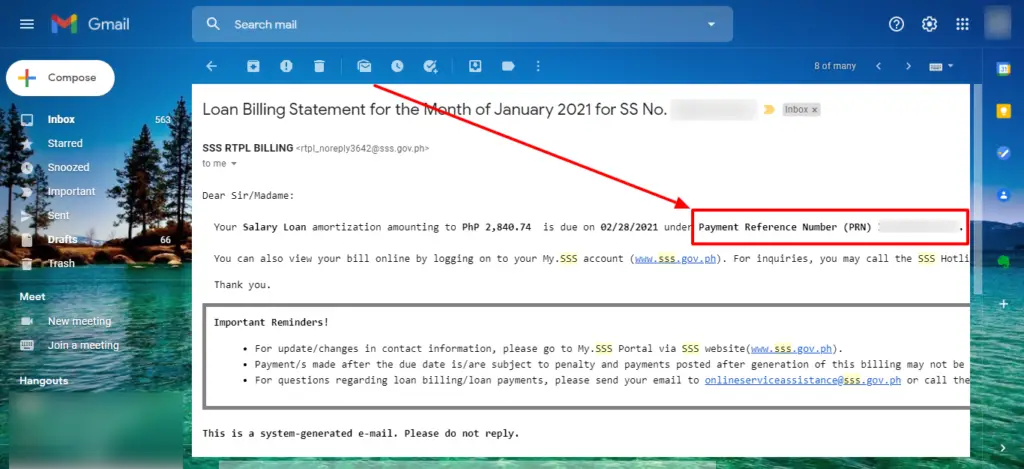

- Via email – SSS usually issues a loan billing statement every first to the sixth day of the month and sends it to the member/employer’s registered email address. The sender is usually “SSS RTPL BILLING” (see the screenshot below). The message contains the amount you need to pay, when it’s due, and the payment reference number you need to complete the payment.

- Via text – SSS also sends the latest billing statement along with the PRN to the member/employer’s registered mobile number every first to the sixth day of the month. However, my experience shows SSS only sent one to my email address. I didn’t receive any reminder from them via SMS. Perhaps they’re still adapting to the new system, hence the technical glitches. If you want to ensure SSS has your latest mobile number, here’s a handy guide to help you.

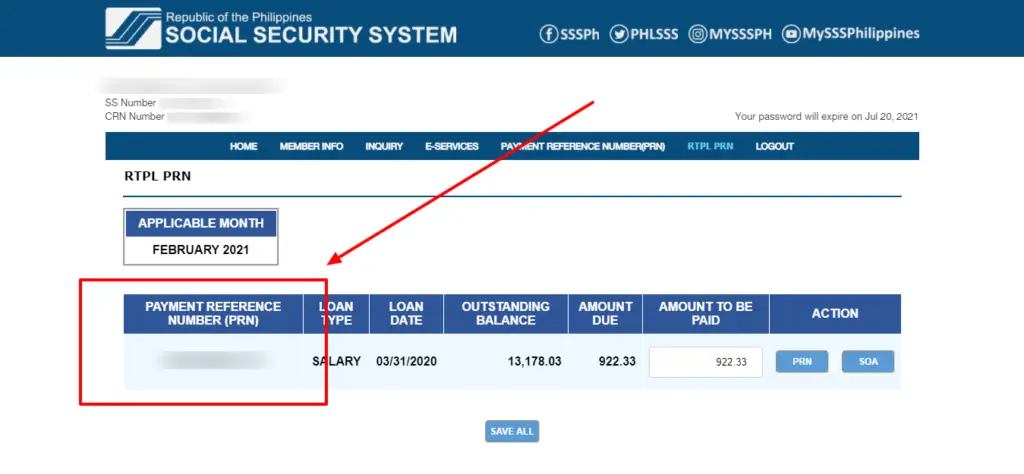

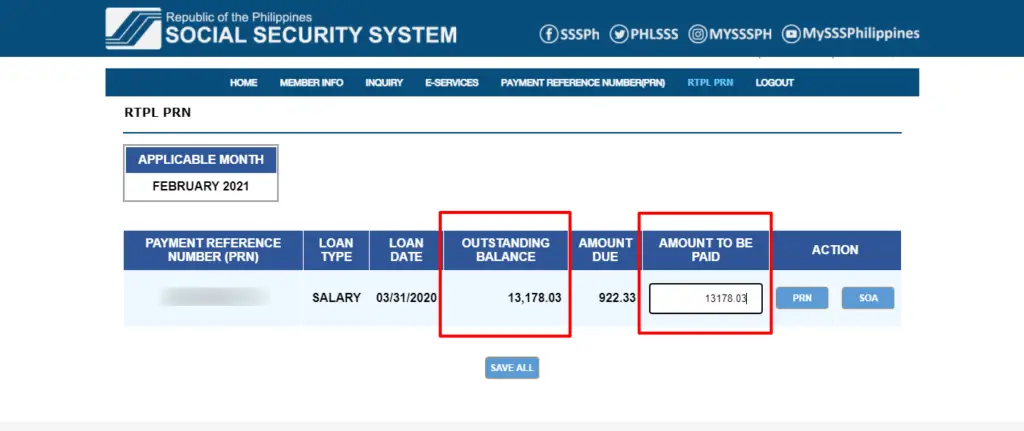

- Via the SSS member portal (Recommended) – Aside from your email, you can check your SSS online account for the latest loan billing statement. Login to your account and look for the “RTPL PRN” tab on the far right of the main menu. Click this to display a table containing the amount due, your outstanding balance, the applicable month, and the payment reference number (PRN). These data usually become available starting every seventh day of the month

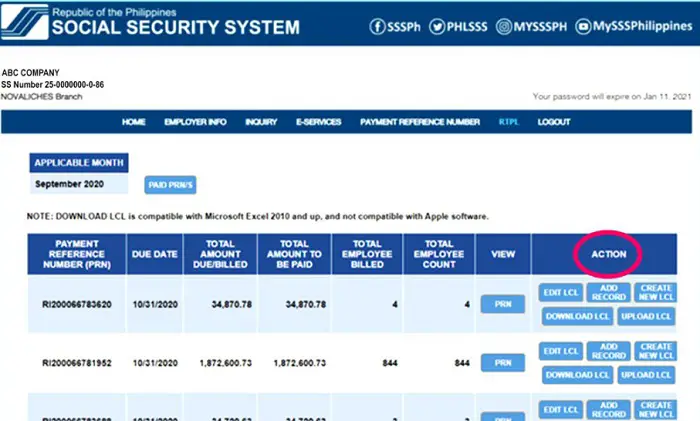

Regular and household employers can also use the above methods to secure PRN for loan payments. However, they can only do so through the last option should they need to change or update their Loans Collection List information.

First, employers must log in to their My.SSS account. Then, go to the “RTPL PRN” tab on the main menu. This will display all active PRN loans that are due for payment. Employers can update the electronic-Loan Collection List (e-LCL) online or offline.

Online actions:

- EDIT LCL – select this option to update or edit the Amount to be Paid for employees included in the Loans Collection List.

- ADD RECORD – choose this if you want to add a new or additional employee to an existing Loans Collection List.

- CREATE NEW LCL – click this to pick a few employees from the existing list and put them in a partial Loans Collection List.

Offline actions:

- DOWNLOAD LCL – employers who prefer to update the list offline can choose this option. It will enable them to download the list in Excel format and work on it.

- UPLOAD LCL – select this to upload the edited Loans Collection List you downloaded previously.

Once the changes have been made or the edited LCL has been uploaded, employers can click the PRN button to view, download, or print the billing statement and proceed to the next step (payment).

2. Pay Your Salary Loan

After obtaining the payment reference number, you have two options to pay your salary loan:

Option 1: Walk-in Payment

| SSS Salary Loan Walk-in Payment Channel | Employer | Individual Members |

| SSS Branches with Automated Tellering System (ATS) | Yes | Yes |

| Security Bank Corporation | Yes | Yes |

| Union Bank of the Philippines | Yes | Yes |

| Philippine National Bank (international) | No | Yes |

| SM Mart Inc. | Yes | Yes |

| Bayad Center | Yes | Yes |

With a screenshot or printed copy of the billing statement containing the PRN and barcode, proceed to the nearest SSS office with tellering facility. Present it to the cashier along with your payment.

Aside from SSS offices, individual members and employers can also pay SSS loans at RTPL-compliant collecting partners like Bayad Center, SM Mart Inc., and banks like Security Bank, Union Bank of the Philippines, and Philippine National Bank (for OFWs).

Suppose you’re an individual member-borrower currently based abroad. In that case, you can also pay your monthly loan amortization through the foreign branches of the Philippine National Bank, Vedtaja International Corporation, and i-Remit, Inc.

Option 2: Online Payment

| SSS Salary Loan Online Payment Channel | Employers | Individual Members |

| Security Bank Corporation | Yes | Yes |

| Union Bank of the Philippines | Yes | Yes |

| Moneygment | Yes | Yes |

| GCash | Yes | Yes |

| Asia United Bank | Yes | No |

| Bank of Commerce | Yes | No |

| China Bank Corporation | Yes | No |

| CTBC Bank | Yes | No |

| Metropolitan Bank and Trust Company | Yes | No |

| MUFG Bank | Yes | No |

| Philippine Bank of Communication | Yes | No |

| Philippine National Bank | Yes | No |

| Philippine Trust Company | Yes | No |

| Philippine Veterans Bank | Yes | No |

| Rizal Commercial Banking Corporation | Yes | No |

| Robinsons Bank | Yes | No |

| Standard Chartered Bank | Yes | No |

| United Coconut Planters Bank | Yes | No |

If you don’t have time to go outside, you can make the payment online.

For employers, PRN loan payments can be completed via BancNet’s eGov facility, which is available to account holders of the following participating banks: United Coconut Planters Bank, Standard Chartered Bank, Robinsons Bank, Rizal Commercial Banking Corporation, Philippine National Bank, Philippine Bank of Communications, MUFG Bank, Asia United Bank, Bank of Commerce, China Bank Corporation, CTBC Bank, and Metropolitan Bank.

For OFWs, voluntary, and self-employed members, online loan payments are accepted via Security Bank, Union Bank of the Philippines, and other approved collecting partners.

I don’t have an account with Security Bank, so I can only share how I successfully paid my salary loan in the past using UnionBank, Moneygment, and GCash.

How To pay your SSS salary loan online via GCash

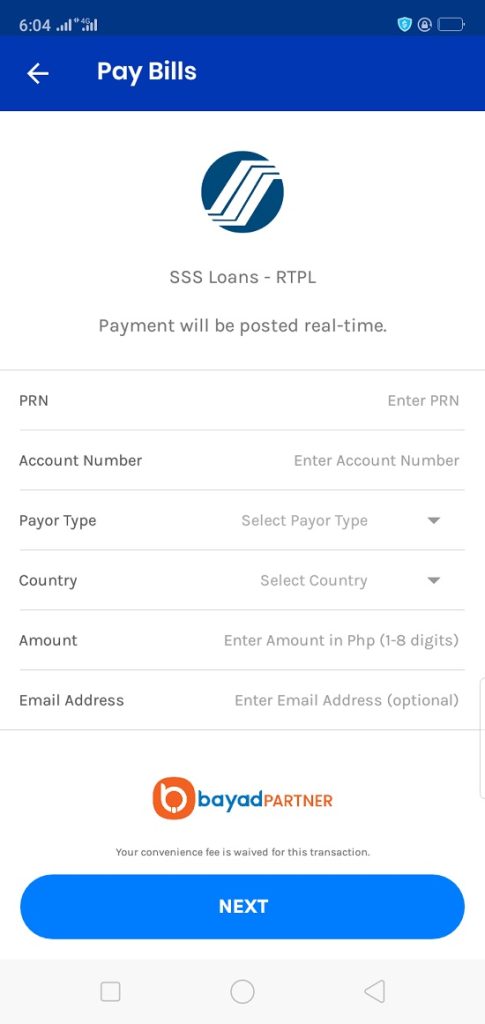

- Open your GCash app.

- Click Pay Bills.

- Select Government from the list of available biller categories.

- There are two options available if you’re transacting with SSS. The SSS Contribution, as the name suggests, enables you to pay your regular monthly SSS contribution straight from your GCash app. The SSS Loans – RTPL allows you to pay your SSS salary loan amortization using a pre-generated PRN. Since you’re paying for your salary loan, select SSS Loans – RTPL.

- Enter your loan PRN, SSS loan account number, payor type (whether you’re paying as an Individual member or Employer), country, the exact loan amount you’ll pay, and your email address. After encoding all the required information, click Next.

- Review the payment details, then click Confirm to proceed with the transaction.

- Wait for an email notification from SSS confirming that your loan payment has been posted.

How To pay your SSS salary loan online via UnionBank of the Philippines

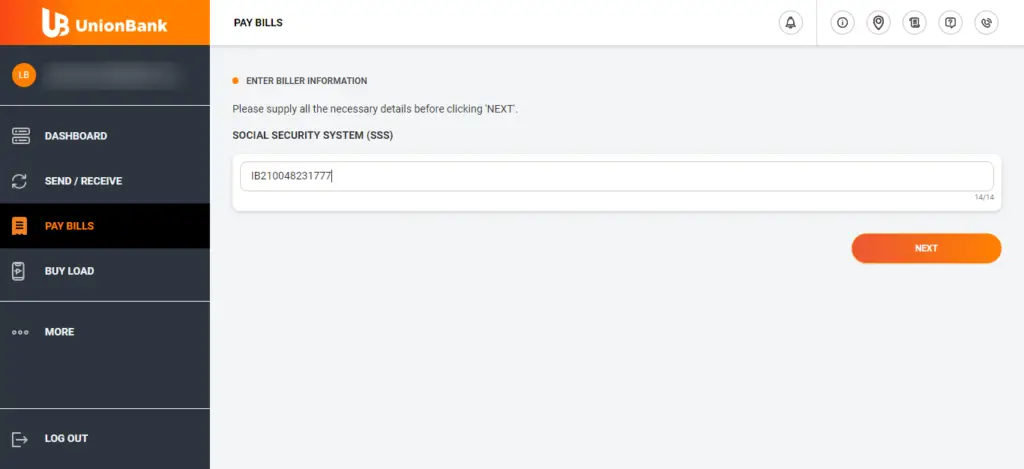

- Log in to your Union Bank online account.

- Click Pay Bills.

- Look for and select Social Security System (SSS) as your biller.

- Enter your PRN and click Next.

- Review the details of your transaction before clicking the Pay button.

- Enter the one-time password (OTP) sent to your mobile number to confirm payment.

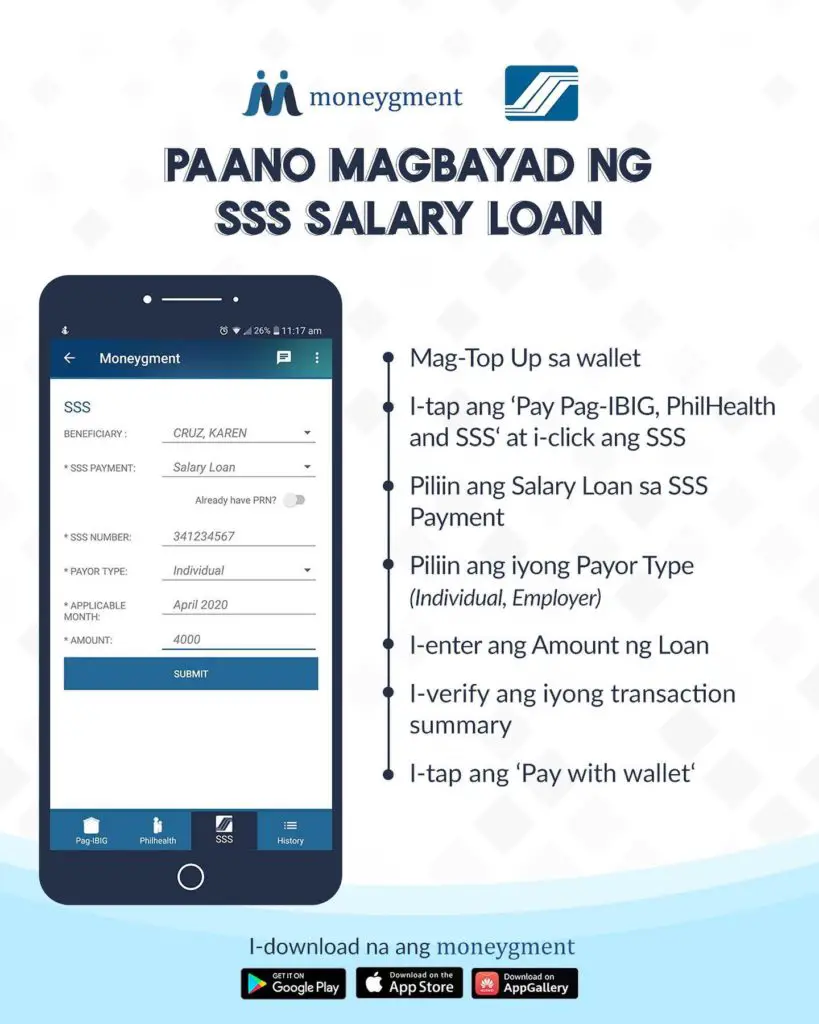

How To pay your SSS Salary Loan Online Using Moneygment App.

- Download the Moneygment app on your phone.

- Open the app and click Register to create an account

- Once you have an account, reopen the app and log in with your email address and password.

- Select Top-up and choose how you want to load your Moneygment wallet. As of this writing, you can pay through bank deposit, ECPay, Dragonpay, 7-11, or PayPal. If you’re already using online banking or have GCash, Dragonpay is the best way to go.

- Enter the desired amount, taking into account the loan you want to pay and the service fee that comes with paying through the Moneygment app. Once the amount is final, click Confirm.

- Once the money is in your wallet, it’s time to pay your salary loan. To do it, go back to your dashboard and select Government.

- Under SSS (with PRN), click PRN Salary Loan.

- To proceed, you need to enroll your SSS account. Click Enroll your government details here to get started. Next, click the add (+) button on the bottom right corner of your mobile screen.

- Fill out the form with your name, email address, birth date, contact number, address, SSS number, and SSS loan number. If you will also use Moneygment to pay your Pag-IBIG and PhilHealth contributions, enter your Pag-IBIG and PhilHealth numbers.

- Select the name of the new account you have just created.

- Enter your loan Payment Reference Number (PRN) and SSS number. Click Continue.

- Review the payment details, then click Confirm to finalize the transaction. Note that Moneygment will charge an app fee of Php 25 to process your loan payment.

- Enter the one-time PIN sent to your registered mobile number. Click Submit.

- A confirmation email will confirm that the payment has been processed. Take note that it may take two or more days for your payment to be processed if you’re making it through the Moneygment app, so make sure you’re not making the payment on the exact day your monthly amortization is due.

3. Wait for Your Payment To Be Posted

After completing the payment, you’ll be notified via email or text message when the payment is confirmed and posted.

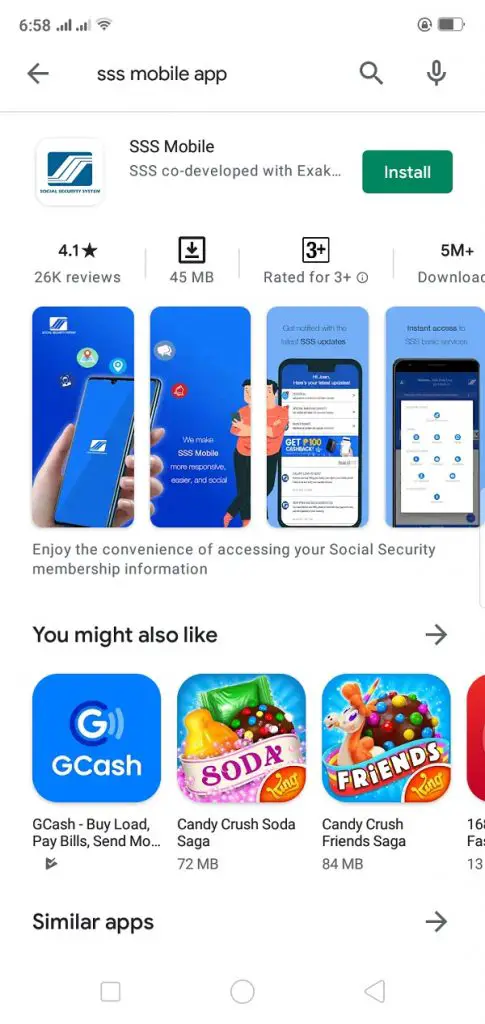

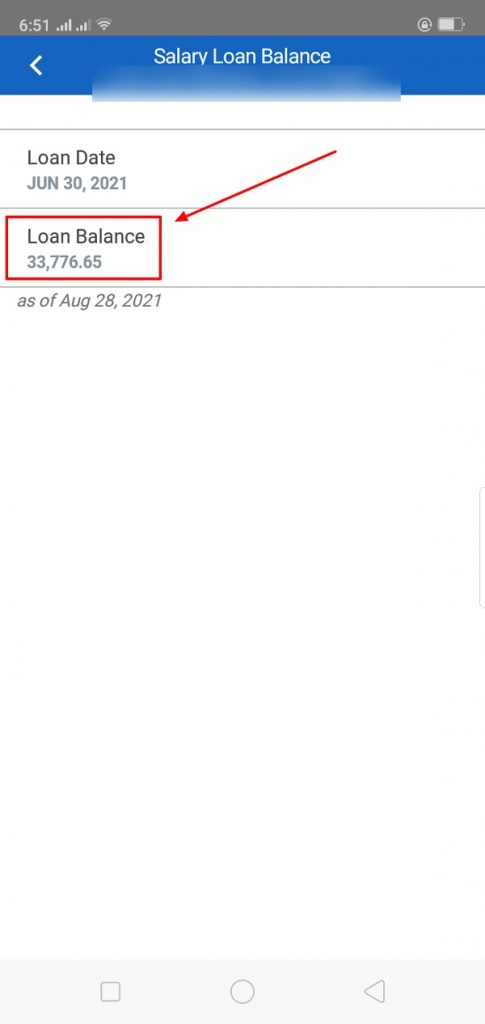

How To Check Salary Loan Balance in SSS Using the SSS Mobile App

With the launch of the enhanced SSS mobile app2, checking your SSS salary loan balance is easier than ever.

To check the remaining balance of your SSS salary loan, follow these steps:

1. Install the SSS Mobile App on Your Phone

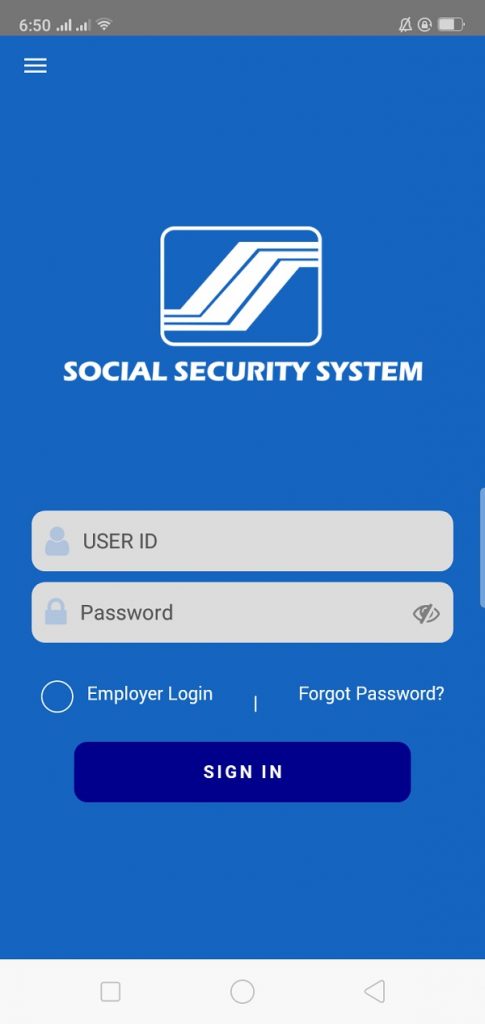

2. Log in Using Your User ID and Password

These are the same login credentials you use to access the SSS member portal. If you haven’t created an account, follow this easy registration guide. Meanwhile, click here to recover your account if you’ve forgotten your SSS user ID, password, or both.

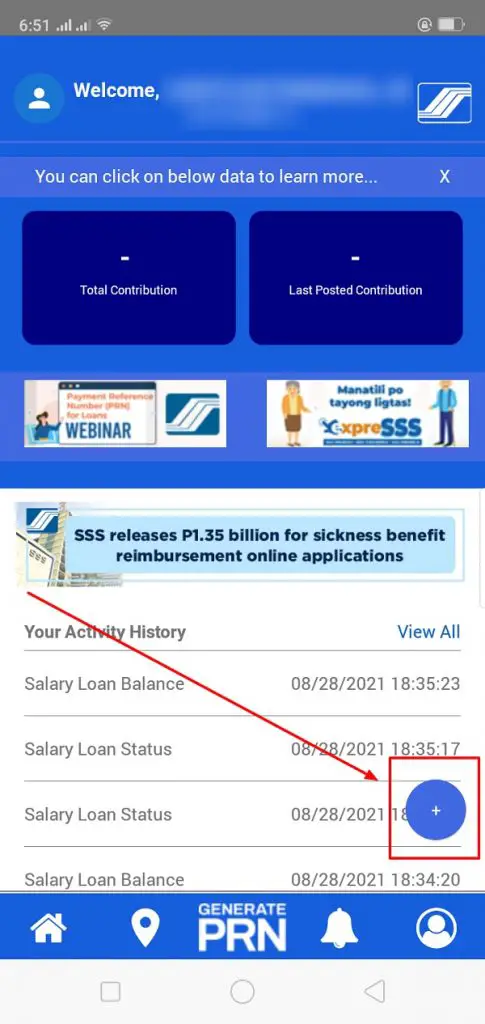

3. Click the floating “+” icon

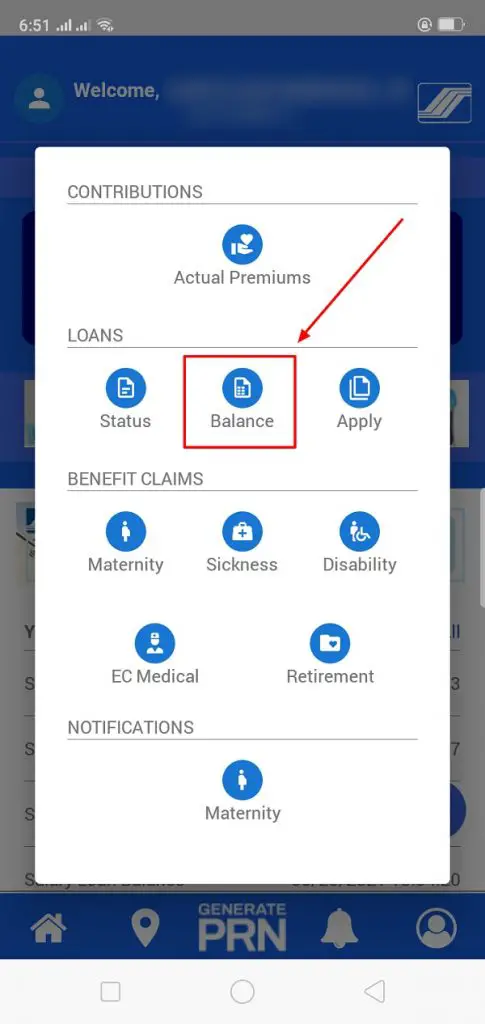

4. Under LOANS, Select Balance

5. View Your Outstanding Loan Balance

Check if your recent payment was posted in real-time and deducted from your existing balance.

You can now also use the app to apply for a salary loan and check the status of your application.

You can also try the automated text messaging service, but based on my experience, the service for checking the loan balance is always unavailable.

If you’re an employed member paying your loan via automatic salary deduction, always ensure that your payments are current. If the payments aren’t posted in the system yet, you can request a copy of your employer’s SSS salary loan collection list to prove that the loan payments have indeed been deducted from your salary and remitted to the SSS.

Suppose the member has proven that the employer has intentionally failed to remit the loan payments to SSS. In that case, the member-borrower is encouraged to file a complaint against the delinquent employer by submitting a Sworn Statement or Sinumpaang Salaysay to any SSS branch office.

Go back to the main article: How to Apply for SSS Salary Loan Online: An Ultimate Guide

Frequently Asked Questions

1. When is the SSS salary loan payment due date?

The deadline for payment of monthly loan amortization is on or before the last day of the month following the applicable month. For example, your loan amortization for June can be paid until the last day of the following month, July 31. The payment can be made on the next working day if the deadline falls on a weekend or a holiday.

2. How much is the penalty for late payment of SSS salary loan?

If the monthly amortization is not remitted on the due date, it will bear a penalty of 1% per month until the loan is fully paid. Even if the delay is a fraction of a month, the amortization will still be charged a whole month’s penalty.

3. How can I pay SSS salary loan if it’s already past due?

If you fail to pay your monthly loan amortization on time, you will incur a monthly penalty of 1%. To keep your loan obligations from ballooning, pay your unsettled loan amortization with the penalty fee not long after the supposed deadline. You can follow the same procedure above to pay for past-due loan amortizations.

4. What happens to unpaid SSS salary loans?

A member’s failure to pay more than six monthly amortizations will result in loan default. A defaulted account incurs 10% interest per annum on the outstanding principal balance and a 1% monthly penalty on unpaid principal and interest.

These unpaid obligations of a defaulted account will be deducted from the future benefits that the member will claim. For example, the unpaid loans (together with the interest and penalty) of a voluntary/self-employed member will be deducted from either short-term benefits like sickness benefits or the member’s death, total disability, or retirement benefit, whichever comes first.

5. I have overpaid my SSS loan. How can I refund it?

You may go to the nearest SSS branch office to have it refunded. Otherwise, any overpayment in your current loan will be applied to the subsequent salary loan you will avail of.

6. Can I pay my SSS loan in full?

Yes. To pay your remaining loan balance in full, log in to the SSS member portal and click “RTPL PRN” on the main menu. Ensure you haven’t paid your most recent loan bill yet; otherwise, the billing statement won’t be displayed. Look for “Amount to be Paid” and enter the exact amount of your outstanding balance. Click “Save All” and proceed with the latest PRN payment.

7. Can I pay my SSS loan in advance?

Yes. To pay your SSS loan in advance, follow the instructions in the previous section. You can either pay the outstanding balance in full or enter the amount you can afford. Save the changes and then pay the indicated amount using the same PRN.

8. Can I pay my SSS salary loan through GCash?

As of October 2021, you can pay your SSS salary loan amortization via the GCash app. To pay your salary loan, open your GCash app, go to Pay Bills, then select Government. Choose SSS Loans – RTPL from the list of options, then enter the requested information like your loan PRN, SSS loan account number, payor type (Individual or Employer), country, loan amount, and email address. After confirming your payment, SSS will email you to inform you that the payment has been processed. The payment made via the GCash app should be posted in real-time.

9. I will resign from my current job but still have an outstanding SSS salary loan. What should I do?

Employed member-borrowers pay their loan amortizations through salary deductions. Therefore, you must coordinate with your company’s HR department to ensure the proper payment arrangement will be implemented. Depending on your request, the HR department will either settle your loan by deducting it from your separation pay or remove your name from the collection list so you can continue paying it. If you choose the latter, you will continue paying your loan amortization as a voluntary member (click here to learn how to update your SSS membership status).

Remember that your loan will incur a monthly penalty fee of 1% if you stop paying after resigning from your job. To prevent these fees from accumulating, continue paying as a voluntary member until you find another job. Once you become employed again, submit your loan SOA (Statement of Account) to your new employer so you can resume loan payment via salary deduction. You can obtain the SOA from your My.SSS account or by requesting it at the nearest SSS branch.

Go back to the main article: How to Apply for SSS Salary Loan Online

References

- Compulsory use of payment reference numbers for short-term SSS loan payments starts April 1. (2021). Retrieved 5 March 2021, from https://www.sunstar.com.ph/article/1885112/Pampanga/Business/Compulsory-use-of-payment-reference-numbers-for-short-term-SSS-loan-payments-starts-April-1

- SSS unveils ‘improved’ version of mobile app. (2021). Retrieved 28 August 2021, from https://news.abs-cbn.com/business/06/30/21/sss-improved-mobile-app

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net