How To Pay PhilHealth Contribution 2025: An Ultimate Guide

Wondering how to pay PhilHealth contribution? Never miss a deadline by knowing the most convenient and accessible ways to send your payment, no matter where you are.

Disclaimer: This article has been published for educational purposes only. Neither the author nor FilipiKnow is affiliated with PhilHealth, so specific queries about your membership and insurance benefits must be forwarded to the proper authority.

Go back to the main article: PhilHealth Contribution Table: A Complete Guide to Contributions and Payment

Table of Contents

Can I Pay My PhilHealth Contribution Online?

Yes. Online payment of PhilHealth contributions is available to both employers and voluntary members. Employers can remit their employees’ contributions via accredited banking portals like Bancnet e-Gov. Meanwhile, self-paying individuals with declared monthly income can pay their contributions online via the newly revamped PhilHealth Member Portal1.

Where To Pay PhilHealth Contribution?

1. PhilHealth Offices

Contributions can be paid at any PhilHealth Regional Office or Local Health Insurance Office in the Philippines.

OFWs may also pay their contribution at the PhilHealth counter of the POEA main office in EDSA Ortigas, Mandaluyong, before securing an Overseas Employment Certificate (OEC).

PhilHealth Express sites in malls don’t accept contribution payments. Instead, you should pay them to the nearest PhilHealth-accredited collecting agent within the mall premises.

2. Over-the-Counter Collecting Partners

You may pay your contribution via any PhilHealth-accredited collecting partner nationwide if there’s no PhilHealth branch near your home or office.

- Asia United Bank Corporation

- Bank of Commerce

- Bank One Savings Corporation

- BDO Network Bank, Inc.

- Camalig Bank Inc. (A Rural Bank)

- Century Rural Bank, Inc.

- Century Savings Bank Corporation

- China Banking Corporation

- China Bank Savings, Inc.

- CIS Bayad Center, Inc.

- Citystate Savings Bank, Inc.

- Development Bank of the Philippines.

- East West Rural Bank, Inc.

- Land Bank of the Philippines

- Local Government Units (selected LGUs only)

- Money Mall Rural Bank, Inc.

- Penbank, Inc. (A Private Development Bank)

- Philippine Business Bank, Inc.

- Philippine Veterans Bank

- Rizal Commercial Banking Corporation

- Robinsons Bank Corporation

- Rural Bank of Bambang (N.V.), Inc.

- Rural Bank of Jose Panganiban (CN), Inc.

- Rural Bank of Sta. Catalina (NO), Inc.

- Saviour Rural Bank, Inc.

- SM Mart, Inc.

- UCPB Savings Bank

- Union Bank of the Philippines

- United Coconut Planters Bank

Related: How to Choose a Bank: An Ultimate Guide to the Top Banks in the Philippines

3. Online Payment Channels

Employers and self-paying members can pay their contributions online.

Employers can conveniently pay their employees’ PhilHealth contributions through any of these online banking facilities:

- Bank of the Philippine Islands (via Bizlink)

- Citibank N.A. (Citidirect)

- IPAY-MYEG Philippines, Inc.

- Land Bank of the Philippines (via EPS)

- Security Bank Corporation (via Digibanker)

- Union Bank of the Philippines (via OneHUB)

- BancNet e-Gov (for clients of BancNet-member banks)

Meanwhile, self-paying individuals can also pay their contributions via the new PhilHealth Member Portal.

4. Overseas Collecting Partners

PhilHealth’s overseas partners accept contribution payments from OFWs and traveling Pinoys abroad.

- Bank of Commerce

- CIS Bayad Center

- Development Bank of the Philippines

- iRemit, Inc.

- Ventaja International Corporation

When Should I Pay My PhilHealth Contribution?

1. PhilHealth Contribution Payment Schedule for Employers

Business and household employers are required to remit their employees’ contributions every month.

- Employers whose PhilHealth Employer Number (PEN) ends in 0 to 4 should pay every 11th to 15th day of the month following the applicable period.

- Employers with PEN ending in 5 to 9 should pay every 16th to 20th day of the month following the applicable period.

For example, contributions for October 2019 should be remitted by the 11th to 15th or the 16th to 20th day of November 2019.

2. PhilHealth Contribution Payment Schedule for Voluntary Members

Here are the contribution remittance deadlines that individually paying members must remember according to their chosen payment frequency:

| Payment Frequency | Payment Deadline | Example |

| Monthly | Last working day of the applicable month | The month being paid for: October 2019 Deadline: October 31, 2019 |

| Quarterly | Last working day of the applicable quarter | Quarter being paid for: October-December 2019 Deadline: December 27, 2019 |

| Semi-annual | Last working day of the first quarter of the applicable semester | Semester being paid for: July-December 2019 Deadline: September 30, 2019 |

| Annual | Last working day of the first quarter of the applicable year | The year being paid for: 2020 Deadline: March 31, 2020 |

How To Pay PhilHealth Contribution for Employees

Employees pay their share of contribution through salary deduction. Their employers remit the deducted amount plus the employer share to PhilHealth monthly.

How To Pay PhilHealth Contribution for Employers

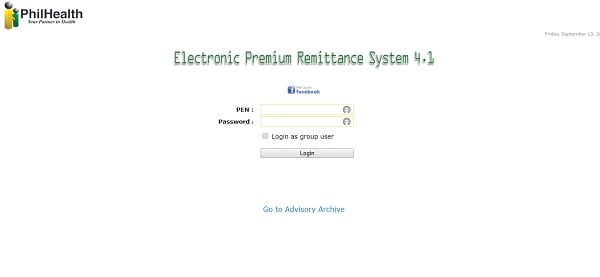

All employers are required to use the Electronic Premium Remittance System (EPRS) for PhilHealth contribution payments. The EPRS is an online service that simplifies the remitting and reporting of employee and employer contributions to PhilHealth.

Here’s how to pay your employees’ contributions through the EPRS.

Step 1: Register for an EPRS Account

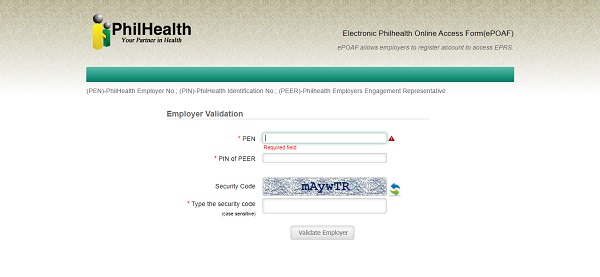

To access the EPRS, employers should register for an account online through the Electronic PhilHealth Online Access Form (ePOAF) using any browser.

Simply provide the required information on the online form.

The PEN field asks for the PhilHealth Employer Number. In contrast, the PIN of the PEER field requires the PhilHealth number of the PhilHealth Employer Engagement Representative (PEER), who is the employer’s designated official point person or representative.

Next, please enter the security code as it appears on the screen. Then click the Validate Employer button.

Alternatively, employers may manually fill out a PhilHealth Online Access Form and submit it to the nearest PhilHealth office.

After filing your online or manual employer registration, check your email for a message from PhilHealth with instructions that you should follow to proceed with your account creation.

Step 2: Update Your Employee Master List

This step ensures that you’re remitting and reporting correctly to PhilHealth.

First, log into your EPRS account. To update only a few employees, click the Edit Employee Profile button corresponding to the name of your employee/s and update each employee’s information as needed. When you’re done, click the Submit button.

To update many employees, click on Remittance Management > file upload.

Upload your latest employee master list in CSV file format. On the Applicable Period drop-down menu, select the month, and year you’re paying for.

Finally, click the Validate CSV File Format button and the OK button. You’ll see a short notification about successfully uploading your remittance report.

Step 3: Generate the Statement of Premium Account (SPA)

The SPA is the basis of how much contribution the employer should remit to PhilHealth.

To generate your SPA, click on Payment Management > Payment Posting. You’ll see the Summary of PhilHealth Premium Payment.

Hover the mouse over the print icon on the right side of the page and click on Generate SPA / PPPS.

The system will display your SPA. Print a copy of it, which you’ll use for the contribution remittance.

Step 4: Pay and Post Your PhilHealth Contribution

Deduct each employee’s share of contribution from his/her monthly basic salary. Refer to the PhilHealth contribution table for employees.

Afterward, remit your employees’ contribution and the employer’s share to any accredited over-the-counter collecting agents nationwide or through any online payment options no later than the due date.

a. How To Pay and Post Contributions via Over-the-Counter Collecting Agents

Present a copy of your latest SPA when contributing to PhilHealth.

Pay only the exact Total Amount Due indicated in your SPA. PhilHealth doesn’t accept insufficient or excess amounts for contribution payments.

After paying your PhilHealth contribution, follow these steps to post your contribution remittance online:

- Log into your EPRS account.

- Click on Payment Management > Payment Posting.

- Hover the mouse over the print icon and click on Payment for Posting.

- Click the Payment Option icon on the right side of the page.

- The Payment for Posting page will appear. On the Payment Option drop-down menu, select “Collecting Agent: Banks / Non-Banks.”

- On the drop-down menu, select the name of the bank or remittance center you transacted with.

- Type your official receipt (OR) number.

- Select the OR date (date of payment) from the drop-down menu.

- Click the Submit button.

Posting of your contribution payment will undergo validation by PhilHealth. It usually takes three days to post the remittance.

b. How To Pay and Post Contributions via Online Payment Channels

- On EPRS, click on Payment Management > Payment Posting.

- Click the Payment Option icon on the right side of the page.

- The Payment for Posting page will appear. On the Payment Option drop-down menu, select “Online Payment.”

- Select the bank which you have an online account with. The system will direct you to the online banking facility of your chosen bank.

- Proceed with the online contribution payment through your bank’s e-banking service.

- Once your transaction is complete, an official receipt (OR) number will be automatically generated. You can find your latest OR number in your transaction history. To view it, click on Transaction Monitoring > Transaction History.

- You’ll also be issued an Employer Remittance Report, which you can access by clicking on Remittance Management > Remittance Status. Your contribution remittance is immediately posted.

How To Pay PhilHealth Contribution for Voluntary Members/Self-Paying Individuals

Members who belong to any of the following categories must pay their PhilHealth contribution on their own:

- Self-employed individuals/Freelancers

- OFWs

- Informal workers

- Employers

- Filipinos with dual citizenship

- Foreign retirees and other foreigners working and/or living in the Philippines

- iGroup members

The two requirements for PhilHealth contribution payment are the PhilHealth Identification Number (PIN) and the Statement of Premium Account (SPA). The latter serves as your billing statement and can be generated via the PhilHealth Member Portal. To access the said portal, you must first create an account.

Lost or forgot your PhilHealth number? Check this guide to recover it.

Although the PhilHealth ID is not required for contribution payment, it’s best to have it in case you need to check your PhilHealth number or the cashier requests it for validation.

Here are two ways to pay your contribution as a voluntary member or self-paying individual:

Option 1: Over the Counter

Step 1: Go to Any PhilHealth Branch (Except Those in Malls) or Over-the-Counter Collecting Agent

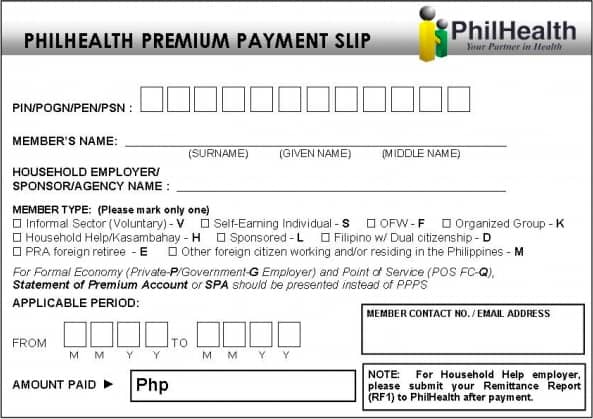

When paying at a PhilHealth office, request a PhilHealth Premium Payment Slip (or download it here beforehand).

When paying at a third-party agent, ask for a payment/deposit/transaction slip for PhilHealth contribution.

Step 2: Fill Out the Payment Slip

Make sure to write down your correct PhilHealth number so that your payment will not be credited to another member’s account.

The Applicable Period/Month(s) field should also be filled out correctly to avoid an error in your record or delay in your transaction.

Filling out the payment slip for PhilHealth contribution payment can be confusing for first-timers. Here are some quick guides to help you properly provide the required information on the payment slip.

a. How To Fill Out the PhilHealth Premium Payment Slip

Only individually paying members and household employers may use this PhilHealth contribution payment slip. Employers in the private or government sector must use their Statement of Premium Account (SPA) instead.

| Field Name | Required Information |

| PIN/POGN/PEN/PSN | Member’s 12-digit PhilHealth number (Provide the PhilHealth Employer Number for household employers.) |

| Member’s name | Member’s surname, first name, and middle name |

| Household Employer/Sponsor/Agency Name | Skip this field if you’re not a household employer or PhilHealth sponsor. |

| Member Type | Put a mark on the applicable membership category. Choose only one. |

| Application Period | Month/s being paid for in MMYY format Examples: *Payment for October 2019 – Write “From 1019 to 1019” *Payment for July to December 2019 – Write “From 0719 to 1219 |

| Member Contact No./Email Address | Member’s landline/mobile number or email address |

| Amount paid | The contribution amount for the applicable period |

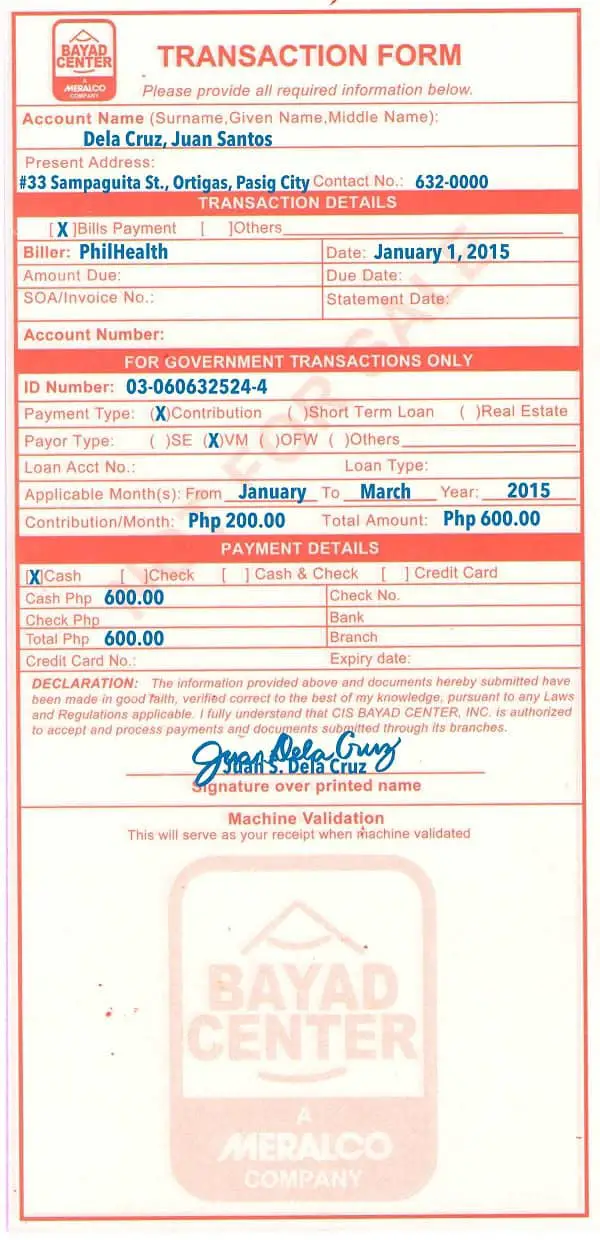

b. How To Fill Out the Bayad Center Transaction Form for PhilHealth Contribution Payment

The listed fields below are required, except for two optional fields. Just skip the fields that are not included in this list.

| Field Name | Required Information |

| Account Name | Member’s surname, first name, and middle name |

| Present Address | Member’s present address (Optional) |

| Contact No. | Member’s landline/mobile number (Optional) |

| Transaction Details | Put a mark on “Bills Payment” |

| Biller | Write “PhilHealth” |

| Date | Date of Payment |

| ID Number | Member’s 12-digit PhilHealth number |

| Payment Type | Put a mark on “Contribution” |

| Payor Type | Put a mark on the applicable membership category: *SE – Self-employed *VM – Voluntary member *OFW – Overseas worker *Others – Other member typ |

| Applicable Month(s) and Year | Month/s being paid for Examples: *Payment for October 2019 – Write “From October to October 2019” *Payment for October to December 2019 – Write “From October to December 2019” |

| Contribution/Month | Contribution amount per month (e.g., Php 200) |

| Total Amount | The total contribution amount for the applicable period |

| Payment Details | Put a mark on “Cash” (Bayad Center accepts only cash payments for PhilHealth contributions.) |

| Cash Php | Write the same amount you indicated on the Total Amount field |

| Total Php | Write the same amount you indicated on the Total Amount field |

| Signature over printed name | Write the payor’s name and sign above it. |

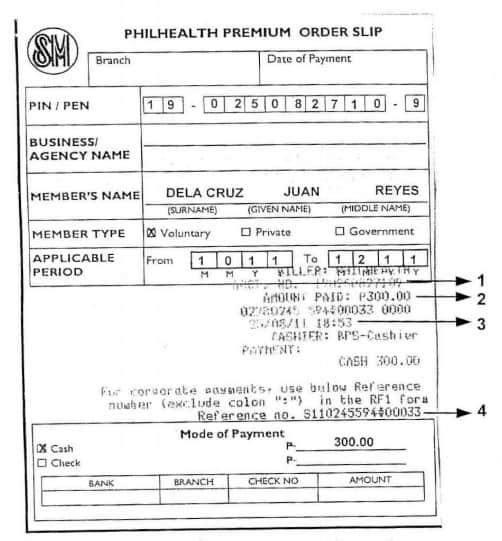

c. How To Fill Out the PhilHealth Premium Order Slip for Contribution Payment at SM Malls

| Field Name | Required Information |

| Branch | Name of SM branch where you’re contributing (e.g., SM Hypermarket Cubao, SM North EDSA, etc.) |

| Date of Payment | Present date when the contribution is paid |

| PIN / PEN | 12-digit PhilHealth number or PhilHealth Employer Number |

| Business / Agency Name | Employer’s company name (For employers remitting employee contributions only. Skip this field if you’re an individually paying member.) |

| Member’s Name | Member’s surname, first name, and middle name |

| Member Type | Put a mark on the applicable membership category: *Voluntary – Individually paying members *Private – Employers in the private sector *Government – Employers in the government sector |

| Applicable Period | Month/s being paid for in MMYY format Examples: *Payment for October 2019 – Write “From 1019 to 1019” *Payment for July to December 2019 – Write “From 0719 to 1219” |

| Mode of Payment | Put a mark on “Cash” and write the total contribution amount to pay (e.g., “600” for October-December payment) |

d. How To Fill Out the Bank Deposit/Payment Slip for PhilHealth Contribution Payment

The steps to accomplish a bank deposit or payment slip for your contribution remittance are quite the same as those of non-bank payment channels.

If you have a question or need help in filling out the form, approach the bank personnel for assistance.

Step 3: Submit the Payment Slip and Pay Your Contribution

Line up at the counter and hand your accomplished payment slip and cash payment to the cashier or teller.

Wait for the teller to issue your validated payment slip—proof of PhilHealth contribution payment.

Your payment would be posted in real-time if you settled it at a PhilHealth office. If you paid through an accredited collecting agent, posting takes up to two working days.

Option 2: Online

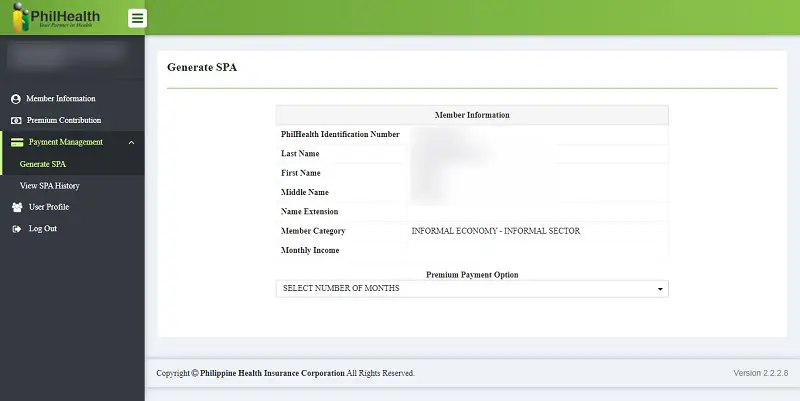

Self-paying members can now pay their PhilHealth contributions online through the newly revamped PhilHealth Member Portal.

How to Pay PhilHealth Contribution Online for Voluntary Members/Self-Paying Individuals

Follow the step-by-step guide below to learn how to pay your PhilHealth contributions online.

- Go to the PhilHealth Member Portal

- Log in with your PhilHealth number and password

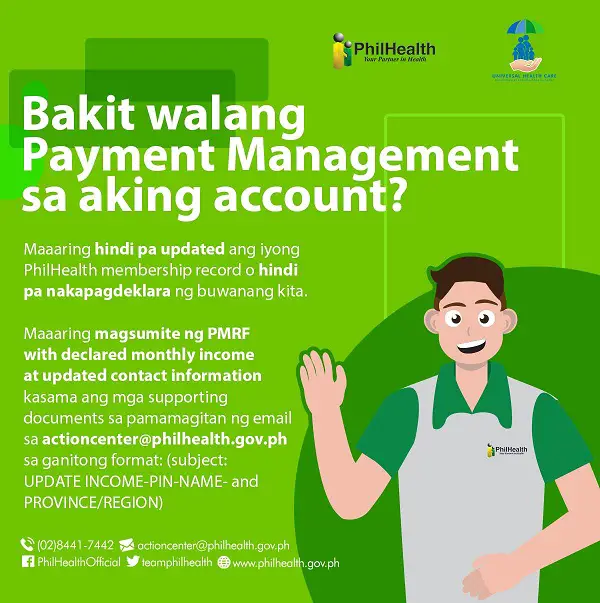

- Look for “Payment Management” on the main menu and click the downward arrow to view the drop-down list

- Select Generate SPA. The SPA or Statement of Premium Account will serve as your billing statement. To access this and start paying your premiums online, ensure your “Member Information” is updated and complete. If you haven’t provided your monthly income yet, please submit a request via email (see the next section for more information).

- Under “Premium Payment Option,” select the number of months that you’ll be paying for. You can pay for 1 to 36 months (3 years).

- Wait for the payment management module to display the total contributions due for payment and the corresponding due date. The computation will be based on your declared monthly income. Again, without a monthly income declared on your Member Information, you won’t be able to generate SPA and pay your contributions online (see step 4)

- Choose an accredited collecting agent (ACA) from the options available. You can pay via IPAY-MYEG Philippines, Inc. Other payment partners will be added later.

- Select how you want to pay. Depending on your chosen payment partner, you can pay through a credit card, debit card, prepaid card, or mobile wallet like GCash. Expect to pay for additional service and convenience fees for the transaction

- Wait for the electronic PhilHealth Acknowledgement receipt or ePAR. You will also receive an email or SMS notification confirming the completed payment.

Go back to the main article: How to Compute PhilHealth Contribution: A Complete Guide to Contribution Table and Payment

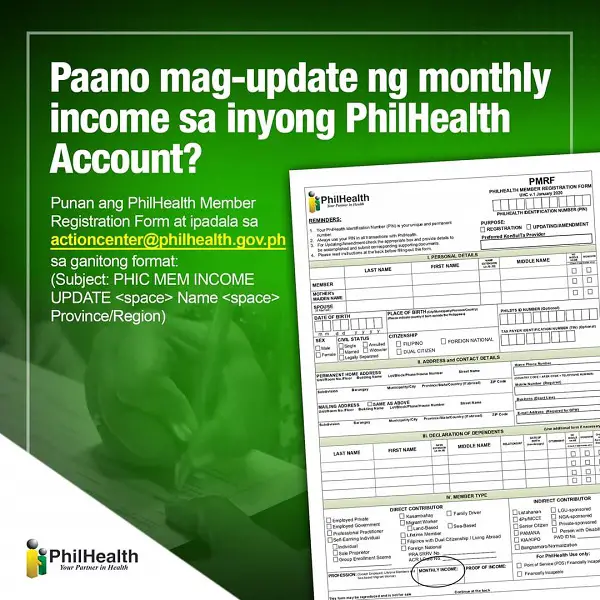

How To Update Monthly Income in PhilHealth Online

This guide is intended for PhilHealth voluntary members who want to update their declared monthly incomes online. By doing so, PhilHealth will enable you to pay your monthly contributions online, so you won’t have to go outside. Follow these steps to update your monthly income in PhilHealth online via email request:

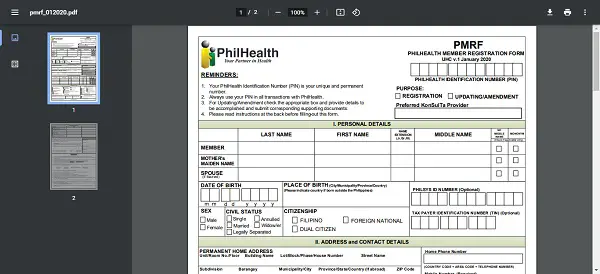

1. Download the Philhealth Member Registration Form (PMRF)

To download the form, go to the official PhilHealth website, click downloads on the main menu, select Forms from the list of options, then click PMRF: PhilHealth Member Registration Form.

2. Print Out the Form

Since you’re required to enter personal details into the PMRF, you must print it out.

Take note that you have to fill out the form manually and then scan the duly accomplished document. PhilHealth won’t accept your request unless the answers and signatures are handwritten on the paper.

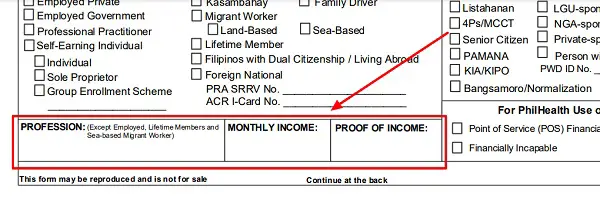

3. Fill Out the Form

Since you’re not a new member and only updating your existing records, tick the box that says “Updating/Amendment.”

Input your PhilHealth Identification Number (PIN) at the right topmost corner of the form.

When accomplishing the form, make sure only to use capital/upper case letters. Put “N/A” if the information is not applicable.

Input your personal information like name, mother’s maiden name, name of spouse (if applicable), date of birth, place of birth, civil status, citizenship, TIN, address, contact details, and type of PhilHealth membership (employed/self-earning individual/kasambahay/etc.).

At the bottom of the first page, input your monthly income in the designated box. You can leave the “Proof of Income” box blank.

Finally, provide your signature over your printed name on the second and last page of the form. Alternatively, you can affix your right thumbmark on the space provided if you cannot write.

4. Send Images or Scanned Copies of the Duly-accomplished Form and Two (2) Valid IDs to PhilHealth Action Center’s Email Address

Requests for online updating of monthly income should be sent to [email protected]

The subject line of your email must contain the following:

PHIC MEM INCOME UPDATE<space>Your Name<space>Province/Region

Example: PHIC MEM INCOME UPDATE CARDO DALISAY BULACAN

Don’t forget to attach the images or scanned copies of your duly accomplished PMRF and at least two (2) valid IDs for verification purposes.

Wait for PhilHealth’s confirmation via email that your monthly income has been updated. Depending on their workload, it can take anywhere from 24 hours to a few days.

If you want to check the status of your request, you can reach out to PhilHealth Corporate Action Center’s callback channel. Just text PHIC callback<space>Your mobile number or Metro Manila landline<space>Details of your concern to 09216300009.

Once they have received your request, they will try to call you back to give you an update. Since this mobile number is only used to receive callback requests, you will not get a response if you try to call it. Your request has already expired if you don’t get a callback after 48 hours. This happens when there are many requests, and yours can’t be accommodated anymore. If this is the case, try to send a request again via text or reach out to PhilHealth Action Center’s multiple social media channels.

Tips and Warnings

- If you can’t see the Payment Management option on your PhilHealth online account, you haven’t updated your membership record or declared monthly income. To update your monthly income, follow the instructions discussed in the latter part of this article.

- When filling out the PMRF to update your monthly income, manually input your answers and affix your signature. To do this, you must print out the form and scan it once it’s duly accomplished. PhilHealth won’t accept electronically signed forms.

Frequently Asked Questions

1. Can I pay PhilHealth in 711 (7-Eleven)?

As of this writing, there’s no option available to enable PhilHealth members to pay their contributions at the nearest 7-Eleven branches. However, voluntary members don’t even have to go outside to pay contributions. After updating their monthly income, voluntary members can regularly pay their contributions from the comfort of their own homes. If you’re a voluntary member, log in to PhilHealth Member Portal, generate your Statement of Premium Account (SPA), and pay using your GCash account or debit/credit card.

2. Can I pay PhilHealth contribution for the months that I missed?

Yes. Under the UHC’s IRR, non-payment will not result in the termination of receiving benefits; however, you will be obligated to make up any missed payments and monthly interest compounding. Read the complete answer here.

3. I stopped paying my PhilHealth contributions years ago. How do I continue making payments?

You can be liable for any missed ones depending on when your previous premium was paid. To discuss your unique situation and the proper payment, it is recommended to stop by your local PhilHealth branch since this may differ from case to case. For more information, kindly read this article.

References

- PhilHealth offers online payment window for self-paying individuals. (2021). Retrieved 23 April 2021, from https://businessmirror.com.ph/2021/03/20/philhealth-offers-online-payment-window-for-self-paying-individuals/

Venus Zoleta

Venus Zoleta is an experienced writer and editor for over 10 years, covering topics on personal finance, travel, government services, and digital marketing. Her background is in journalism and corporate communications. In her early 20s, she started investing and purchased a home. Now, she advocates financial literacy for Filipinos and shares her knowledge online. When she's not working, Venus bonds with her pet cats and binges on Korean dramas and Pinoy rom-coms.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net