Top 10 Best Banks in the Philippines: 2025 Updated Guide

When every bank promotes itself as the best bank in the Philippines, you can’t help but wonder which one delivers.

A bank offering a low minimum deposit and not charging you every time you touch your money sounds like a winner.

However, you must look at the bigger picture to get the best deal.

Whether you’re a student, entrepreneur, expat, OFW, or anyone who wants to save, this guide gives you a leg up in choosing the best bank in the Philippines.

Related: The Ultimate List of Philippine Bank Codes and SWIFT Codes

Table of Contents

At a Glance: The Top Banks in the Philippines

| Category | Name of Bank |

| Best for Savings | Bank of the Philippine Islands (BPI) |

| Best for High-Yields Savings (Traditional) | Philippine National Bank |

| Best for Checking Account | Philippine National Bank (PNB) |

| Best Rural Bank | BDO Network Bank (BDO NB) |

| Best for Time Deposit (Traditional) | Security Bank |

| Best Digital Bank for High-Yield Savings & Time Deposit | Tonik |

| Best for Paypal | UnionBank of the Philippines |

| Best of Expats | Citibank |

| Best for OFWs | BDO |

| Best for Students | Bank of the Philippine Islands (BPI) |

| Best in Online Banking | RCBC |

Top 10 Best Banks in the Philippines According to Bangko Sentral Ng Pilipinas

The Central Bank of the Philippines, or the Bangko Sentral ng Pilipinas (BSP), is the governing body that has been authorized by law through the provisions of the General Banking Act of 20001, to regulate all banks in the Philippines. These include all universal or commercial banks that offer the broadest range of banking services.

As of March 31, 2022, the following are the top 10 universal and commercial banks the BSP ranks according to their total assets2:

| Name of Bank | Total Assets |

| BDO UNIBANK INC. | ₱3,530,797.42 |

| LAND BANK OF THE PHILIPPINES | ₱2,788,780.74 |

| METROPOLITAN BANK & TCO | ₱2,384,541.48 |

| BANK OF THE PHIL ISLANDS | ₱2,355,209.60 |

| PHIL NATIONAL BANK | ₱1,138,695.29 |

| DEVELOPMENT BANK OF THE PHIL | ₱1,065,040.76 |

| CHINA BANKING CORP | ₱1,036,604.47 |

| RIZAL COMM’L BANKING CORP | ₱952,558.81 |

| UNION BANK OF THE PHILS | ₱745,488.51 |

| SECURITY BANK CORP | ₱724,831.75 |

What Type of Bank Do You Need?

According to the 2021 Financial Inclusion Survey by the Bangko Sentral ng Pilipinas (BSP) 3, 56% or about 42.9 million Filipino adults have formal accounts. This upsurge is a significant increase from 2019’s 29%. Over half of the Filipino adults have financial accounts in formal institutions like banks, cooperatives, and e-money issuers.

Of these formal account holders, around 23% have bank accounts, nearly double 2019’s 12%. Even with the dominance of e-money accounts as a formal financial platform, bank accounts are still relevant to Filipinos’ savings decisions.

But saving money isn’t the only reason for opening a bank account. Depending on your needs, you can choose from five types of bank accounts.

- Savings Account – is where you put your money if you want to build your emergency fund or save up for something important like a car, wedding, or vacation. It requires a low initial deposit, so students or anyone with an unstable income can open an account. The drawback is its annual interest rate of less than 1% and the penalty fees you’ll incur if your balance falls below the required maintaining balance.

- Checking Account – this type of deposit account you mainly use for payments. It requires a higher initial deposit and maintaining balance than a savings account. A checking account allows you to issue checks, which is impossible if you’re a savings account holder. Use this account if you have loans that require repayments through post-dated checks or for regular transactions such as payments for bills, tuition fees, rent, and business expenses.

- Time Deposit Account – pays higher interest than a regular savings account. The money you put here is kept for one month to seven years, during which the bank lends and invests the money to earn you a higher interest of up to 3.50%. Only choose this account if you have money you won’t touch anytime soon. While it’s possible to withdraw the money prematurely, it comes with a huge penalty fee that easily beats the money you should have earned.

- Dollar/Foreign Currency Account – ideal for those who regularly transact using foreign currencies, including OFWs and their families, online business owners, and regular travelers. Money in dollar accounts also earns interest in dollars. You can also withdraw your money in pesos with a better exchange rate than most money changers. Aside from US dollars, you can also open an account for other foreign currencies such as the British pound, euro, Chinese yuan, Hong Kong dollar, Japanese yen, and many more.

- Joint Account – is preferred by couples, associations, or business partners who want to keep their income under one account. A joint account can be savings, checking, or a time deposit. The account holders may choose a joint “AND” or a joint “OR” account. The former requires both signatories for any withdrawal to occur, while the latter allows either account holder to withdraw without the need for the other’s signature.

These types of bank accounts cater to the different needs of people. Identify your needs or the reason you want to open an account. Then, choose a bank that can fulfill those needs.

When choosing a bank account, you must consider what’s important. Is it the interest rate, the proximity of the bank’s location, or something else?

Once you’ve identified your criteria, it’s time to select from one of these general categories of banks:

- Commercial bank – offers the broadest range of services for businesses and individual depositors. With these mainstream banks, you can open a savings account, invest money, or secure loans.

- Thrift/Savings bank – focused on helping individuals and families to secure their financial futures via cash deposits. The bank invests the money they collect to help grow it and give the depositors a higher earning potential.

- Rural bank – also known as a cooperative bank, this institution finances agricultural projects and offers high-interest yields to help boost the rural economy.

- Digital bank – unlike traditional online banking, you don’t have to visit a branch to open an account; you can open one through your smartphone. Digital bank apps allow you to do most banking transactions on your smartphone, such as depositing a check. However, there’s currently no easy way to deposit cash on hand.

- Credit unions or member-owned financial cooperatives – small-scale banks controlled by their members motivated to help each other financially.

- Non-banks that may not own a full banking license but offer bank-related services.

Each bank in the Philippines has its pros and cons.

The key to choosing the best bank in the Philippines is to know the most important criteria to you and then pick a bank that excels in these areas.

The following section discusses these criteria and how we chose the best banks in the Philippines for different categories.

How We Chose the Best Banks

No bank is perfect, but to choose the best bank in the Philippines, we’ve put a lot of weight on the following factors/criteria:

1. Minimal Bank Fees

Banks aren’t the best place to make your money work hard for you; many investment vehicles can do better.

However, putting your hard-earned money in a bank account is better than storing them under your bed. For one, banks pay you annual interest by just letting them keep your money.

The downside is that whatever small interest you earn can be offset by the numerous fees the bank charges for its services.

Before entrusting your money to the bank, read the terms and agreement in the contract, and pay attention to “hidden” fees that may not have been discussed with you.

The worst banks in the Philippines charge you for every transaction, whether for ATM use, overdrafts (a fee charged when you withdraw money that exceeds the available balance), transferring money between accounts, etc.

Fees allow banks to maintain their daily operations, but when you get charged for every transaction, consider it a red flag.

2. Low Maintaining Balance

A lot of Filipinos store their money in banks temporarily and often withdraw them as the need arises.

Sometimes, you may accidentally withdraw money that exceeds the minimum balance requirement. When this happens, banks may charge you a penalty fee and deactivate your account for failing to keep the maintaining balance.

For this reason, choose a bank that offers a low maintaining balance that can keep your account even if you’re not a regular depositor.

3. Few or No Limitations on the Number or Method of Transactions

Banks may limit the amount of money you can withdraw or the number of transactions you can do daily.

A good bank allows you to do as many transactions in your account without charging you incurring fees, whether for withdrawing and depositing money or transferring money between checking and savings accounts.

4. Accessible Location of the Bank and Its ATMs

While almost all banks now offer full online banking services, nothing beats a bank close to your location and where you can do an over-the-counter transaction at a moment’s notice.

If you’re usually busy at work during weekdays, choosing a bank with branches open on weekends is only logical. For instance, a famous commercial bank has a branch in every SM mall in the country, and all these branches are ready to accommodate its clients seven days a week.

5. Secure Online and Mobile Banking

Since you won’t always be available to go to the bank to deposit or withdraw cash personally, priority should be given to seamless online/mobile banking.

Most banks already have this feature, but they’re not created equal. A bank that successfully embraces technology enables you to do the following:

- Transfer money to any account online without going to the physical branch for authorization;

- Deposit, withdraw, or track money in your account through the bank website or smartphone app;

- Enroll autopay for bills payment;

- Secure an appointment in advance to avoid long queues upon arriving at the branch;

- Receive email or SMS alerts every time you withdraw from an ATM or make an online transaction.

Other excellent online banking features include automated savings plans, budgeting tools, and stringent security measures to protect your account.

6. Verifiable Deposit Insurance

Deposit insurance guarantees you get back your insured deposits in case the bank fails and closes down.

In the Philippines, all deposit accounts are insured by the Philippine Deposit Insurance Corporation for up to ₱500,000 per depositor per bank.

To ensure you’re depositing your money in a trustworthy bank, check if it’s a Philippine Deposit Insurance Corporation (PDIC) member.

Since the insured deposits are only limited to ₱500,000 per bank, it’s only practical to keep money that doesn’t exceed that amount in a single bank. If you have extra cash, open another account in a separate bank and keep it there.

If you want to spare yourself from the trouble, ensure you can confidently keep more than the minimum insured deposit in a bank. Factors that you need to keep your eyes on are the bank’s track record, total assets, and the level of security provided in the branch you regularly transact with.

7. Competitive Interest Rate/s

Interest is what the bank pays you for trusting them to keep your money. It should be the least of your priority if you’re planning to only save a few thousand in your savings account.

A competitive interest rate, or one that can keep up with inflation, will only be of value to you if you have millions in cash deposits. If this is the case, look for a bank that offers all the features already mentioned, plus a high-interest savings account.

Digital banks typically have higher interest rates than traditional banks because of the lower operating costs of not having any physical branches. However, if you are uncomfortable using digital banks, you might also want to explore investing your savings in UITF or mutual funds, where you’ll earn relatively more than a traditional bank’s interest rate.

8. Reliable and Efficient Customer Service

Banks with multiple customer service channels speak volumes about their commitment to pleasing their clients.

If you want your issues to get resolved as soon as possible, choose a bank that lets you talk to an agent within minutes and whose customer service department can be easily accessed via phone, email, or social media channels like Facebook, Twitter, Instagram, Viber, to name a few.

Best for Savings: Bank of the Philippine Islands (BPI)

To find the best bank in the Philippines for savings, we had to zero in on three of the most important criteria: bank fees, interest rate, and customer service. We also considered the stability of the bank and its overall performance over the years.

Based on these factors, our choices dwindled to BDO and BPI.

Related Article: Which is the better bank to open a savings account: BPI or BDO?

Both are two of the largest commercial banks in the country as of 2022, with BDO’s total assets amounting to ₱3,530,797.42 and BPI’s at ₱2,355,209.60.

Banks of this magnitude have many products, services, and awards under their belts. But none of these matters if they fail to serve individual clients well.

Like any famous bank serving millions of customers, both may show occasional inefficiency issues.

Long queues at their branches can look like a line to a blockbuster movie, especially during peak hours. Meanwhile, their customer hotlines are plagued with inconsistency in how they resolve customer complaints.

Despite all the shared flaws, we still consider the Bank of the Philippine Islands (BPI) the best bank to open a savings account. Founded in 1851 and known as the oldest bank in the country and Southeast Asia, BPI currently has 869 branches and over 2,000 ATMs and cash deposit machines nationwide4.

Although BPI has fewer branches than BDO, the former enables its clients to book an appointment online, bypassing the long queues at the physical branch.

Even without using the convenience of online appointments, you can still visit the branch, get your queue number, and comfortably sit in a chair while waiting for your turn to make a transaction.

BDO, by contrast, provides neither queue numbers nor chairs. Transactions are also slower since BDO doesn’t have an automatic queuing system like BPI’s that would have enabled them to pull up the client’s account in advance.

Fortunately, both banks now have cash deposit machines in every branch, allowing you to conveniently deposit money without lining up to talk to a teller. For anyone planning to open a savings account to deposit money regularly, BDO and BPI are excellent choices for their cash deposit machines alone.

Now let’s get down to the nitty-gritty: While BDO has more branches nationwide (with those inside SM malls open even on weekends), its unreasonable fees are a significant turn-off.

There is a processing fee for literally every transaction you make with BDO.

Transferring from a foreign bank? You’ll get charged at least $10 regardless of your transfer amount. Withdrawing money over the counter? Expect a withdrawal fee. Receiving money from other banks? Of course, there’s a fee.

But here comes the worst part: BDO treats its branches separately, so when you deposit or withdraw money in a branch other than the branch where you opened your account (i.e., account holding branch), you’ll be slapped with fees for the said transaction.

BPI, on the other hand, has significantly fewer fees for everything.

Over-the-counter cash deposits and withdrawals are free if you do the transaction in the BPI branch where you opened your account or another branch, provided it’s located in the same region as your branch of account. Cash deposits and withdrawals made in a different region (e.g., NCR to Region I, etc.) come with a service fee of ₱50 and ₱100 per transaction, respectively. For an updated list of BPI bank service fees, click here.

They also have a Transfer to Anyone feature if you want to securely transfer money online to unenrolled BPI accounts. Moreover, it’s now easier to enroll a BPI account through the BPI app.

As for ATM fees, both banks don’t charge anything so long as you use your ATMs and not those of competing banks.

Regarding interest rates, BDO offers 0.750%5 for its Optimum Savings Account holders. The highest BPI can offer is only 0.125%6 for those with a Maxi-Saver Savings Account.

However, as mentioned in the previous section, interest rates aren’t the best way to gauge the performance of a savings bank. If anything, even the highest interest rate can only give you coffee money every year unless you have millions in cash to put in the bank.

READ: How to Open a BPI Savings Account: An Ultimate Guide

Best for High-Yield Savings (Traditional): Philippine National Bank (PNB)

When you’re keeping millions in your savings account, expecting higher returns is only appropriate. Although digital banks now offer the most competitive yield rates in the market, traditional banks still offer high-earning savings accounts for people like you.

Interest rates from traditional banks have been dropping since 2020. Fortunately, Philippine National Bank still has the PNB Top Saver Account7, which has interest rates of up to 0.5% per annum.

With a minimum initial deposit of ₱30,000, you start with a 0.125% interest rate. This savings account works on a tiered basis, so your applicable interest rate increases as your account balance increase until you reach the maximum 0.5% rate.

PNB Top Saver also comes with PNB-PAL Mabuhay Miles Debit Card, which earns 0.1% per annum 8 which is also significantly higher compared to regular savings accounts.

In close second is RCBC Dragon Peso Savings9, with a maximum of 0.45% interest per annum. With a minimum initial deposit of ₱25,000, you’ll earn 0.150% per year. This account also works on a tiered basis with 0.45% interest for an account balance of 10 million pesos and above.

BDO’s Optimum Savings is also a great choice if you’re looking for a high-yield savings account. There are claims that it offers a maximum interest rate of 1.25%. However, BDO has never announced its effective rates on its official website and advises people to inquire at their branches for details. With this uncertainty on BDO’s part, we keep the title of the best bank in terms of high-yield savings to PNB.

Best for Checking Account: Philippine National Bank (PNB)

Checks are more convenient and safer to carry than cash. You first need to open a checking or current account to issue checks when making payments.

When choosing the best bank in the Philippines for a checking account, look for a low initial deposit amount and required maintaining balance. Since checking accounts aren’t suited for saving money, interest rates are irrelevant.

More importantly, choose a bank that doesn’t require a pre-existing savings account with them before allowing you to have a checking account.

For this reason, BDO and BPI fail to make the cut since both big banks can’t provide you with a checking account. Although both of these banks have a low minimum initial deposit and maintaining balance of ₱5,000, you must maintain a savings account with them for at least six months.

Security Bank’s All-Access Checking Account10sounds like a great idea at first (free life insurance of up to 3 million pesos, ₱5,000 initial deposit, and savings and checking accounts in one). However, its all-in-one package may scare clients who only prefer a checking account. It also has a high maintaining balance of ₱25,000.

And that brings us to the Philippine National Bank’s wide range of checking accounts.

Leading the pack is the Budget Checking Account11, a non-interest earning account with a minimum initial deposit and a maintaining balance of only ₱5,000. You can have three negotiations per month for free and then ₱20 per transaction thereafter.

PNB’s Regular Checking Account12, on the other hand, requires ₱10,000 as an initial deposit and maintaining balance. You can monitor your checking account via online banking and make interbranch/interoffice transactions free of charge except in select provincial branches.

Best Rural Bank: BDO Network Bank (BDO NB)

Most people shy away from rural banks due to issues of stability. The fear is not unfounded as BSP is becoming more aggressive in closing down low-performing rural banks in the country13.

Therefore, should you decide to deal with a rural bank, choose one with proven longevity and sustainable assets. Considering these criteria, we’ve chosen BDO Network Bank (BDO NB), previously known as One Network Bank (ONB), as the best rural bank in the Philippines. As of September 30, 2021, it has assets of ₱51,269.83.

Acquired by no less than Banco De Oro in 2014, BDO NB is now the largest rural bank in the country, with its fleet of over 120 branches and 300 ATMs, most of which are in Mindanao. It also has branches in Makati City and a few around the NCR.

Since it’s a rural bank subsidiary of BDO, you can tap the latter’s extensive ATM network to withdraw or deposit money anywhere in the Philippines.

BDO NB offers savings and checking accounts, the first rural bank to do so. With only ₱500, you can already open a Regular Savings account14. With a minimum deposit balance of ₱1,000, this savings account earns a competitive interest rate of 0.0125%. Kids and teenagers are encouraged to save money and develop their personal finance IQ early through the Young Pera Savers15. You only need ₱50.00 to open an account and maintain a balance of ₱500.00 to earn 0.125% interest.

Staying true to its roots as a rural bank, BDO NB also offers salary and business loans for professionals and micro-entrepreneurs who contribute to the economic growth in the countryside.

Best for Time Deposit (Traditional): Security Bank

A time deposit is an ideal investment for the risk-averse. It earns higher interest than a regular savings account but requires a specified time of maturity.

The maturity period can last from 1 week to 7 years, depending on your goal. While your money is locked in, you can receive interest payments in your preferred frequency–annually, semi-annually, quarterly, or monthly.

Choosing a bank with the highest interest rate for time deposit accounts only makes sense. But the interest rate isn’t the only parameter you need to consider.

An ideal time deposit account also allows you to pre-terminate your account once an immediate need arises.

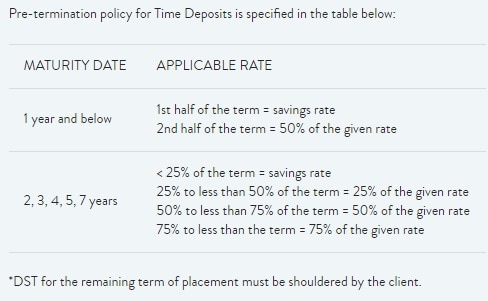

Among the time deposit accounts we’ve reviewed Security Bank’s Peso Time Deposit16 stood out.

From a user experience standpoint, its website provides everything one needs to make an informed decision. It provides comprehensive information and features a unique time deposit calculator to give you an idea of how much you can earn from a time deposit.

Security Bank also has the industry’s highest interest rates for time deposit accounts. For a minimum investment of ₱100,000 in a 3-year tenure, you can get an interest rate of 1.80%.

Of course, you’ll get paid bigger the longer you keep the money in your account, the maximum being seven years.

Whereas other banks with high-interest rates for time deposits don’t explicitly display their pre-termination policy, Security Bank’s is visible on their information page:

Aside from Philippine pesos, Security Bank offers time deposit accounts for US dollars and Chinese yuan with minimum placements of $1,000 and ¥5,000, respectively.

In second place is Unionbank’s subsidiary, CitySavings17, which has higher time deposit interest rates. At a minimum investment of ₱100,000 and a 3-year tenure, you can get an interest rate of 2.2%. However, since time deposits require stability, you might prefer choosing a more proven bank like Security Bank.

Best Digital Bank for High-Yield Savings & Time Deposit: Tonik

With the continued rapid growth of digital transactions18 in the Philippines, it’s no surprise that digital banks such as CIMB Bank Philippines and ING Philipines have gained in popularity. Apps like Komo by East West Bank and Diskartech by RCBC also see increased transactions.

The Bangko Sentral ng Pilipinas is supporting this growth. In September 202119, they granted digital banking licenses to an additional six digital banks in the Philippines, namely, Maya Bank, Overseas Filipino Bank, Tonik Digital Bank, UNOBank, Union Digital Bank, and Gotyme.

If you are looking for an alternative to the low-interest rates of traditional banks, then a high-yield savings account from a digital bank may be for you. Due to having no physical branches, they pass on those savings through higher interest rates for their clients.

Tonik currently offers the highest annual interest rate at 4% for a Solo Stash account and 4.5% for a Group Stash account20. While relatively new in the Philippines, Tonik has established a regional reputation with offices in Singapore and India. As of this writing, they also have a 4.4-star rating in both the Google Play Store and Apple App Store.

They have a stash system where you, the account holder, can separate your savings into different “stashes” according to your goals. Currently, a maximum of 5 stashes is available per account.

Tonik also offers the highest interest for time deposit accounts21 with a range of 6% per annum for a 6-month tenure and 5.25% per annum for a 24-month tenure.

Best for Paypal: UnionBank

PayPal is an online payment system that allows you to receive and transfer money electronically. It’s suitable for paying bills or goods online, but you must link it to a local bank if you want to encash your PayPal funds.

In my experience as a freelancer, the two best banks that work for PayPal are Security Bank and UnionBank.

As much as I’d love to use Security Bank because of its zero annual and withdrawal fees, the ₱5,000 minimum deposit defeats its purpose for PayPal withdrawals. If I intend to save money, I’d rather open a regular savings account.

Unionbank’s EON Visa Card, by contrast, doesn’t require an initial deposit and maintaining balance. Fund transfer takes 5-7 business days, according to UnionBank’s information page, but I usually get my money in a shorter time frame.

My only complaint in several years of using Unionbank EON is their customer service. The EON hotline doesn’t respond at all, so I have to connect with the main Unionbank hotline every time I encounter some issues.

Other than that, Unionbank EON is good for PayPal if you don’t mind paying small fees for the transactions.

Best for Expats: Security Bank

Whether living in the Philippines permanently or for an extended period, you need a bank that will handle your financial transactions.

Expats usually choose banks that trade internationally–either national banks like Bank of the Philippine Islands or international institutions like HSBC and Bank of America. However, the problem with international banks is that they usually have few ATMs compared to more popular national banks.

To choose the best bank in the Philippines for expats, we focused on the following parameters: ease of application, online banking, and fees (most notably, ATM fees).

Foreigners with either immigrant or non-immigrant visas who have been in the country for over 59 days must present an ACR I-Card. You can secure this document from either the main or field offices of the Bureau of Immigration throughout the country. Other requirements include your foreign passport and proof of address, like utility bills.

Some banks may let you open an account even without the ACR provided you talk directly with the bank manager. Other institutions are more strict and don’t let expats open an account without proof of their permanent residency status.

For this category, we have picked Security Bank because of its variety of bank products suited for expats like you. For instance, they have a Third Currency account22 that lets you withdraw your money either in ₱ or foreign currency. This savings account is available in 8 currencies, including Euros, Hong Kong Dollars (HKD), and Canadian Dollars (CAD). Meanwhile, you may open a separate US Dollar Savings account23 that also allows you to withdraw your funds in ₱ or $. These international savings accounts allow you to make or receive foreign currency payments and transact internationally for personal or business purposes.

However, these savings accounts still charge an Interbank withdrawal fee of ₱1524. You may join the Security Bank Gold Circle to enjoy free ATM withdrawal charges. You can join this VIP circle once your consolidated monthly average daily balance in different Security Bank’s eligible accounts reaches ₱500,000 ($10,000).

In terms of account opening, Security Bank offers a convenient online account application25 on its official website. Select the type of savings account you prefer, complete the form, upload the documentary requirements, and select your preferred time and date. A staff from Security Bank will reach out to you through Microsoft Teams for a video call interview anytime between 9 AM to 4 PM on weekdays. For their foreign currency accounts, they usually ask for your Passport or ACR-I card.

Security Bank Online Banking is also impressive with its daily aggregate limit of ₱600,000 ($12,000)26 which is best for those who do large transactions daily. It is also accessible even outside the country with an internet connection.

Whatever bank you choose, read the terms and conditions as if you’re reviewing a job contract. Security BankGold account, for instance, charges a service fee of ₱100027 if your balance falls below ₱500,000 after three consecutive months

As a side note, avoid opening accounts in rural banks with few or no ATMs. They also have a higher risk of bankruptcy due to the nature of the loans they provide. Although the PDIC insures your deposits, you’ll only get a maximum of ₱500,000 ($10,000) even if you have a higher amount deposited in that bank.

Best for OFWs: BDO

As an OFW, your goal has always been to secure your family’s future and have a financial cushion in case your life in a foreign land goes awry.

Therefore, an ideal bank for OFWs is one that doesn’t just offer a means to save money but also has life insurance tied with it.

With these in mind, we’ve eliminated Metrobank’s OFW savings account because although it requires zero initial deposit, it doesn’t come with life insurance and an extensive bank network.

After careful deliberation, we can now crown BDO as the best bank in the Philippines for OFWs. Through the BDO Kabayan Savings, you can now open an account at any BDO branch with only ₱100 (Peso Account) or $100 (Dollar Account) as an initial deposit.

READ: How to Open an Account in BDO

As long as you remit at least once every year, you can keep your account active even with a zero maintaining balance.

Most importantly, opening a Kabayan savings account28 qualifies you to get free life and accident insurance29. It also builds your credit history with BDO, making it easier for you to apply for loans in the future.

The runner-up is BPI’s similar product, Pamana Savings Account30. Like BDO’s Kabayan, Pamana offers free life insurance but a relatively higher initial deposit requirement.

Related Article: I’m an OFW and currently based abroad. Can I have someone in the Philippines open a BPI account for me?

Best for Students: Bank of the Philippine Islands (BPI)

Mounting school expenses should never be an excuse not to save money. When choosing the best bank in the Philippines for students, we only focused on the low initial deposit and the bank’s accessibility.

Both BDO and BPI have the country’s largest network of banks and ATMs. Most of these are located within a short distance from schools to make it easier for students to make transactions.

Both banks have an account type suitable for students. BPI has the Jumpstart account31 while BDO has the Junior Savers account32. Both have a low initial deposit of ₱100, the same annual interest rate of 0.0625%, and the same required daily balance to earn an interest of ₱2,000.

However, unlike BDO, which has been notorious for “finding ways” to charge its clients, BPI offers free ATM withdrawal, over-the-counter withdrawal if a passbook account, and ₱100 for over-the-counter withdrawal if without a passbook.

Also Read: BPI Savings Account for Students – Procedure and Requirements

Best in Online Banking: RCBC

Online banking has proven to be helpful in the new normal. Thus, if you’re looking for a bank with online platforms that are reliable, user-friendly, and bundled with unique features, RCBC should be one of your top choices.

In 2020, RCBC was hailed as the best digital bank in the country by reputable organizations such as Alpha Southeast Asia and Asiamoney. The following year, RCBC received the title of the best digital bank from Asiamoney33 as well as the Business Tabloid.

Its mobile application, RCBC Online Banking, includes various features, including bills payment to 400 billers nationwide, biometrics login, online check deposits, credit card and loans management, credit card lock and unlock feature, Forex trading, and so on.

They also have a dedicated online platform through the RCBC Online Corporate site for their corporate customers.

Frequently Asked Questions

1. Should I keep my money in just one bank or open multiple bank accounts?

As you can see from the article, different accounts are best for different purposes. You can open multiple accounts depending on your needs, but there’s no need to rush it. Just open an account as there becomes a purpose for it.

Here are the benefits of opening multiple bank accounts:

– Allows you to designate each account for specific purposes – for example, you can separate your account for your payroll, living expenses, and emergency fund.

– PDIC insurance limit – each account is only insured for up to ₱500,000 by the Philippine Deposit Insurance Commission (PDIC). If you want to protect yourself from bank closure, you can spread your money across different PDIC member banks.

– Multiple payment gateways for businesses and freelancers – if you are running a business or working as a freelancer, having various accounts makes it easier to transact with your clients.

– Access to your money during system maintenance – banks and their systems may go down for maintenance occasionally. If you have multiple accounts, you can access your money from your other accounts if your other account is down.

Of course, it might be difficult to keep track of the balance of each account. So make sure to have a tracking system that involves recording your balances and cash flows in an app or notebook.

References

- Robles, E. (2018). Top banks in the Philippines – The Manila Times. Retrieved 14 May 2020, from https://www.manilatimes.net/2018/07/30/supplements/top-banks-in-the-philippines/424778/

- Ranking as to Total Assets. (2022). Retrieved 15 August 2022, from https://www.bsp.gov.ph/Statistics/Financial%20Statements/Commercial/assets.aspx

- 2021 Financial Inclusion Survey [PDF]. (n.d.). Bangko Sentral ng Pilipinas (BSP).

- Company Information. (2021). Retrieved 15 August 2022, from https://edge.pse.com.ph/companyInformation/form.do?cmpy_id=234

- Optimum Savings. Retrieved 15 August 2022, from https://www.bdo.com.ph/personal/accounts/peso-savings-account/optimum-savings

- Deposit Rates – Savings and Checking. Retrieved 15 August 2022, from https://www.bpi.com.ph/bank/deposit-rates-savings-and-checking

- PNB Top Saver Account. (n.d.). Retrieved January 7, 2023, from https://www.pnb.com.ph/index.php/accounts/pnb-top-saver-savings?tpl=revamp&tg=AC

- PNB Debit Savings Account. (n.d.). Retrieved January 7, 2023, from https://www.pnb.com.ph/pnb-pal-mabuhay-miles-debit-mastercard-savings.html

- Dragon Peso Savings. (n.d.). Retrieved January 7, 2023, from https://www.rcbc.com/dragon-peso-savings

- All Access Checking Account. Retrieved 15 August 2022, from https://www.securitybank.com/personal/accounts/savings-checking/allaccess/

- PNB Budget Checking Account. Retrieved 15 August 2022, from https://www.pnb.com.ph/index.php/budget-checking?tpl=1

- PNB Regular Checking Account. Retrieved 15 August 2022, from https://www.pnb.com.ph/index.php/regular-checking?tpl=1

- Agcaoili, L. (2018). 7th rural bank ordered closed. Retrieved 14 May 2020, from https://www.philstar.com/business/2018/08/06/1839905/7th-rural-bank-ordered-closed

- Regular Savings. Retrieved 15 August 2022, from https://www.bdonetworkbank.com.ph/regular-savings

- Young Pera Savers. Retrieved 15 August 2022, from https://www.bdonetworkbank.com.ph/young-pera-savers

- Peso Time Deposit Account. Retrieved 15 August 2022, from https://www.securitybank.com/personal/accounts/time-deposit/peso/

- Time Deposit. Retrieved 15 August 2022, from https://www.citysavings.com.ph/deposits/time-deposit

- Dharmaraj, S. (2022). The Philippines Central Bank Expects Digital Transactions to Continue Rapid Growth. Retrieved 7 February 2022, from https://opengovasia.com/the-philippines-central-bank-expects-digital-transactions-to-continue-rapid-growth/

- Reyes, M. (2021). Digital banking in the Philippines. Retrieved 7 February 2022, from https://www.philstar.com/business/2021/11/06/2139242/digital-banking-philippines

- Stashes. Retrieved 15 August 2022, from https://tonikbank.com/savings-cards/stashes

- Time Deposit. Retrieved 15 August 2022, from https://tonikbank.com/savings-cards/time-deposit

- Third Currency Account. (n.d.). Retrieved January 7, 2023, from https://www.securitybank.com/personal/accounts/foreign-currency/third-currency-forex/

- USD Savings Accounts. (n.d.). Retrieved January 7, 2023, from https://www.securitybank.com/personal/accounts/foreign-currency/us-dollar/

- Fees and Charges. (n.d.). Retrieved January 7, 2023, from https://www.securitybank.com/personal/accounts/fees-charges/

- Can I open an account online? (n.d.). Retrieved January 7, 2023, from https://help.securitybank.com/all-access/can-i-open-an-account-online

- Frequently Asked Questions. (n.d.). Retrieved January 7, 2023, from https://www.securitybank.com/online-banking/faq/

- The Gold Circle. (n.d.). Retrieved January 7, 2023, from https://www.securitybank.com/personal/gold/

- BDO Kabayan Savings. Retrieved 15 August 2022, from https://www.bdo.com.ph/personal/remittance-services/bdo-kabayan-savings

- Free Life and Accident Insurance. Retrieved 15 August 2022, from https://www.bdo.com.ph/remittance-services/get-insured-you-send-more-remittances

- Pamana Savings. Retrieved 15 August 2022, from https://www.bpi.com.ph/bank/savings/pamana-savings

- Jumpstart. Retrieved 15 August 2022, from https://www.bpi.com.ph/bank/savings/jumpstart

- Junior Savers. Retrieved 15 August 2022, from https://www.bdo.com.ph/personal/accounts/peso-savings-account/junior-savers

- Hilario, E. (2021). RCBC is AsiaMoney’s back-to-back ‘Best Digital Bank’ in the country. Retrieved 28 March 2022, from https://mb.com.ph/2021/09/24/rcbc-is-asiamoneys-back-to-back-best-digital-bank-in-the-country/

Luisito Batongbakal Jr.

Luisito E. Batongbakal Jr. is the founder, editor, and chief content strategist of FilipiKnow, a leading online portal for free educational, Filipino-centric content. His curiosity and passion for learning have helped millions of Filipinos around the world get access to free insightful and practical information at the touch of their fingertips. With him at the helm, FilipiKnow has won numerous awards including the Top 10 Emerging Influential Blogs 2013, the 2015 Globe Tatt Awards, and the 2015 Philippine Bloggys Awards.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net