How To Apply for Pag-IBIG Calamity Loan: An Ultimate Guide

A calamity destroys lives and livelihoods.

This is why it’s essential for the government to support its people financially after a calamity, whether it’s natural or man-made.

The Pag-IBIG Calamity Loan is one example of financial assistance offered by the government to help Filipinos rebuild their lives and properties after a tragedy.

This guide will show you how to avail of the Pag IBIG Calamity Loan and walk you through the whole process–from application to approval.

Related: How to Compute Your Pag-IBIG Contribution: A Complete Guide to Contribution Table and Payment

Table of Contents

- What Is a Pag IBIG Calamity Loan?

- Who Are Qualified To Avail of the Pag IBIG Calamity Loan?

- When Can I Avail of the Pag IBIG Calamity Loan?

- What Is the Coverage of the Pag-IBIG Calamity Loan Program?

- How Much May I Borrow From the Pag IBIG Calamity Loan Program?

- How Much Is the Interest Rate for Pag IBIG Calamity Loan?

- What Are the Requirements for Pag IBIG Calamity Loan Application?

- How To File for Pag-IBIG Calamity Loan: Two Ways

- How Long Is the Processing Period of the Calamity Loan Application?

- How Can I Claim/Receive the Pag IBIG Calamity Loan?

- How To Pay the Pag IBIG Calamity Loan

- 1. How long am I going to pay for the Pag IBIG Calamity Loan?

- 2. How can I pay my Pag IBIG Calamity Loan?

- 3. When is the deadline for payment for Pag IBIG Calamity Loan?

- 4. How much is the penalty if I fail to pay my Pag IBIG Calamity Loan on time?

- 5. What will happen if I don’t pay the Pag IBIG Calamity Loan?

- Tips and Warnings

- Frequently Asked Questions

- 1. I want to know if I’m qualified to avail of the Pag-IBIG Calamity Fund. How can I check or verify my total Pag-IBIG contributions?

- 2. How can I view my Pag-IBIG calamity loan status/records online?

- 3. What is the Total Accumulated Value (TAV) of Pag-IBIG?

- 4. Can I still avail of the Pag-IBIG Calamity Loan even if I have an existing loan with Pag-IBIG?

- References

What Is a Pag IBIG Calamity Loan?

Aside from the opportunity to finance their dream homes, Pag-IBIG Fund members also enjoy the benefit of getting quick financial assistance in times of calamity.

The Pag IBIG Calamity Loan offers immediate financial aid to members living in calamity-stricken areas. In order to qualify, the area must be declared under the State of Calamity1 by the President OR the Sangguniang Bayan (local government unit) upon the recommendation of the National Disaster Risk Reduction Management Council (NDRRMC) OR their local counterparts known as the Local Disaster Risk Reduction Management Council (LDRRMC), respectively.

Related: How to Apply for SSS Unemployment Benefit: An Ultimate Guide

Who Are Qualified To Avail of the Pag IBIG Calamity Loan?

Pag-IBIG Fund members can avail of the calamity loan as long as they meet the following qualification requirements:

- Must be an actively contributing member with at least twenty-four (24) monthly savings (Do you want to know if you’re qualified? Here’s how to check your Pag-IBIG contributions). If you’ve already withdrawn/claimed your Pag-IBIG contributions either upon membership termination or through optional withdrawal, you can’t avail of the calamity loan unless you pay the required 24 monthly savings after making the said withdrawal. On the other hand, members who failed to pay their contribution for 24 straight months may still be allowed to avail of the loan provided that their total savings are equivalent to the required 24 monthly savings, at the rate applicable to him;

- Has paid at least one (1) monthly savings within the last 6 months prior to the date of application;

- With sufficient proof of income;

- If with an existing/outstanding Pag-IBIG loan (housing loan, multi-purpose loan, or another calamity loan), payments must be updated and the account must not be in default in order to qualify;

- Must have their place of residence (present or permanent address) or place of work declared under State of Calamity.

When Can I Avail of the Pag IBIG Calamity Loan?

Assuming that you meet all the qualification requirements listed in the previous section, you can avail of the calamity loan within a period of ninety (90) days2 from the declaration of a State of Calamity.

What Is the Coverage of the Pag-IBIG Calamity Loan Program?

The loan program is available to qualified members affected by man-made hazards or any of the following natural disasters:

- Typhoon

- Storm Surge

- Tornado

- Landslide

- Earthquake

- Tsunami

- Volcanic Eruption

- El Niño or La Niña

How Much May I Borrow From the Pag IBIG Calamity Loan Program?

According to the Pag-IBIG Fund, the loanable amount (i.e., the amount of loan you can borrow) will be based on the LOWEST of the following:

1. Desired loan amount.

2. Loan entitlement – which is equivalent to 80% of the member’s TAV (Total Accumulated Value) or total regular Pag-IBIG savings (meaning your Pag-IBIG MP2 contributions are excluded), which consist of your monthly contributions, your employer’s contributions, as well as the accumulated dividends you’ve earned.

The table below shows how much calamity loan you can borrow based on the number of your monthly savings: From as low as Php 5,000 for those with a minimum number of membership contributions to Php 25,000 for those with 120 monthly savings or more.

| Number of Membership Contributions | Amount (Php) |

| 24-47 months | 5,000 |

| 48-83 months | 10,000 |

| 84-95 | 15,000 |

| 96-119 months | 20,000 |

| At least 120 months | 25,000 |

However, if you have an existing/outstanding calamity loan from Pag-IBIG, you’ll only receive the difference between 80% of your total savings and the outstanding loan balance.

3. Capacity to pay – which means your loanable amount will be based on how much you earn. Upon applying the deductions to pay for the loan, your net take-home pay must not fall below the recommended minimum amount stated in the company policy or the General Appropriation Act, whichever is applicable.

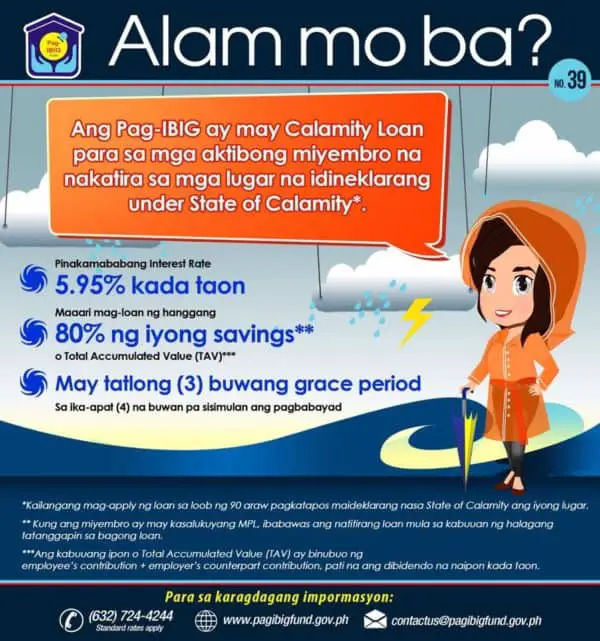

How Much Is the Interest Rate for Pag IBIG Calamity Loan?

Taking into consideration the unfortunate situation the borrowers are in, the Pag-IBIG Fund offers the calamity loan with a 5.95% interest rate per annum, the lowest rate in the market. Note that the same interest rate applies during the grace period of three months.

What Are the Requirements for Pag IBIG Calamity Loan Application?

The borrower must submit the following requirements to any Pag-IBIG Fund office:

1. Duly accomplished Pag-IBIG Calamity Loan Application Form or CLAF (available at Pag-IBIG website and offices).

2. Photocopy of at least 1 valid ID acceptable to the Fund.

Acceptable IDs3 include:

- Passport

- Driver’s License

- PRC ID

- NBI Clearance

- Police Clearance

- Postal ID

- GSIS/SSS card

- Senior Citizen card

- OWWA ID

- OFW ID

- Seaman’s book

- ACR

- Government or GOCC ID

- PWD ID

- DSWD certification

- IBP ID

- Company ID issued by institutions regulated by BSP, SEC, or IC.

3. Proof of income.

If formally employed: Latest payslip authenticated by the company’s authorized signatory(photocopy) OR accomplished “Certificate of Net Pay” portion at the back of the application form by the employer.

If self-employed: Any of the following:

- Income tax return (ITR), audited financial statements, official receipt of tax payments from bank supported with DTI registrant AND Mayor’s permit (photocopy)

- Original copy of commission vouchers (last 12 months)

- Bank statements for the last 12 months (original)

- Certificate of True copy of Transport Franchise (original)

- Certificate of Engagement issued by the owner of the business (original)

- Affidavit of Income (original)

If employed overseas: Employment contract OR Certificate of Employment and Compensation OR ITR filed with the host country.

4. Duly accomplished Declaration of Being Affected by Calamity (for formally employed members; also available at Pag-IBIG website and offices).

5. Photocopy of payroll account, disbursement card, or deposit slip (for a newly-opened account). Pag-IBIG Fund releases the loan proceeds through the Loyalty Card Plus OR Landbank, DBP, or UCPB cash card.

6. Authorization letter (if applying through a representative).

How To File for Pag-IBIG Calamity Loan: Two Ways

Option 1: Walk-in Application

Update: Pag-IBIG Fund branches are now open in most areas of the country due to less strict pandemic protocols. For instance, NCR branches4 are open from 9 AM to 3 PM and have drop boxes for Multi-Purpose Loan and Calamity Loan applications.

You can apply for a calamity loan at any Pag-IBIG office within 90 days after your place of residence or work has been put under the State of Calamity, provided that Pag-IBIG offices remain open and a nationwide lockdown hasn’t been implemented.

Here’s how you can file your application through this standard method:

- Download and accomplish the forms required for the calamity loan application (see the list of requirements in the previous section).

- Submit the duly-accomplished forms along with the other documentary requirements to any Pag-IBIG Fund branch/office. Your loan will be processed only once you have completely submitted all the required documents. A representative will let you know if your loan application is verified. You will also receive your STL-Acknowledgement Receipt.

- Wait for your application to be processed. Once approved, you’ll receive a text notification telling you that you can claim the loan proceeds through your payroll account/disbursement card.

Note that your Pag-IBIG calamity loan application can be submitted also by a representative such as your employer. You only have to provide an authorization letter so that your employer can file the application on your behalf.

Option 2: Online Application

During instances when all Pag-IBIG offices are required to close temporarily and a nationwide calamity forces everyone to stay at home, members are encouraged to submit their loan applications online.

Such is the case with the pandemic in 2020 that prompted President Rodrigo Duterte to sign Proclamation 9295, placing the whole country under the State of Calamity.

The pandemic has led to an unprecedented number of job losses and business closures, hence the need for immediate financial aid for those who are affected.

Here’s a summary of the online application process:

Requirements6.

- Duly-accomplished Pag-IBIG Calamity Loan Application Form. You can download the form, print it out, fill in all the required information, sign it, and then scan/take a photo of it along with the other documentary requirements listed here. If you don’t have a printer at home, you can have the Adobe Acrobat Reader installed on your computer first so you can fill out the form digitally (the signature is not required if you’re filling it out digitally). Note that your employer/authorized company signatory will be required to sign on the Application Agreement portion of the form. You can send him/her a copy before or after filling out the form, whatever works for you;

- 1 valid ID;

- Front and back images of your Loyalty Card Plus, or LandBank, UCPB, or DBP cash card. If this is your first time to borrow and you have none of the aforementioned cards, you’ll be advised by the Pag-IBIG Fund on how you’ll receive the loan proceeds.

- Selfie photo showing your valid ID and cash card.

Online Pag-IBIG Calamity Loan Application Through Virtual Pag-IBIG

If you have a Pag-IBIG Loyalty Card Plus or a cash card issued by a partner bank of Pag-IBIG, you can apply online using Virtual Pag-IBIG.

Here are the steps:

- Visit Virtual Pag-IBIG, the online portal for calamity loan application. Note that you don’t need to have a Virtual Pag-IBIG account to apply for a calamity loan.

- Upon opening the Virtual Pag-IBIG site, download calamity loan application form from the list. Use the guides provided there to help you complete the application form. When you’re done, click the Proceed button to continue.

- Select the calamity loan type that is applicable to you from the drop-down list. For instance, if you have been affected by the onslaught of typhoon “Odette” and you’re from the province of Cebu , select “Cir 449 Odette Cebu”. Cir 449 refers to Circular No. 449 or the Modified Guidelines of Pag-IBIG Calamity Loan Fund.

- Provide your Pag-IBIG membership ID (MID) number.

- After verification of your MID number, provide your contact details such as mobile number and email address.

- Enter the OTP sent to your mobile number.

- Select the cash card you have. Enter the card number then click Check Cash Card Status. Wait for it to be validated.

- Upload the scanned copies or photos of the following: Duly accomplished Calamity Loan Application Form, your valid ID, and a selfie photo showing your cash card and valid ID.

- Submit your application. You will receive your loan reference number that you can use to check the loan status.

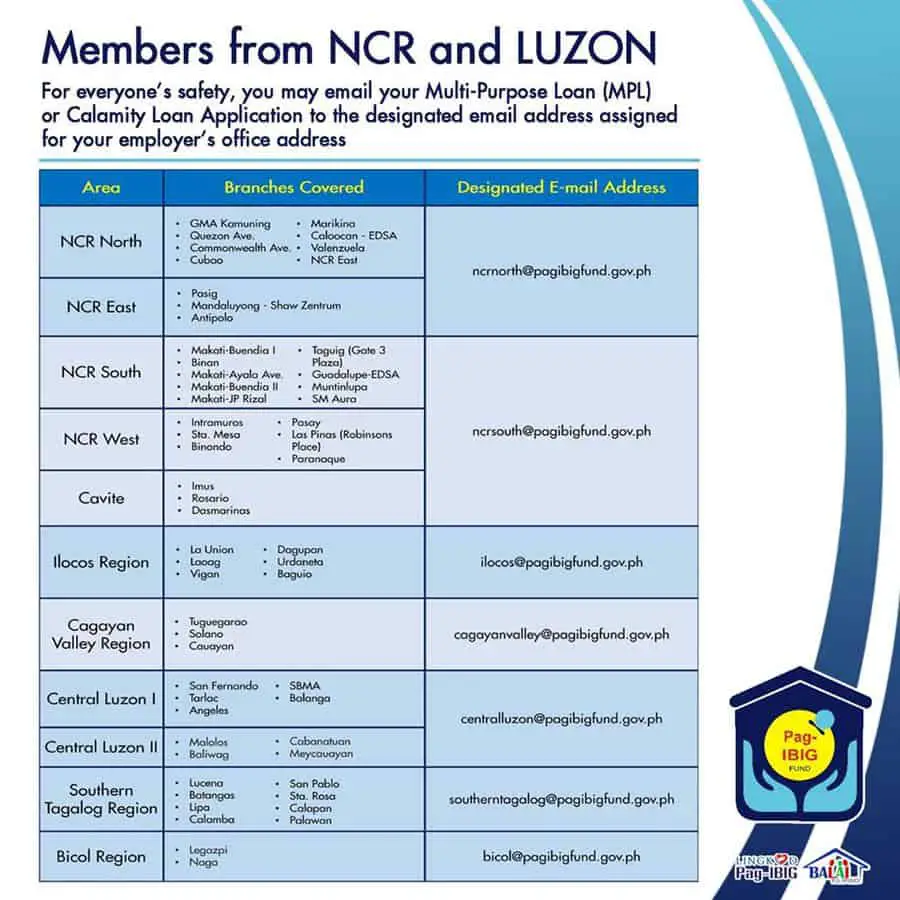

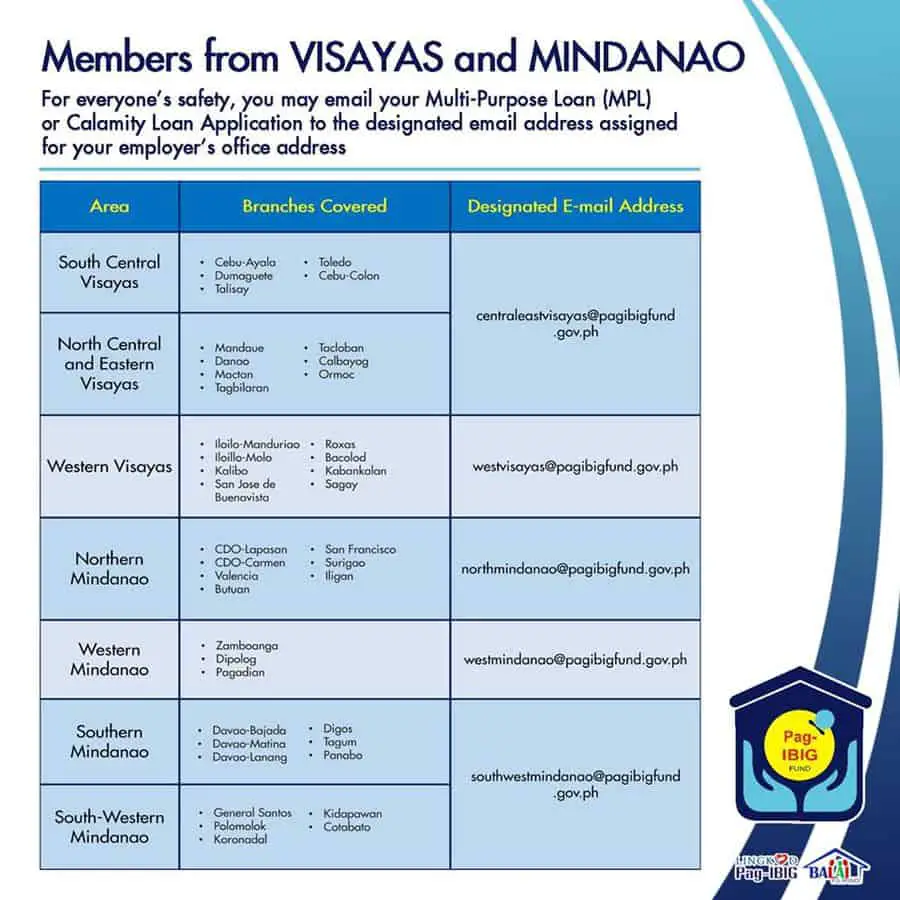

Online Pag-IBIG Calamity Loan Application Through Email

You can also file your Pag-IBIG calamity loan application via email7 by following these steps:

- Download and accomplish the Pag-IBIG Calamity Loan Application form.

- Scan or take a photo of the accomplished Calamity Loan Application form. Send it to your company’s HR or authorized personnel. They will sign the Application Agreement Portion and return the form to you.

- Prepare the scanned copies or clear photos of the following: Valid ID; Landbank/UCPB/DBP Cash Card or Loyalty Card Plus (front and back); and accomplished Calamity Loan Application form signed by the authorized personnel of your company.

- Send the documents indicated in step 3 to the email address of the respective Pag-IBIG fund office assigned to your employer’s office address.

How Long Is the Processing Period of the Calamity Loan Application?

Upon submission of the requirements, it will usually take less than two days for the application to be processed and the loan proceeds to be released.

How Can I Claim/Receive the Pag IBIG Calamity Loan?

After approval of your loan application, you’ll receive the money/loan proceeds through any of the following:

- Disbursement card (i.e., Pag-IBIG Loyalty Card Plus);

- Bank account through LandBank’s Payroll Credit Systems Validation (PACSVAL);

- Check payable to the borrower (Note, however, that checks that are unclaimed for 30 days from the DV/Check date will cause the loan to be canceled);

- Other acceptable modes to be announced by the Pag-IBIG Fund.

How To Pay the Pag IBIG Calamity Loan

This section contains all the information you need to know about how you can pay the Pag-IBIG calamity loan and the penalties you’ll incur for late payment/non-payment.

1. How long am I going to pay for the Pag IBIG Calamity Loan?

The Pag-IBIG calamity loan is payable within a period of 24 months or 36 months as preferred by the member upon application. It comes with an initial grace period of 3 months which means the first payment is due on the 4th month after the loan is released.

If the borrower did not indicate his/her preferred loan term, the default 36-month period will prevail.

2. How can I pay my Pag IBIG Calamity Loan?

It depends on your membership category.

- For formally-employed members: Payments will be made through salary deduction. In case this isn’t possible because of suspension from work, leave of absence without pay, insufficiency of take-home pay, or other related circumstances, the member should pay directly to the Pag-IBIG office;

- For self-employed members, OFWs, and other types of individual payors: Monthly amortizations will be paid over the counter or any other modes of payment approved by the Pag-IBIG Fund. For instance, you can now pay your calamity loans online via Virtual Pag-IBIG.

3. When is the deadline for payment for Pag IBIG Calamity Loan?

Monthly amortizations should be paid on or before the 15th day of each month starting on the 4th month after the loan release.

If the due date falls on a non-working day (i.e., holiday), payment should be made on the first working day following the original deadline/due date.

You can also pay the full amount of your outstanding loan balance prior to loan maturity.

4. How much is the penalty if I fail to pay my Pag IBIG Calamity Loan on time?

The cost of the penalty is 1/20 of 1% of the unpaid amount to be applied for every day of the delay.

If you’re a formally-employed member paying through salary deduction, the said penalty can be reversed provided that you present proof that it’s the fault of your employer why the payment was remitted late. The penalties will then be subsequently charged to the employer.

5. What will happen if I don’t pay the Pag IBIG Calamity Loan?

Defaulting on a loan will cause your outstanding loan to be deducted from your Total Accumulated Value (TAV) or the total savings you’ve accumulated in your regular Pag-IBIG account. This will happen upon your request, provided that the non-payment is due to any of the following reasons as verified and approved by the Pag-IBIG Fund:

- Unemployment;

- Illness (of you or any of your immediate family members) as attested by a certification from a licensed physician;

- Death of any of your immediate family members.

Tips and Warnings

- In case the member dies, the outstanding balance will be computed only up to the date of the borrower’s death. This means that if you have paid in advance and you die suddenly, all the payments received after the date of your death will be refunded to your beneficiaries.

- If you terminate your Pag-IBIG membership before the loan maturity, the outstanding balance will be deducted from your TAV or the total amount you’ve accumulated in your regular Pag-IBIG Savings.

Frequently Asked Questions

1. I want to know if I’m qualified to avail of the Pag-IBIG Calamity Fund. How can I check or verify my total Pag-IBIG contributions?

2. How can I view my Pag-IBIG calamity loan status/records online?

3. What is the Total Accumulated Value (TAV) of Pag-IBIG?

4. Can I still avail of the Pag-IBIG Calamity Loan even if I have an existing loan with Pag-IBIG?

References

- Official Gazette of the Republic of the Philippines. Republic Act No. 10121 (Philippine Disaster Risk Reduction and Management Act of 2010) (2010).

- Pag-IBIG Fund. (2021). Pag-IBIG Fund Circular No. 449 (Modified Guidelines on the Pag-IBIG Fund Calamity Loan Program) (p. 3). Makati City.

- Short-Term Loan (STL). Retrieved 6 January 2022, from https://www.pagibigfund.gov.ph/STL_MPL_Calamity.html#calamitylanding

- Guzman, J. (2021). Pag-IBIG branches in NCR to remain open during ECQ. Retrieved 6 January 2022, from https://pia.gov.ph/news/2021/08/06/pag-ibig-branches-in-ncr-to-remain-open-during-ecq

- Lopez, V. (2020). Philippines placed under state of calamity over COVID-19. Retrieved 6 January 2022, from https://www.gmanetwork.com/news/topstories/nation/730112/philippines-placed-under-state-of-calamity-over-covid-19/story/

- Apply for a Short-Term Loan. Retrieved 6 January 2022, from https://www.pagibigfundservices.com/virtualpagibig/STLReminder.aspx?fbclid=IwAR2xz-YadwoGQ7MqjJT8YA2MKIBX706oDHh_d9_oebj91b9r2RDDUl5arZU

- Filing of Multi-Purpose Loan and Calamity Loan Application via Email – Frequently Asked Questions. Retrieved 6 January 2022, from https://www.pagibigfund.gov.ph/FAQ_STLEmail.html

Written by Luisito Batongbakal Jr.

Luisito Batongbakal Jr.

Luisito E. Batongbakal Jr. is the founder, editor, and chief content strategist of FilipiKnow, a leading online portal for free educational, Filipino-centric content. His curiosity and passion for learning have helped millions of Filipinos around the world get access to free insightful and practical information at the touch of their fingertips. With him at the helm, FilipiKnow has won numerous awards including the Top 10 Emerging Influential Blogs 2013, the 2015 Globe Tatt Awards, and the 2015 Philippine Bloggys Awards.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net