How To Apply for Student Loan: Guide to the Best Educational Loans in the Philippines

A lot of Filipino students dream of having a college or postgraduate diploma. Most of them use it as a ticket for employment and career opportunities.

However, graduating from college or postgraduate studies entails financial costs. You will most likely shoulder the tuition fees, laboratory fees, uniforms, books, and the list goes on. Although there are scholarship grants or financial assistance offered by various institutions, they have limited slots or are sometimes unavailable.

Fortunately, student loans are now a thing in our country. Whether you are a college or a postgraduate student aiming for a diploma, student loans will help you achieve that. Let this article guide you to the best student loans in the Philippines.

Table of Contents

- At a Glance: Best Student Loans in the Philippines

- What Is a Student Loan?

- Where Can I Apply for a Student Loan in the Philippines?

- How To Choose the Right Student Loan Program in the Philippines

- How To Pay Off Your Student Loan

- Tips and Warnings

- Frequently Asked Questions

- 1. Are there student loans in the Philippines available for those who want to study abroad?

- 2. Are student loans in the Philippines “debt traps”?

- 3. I want to loan for gadgets (e.g. laptops) for my online classes. Are there gadget loans available for me?

- 4. I have a student loan that I need to repay after graduation, but I need to take a licensure exam before having a job. How can I pay the loan while studying?

- 5. I’m applying for a student loan. What are the IDs that are usually accepted?

- References

At a Glance: Best Student Loans in the Philippines

| Loan | Loan Amount | Loan Provider |

| CHED Unified Student Financial Assistance System for Tertiary Education (UniFAST) Student Loan Program | ₱60,000 | CHED |

| Government Service Insurance System (GSIS) Educational Loan | ₱100,000 | GSIS |

| Social Security System (SSS) Educational Assistance Loan Program (EALP) | ₱20,000 | SSS |

| InvestEd Student Loan | ₱100,000 | InvestEd |

| Bukas Tuition Installment Plans (Student Loans) for College and Graduate Students | Up to 100% of tuition fee | Bukas Finance Corp. |

| BDO Personal Loan | ₱1,000,000 | BDO |

| BPI Personal Loan | ₱20,000 | BPI |

| Security Bank Personal Loan | ₱30,000 | Security Bank |

| University of the Philippines (UP) Student Loans | Varies on the type of loan | UP |

| De La Salle University (DLSU) Student Loan Program | Up to 100% of tuition fee | DLSU |

| Mapua University Student Financial Assistance Program (STUFAP) | ₱8,000 | Mapua University |

| STI-Landbank Student Loan | Based on the student’s total assessment amount | STI |

What Is a Student Loan?

A student loan refers to the money you borrow from public or private institutions to fund your education. You have to pay the lender the principal amount borrowed together with interest.

Student loans in the Philippines are similar to their Western counterparts such that you can repay the loan either before or after you finish your studies. But whereas US Federal student loans have a 10-year loan term under the Standard Repayment Plan1, lending institutions here have different repayment terms.

There are student loans in the Philippines that you can repay within one year (CHED UniFAST short-term loan), 5 years (SSS Educational Assistance Loan Program), or 10 years (GSIS Educational Loan).

Furthermore, we are more familiar with scholarships or financial assistance to fund our education. So unlike in the West, student loans are not that popular here. They only started to get traction as different institutions began initiating affordable and inclusive student loan programs.

Where Can I Apply for a Student Loan in the Philippines?

Student loans can come from different sources. In this article, we’re going to explore the student loan programs offered by the government, non-government banks, and institutions, as well as student loans available in specific universities and for specific courses.

Student Loans in the Philippines Offered by Government Institutions

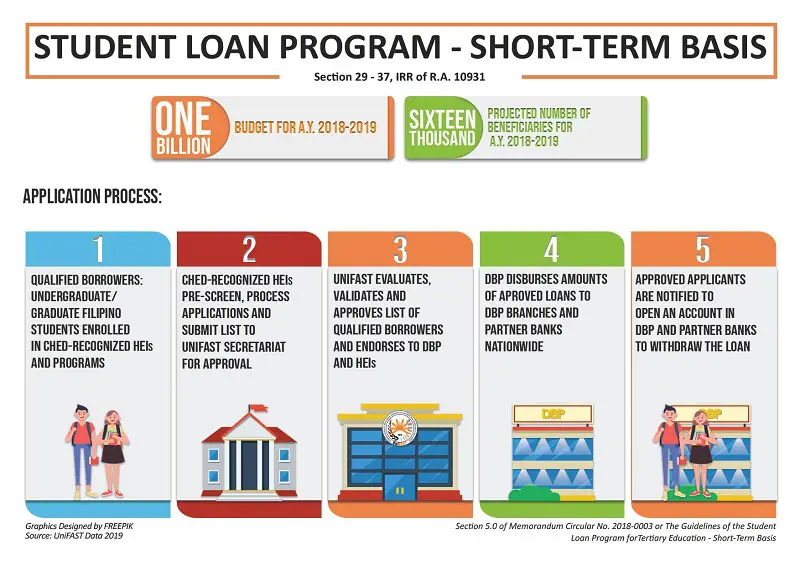

1. CHED Unified Student Financial Assistance System for Tertiary Education (UniFAST) Student Loan Program

Description: As an institution that promotes tertiary education to the youth, CHED offers short-term student loans2 to support:

- College students

- Graduates who will review for their licensure exam

- Graduate students

- Medical students

- Law students

UPDATE: CHED UniFAST Student Loan Program has officially replaced the more commonly known CHED Study Now Pay Later Program (SNPLP)3. CHED discontinued SNPLP in 2018 because of its low repayment rate. Unlike in the previous loan program where students can pay their debt two years after employment, UniFAST requires loan repayment to be done before graduation.

Qualifications:

- Must be a Filipino undergraduate or graduate student enrolled in any of the State University Colleges (SUCs) or CHED-recognized Local University Colleges (LUCs) and private Higher Education Institutions (HEIs).

- Have not availed of the loan program during their undergraduate studies (For graduates who will review for their licensure exam as well as postgraduate, law, or medical students).

- Pursuing a program accredited by CHED

Loan Amount: Maximum of ₱60,000

Interest Rates, Charges, and Fees4:

- If the loan was paid on or before the end of the semester: No interest (0%)

- If the loan was not paid on or before the end of the semester: 6% or the prevailing interest rate in the Philippine Dealing System for a term of one year, whichever is lower, from the time the short-term loan was availed.

Loan Repayment Terms:

The loan can be paid within one year. Loan repayment can be done over the counter at any Development Bank of the Philippines (DBP) branch. The student can also direct the payment to the school, which will then remit the payment to any DBP branch.

Requirements:

- Accomplished and signed Student Loan Program Application Form

- Recent 1” x 1” ID picture of the applicant and co-maker

- Certificate of Registration or Enrollment

- Income Tax Return (ITR) of the applicant (if employed) or other proof of family income

- School ID of the applicant

- Government-issued ID of the co-maker

- Any of the following (for the guarantor or co-maker): Latest Income Tax Return (ITR) filed; Certificate of Tax Exemption from the BIR; or copy of the latest contract or any of proof income (For children of OFWs and seafarers)

How to Apply for CHED Unifast Student Loan Program

- Fill out the Student Loan Program Application form. You can visit CHED’s official website here and download the form. Paste your 1” x 1” picture and your guarantor in the form.

- Submit documentary requirements to your school. Your school will then pre-screen your loan application and endorse it to Unifast regional coordinators.

- Wait for the notice of approval or disapproval from the UniFast Central Office. Once your application is approved, you need to accomplish and sign the loan documents and submit them to your Higher Education Institution (HEI).

- Wait for the list of DBP-approved student beneficiaries. UniFast is the one that will provide the list of DBP-approved student beneficiaries.

- Open a DBP account. The DBP credits the loan proceeds to your DBP account or HEI account.

Other information: For inquiries, please contact CHED UniFAST at [email protected]

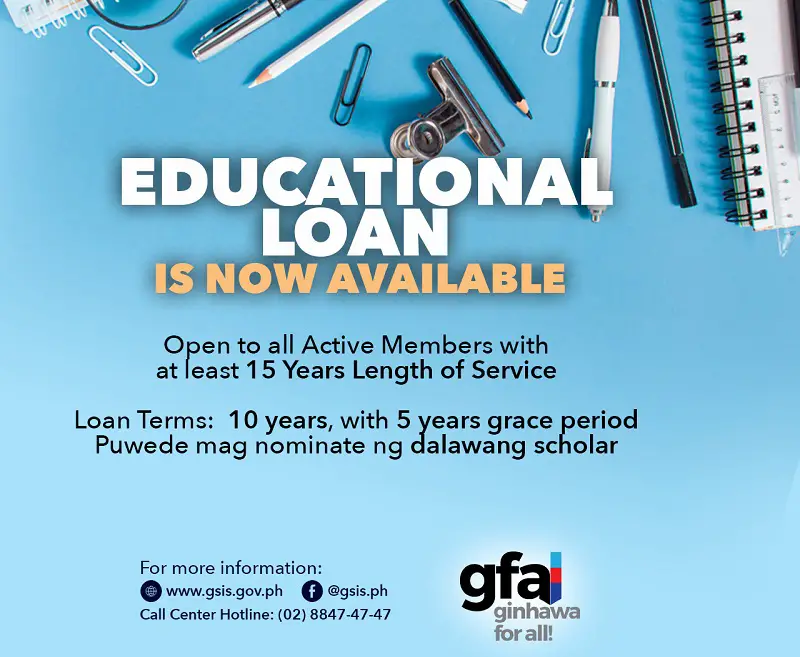

2. Government Service Insurance System (GSIS) Educational Loan

Description: GSIS provides a “Study Now, Pay Later” program5 to finance the educational expenses of GSIS members’ kins. GSIS members can nominate two student beneficiaries in this program.

Qualifications:

For the GSIS member-borrower:

- Must have served the government for at least 15 years

- Must have a net take-home pay of at least ₱5,000 (after deduction of monthly premium contributions and loan amortization)

- Must not be on leave of absence without pay

- Has no pending administrative case

- Has no past due GSIS loan

For the student-beneficiary:

- Must be related to the GSIS member-borrower to the third degree of consanguinity or affinity

- Pursuing a four- or five-year course in a public or private educational institution

Loan Amount: Maximum of ₱100,000 per academic year.

Interest Rate: 8% per annum6.

Loan Repayment Terms:

- The loan can be paid for 10 years

- Paid in monthly installments

- Collection of payments will only start on the 6th year of the loan, meaning you are not required to pay anything for the first five years

Requirements:

- Duly accomplished Application Form endorsed by the borrower’s authorized agency officer

- Latest Tuition Fee Assessment Form (Photocopy)

- Photocopy of the school ID (front and back) with three signatures of the student-beneficiary or any valid government-issued ID (with photo, signature, and birthdate of the student)

How to Apply for Government Service Insurance System (GSIS) Educational Loan

You may apply through the e-GSISMO or GSIS website. You can also submit your application to the drop boxes placed in various GSIS Offices.

Other Information:

- In the event that the member-borrower or student beneficiary dies or becomes totally disabled, the loan would be assumed paid, thanks to the redemption insurance

- For more information, you may contact the agency through their website or email address, [email protected]

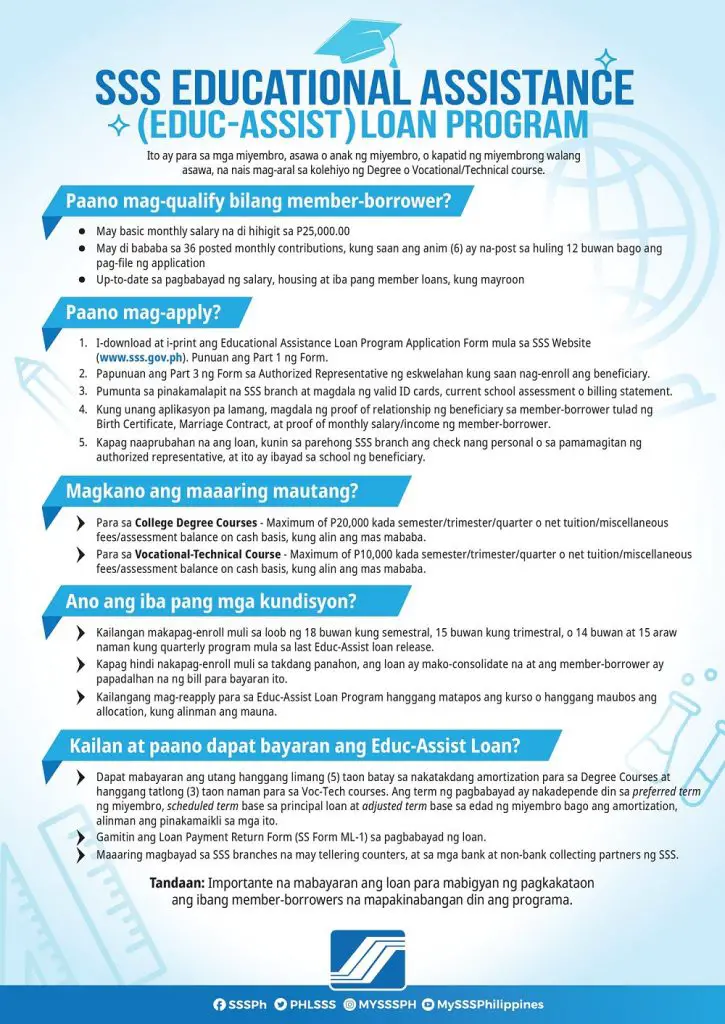

3. Social Security System (SSS) Educational Assistance Loan Program (EALP)

Description: This loan helps SSS members finance the educational expenses of their student beneficiaries which could be their child, spouse, or sibling7. The member-borrower can also avail of the loan to support his/her own studies.

Qualifications:

For Member-borrowers:

- Below 60 years old

- Monthly income salary of ₱25,000 or below

- Has at least thirty-six (36) posted monthly contributions, six of which were in the last twelve months prior to the month of application

- Has no overdue SSS loan

For student beneficiaries:

- Must be a child (legitimate, illegitimate, or legally adopted), legal spouse, or sibling of the member borrower

- Has no full-tuition scholarship

- Must take a course administered by CHED, TESDA, Civil Aviation Authority of the Philippines, or any institutions recognized by the government

Loan Amount:

- Maximum of ₱20,000 per program term

- For 4-year degree programs: Maximum of 8 semesters / 12 trimesters / 16 quarters availments or a maximum of ₱160,000 full allocations.

- For 5-year degree programs: Maximum of 10 semesters /15 trimesters / 20 quarters availments or a maximum of ₱200,000 full allocations.

- For 2-year Vocational or Technical Course: Maximum of ₱10,000 per semester

Interest Rate, Charges, and Fees:

- Interest rate: 50% of this loan is funded by the National Government while 50% is funded by the SSS. The National Government portion of the loan has 0% interest while the SSS portion of the loan has a 6% per annum interest rate based on diminishing principal balance until completely paid

- Maintenance Charge: 2% of the principal loan which shall be included in the amortization

- Penalty: 1% per month for any unpaid amortization

Loan Repayment Terms:

- Repayment starts after 18 months for semestral programs; 15 months for trimestral programs; or 14 months and 15 days for quarter programs from the month of the last release

- The loan is payable up to five years (for 4 and 5-year degree programs) or three years (for Technical/Vocational courses)

- Payment is made through any SSS branch or SSS accredited banks

Requirements:

- Valid ID

- Accomplished EALP Application form

- Assessment billing from the school

- Proof of monthly Income of the member-borrower

- Proof of relationship to the beneficiary

How to Apply for Social Security System (SSS) Educational Assistance Loan Program (EALP)

- Secure a copy of the EALP Application Form. You may download it here.

- Submit the application form and documentary requirements. You can submit them to the nearest SSS branch.

Student Loans in the Philippines Offered by Non-Government Banks and Institutions

1. InvestEd Student Loan

Description: InvestEd8 has helped students from different universities through their inclusive and easy loan application. Aside from lending money to students, they also coach the borrowers on how to manage and pay their loans.

Qualifications:

- Filipino citizen

- At least 18 years of age

- Must be in the last two years of college

- Enrolled in any university in the Philippines

Loan Amount: May range from ₱10,000 to ₱100,000, depending on students’ financial needs, year level, and other factors.

Interest Rates, Charges, and Fees:

- Interest Rate: 2.3% to 2.9% monthly

- Service Fee: 22% of the requested loan amount, or ₱3,000 (whichever is higher)

Loan Repayment Terms:

The InvestEd Basic Plan allows borrowers to begin repayment once they have graduated. Repayment plans are open for adjustments to assure students will be able to pay their loans.

Monthly payments can be done through any of the following:

- Online and offline bank payments

- Bayad centers

- Pawnshops

- Convenience stores

Requirements:

- Online Application Form

- If you’re qualified for the loan, InvestEd will request documents about your: Enrollment status, address and Philippine Government Identity, and loan guarantors’ identity

How to Apply for InvestEd Student Loan

- Apply Online. You may access their online application here. After submitting your application, you will be notified within 2 to 5 days if your application has been approved

- Phone Interview. A loan officer will contact you to verify your information and provide you with a sample loan computation.

- Submit Requirements. You will be asked by InvestED to submit documentary requirements to process your application.

- Sign the loan agreement and select your preferred disbursement channel and schedule. You will be notified to sign the loan agreement and select the means of accepting the loan amount.

Other Information:

- InvestED has its Investee Success Program that provides borrowers with tips and strategies for pursuing their careers. You will be part of the Investee Success Program once you’ve qualified for the loan.

- Unfortunately, InvestED can only support select degree programs.

- You may visit this FAQ section to learn more about InvestED Student Loans.

2. Bukas Tuition Installment Plans (Student Loans) for College and Graduate Students

Description: Bukas Finance Corp. provides affordable student loans for undergraduate and postgraduate students of their partner institutions. Through their tuition payment plans, they assist students and parents achieve a brighter future.

Qualifications:

- Filipino citizen

- At least 18 years of age

- About to enroll or enrolled as an undergraduate or postgraduate student in any of Bukas Partner Schools (see list below)

Loan Amount: Up to 100% of tuition fee including other enrollment and miscellaneous fees

Interest Rate, Charges, and Fees:

- Interest Rate: 1.5% per month

- One-time Service (Origination) Fee: 3%

Loan Repayment Terms:

- The loan is payable for 12 months

- 12 monthly payments

- Repayment starts exactly 30 days

Requirements9:

- Student ID (if you don’t have a student ID you may submit any valid ID10)

- School Assessment Form (which could be your tuition billing, registration form, or a screenshot of your student portal)

- One valid proof of income such as BIR Income Tax Return (ITR), payslips, Certificate of Employment with monthly income (issued within the last 3-6 months), DTI permit (if with business), Employment Contract (if OFW).

- One proof of residence (UMID, Driver’s License, Barangay Certificate, Police Clearance, etc.)

- Complete copy of grades

How to Apply for Bukas Tuition Installment Plans

- Create an account. You may register here.

- Complete your profile. Provide all required information until you reach Profile Level 3. Provide your contact details as well as your guardian’s and guarantor’s contact details and proof of income. To increase your chance of being qualified, provide more information including a link to your Facebook account to reach Profile Level 5.

- Fill out the application form. Afterward, you will receive feedback within 1 to 2 business days.

- Once approved, review the approved tuition amount and plan details in your Bukas account. After reviewing, you can now confirm your application.

- Wait for the tuition disbursement. After 1 to 2 business days, Bukas will disburse the tuition amount to your school.

3. BDO Personal Loan

Description: This multi-purpose personal loan from BDO can cover your educational expenses such as tuition fees and electronic gadgets for online education.

Qualifications:

- Filipino citizen or foreign resident of the Philippines

- At least 21 years old but not more than 70 years old

- Regular employee with a minimum fixed annual income of ₱180,000 OR self-employed with a business operating for at least two years with a minimum fixed annual income of ₱400,000.

- Resides or works in an office near a BDO branch

Loan Amount: Minimum of ₱10,000 to a maximum of ₱1,000,000 which can be repaid in 6 to 36 months.

Interest Rate, Charges, and Fees:

The interest rate depends on your loan tenor:

- Loan Tenor of 6 months: 26.27% per annum

- Loan Tenor of 12 months: 26.63% per annum

- Loan Tenor of 18 months: 26.76% per annum

- Loan Tenor of 24 months: 26.58% per annum

- Loan Tenor of 36 months: 25.98% per annum

Processing Fee: ₱1,300 (deducted from loan proceeds)

Late Payment Fee: ₱300 or 5% of the amount due (whichever is higher)

Documentary Stamp Tax Fee (for a loan amount that exceeds ₱250,000)

Returned Check Fee: ₱500 per returned check

Installment Processing Fee: ₱300 or 5% of the outstanding principal balance (whichever is higher)

Loan Repayment Terms:

- You can choose your payment term from 6, 12, 18, 24, or 36 months.

- Monthly Installments are paid via Auto Debit Arrangement (ADA) or Over-the-counter (OTC) at any BDO branch

Requirements:

1. Proof of Income

If you are an employee:

- Latest BIR Income Tax Return (Photocopy)

- Any of the following: Original Certificate of Employment, service tenure, or compensation breakdown.

If you are self-employed or a professional:

- Latest BIR Income Tax Return (Photocopy)

- Audited Financial Statements for the last two years

- Registration of Business Name

- Latest three months’ bank statement

2. Proof of Identification.

- Two valid IDs (can be Passport, Driver’s License, UMID, Police Clearance, Senior Citizen Card, etc.)

How to Apply for BDO Personal Loan

- Check your qualifications and prepare documentary requirements. Refer to our list above for BDO Personal loan qualifications and documentary requirements.

- Submit your application to any BDO branch near you

Related: How to Open a BDO Savings Account: An Ultimate Guide

4. BPI Personal Loan

Description: This multi-purpose loan helps parents fund the educational needs of their children. As long as you meet the loan qualifications, you can enjoy its benefits.

Qualifications11:

- Must be a Filipino citizen

- At least 21 years old but not more than 60 years old

- Must be residing in the Philippines (If you are an OFW, you have to be physically present to sign the loan documents in any BPI branch)

- Must be working or residing 30 kilometers from the nearest BPI branch

Loan Amount: Minimum of ₱20,000

Interest Rate, Charges, and Fees:

- Annual Contractual Rate/Interest Rate: 25.60%

- One-time Processing Fee: ₱1,500

- Documentary Stamp Tax: ₱1.50 for every ₱200 loan amount (for loans above ₱250,000)

Loan Repayment Terms:

- The loan is paid through monthly installments via automatic debit from your BPI Deposit Account

- The first payment installment starts 30 days after the loan booking date

- Monthly amortization is equal to the interest (principal loan amount multiplied by 1.2%) plus principal

Requirements12:

- One valid government-issued ID with photo and signature

- Duly accomplished and signed application form

- Proof of Income: Payslips for the last 3 months or latest ITR from BIR (for employed or professionals) or latest Audited Financial Statements / ITR / DTI or SEC Business Registration Certificate (for self-employed)

How to Apply for BPI Personal Loan

- Secure an application form. You may access their site for the application form

- Submit your application and documentary requirements. Send scanned copies to [email protected]

- Wait for an email notification. You will be notified if your application was received.

- Wait for the SMS notification. You will be notified of your loan status within 5 – 7 banking days.

Other Information: BPI has its own loan calculator which you may use to determine your monthly installment.

Related: How to Open a BPI Savings Account: An Ultimate Guide

5. Security Bank Personal Loan

Description: Security Bank offers a multi-purpose loan that can cover your educational expenses. Whether you are a parent looking for a way to fund your child’s college or a young professional dreaming of pursuing a postgraduate study, this personal loan can help you.

Qualifications:

- Filipino citizen

- 21 – 65 years old

- If employed: Minimum gross monthly income of ₱15,000 if living in Metro Manila or ₱12,000 if residing outside Metro Manila

- If self-employed: Must own a business that has been operating for at least 2 years, with a minimum gross monthly income of ₱100,000

Loan Amount: Minimum of ₱30,000

Interest Rate, Charges, and Fees:

- Monthly Add-on Rate: 1.89% (Annual Percentage Rate starts at 39.53%)

- Processing Fee: ₱2,000

- Late Payment Fee: 3% of the amount due or ₱500 (whichever is higher)

- Documentary Stamps (for loans amounting to ₱250,000 and above): ₱1.50 per ₱200 of the loan amount

- Notarial Fee: ₱100

Loan Repayment Terms:

You can pay the loan amount for 12, 18, 24, or 36 months. Payment is done in monthly installments.

Requirements:

- Application Form

- One valid government-issued ID

- If employed: Any of the following – Certificate of Employment and Compensation within the last six months, latest ITR, or latest payslip (one month)

- If self-employed: Latest Audited Financial Statement (one year), SEC/DTI registration, Business/Mayor’s permit, latest three-month bank statements

How to Apply for Security Bank Personal Loan

- Apply online. You may access the online application here.

- Attach scanned copies or photos of documentary requirements. Refer above for the requirements

- Finish application. Agree to the terms and conditions and wait for SMS confirmation.

Related: How to Choose a Bank: An Ultimate Guide to the Top Banks in the Philippines

Student Loans in the Philippines Offered by Universities

1. University of the Philippines (UP) Student Loans

Listed below are the student loans for UP students available on some campuses:

- UP Diliman (UPD) Student Loans. UPD offers five types of student loans that may cover tuition fees and other expenses.

- UP Open University (UPOU) Student Loan. This student loan provides financial assistance to help qualified students of UPOU complete their registration.

- UPLB Tuition Loan/Student Loan Board Program. Open to all undergraduate and graduate UPLB students except to those who are taking up non-degree programs.

- UP Manila Student Loan. This student loan funds part of the tuition fee and other expenses of qualified undergraduate and graduate students of UPM.

- UP Cebu Student Loan. With a 6% interest rate, this student loan covers the school fees of qualified UP Cebu students.

Related: 30 Things You Didn’t Know About University of the Philippines

2. De La Salle University (DLSU) Student Loan Program

De La Salle University offers a short-term interest-free loan13 for tuition fee payment of its undergraduate and graduate students. The borrower must be a student of DLSU with at least one term of enrollment and has no unsettled loan.

Loan Amount: Maximum of 100% of tuition fee.

Interest Rate: 0% if paid before the deadline, 1% per month after the deadline.

The deadline for payment is at the end of week 8 of the loan term.

Other Information:

- Documentary requirements are listed here.

- For more details, you may send an inquiry to [email protected]

3. Mapua University Student Financial Assistance Program (STUFAP)

This student loan program is open to 3rd and 4th-year students of Mapua University14. Qualified borrowers may loan a maximum of ₱8,000 without interest.

4. STI-Landbank Student Loan

This loan15 is offered to first, second, and third-year college students of STI who are enrolled in a 4 or 5-year course or 2 to 3-year technical-vocational program. The total loanable amount is based on the student’s total assessment amount indicated in the Registration Form.

To apply, the borrower must submit the following:

- Two valid IDs (at least one must be a government-issued ID)

- Proof of address (latest utility bills or latest bank statements)

You may submit your application online or to your preferred STI campus.

Student Loans in the Philippines for Specific Courses

- ADMU School of Law Student Loan. This student loan is granted to qualified Ateneo De Manila University law school students based on merit and needs.

- DLSU College of Law Student Loan. A short-term interest-free loan that covers tuition and other school fees of De La Salle University (DLSU) College of Law students.

- Alpha Aviation Group Study Now Pay Later Program (for Cadet Pilots). This program, in partnership with RCBC Savings Bank, helps aspiring pilots finance their training with Alpha Aviation Group of the Philippines.

How To Choose the Right Student Loan Program in the Philippines

Selecting the best student loan out there is not a cakewalk. Hence, here are some tips to help you choose the student loan that suits you best:

1. Consult Your Parents or Guardians

Most lending institutions require you to have a loan guarantor or a co-borrower who is usually your parent or guardian. For this reason, you have to consider their opinion on which student loans they deem are manageable not only for you but also for them. Never make a decision on your own.

2. Make Sure the Lending Institution Is Legitimate

Consider only those recognized by the Securities and Exchange Commission (SEC) and have a good profile. You may visit their websites or ask students who have taken loans from these institutions so you can verify their legitimacy.

3. Compare Student Loans Before Deciding

Select the one with a low-interest rate, no hidden fees, and fewer charges. Furthermore, make sure that it provides you ample time to pay, an easy repayment process, and adjustments for any untoward circumstances.

4. Understand the Loan Terms

Once you have that “best” student loan in mind, don’t sign everything immediately. Make sure first that you understand its terms.

To determine whether you understand everything about the loan, you must be able to answer the following:

- How much are the loan amount, interest rate, and other charges?

- When do I have to start paying for the loan?

- How long do I need to pay the loan?

- What will be my monthly (or periodic) payments?

If you can’t answer any of these questions, contact the lending institution and let them clarify everything for you.

How To Pay Off Your Student Loan

- Avoid delayed periodic payments. Delayed installments incur penalties which only further increase your burden. If you can make a payment this month, don’t wait until next month to pay it off.

- Make the advanced payment if possible. If you have extra money, you can make an advanced payment to lower your installment next period.

- Take advantage of the “grace period”. Your lender may give you some time to adjust and secure employment after graduation. This is your grace period. Ensure that your grace period is spent well by looking for an employment opportunity.

- Accept consultations and coaching offered by the lending institution. These personal consultations will help you manage your finances and provide you with tips to pay your loan on time.

Tips and Warnings

- Student loans should be your last resort. There are other options that can help you including scholarships, student financial assistance, and student assistantship programs. These options are a lot better than student loans since you don’t have to pay them. Make sure that you’ve considered these options first before availing of a student loan.

- Beware of loan sharks. As you search for a potential lender, you might meet loan sharks. Loan sharks will lend you money but with high-interest rates. Beware of loan sharks as they operate outside the law, do not provide contracts, and may use violence once you defer paying.

- Use your student loan for educational purposes only. Refrain from spending it for personal purposes such as leisure or food.

- Do not lend your student loan money. Lending it even to your relatives or friends can be risky.

Frequently Asked Questions

1. Are there student loans in the Philippines available for those who want to study abroad?

Most student loans in the Philippines require you to study at a local university or college. However, there are overseas private institutions that offer loans for those who want to study abroad. These include:

- MPower Financing – available only for those who have been accepted in select schools in US or Canada.

- Prodigy Finance – supports about 800 schools globally within the fields of business, engineering, law, public policy, and medicine.

If you want to study abroad but have no luck with student loans, consider applying for scholarship grants to sustain your international studies.

2. Are student loans in the Philippines “debt traps”?

It depends on where and how you obtain the student loan. You’re not supposed to be subjected to unrealistically high-interest rates as there are laws16 that protect borrowers from possible abuses of the lender. Make sure that your lender is transparent and has no hidden charges.

3. I want to loan for gadgets (e.g. laptops) for my online classes. Are there gadget loans available for me?

Yes, some of these loans are:

- Landbank I-STUDY Program – offers a loanable amount of ₱50,000 per student to help finance the purchase of learning gadgets such as laptops, desktops, or tablets. This loan can be included in the maximum loanable amount of ₱150,000 per student and ₱300,000 per parent-borrower to cover payment of tuition fees and other educational expenses. Note: This loan is available only for the school year 2021 – 2022.

- Home Credit Computer and Laptop Loan – open to Filipinos aged 18 – 68 years old who have primary and secondary IDs. You may loan for the purchase of a computer or laptop and pay the said loan in monthly installments.

4. I have a student loan that I need to repay after graduation, but I need to take a licensure exam before having a job. How can I pay the loan while studying?

Your lender may provide you with a grace period after you graduate so you can focus on reviewing. However, it is helpful to consult your loan officer about adjusting your repayment terms.

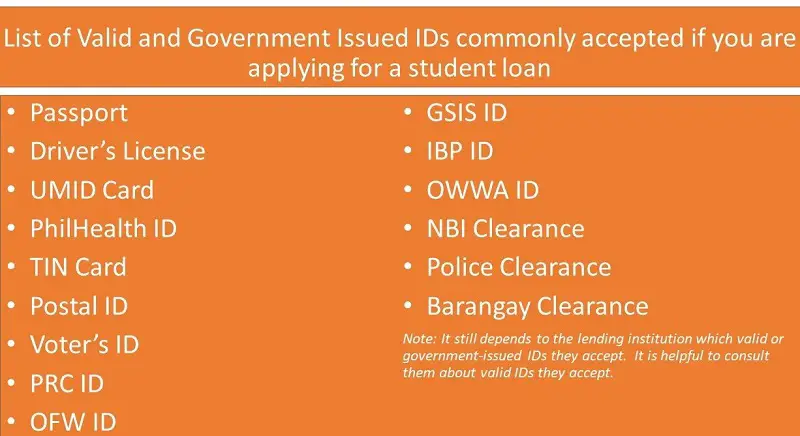

5. I’m applying for a student loan. What are the IDs that are usually accepted?

You may consult the lending institution or its website for the list of IDs they accept. Meanwhile, here is a list of IDs that are commonly accepted by lending institutions:

References

- Federal Student Aid Repayment Plans. Retrieved 13 July 2021, from https://studentaid.gov/manage-loans/repayment/plans

- CHED/UniFAST, DBP launch national Student Loan Program. (2019). Retrieved 13 July 2021, from https://ched.gov.ph/ched-unifast-dbp-launch-national-student-loan-program/

- CHED Scraps ‘Study Now, pay later’ program due to low repayment rate. (2022, September 7). Retrieved December 14, 2022, from https://www.cnnphilippines.com/news/2022/9/7/CHED-scraps-study-now-pay-later-program.html?fb

- Tomacruz, S. (2019). CHED allots P1 billion for short-term student loan program. Retrieved 13 July 2021, from https://www.rappler.com/nation/ched-allotment-for-student-loan-program

- GSIS opens ₱20B study-now, pay-later loan program for members’ kin. (2020). Retrieved 13 July 2021, from https://www.gsis.gov.ph/gsis-opens-php20b-study-now-pay-later-loan-program-for-members-kins/

- Villanueva, J. (2020). GSIS educational loan program extends 5-year payment leeway. Retrieved 13 July 2021, from https://www.pna.gov.ph/articles/1121529

- SSS Corporate Communications Department. (2017). Revised Guidelines for the SSS Educational Assistance Loan Program [PDF]. Retrieved from https://www.sss.gov.ph/sss/DownloadContent?fileName=Educ_Assist_Brochure_Oct23.pdf

- InvestEd Student Loan Help Center. Retrieved 13 July 2021, from https://invested.ph/borrower-faqs

- What Valid Documents Do I Need to Apply for a Tuition Installment Plan. Retrieved 13 July 2021, from https://bukas.ph/help-center/what-valid-documents-do-i-need-apply-tuition-installment-plan/

- I still don’t have a school ID. what do I submit? (n.d.). Retrieved December 14, 2022, from https://bukas.ph/help-center/i-still-dont-have-a-school-id-what-do-i-submit/

- List of Required Documents. Retrieved 13 July 2021, from https://www.bpipersonalloans.com/requirements

- List of Requirements When Applying for a Personal Loan. Retrieved 13 July 2021, from https://www.bpi.com.ph/borrow/personal/regular/requirements

- De La Salle University. De La Salle University Student Loan Program [PDF]. Retrieved from https://www.dlsu.edu.ph/wp-content/uploads/pdf/scholarships/sfa1112t3-Student-Loan-Program.pdf

- Student Financial Assistance Program (STUFAP). Retrieved 14 July 2021, from https://www.mapua.edu.ph/About/Offices/CSFA/Financial-STUFAP.aspx

- About the Landbank-STI Student Loan Program. Retrieved 14 July 2021, from https://studentloan.sti.edu/default.asp#features

- Republic Act No. 3765 or the Truth in Lending Act (1963).

Written by Jewel Kyle Fabula

Jewel Kyle Fabula

Jewel Kyle Fabula graduated Cum Laude with a degree of Bachelor of Science in Economics from the University of the Philippines Diliman. He is also a nominee for the 2023 Gerardo Sicat Award for Best Undergraduate Thesis in Economics. He is currently a freelance content writer with writing experience related to technology, artificial intelligence, ergonomic products, and education. Kyle loves cats, mathematics, playing video games, and listening to music.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net