How To Apply for Pag-IBIG Housing Loan: An Ultimate Guide

Having a house they can call their own is every Filipino family’s dream. A dream that millions of Filipinos are still struggling to turn into a reality, as proven by the results of the 2020 Annual Poverty Indicator Survey of the Philippine Statistics Office 1, which shows that only three in five families, or 59.8 own a house and lot.

Fortunately, the Pag IBIG housing loan continues to evolve to meet the housing needs of every Filipino, including minimum wage earners.

If you don’t want to be a statistic, there’s no better time to apply for a Pag IBIG housing loan than now. Even the 2020 pandemic is not a hindrance to avail of the government’s low-cost housing loan. In fact, Pag IBIG announced in 2020 that they are increasing their construction fund from ₱2 billion to ₱10 billion in order to continue supporting the housing market and the Philippine economy2. And in 2021, they released ₱9.71 billion in loans3 for socialized housing.

This always-updated guide provides everything you need to know about Pag IBIG housing loan and its application process.

Related: How to Compute Your Pag-IBIG Contribution: A Complete Guide to Contribution Table and Payment

Table of Contents

- What Is a Pag IBIG Housing Loan?

- Pag IBIG Housing Loan vs. Bank Housing Loan: What’s the Difference?

- Pag IBIG Housing Loan Requirements

- How To Apply for Pag IBIG Housing Loan: A 8-Step Guide to Getting Approved

- 1. Check if You’re Eligible To Apply for the Pag IBIG Housing Loan

- 2. Know Your Purpose for Applying for the Pag IBIG Housing Loan

- 3. Choose the Pag IBIG Housing Loan Program That Matches Your Current Income Level

- 4. Complete All the Pag IBIG Housing Loan Requirements

- 5. Submit All Housing Loan Requirements to Pag IBIG

- 6. Wait for the Approval of Your Pag IBIG Housing Loan

- 7. Claim Your Check/Loan Proceeds at the Pag IBIG Fund

- 8. Start Paying Your Monthly Amortization

- Tips and Warnings

- Frequently Asked Questions

- 1. How much will Pag IBIG deduct from my salary if my housing loan is approved?

- 2. What is a fixed pricing period?

- 3. I haven’t decided on which property to buy yet. Can Pag IBIG provide assistance?

- 4. Can I avail of the housing loan even if I still have an outstanding loan with Pag IBIG?

- 5. Can a Pag IBIG member apply for multiple/additional housing loans?

- 6. How many co-borrowers can I have?

- 7. What is the loan-to-value ratio?

- 8. How much can I borrow from the Pag IBIG housing loan?

- 9. How long does it take for my Pag IBIG housing loan to be approved?

- 10. How can I apply for a Pag IBIG housing loan if I’m an OFW?

- 11. Can I make a lump-sum payment to reach the required 24 monthly contributions for the Pag-IBIG housing loan?

- 12. How many months of missed payments before I am considered to default on my Pag-IBIG housing loan?

- 13. What happens if I default on my Pag-IBIG housing loan?

- References

What Is a Pag IBIG Housing Loan?

The Pag IBIG Fund, also known as the Home Development Mutual Fund (HDMF), was established on June 11, 1978, by virtue of Presidential Decree No. 15304 to serve the two basic needs of Filipino workers:

- a national/government savings program; and

- affordable housing/shelter financing.

In other words, Pag IBIG isn’t just a government agency you go to if you want to secure a housing loan; it’s also a good alternative to a bank because the money you put in your Pag IBIG savings earns higher interest (4-5% versus 1% per annum offered by most banks) over time.

Your Pag IBIG savings also serve as collateral that will qualify you not just for housing loans but also for other Pag IBIG products like calamity loans and multi-purpose loans.

Pag IBIG actually stands for “Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industriya at Gobyerno.”

In a nutshell, the Pag IBIG Fund enables the four sectors of society (i.e., the borrower/member, the bank, the industry, and the government) to collaborate in developing a savings scheme that ultimately provides Filipinos with an affordable way to own a house.

Such is the effectiveness of the Pag IBIG Fund in providing ordinary Filipinos with the means to build or own their own houses that then-President Gloria Macapagal-Arroyo signed into law the Home Development Mutual Fund Law of 20095.

Through the said law, Pag IBIG membership has become mandatory for all Filipino workers whether hired by a local or foreign employer.

Pag IBIG Housing Loan vs. Bank Housing Loan: What’s the Difference?

In building their dream house or buying a property, Filipinos usually count on two housing loan providers: Pag-IBIG Fund and banks.

Each provider has its pros and cons. Your final decision should be based on your own criteria.

However, priority should be given to factors that matter more like qualifications, loanable amount, interest rate, loan term, and miscellaneous fees.

1. Qualifications

Pag IBIG only offers housing loans to its members. Most banks, on the other hand, don’t require borrowers to be a member or savings account holders in order to qualify for their housing loans, provided that the applicant can present proof of income and/or employment.

Minimum wage earners are more likely to get rejected when applying for bank housing loans. After all, banks are still businesses and they have the prerogative to reject your application if you can’t prove you’re capable of paying off your loans.

Pag-IBIG, by contrast, has an Affordable Housing Loan Program specifically designed to give low-income earners the chance to have their own house.

2. Loanable Amount

Borrowers under the Affordable Housing Loan Program can avail of housing loans up to ₱580,000 for socialized housing or up to ₱750,000 for socialized condominium units6. Meanwhile, regular applicants with above-average income can borrow up to ₱6 million.

Banks, meanwhile, have an average minimum loanable amount of ₱300,000. For both housing loan providers, the final loanable amount depends on several factors or criteria set by the provider itself.

3. Interest Rate

Those who are availing of Pag IBIG housing loans enjoy lower interest rates: as low as 3% for low-income earners and 5.75% for regular housing loan borrowers in a 1-year fixed pricing period. You can check the complete list of rates on PAG-IBIG’s FAQ page.

For this reason, Pag IBIG housing loan can now compete with banks that offer housing loans with a similar interest rate of 5.25 to 6.25% for the first year (e.g., Metrobank and BDO) and up to 6.75% for a 3-year fixed pricing period.

Moreover, Pag IBIG isn’t allowed by law to increase its interest rate beyond 2% per annum. By contrast, banks don’t have a ceiling on the interest rate.

Loan term: In Pag IBIG, borrowers can choose how long they’ll pay off their housing loan, with 30 years as the maximum loan period. Banks offer loans with a repayment period ranging from 20 to 25 years, depending on the purpose of the loan.

4. Miscellaneous Fees

Pag IBIG guarantees applicants they will not be charged with fees other than the ₱1,000 to be paid during application and another ₱2,000 before loan release.

Depending on your bank, fees may include an appraisal fee of ₱4,000, a handling fee of ₱3,000, a notarial fee of ₱200 as well as doc stamps tax and registration fee.

Since you’re reading this article, it’s safe to assume that you’re leaning more toward the Pag IBIG housing loan.

The best part of being a Pag IBIG member is you get to keep all your contributions in your own savings account.

Even if you don’t avail of the housing loan, your money can potentially earn a lot of dividends over the years. The money will stay in your account until you decide to withdraw your savings at the end of the membership period which is 20 years.

Pag IBIG Housing Loan Requirements

1. Required Fees and Documents (Upon Loan Application)

a. Processing fee (non-refundable) of ₱1,000 and appraisal fee of ₱2,000.

A fee of ₱1,000 will also be charged for every re-evaluation or re-filing of the housing loan application.

b. Duly accomplished Housing Loan Application Form with a recent ID photo of the principal borrower or co-borrower (if applicable).

c. Proof of income

For Employed, bring ANY of the following:

- Notarized Certificate of Employment and Compensation (CEC) showing your gross monthly income, allowances, or monetary benefits.

- Income Tax Return for the year prior to the date of loan application with attached BIR Form No. 2316, received and stamped by the BIR.

- Any certified 1-month payslip from the last three months prior to the date of the loan application. If you’re a government employee, the payslip must be submitted with CEC or ITR.

For Self-Employed, bring ANY of the following:

- Income Tax Return (ITR), Audited Financial Statements, and Official Receipt of tax payment from the bank supported by Mayor’s Permit/Business Permit and DTI Registration.

- Commission vouchers issued within the last 12 months and showing the issuer’s name and contact details.

- If your income comes from pensions, foreign remittances, etc., a copy of bank statements or passbook for the last 12 months.

- If your income comes from rental payments, a copy of the Lease Contract and Tax Declaration.

- Certified True Copy of Transport Franchise issued by the authorized government agency like the LGU for tricycles and LTFRB for other PUVs.

- Certificate of Engagement issued by the business owner.

- Other documents that can validate or prove your source of income.

For Overseas Filipino Workers (OFW), bring any of the following:

- Employment Contract (Employment Contract between the employer and the employee or POEA Standard Contract).

- Notarized Certificate of Employment and Compensation (CEC). This CEC can be in the form of a document signed by the employer (for household staff and other similar employees) and supported by the employer’s passport or ID. A CEC written on the company/employer’s official letterhead is also accepted.

- Income Tax Return filed with the OFW’s host country or government. If written in a foreign language, an English translation is required.

d. Photocopy (front and back) of one valid ID of the principal borrower and spouse, co-borrower and spouse, seller and spouse, owner of the title (for accommodation mortgage), and developer’s authorized representative/Attorney-in-Fact, if applicable.

The following is a list of valid government-issued IDs accepted by Pag IBIG Fund:

- Company ID

- Passport (Philippine or foreign)

- Professional Regulation Commission (PRC) ID

- Driver’s License

- Government Service Insurance System (GSIS) eCard

- Social Security System (SSS) Card

- Integrated Bar of the Philippines (IBP) ID

- Government Office and GOCC ID (e.g. AFP ID, Pag-IBIG

Loyalty Card) - Overseas Workers Welfare Administration (OWWA) ID

- Senior Citizen Card

- Overseas Filipino Worker (OFW) ID

- Postal ID

- Seafarer’s Identification and Record Book (SIRB)

- Voter’s ID

e. Latest Certified True Copy of the Transfer Certificate of Title (TCT). If you’re applying for a loan to purchase a condominium unit, present the TCT of the land and a Certified True Copy of the Condominium Certificate of Title (CCT).

f. Photocopies of the updated Tax Declaration (house and lot) and Real Estate Tax Receipt.

g. Vicinity map or sketch of the property.

h. Additional Requirements (if applicable only)

For Purchase of Lot/Residential Unit.

- Contract-to-Sell or similar agreement between the buyer and seller.

For Purchase of Lot with Construction of House (PLCH).

- Contract-to-Sell or similar agreement between the buyer and seller.

- Building Plans, Specification with Bill of Materials duly signed by the

Licensed Civil Engineer or Architect.

For Purchase of Properties from a Developer/Association/Corporation.

- License to Sell (applicable to the Developer only).

- Secretary’s Certificate on the Authorized Signatory of the Developer/Corporation/Association.

- One (1) valid ID of the Corporate Secretary and Authorized Signatory of the Developer/Corporation/ Association (Photocopy, back-to-back).

For Construction of House/Home Improvement.

- Building Plans, Specifications with Bill of Materials duly signed by the Licensed Architect or Civil Engineer. This requirement is to ensure that the loan will be used by the borrower for the intended purpose and not for something else like investing in a business, buying a car, etc.

For Accommodation Mortgage.

- Building Plans, Specifications with Bill of Materials duly signed by the Licensed Architect or Civil Engineer.

- Notarized SPA for Accommodation Mortgagor.

For Refinancing.

- Latest Statement of Account on Outstanding Loan Balance duly signed by the manager or the account officer.

- Either of these two documents: Subsidiary Ledger or Official Receipt for the past 12 months (or any valid proof of payment).

For Refinancing with Construction of House/Home Improvement.

- Latest Statement of Account on the Outstanding Loan Balance duly signed by the manager or the account officer.

- Either of these two documents: Subsidiary Ledger or Official Receipt for the past 12 months (or any valid proof of payment).

- Building Plans, Specification with Bill of Materials duly signed by the Licensed Civil Engineer or Architect.

For OFW Pag IBIG Fund members.

- Special Power of Attorney notarized either by a Philippine Consular Officer or a notary in the country where you’re working. The SPA should be authenticated by the Philippine Consulate.

- Any or a combination of the following documents (written in or translated into the English language): Valid OWWA Membership Certificate; Payslip indicating income received and the period covered; Professional License issued by Host Country/Government; Residence card/permit (permit to stay indicating work as the purpose); Overseas Employment Certificate; Passport with appropriate visa (Working Visa); Bank remittance record.

Insurance Coverage.

- Health Statement Form (Medical Questionnaire) for borrowers over 60 years old or those 60 years old or younger whose loans are over ₱2 million to ₱6 million.

- For OFWs over 60 years old, a Health Statement Form (Medical Questionnaire) along with a copy of the medical examination result as required by the employment agency and conducted before you flew overseas.

2. Required Fees and Documents (Prior to Loan Release)

a. ₱2,000 upon loan take-out (to be deducted from loan proceeds).

Additional fees (if applicable):

- ₱1,000 (to be deducted from the final loan release) for every inspection in excess of four inspections for accounts with staggered releases (e.g., home construction or improvement).

- A handling fee of ₱2,000 for every additional check issued for split payment of loan proceeds.

b. TCT/CCT in the name of the borrower/co-borrower/s (if applicable) with proper mortgage annotation in favor of the Pag-IBIG Fund (Owner’s Duplicate Copy).

c. TCT/CCT in the name of the borrower/co-borrower/s (if applicable) (Certified True Copy) with proper mortgage annotation in favor of the Pag-IBIG Fund (RD’s copy).

d. Updated Tax Declaration (House and Lot) and Updated Real Estate Tax Receipt (photocopy) in the name of the borrower/co-borrower/s, if applicable.

Note: For refinancing, you will only need a photocopy of the updated Real Estate Tax Receipt.

e. Loan Mortgage Documents (to be provided by Pag IBIG upon loan approval):

- Loan and Mortgage Agreement duly registered with Registry of Deeds with original RD stamp (HQP-HLF-162/163).

- Duly accomplished/notarized Promissory Note (HQP-HLF-086/087).

- Disclosure Statement on Loan Transaction (HQP-HLF-085).

f. Additional Requirements (if applicable only)

Surety bond (for properties that are subject to the lien imposed by Section 4 Rule 74 of the Rules of Court).

Collection Servicing Agreement with Authority to Deduct Loan Amortization or Post Dated Checks, if applicable.

For Purchase of Lot/Residential Unit.

- Deed of Absolute Sale duly registered with Registry of Deeds with original RD stamp.

For Purchase of New Residential Units only.

- Deed of Absolute Sale duly registered with Registry of Deeds with original RD stamp.

- Occupancy Permit.

For Purchase of Lot with Construction of House (PLCH) only.

- Deed of Absolute Sale duly registered with Registry of Deeds with original RD stamp.

- Occupancy Permit.

- Building Plans/Electrical/Sanitary Permits duly approved by the building

officials.

For Construction of House/Home Improvement.

- Occupancy Permit.

- Building Plans/Electrical/Sanitary Permits duly approved by the building officials.

For Refinancing.

- Updated Statement of Account on Outstanding Loan Balance duly signed by the Manager or the account officer.

For Refinancing with Construction of House/Home Improvement.

- Updated Statement of Account on Outstanding Loan Balance duly signed by the Manager or the account officer.

- Occupancy Permit.

- Building Plans/Electrical/Sanitary Permits duly approved by the

building officials. - Updated Tax Declaration (House) in the name of the borrower/ co-borrowers.

How To Apply for Pag IBIG Housing Loan: A 8-Step Guide to Getting Approved

This guide is written with the assumption that you’re already a member of the Pag IBIG fund. If you’re not one yet, register now so you can avail of the Pag IBIG housing loan and enjoy other member-exclusive benefits.

You should also be aware that there are two modes of applying for the Pag IBIG housing loan:

- Developer-Assisted where the developer helps you with the application; and

- Retail in which the member applies for the housing loan on his/her own.

The procedures below are intended for the “Retail” applicants who want to avail of the housing loan unassisted.

1. Check if You’re Eligible To Apply for the Pag IBIG Housing Loan

The Pag IBIG housing loan program is available to anyone with the following qualifications:

a. An active Pag IBIG Fund member with 24 months worth of contributions at the time of application

New members who have been paying contributions for at least 12 months can also complete the required amount of contributions through lump-sum payments.

Members who have contributed for at least two years and whose housing loans exceed ₱500,000 will be required to pay the upgraded membership contribution rates upon approval of the said loan and onwards.

Related Article: Pag-IBIG Contribution Table (with Detailed Computations and Explanations)

b. Not more than 65 years old at the time of loan application and not more than 70 years old at loan maturity

Remember, the maximum loan period is 30 years.

For senior applicants, your loan period is determined by how close your age is to the maximum age of 70. For example, if you’re 50 years old at the time of application, your maximum loan period is only 20 years because you’ll be turning 70 by the time the period ends.

c. With a legal capacity to acquire and encumber the real property.

d. Has passed the background checks (credit/employment/business, etc.) conducted by the Pag IBIG Fund.

e. No previous Pag IBIG housing loan that ended up with the borrower’s property being foreclosed, brought back to default, canceled, or surrendered (dación en pago).

f. If with existing Pag IBIG housing loan or Short Term Loan (STL), either as principal borrower or co-borrower, payments must be updated (READ: Can a Pag IBIG member apply for multiple/additional housing loans?)

2. Know Your Purpose for Applying for the Pag IBIG Housing Loan

Contrary to popular belief, a Pag IBIG housing loan isn’t only used to finance the construction of a new house.

The loan can support you financially if you’re planning to do one of the following:

- Buy a fully-developed residential lot or adjoining residential lots not exceeding 1,000 sq.m.

- Buy a residential house and lot, condominium unit, or townhouse (inclusive of the parking lot). The property can be new, old/pre-owned, an acquired asset of the Pag-IBIG Fund, or adjoining houses and lot/condominium units/rowhouses/townhouses (cost of transfer is included)7.

- Build or construct a residential unit on a residential lot owned either by you or a relative.

- Give your home a major repair or overhaul. Take note that Pag-IBIG offers two options to finance home improvement. The Pag IBIG housing loan is intended for homes that need more serious and costly repairs. For minor home improvement or renovation, you can avail of the Pag IBIG Multi-Purpose Loan instead.

- Refinance an existing housing loan provided that the institution you borrowed the money from is acceptable to Pag IBIG and that your account is updated at least 1 year upon application as supported by official receipts and a Statement of Account.

Pag IBIG also allows borrowers to avail of the housing loan for a combination of the above-mentioned purposes. However, the combinations are limited to the following:

- Buy a fully-developed lot not exceeding 1,000 sq.m. + Build a residential unit on the said lot.

- Buy a residential unit (old or new) + Home improvement.

- Refinance an existing housing loan or mortgage + Home improvement.

- Refinance an existing loan for the purchase of a lot + Build a residential unit on the same lot.

Lastly, Pag IBIG can also finance one or more of the loan purposes as well as the transfer of the title. The combinations are limited to the following:

- Buy a residential unit + Transfer the title to the borrower.

- Buy a residential unit + Home improvement + Transfer of title to the borrower.

- Buy a residential lot + Transfer of title to the borrower.

- Buy a residential lot + Build or construct a house/residential unit + Transfer of title to the borrower.

3. Choose the Pag IBIG Housing Loan Program That Matches Your Current Income Level

Unlike banks in the Philippines, Pag IBIG Fund offers two programs tailored to the borrower’s capacity to pay:

a. Affordable Housing Loan Program for Minimum Wage and Low-Income Earners

This is exclusively offered to low-income or minimum-wage earners

The applicable maximum loanable amount and interest rates depend on the income cluster to which the member belongs8. Members earning not exceeding PHP 15,000 within NCR or PHP 12,000 outside NCR belong to Cluster 1. Meanwhile, members earning not exceeding PHP 17,500 within NCR or PHP 14,000 outside NCR belong to Cluster 2.

Cluster 1 members can enjoy a loanable amount not exceeding the socialized housing loan ceiling set by Pag-IBIG (the current ceiling is at PHP 580,000) with a 3% interest rate for the first five years of the loan term. Meanwhile, cluster 2 members can enjoy a loanable amount of up to PHP 750,000 with a 6.5% interest rate for the first ten years of the loan term.

b. Regular Housing Loan Program

This is for applicants with above-average gross monthly income. Under this program, qualified applicants can borrow up to ₱6 million with an interest rate of as low as 5.750%9 (one-year fixed pricing period).

To determine how much you can borrow from the Regular Housing Loan Program, Pag IBIG uses the following criteria:

- Your actual need;

- Your desired loan amount;

- Your current income, which suggests your capacity to pay;

- The loan-to-appraised value ratio.

After determining the value of each criterion above, Pag IBIG will pick the lowest value and declare it the loanable amount

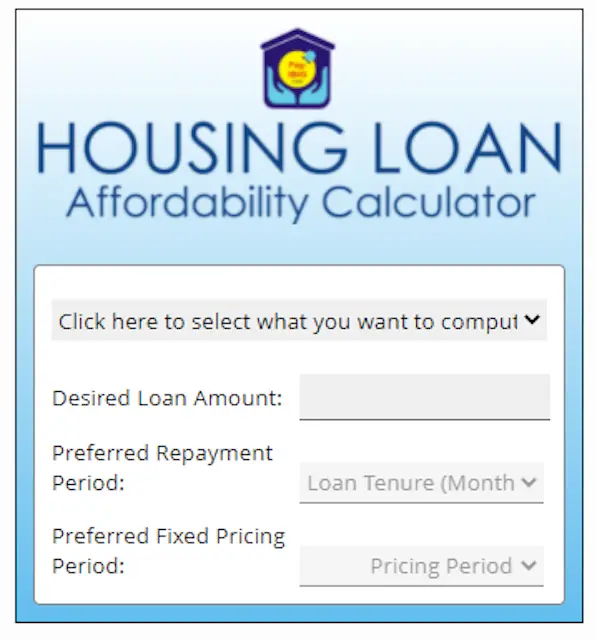

Alternatively, you can also use the Pag-IBIG Fund Housing Loan Affordability Calculator, which gives you an estimate of how much you can borrow based on your desired loan amount, preferred repayment period, and preferred fixed pricing period.

It’s located at the bottom right corner of the page.

Note, however, that the online calculator is only used as a guide. The actual loanable amount will vary depending on the results of Pag IBIG’s evaluation.

c. Pag-IBIG Home Equity Appreciation Loan (HEAL)

This is open for members with commendable loan payment records. Under this program, qualified members may borrow an amount based on their mortgaged property’s net value. Loaned amount from Pag-IBIG HEAL can be used not only for home improvement purposes but also for education expenses, acquisition of appliances, and other life goals 10.

The applicable interest rate is based on the chosen period but is set lower as an incentive for good-paying members.

The maximum loanable amount is the difference between 6 million pesos and the remaining balance of your existing Pag-IBIG Housing loan. However, this is still subject to other considerations, such as the capacity to pay and the preferred loan amount.

d. Pag-IBIG Acquired Assets Program

A property becomes a Pag-IBIG acquired asset11 or a foreclosed property after a person fails to repay its Pag-IBIG housing loan. Pag-IBIG “resells” these properties through public bidding to recover its loss.

Acquired assets12 are sold at a cheaper price, making them attractive to low-earners or those with tight budgets.

Buyers of acquired assets may purchase them through cash or on an installment basis. Paying on an installment basis makes it similar to a housing loan since you have to pay on a regular basis with interest accruing per period. You can pay through short-term installments, with 6.375% interest, and must be paid within a year, or through long-term installments.

You can find foreclosed properties available for public bidding on the Pag-IBIG Acquired Assets webpage. Scroll down to see the schedule of public auctions.

4. Complete All the Pag IBIG Housing Loan Requirements

Applicants must submit two sets of fees and requirements–one during the loan application and another upon or before loan release. For more information, please jump to the previous section containing the Pag IBIG housing loan requirements.

5. Submit All Housing Loan Requirements to Pag IBIG

There are two ways to do this: through online scheduling or by applying over the counter at the nearest Pag IBIG branch.

Option 1: Online Application

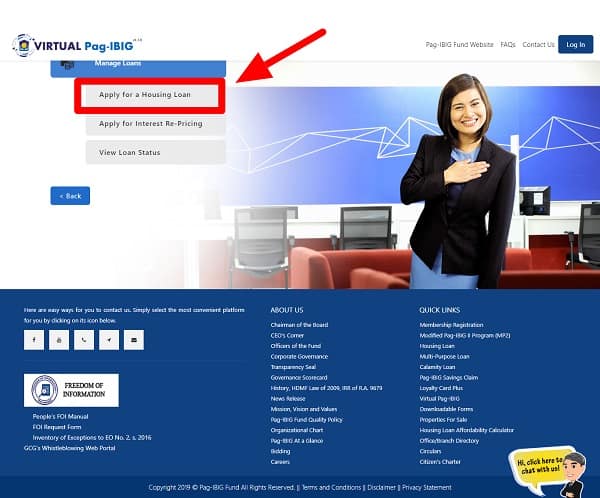

The Pag-IBIG Fund has officially launched the new Virtual Pag-IBIG, an online portal where members can easily complete different transactions – from housing loan applications to payment of contributions – in the comfort of their own homes.

If you don’t have a Virtual Pag-IBIG account yet, here’s a step-by-step guide on how to create one. With this innovation, you can now submit your housing loan application online and schedule an appointment with the nearest Pag-IBIG office which will process your application.

Here’s how to do it:

Here’s how to do it:

1. Go to the Virtual Pag-IBIG website.

2. Click Apply for and Manage Loans.

3. Select Apply for a Housing Loan from the list of options.

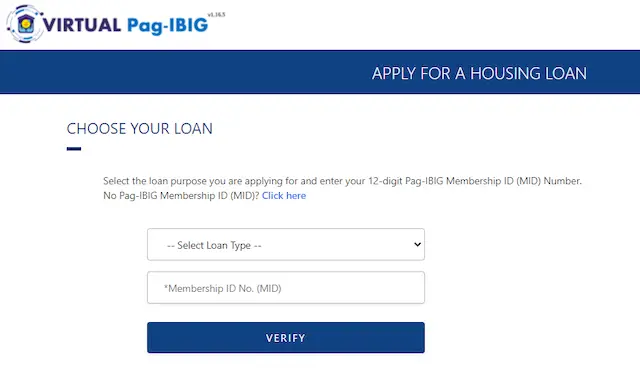

4. Once you’re on the Online Housing Loan Application page, check the list of requirements before you continue. Click Proceed.

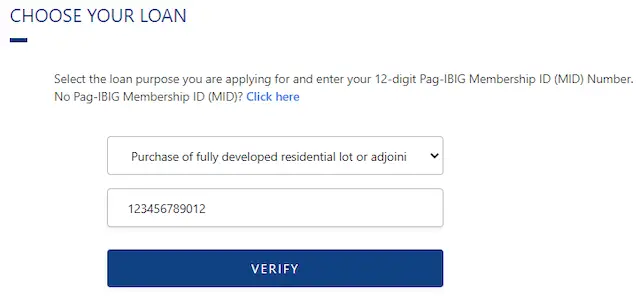

5. From the drop-down list, select the loan type that applies to you.

6. Next, enter your 12-digit Pag-IBIG Membership ID (MID) and click on Verify.

Another application form will appear.

Fill out the online application form with the requested information, which includes:

- Loan information like the purpose of the loan, mode of payment, desired loan term, desired re-pricing period, etc.

- Personal information like your e-mail address, cell phone number, home ownership, years of stay in present home address, occupation, years in employment or business, number of dependents, gross monthly income, etc.

- Preferred Pag IBIG branch office where you’ll submit the application form and housing loan requirements.

Once you’re done, click Submit.

You will then receive a reference number or Housing Loan Application Tracking Number via SMS. Pag IBIG will also send you through e-mail the schedule of your appointment, the address of the Pag IBIG office, and the Pag IBIG Fund contact person you’ll be transacting with.

Option 2: Over-the-Counter Application

All applicants are required to file their Pag IBIG housing loan applications personally at:

- For NCR/Metro Manila applicants: Servicing Department, 2/F JELP Business Solutions, 409 Shaw Blvd., Mandaluyong City; or at any Pag-IBIG branch office.

- For provincial applicants: Pag-IBIG branch office nearest you.

Here are the things you should expect to accomplish upon arriving at the Pag IBIG branch office:

1. Submit two copies of the application form and the rest of the documentary requirements to any of these counters: Members Services Support Division-Servicing Department, Loans Origination-Housing Business Center, or Members Services Branch.

2. Pay the required processing and appraisal fees (see the list of requirements in the previous section) plus the lump sum payment of membership savings (if applicable) at the Cash-Collection Division-Loans Support Services Department/Members Services. Don’t forget to get the Pag IBIG Fund Receipt.

3. Submit the receipt to the Members Services Support Division-Servicing Department/Loans Origination-Housing Business Center/Members Services Branch servicing counter, which will then give you the Housing Loan Application Acknowledgement Receipt (HLAAR).

6. Wait for the Approval of Your Pag IBIG Housing Loan

Pag IBIG will notify you regarding the status of your housing loan application within 17 days.

In case you get denied, you’ll receive a Notice of Disapproval (NOD) along with your loan documents.

If your application is approved, expect a call from Pag IBIG informing you when you can pick up the Notice of Approval (NOA) and Letter of Guaranty (LOG).

Let’s summarize the procedures you’ll go through after getting approved:

a. Receive the Notice of Approval (NOA) and Letter of Guaranty (LOG)

Take note that LOG is not applicable to housing loans intended for house construction or home improvement.

Only the borrower can receive the NOA. For OFWs who can’t make it home to personally receive the NOA, Pag IBIG can release it to the authorized representative/Attorney-in-Fact provided that there’s a notarized Special Power of Attorney (SPA).

b. Sign your loan documents

After receiving the NOA and LOG from the Pag IBIG, go straight to the Members Services Support Division-Servicing Department/Loans Origination-Housing Business Center/Members Services Branch servicing counter.

There, a Pag IBIG officer will discuss your loan obligations as well as the terms and conditions of the following loan documents:

- Disclosure Statement on Loan Transaction (DSLT)

- Loan and Mortgage Agreement (LMA)

- Promissory Note (PN)

Once you’ve fully understood their content, affix your signature to these documents. If you’re borrowing with your spouse or a co-borrower, both of you need to sign the documents.

c. Complete your NOA requirements for check release

At this point, the only thing standing between you and the release of the Pag IBIG housing loan is the list of requirements in the Notice of Approval.

The complete NOA requirements must be submitted within 90 days, or else you won’t get the check and will receive a Notice of Deficiency instead.

All documentary requirements must be notarized at the place or city where they are executed.

The process of completing the NOA requirements vary depending on the purpose of the housing loan. To give you an idea, please check out the following checklists:

For Purchase of Lot/Condominium Unit/House & Lot

- Give the LOG to the seller.

- Proceed to the BIR for payment of Capital Gains Tax and Documentary Stamp Tax. The BIR will issue the Certificate Authorizing Registration.

- Proceed to the Local Government Unit (LGU) for payment of Transfer Tax.

- Proceed to the Registry of Deeds (RD) for the transfer of the title and annotation of the mortgage.

- Proceed to the LGU for the transfer of the Tax Declaration.

- Submit complete requirements to Pag IBIG Fund.

For Purchase of House and Lot Mortgaged with Pag IBIG Fund

- Proceed to the BIR for payment of Capital Gains Tax and Documentary Stamp Tax. The BIR will issue the Certificate Authorizing Registration.

- Proceed to the Local Government Unit (LGU) for payment of Transfer Tax.

- Go to the Pag IBIG office to schedule a trip to the Registry of Deeds (RD) for the transfer of title and annotation of the mortgage.

- Proceed to the LGU for the transfer of the Tax Declaration.

- Submit complete requirements to Pag IBIG Fund.

For the Construction of House/Home Improvement

- Proceed to the BIR for payment of Documentary Stamp Tax.

- Proceed to the Registry of Deeds (RD) for annotation of the mortgage.

- Submit complete requirements to Pag IBIG Fund.

For Refinancing

- Proceed to the bank/financing institution to give the Letter of Guaranty (LOG) and Loan and Mortgage Agreement (LMA).

- Proceed to the Registry of Deeds (RD) for annotation of the mortgage.

- Submit complete Requirements to Pag IBIG Fund.

7. Claim Your Check/Loan Proceeds at the Pag IBIG Fund

Once the check is available for pick-up, you’ll get another call from Pag IBIG.

To claim the check/loan proceeds, present 2 valid IDs (see requirements section for a list of valid IDs accepted by Pag IBIG) at the Cash-Disbursement Division-Loans Support Services Department/Members Services Branch.

The check can only be released to the borrower or any of the following:

- An authorized representative provided that he/she submits a notarized Special Power of Attorney (SPA) and 2 valid IDs each of the principal borrower and the representative/Attorney-in-Fact.

- The seller, if the loan purpose is one of the following: Purchase of Residential Unit, Lot Purchase, or Purchase of Lot and Construction of House.

The borrower will also be required to bring 12 PDCs (post-dated checks) if the payment is not through salary deduction (see next step for more information).

8. Start Paying Your Monthly Amortization

Amortization is defined as the process of spreading out a loan (in this case, a Pag IBIG housing loan) into a series of fixed payments over time.

It refers to the monthly payments that you’ll make for the next coming months and years to pay off the Pag IBIG housing loan.

There are different ways to pay your monthly amortization:

a. Payment Through Post-Dated Checks (PDCs)

If you choose this, you need to issue and submit 12 post-dated checks to the Pag IBIG Fund upon loan release. These checks will cover 1-year monthly amortization.

Get the Acknowledgment Receipt (AR).

Return to the Pag IBIG upon consumption of the 10 PDCs (exclusive of the remaining 2) to issue another 12 checks.

Always claim and keep the receipts from Pag IBIG each time you issue a check.

b. Payment Through Salary Deduction

If you opt for amortization payment via salary deduction (as most Filipino employees do), you need to submit Authority to Deduct to the Billing Division/Accounts Management and Billing Department/Loans Management and RecoveryHousing Business Center/Members Services Branch.

Upon loan takeout, an equivalent of one-month amortization will be deducted from the loan proceeds.

c. Other Modes of Payment

- Auto debit arrangement with banks.

- Accredited collection partners (available for both local and overseas remittance).

- Payment to an accredited developer with a Collection Servicing Agreement with the Pag IBIG Fund.

- Other methods of payment that the Pag IBIG Fund may implement in the future.

Tips and Warnings

a. While we try our best to answer all possible questions in this guide, you should also be on the lookout for the latest schedules of the Pag IBIG Housing Loan orientation program on their Facebook page.

In this program, which is conducted several times a year in specific Pag IBIG branches and venues, you can address your concerns directly to the Pag IBIG personnel.

b. Just like when you’re applying for a credit card, your credit score may also be reviewed during the evaluation of your Pag IBIG housing loan application.

A credit score contains vital personal information as well as your past financial transactions with banks and lending institutions.

Make sure your credit score is up-to-date, accurate, and isn’t tarnished by unpaid debts. You can secure a free copy of your credit score from the Credit Information Corporation (CIC) or any of its accredited credit bureaus.

c. Don’t go to Pag IBIG empty-handed. Before applying for a housing loan, you should already have saved up at least 20% of the property’s value for the down payment.

The higher the down payment you can afford, the more likely your housing loan application will get approved. It can also lower your interest rate, monthly mortgage, loan-to-value ratio, and loan term.

d. For the employed, the key to getting approved is to show you have a solid employment history. Job hopping and gaps in your employment history may be seen as red flags. Employment tenure means income stability and the capability to pay off your housing loan.

e. If you’re afraid you might not be qualified due to insufficient income, convince someone with a regular job and good credit history to take you as a co-borrower.

Pag IBIG allows a principal borrower to share the housing loan with up to two co-borrowers who can be a relative or not.

f. Carefully assess your current income and determine how much of it you can set aside for monthly amortization. Ideally, the loan amount shouldn’t exceed your three-year salary, while your mortgage or monthly amortization shouldn’t go beyond 20-30% of your gross monthly income.

Use the Pag IBIG’s housing loan affordability calculator to help estimate the loan amount and monthly amortization based on your income and other factors.

g. If you’re investing money to prepare for your housing loan13, it’s best to put them in investment vehicles with conservative risks and insured by the Philippine Deposit Insurance Commission, such as Pag-IBIG P1 and MP2, cooperative time deposits with at least 10 years of operation, and rural bank deposits. Government bonds are also recommended since they have low default risk. Refrain from investing money in volatile investment vehicles like stocks, cryptocurrencies, or NFTs. It’s difficult to regain lost amounts in these financial instruments since they are not covered by deposit insurance.

h. If possible, your loaned (or purchased) house should not comprise as high as 50% of your total assets. Make sure its share in your total assets decreases over time by acquiring other real properties or investing in different financial instruments14.

i. As much as possible, limit your loan term to a maximum of 20 years. Loan term beyond this period increases the risk of you financing the loan until your retirement. It’s better that you’re free from any debt, especially at an old age.

j. The total monetary value of the house (sum of all amortized payments) should not exceed your (and your partner’s combined) three-year income. This is to ensure that the loan amortization is not beyond your subsistence and to prevent any difficulties in loan repayment.

k. If in the future you find that you need to renegotiate your housing loan terms, you can apply for a loan restructuring at Pag-IBIG’s Special Housing Loan Restructuring Program page. Compared to the 7.75% per annum interest rate for the regular Housing Loan Restructuring Program, the special program only has an interest rate of 6.375% per annum on a 1-year fixing period. This special program was created to help Filipinos during the ongoing COVID-19 situation.

Frequently Asked Questions

1. How much will Pag IBIG deduct from my salary if my housing loan is approved?

2. What is a fixed pricing period?

3. I haven’t decided on which property to buy yet. Can Pag IBIG provide assistance?

4. Can I avail of the housing loan even if I still have an outstanding loan with Pag IBIG?

5. Can a Pag IBIG member apply for multiple/additional housing loans?

6. How many co-borrowers can I have?

7. What is the loan-to-value ratio?

8. How much can I borrow from the Pag IBIG housing loan?

9. How long does it take for my Pag IBIG housing loan to be approved?

10. How can I apply for a Pag IBIG housing loan if I’m an OFW?

11. Can I make a lump-sum payment to reach the required 24 monthly contributions for the Pag-IBIG housing loan?

12. How many months of missed payments before I am considered to default on my Pag-IBIG housing loan?

Failure to pay three consecutive monthly amortizations is considered a default. You’re also considered in default if you fail to submit proof of payment on the annual real estate taxes and perform any obligations on your signed Pag-IBIG Fund contract15.

13. What happens if I default on my Pag-IBIG housing loan?

According to the Pag-IBIG Fund Circular No. 396, defaulting on the Pag-IBIG housing loan means that you’ll be demanded to pay all the outstanding payments (principal, interest accruals, and penalties) immediately. This unpaid amount will be charged with a penalty of 1/20 of 1% of the amount due every day.

References

- Philippine Statistics Office (PSA). (2021, July 12). Nine in Every 10 Families Reside in a Single Type Buildings/House [Press release]. Retrieved December 5, 2022, from https://psa.gov.ph/sites/default/files/attachments/ird/pressrelease/PR%20on%20Housing%20Characteristics-optimized.pdf

- Noble, L. (2020). Pag-IBIG expands home construction funding. Retrieved 28 May 2020, from https://www.bworldonline.com/pag-ibig-expands-home-construction-funding/

- Rosales, E. (2022). Pag-IBIG lends P9.7 billion for socialized housing. Retrieved 4 March 2022, from https://www.philstar.com/business/2022/02/11/2159947/pag-ibig-lends-p97-billion-socialized-housing

- Official Gazette of the Republic of the Philippines. Presidential Decree No. 1530 Instituting a System of Voluntary Contributions for Housing Purposes (1978).

- Official Gazette of the Republic of the Philippines. Implementing Rules and Regulations of Republic Act No. 9679 or the Home Development Mutual Fund Law (2009).

- Kabagani, L. (2021). 16.9K low-wage earners benefit from the affordable Pag-IBIG program. Retrieved 5 March 2022, from https://www.pna.gov.ph/articles/1130462

- Rapisura, V. (Director). (2022, June 8). Vince Rapisura 2037: Pag-IBIG housing loan hacks [Video file]. Retrieved December 5, 2022, from https://youtu.be/m_5-E1PQ8JI?t=1231

- Affordable Housing Loan for minimum-wage and low-income earners frequently asked questions. (n.d.). Retrieved December 11, 2022, from https://pagibigfund.gov.ph/FAQ_AHL.html

- Pag-IBIG Housing Loan – Frequently Asked Questions. Retrieved 5 March 2022, from https://www.pagibigfund.gov.ph/FAQ_HL.html

- Pag-IBIG Home Equity Appreciation Loan (HEAL) – Frequently Asked Questions. (n.d.). Retrieved December 11, 2022, from https://www.pagibigfund.gov.ph/FAQ_HEAL.html

- What to know about PAG-IBIG acquired assets. (n.d.). Retrieved December 11, 2022, from https://www.metrobank.com.ph/articles/learn/what-to-know-about-pag-ibig-acquired-home

- Steps to purchase acquired properties. (n.d.). Retrieved December 11, 2022, from https://www.pagibigfund.gov.ph/acquiredassets_easysteps.html

- Rapisura, V. (Director). (2022, June 08). Vince Rapisura 2037: Pag-IBIG housing loan hacks [Video file]. Retrieved December 11, 2022, from https://youtu.be/m_5-E1PQ8JI?t=415

- Rapisura, V. (Director). (2022, June 08). Vince Rapisura 2037: Pag-IBIG housing loan hacks [Video file]. Retrieved December 11, 2022, from https://youtu.be/m_5-E1PQ8JI?t=20

- Pag-IBI Fund. (2018, January 9). Modified Guidelines on the Pag-IBIG Fund End-User Home Financing Program [Press release]. Retrieved December 11, 2022, from https://www.pagibigfund.gov.ph/document/pdf/circulars/housing/Circular%20No.%20396%20-%20Modified%20Guidelines%20on%20the%20Pag-IBIG%20Fund%20End-User%20Home%20Financing%20Program.pdf

Written by Luisito Batongbakal Jr.

Luisito Batongbakal Jr.

Luisito E. Batongbakal Jr. is the founder, editor, and chief content strategist of FilipiKnow, a leading online portal for free educational, Filipino-centric content. His curiosity and passion for learning have helped millions of Filipinos around the world get access to free insightful and practical information at the touch of their fingertips. With him at the helm, FilipiKnow has won numerous awards including the Top 10 Emerging Influential Blogs 2013, the 2015 Globe Tatt Awards, and the 2015 Philippine Bloggys Awards.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net