How To Get SSS Number Online in the Philippines: An Ultimate Guide

Having an SSS number is your first step to enjoying the benefits of being a member of the Social Security System (SSS)—the government-run social insurance program in the Philippines.

You’ll probably get an SSS number to fulfill your requirements for your first job, but this number is more than just a requirement for employment.

Find out what an SSS number is used for and how to get one quickly through this guide.

READ: How to Compute and Check Your SSS Contribution Online: An Ultimate Guide

Table of Contents

What Is an SSS Number?

The Social Security Number or SSS number is a 10-digit number assigned to Filipinos who apply for membership with the SSS. It’s used in all transactions with the SSS, such as availing of benefits and loans.

Why Do You Need To Get an SSS Number?

1. Job Requirement

When you get a new job, your employer will ask for your SSS number. Under the Social Security Law1, employers cannot hire a person without an SSS number, so you must provide this number to get employed.

2. SSS Contribution Payment

Employers use the SSS number to report new employees and remit contribution payments (part of salary deductions) to the SSS.

Employers in the Philippines who don’t comply with this requirement face penalties under the law.

3. Availment of SSS Benefits

Your SSS number is crucial for computing your paid contributions and determining how much benefit you can claim from the SSS.

Having an SSS number and meeting specific qualifications entitle a member to these SSS benefits:

- Salary loan – Members can borrow from the SSS to meet their short-term cash needs.

- Sickness – When members can’t work due to an injury or illness, they can avail of a sickness benefit that pays a cash allowance for each day confined in a hospital or at home.

- Unemployment insurance – The newly enacted Social Security Act of 2018 requires the SSS to provide a cash allowance to involuntarily separated employees for two months to help them get by while finding a new job.

- Maternity – Daily cash allowance is given to female SSS members who can’t work due to childbirth or miscarriage.

- Disability – Members with a partial or total permanent disability may avail of a cash benefit, which is paid as a lump sum or monthly pension.

- Retirement – Members who are 60 years old and can’t work anymore receive a cash benefit as a lump sum or monthly pension.

- Death – When an SSS member dies, his or her beneficiaries will receive a cash benefit as a lump sum or monthly pension.

- Funeral – This is a cash benefit given to anyone who paid for the burial costs of a deceased member.

Who Can Get an SSS Number?

Filipinos aged 60 and below who belong to any member categories listed here and have not been issued a social security number are required to get an SSS number.

1. Employees

Employees include workers who are on regular, contractual, or probationary status, such as the following:

- Private sector employees

- Household service workers or kasambahays

- Seafarers

- Employees of foreign governments or international organizations under administrative agreement with the SSS

2. Self-employed persons

Self-employed individuals are those earning at least PHP 1,000 monthly from their own business or profession, such as the following:

- Professionals

- Entrepreneurs (Partners and single proprietors of businesses)

- Farmers and fishermen

- Informal workers (sidewalk vendors, jeepney or tricycle drivers, etc.)

- Contractual and job order employees working for government agencies which the GSIS does not cover

- Actors, directors, scriptwriters, journalists/news correspondents, etc.

- Professional athletes, coaches, and trainers licensed by the Games and Amusement Board, as well as jockeys and trainers licensed by the Philippine Racing Commission

3. Overseas Filipino Workers (OFWs)

The Social Security Act of 2018 makes SSS coverage mandatory for all OFWs, which means all Filipinos working abroad are now protected under the SSS.

To enjoy such protection, the following overseas Filipinos need to get an SSS number first:

- Workers recruited in the Philippines by foreign employers for deployment abroad

- Filipinos who earn income from outside the country

- Filipinos who are permanent residents in other countries

4. Non-working spouse

If you’re a legal spouse of an SSS member, you’re qualified to get an SSS number as long as you pay your SSS contributions, manage the household full-time, and have not registered as an SSS member.

Related Article: How to Register Your SSS Account Online: A Step-By-Step Guide

Requirements for SSS Number Application

Submit copies of the documents listed below. As of September 7, 2021efn_note]Baron, G. (2021). SSS enhances online application of Social Security number. Retrieved 20 December 2021, from https://mb.com.ph/2021/09/07/sss-enhances-online-application-of-social-security-number/[/efn_note], the improved online application system of the SSS now enables new registrants to upload the required documents directly to the SSS portal. As a result, applicants no longer have to submit them via the Dropbox system at SSS offices personally.

1. Birth certificate or a valid ID

SSS only accepts birth certificates issued by the Philippine Statistics Authority (PSA) or the local civil registrar.

If you don’t have any birth records with the PSA, you can file for late birth certificate registration at the local civil registrar in the city or municipality where you were born.

Without a birth certificate, you can submit any of the following valid IDs instead:

- Baptismal certificate

- Passport

- Driver’s license

- PRC card

- Seaman’s Book

If you don’t have any of those primary IDs, you may submit any two of the following IDs with your correct name and birthdate:

- Alien Certificate of Registration

- ATM card (with cardholder’s name)

- Certificate of Confirmation from the National Commission on Indigenous Peoples

- Certificate of Licensure/Qualification Documents from MARINA

- Certificate of Muslim Filipino Tribal Affiliation from the National Commission on Muslim Filipinos

- Children’s baptismal certificate

- Children’s birth certificate

- Company ID

- Court Order granting the petition for change of name or birthdate

- Credit card

- Firearm Licence card issued by PNP

- Fishworker’s License issued by BFAR

- GSIS card / Member’s Record / Certificate of Membership

- Health or Medical card

- Homeowner’s Association ID

- ID card issued by LGUs

- ID card issued by any professional association recognized by PRC

- Life insurance policy

- Marriage certificate

- NBI Clearance

- OWWA card

- Pag-IBIG transaction card / Member’s Data Form

- Passbook

- PhilHealth card / Member’s Data Record

- Police Clearance

- Postal ID

- School ID

- Seafarer’s Registration Certificate issued by POEA

- Senior citizen ID

- Student Permit issued by LTO

- TIN card

- Transcript of Records

- Voter’s ID / Affidavit / Certificate of Registration issued by Comelec

2. Additional documents

You may also be required to submit any of these additional documents, depending on your civil status:

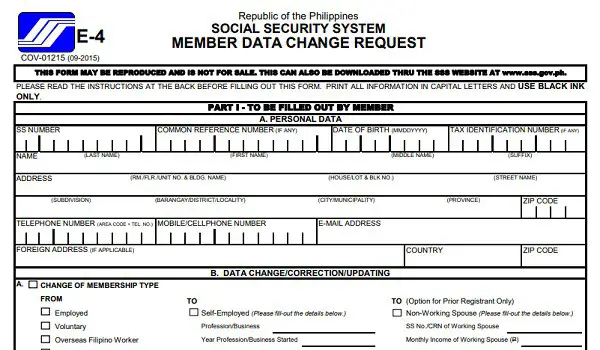

- Married: Marriage certificate or copy of spouse’s Member Data Change Request form (SS Form E-4) that indicates the applicant’s name as the legal spouse.

- Widows/widowers: Marriage and death certificates of the deceased spouse or Court Order on the Declaration of Presumptive Death.

- Legally separated: Decree of Legal Separation.

- Annulled: Certificate of Finality of Annulment/Nullity or annotated marriage certificate.

- Divorced: Decree of Divorce and Certificate of Naturalization/Certificate of Divorce (for divorced Muslim applicants).

- With children (to be registered as beneficiaries): Children’s birth certificate or baptismal certificate/Birth certificate with “Legitimated” status/Decree of Adoption.

How To Get SSS Number Online in the Philippines: A Step-by-Step Guide

1. Visit the SSS website

Tick the checkbox that says “I’m not a robot” and click the Submit button to continue.

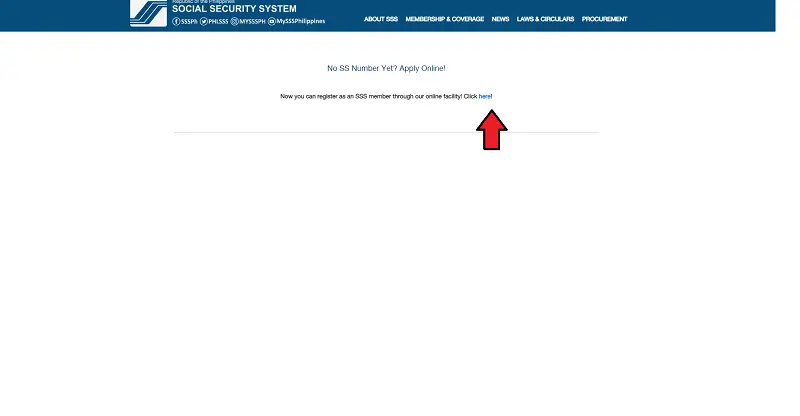

2. Hover your cursor to “Apply For An SS Number Online” and click the link that says “No SS Number yet? Get it here!”

You will be directed to the screen as shown below. Click the hyperlink here to continue.

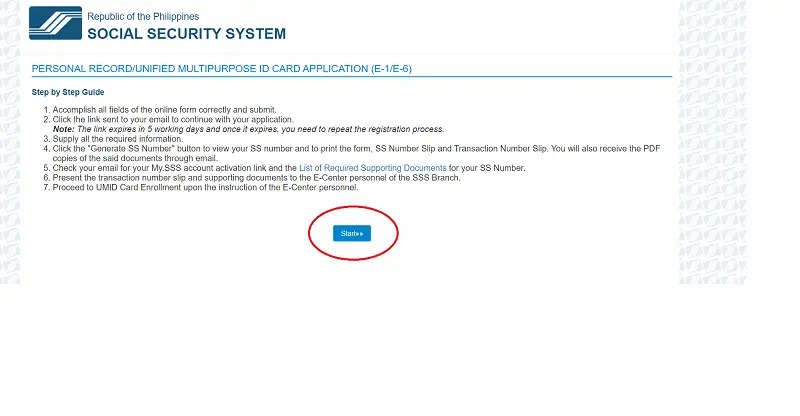

3. Read the step-by-step guide and click the “Start” button to proceed

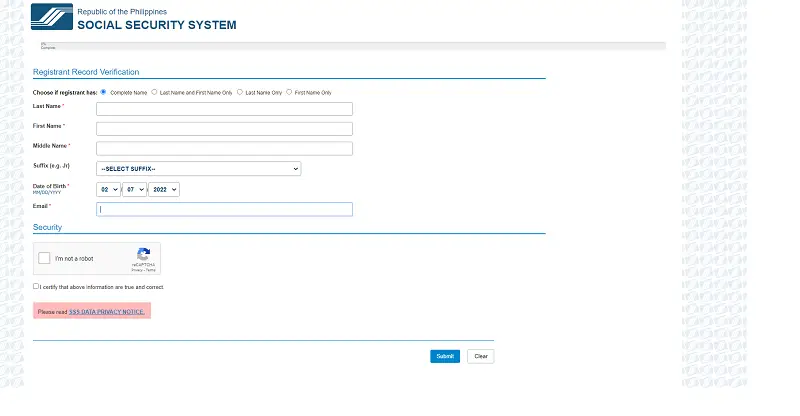

4. Complete the “Registrant Record Verification” by entering the required information

Enter your name, birth date, and email address. Afterward, complete the captcha and tick the checkbox. Click the Submit button to continue.

You’re now done with the first phase of registration and ready for the second phase.

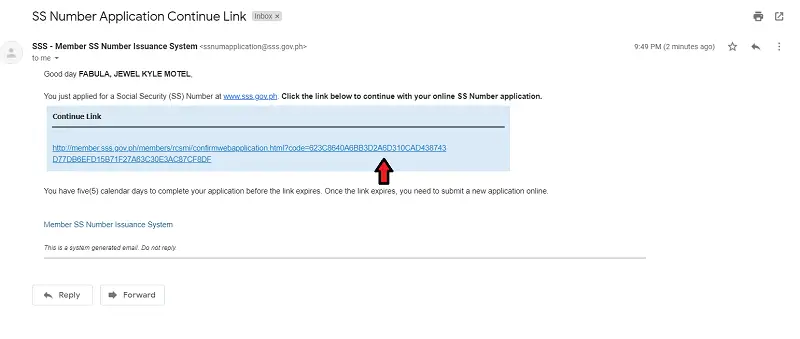

5. Wait for the email notification containing the link to the registration’s second phase

Check your SPAM or Trash folder if you can’t find the email in your inbox.

Once you find the email notification, please open it and click the link provided.

Clicking the link will redirect you to the SSS website. You have five days to finish your registration before the link expires. Once this link expires, you have to do the previous steps again.

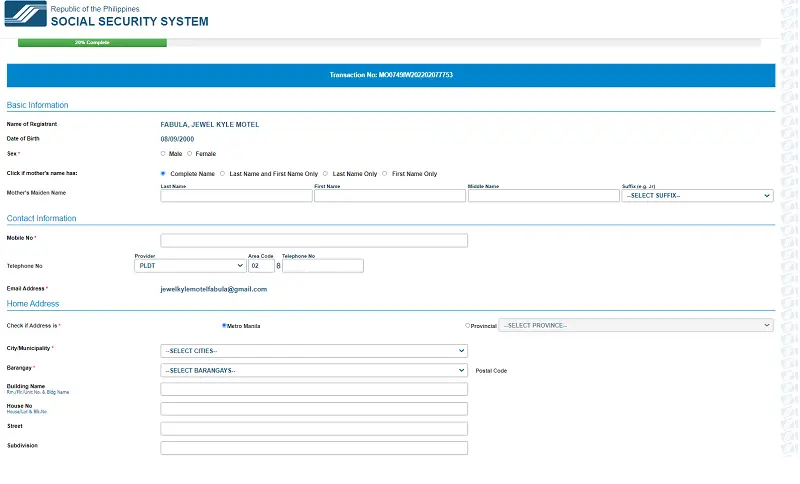

6. Complete the online form by providing the necessary information

Click the Next button at the bottom of the page to proceed to the next page of the registration form.

Note that in this step, you must also provide your preferred user ID for your My.SSS account. This user ID works like a username you use every time you log in.

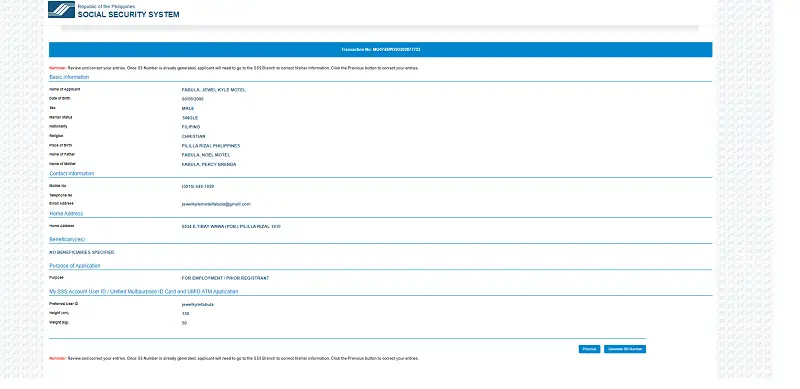

7. Review the information you have entered and submit your registration to generate your SS number

Once you have submitted your registration, you can no longer change any of the encoded information unless you go to the nearest SSS branch.

8. Upload a digital copy of your valid ID to finalize your registration

Once you have successfully uploaded your valid ID, you’ll receive a confirmation email.

9. Click the link in the confirmation email to set your My.SSS account password

Enter the last six digits of your SS number and then your preferred password. Afterward, click Submit.

Tips and Warnings

1. Don’t get more than one SSS number

Your SSS number is meant for lifetime use.

Once you’re issued this number, you should never apply for a new one—even if you lose it, change your civil status, or get a new job.

Multiple SSS numbers will cause a mix-up in your records, as your contributions have been paid using your different numbers. This will lead to delays in processing your SSS benefits and loans in the future.

If you have two or more SSS numbers, go to the nearest SSS branch to request the cancellation of the other numbers and consolidate all your contributions under just one SSS number.

2. Having an SSS number doesn’t mean you’re already a member and entitled to SSS benefits

You’re not automatically covered as an SSS member when you secure an SSS number.

You’ll become a member who can qualify for SSS benefits only when your employer has reported you for SSS coverage and you’ve paid at least one-month contribution.

If you’re an OFW, self-employed person, or non-working spouse, your SSS membership starts after you’ve paid at least a one-month contribution.

3. Beware of fake SSS agents

Avoid dealing with online scammers who offer assistance for a fee for SSS number applications and other related services.

An SSS number is issued free of charge. To be safe, apply using the official SSS website or any SSS branch.

Also, never disclose your personal information to strangers you meet online to avoid identity theft.

4. Follow the official SSS Facebook page

The SSS regularly posts updates on SSS membership and benefits on its Facebook page.

Its Facebook admins respond to inquiries, so it’s good to follow this page should you need help with your SSS number application and other SSS-related concerns.

5. New members who didn’t complete online registration due to internet connectivity issues may proceed to the nearest SSS office

Due to poor internet connection or other technical issues, some users cannot complete online registration. However, when they try to click the registration link sent to their email addresses, the system often shows they have already completed the registration process. This is not the case, as they have failed to obtain an SSS number.

If this happens to you, bring all the supporting documents and proceed to the nearest SSS office. Explain your concern to the security guard, and you’ll be pointed to the appropriate queue to handle this type of concern. Wait for your turn; once your number is called, explain your issue again and present the requirements. The entire process should be done in less than an hour.

Related Article: How to Get UMID Card (New SSS ID) in the Philippines

Frequently Asked Questions

1. Is CRN the same as the SSS number?

No, they’re different. The Common Reference Number (CRN) is issued to SSS members who apply for a Unified Multi-Purpose ID (UMID). It links the ID numbers of SSS, GSIS, Pag-IBIG Fund, and PhilHealth. It’s printed on the upper right of UMID cards issued since 2011.

These numbers also differ in format. The CRN consists of 12 digits in this format: ####-#######-#. Meanwhile, the SSS number has ten digits in this format: ##-#######-#.

2. What’s the difference between temporary and permanent SSS numbers? How can I change a temporary SSS number to a permanent one?

The temporary and permanent numbers are just the same 10-digit number you’ll use in your lifetime.

The SSS recently issued temporary numbers to applicants who don’t submit their birth certificates. If this is your case, it means your membership status is temporary.

A temporary SSS number can be used only for contribution payments and employee reporting by your employer. You can’t get a salary loan, UMID card, or SSS benefit granted to permanent members.

To change your SSS number from temporary to permanent, fill out two copies of the Member Data Change Request form (Put a checkmark in the box next to “UPDATING OF MEMBER RECORD STATUS from “Temporary” to “Permanent”).

Submit the accomplished forms with a copy of your birth certificate or valid ID. The SSS needs these documents to verify your identity, mainly your name, and birthdate.

3. Can students apply for an SSS number?

Yes, if the purpose is for employment, like a summer job or part-time job for working students. Present your birth certificate or school ID when applying for an SSS number.

4. Can senior citizens apply for an SSS number?

The SSS doesn’t issue an SSS number to anyone above 60 years old and not a surviving spouse or guardian of a pensioner.

Practicality-wise, getting an SSS number at your retirement age is too late, as you must have paid at least 120 monthly contributions to qualify for retirement benefits.

5. Can I get an SSS number even if I’m unemployed?

The SSS currently has no rules regarding SSS number applications for unemployed people. The only unemployed in the SSS membership categories is the non-working spouse, so if you’re one, then you can get an SSS number.

6. Are kasambahays required to get an SSS number? How?

Yes. The Kasambahay Law requires SSS coverage for maids, cooks, gardeners, and other household service workers in the Philippines.

This means all kasambahays need to get an SSS number.

Related: Are yayas and house helpers entitled to 13th month pay?

Under the Kasambahay Unified Registration System, kasambahays can choose any SSS, Pag-IBIG, or PhilHealth branch where they’ll register and get membership numbers from all three government agencies.

To apply for SSS, Pag-IBIG, and PhilHealth numbers, fill out a Kasambahay Unified Registration Form available in any branch of the three agencies. The form may be downloaded online and filled out in advance.

Submit the accomplished form to the nearest SSS, Pag-IBIG, or PhilHealth branch.

References

- Social Security System. Republic Act No. 11199, or the Social Security Act of 2018 (2018).

Written by Venus Zoleta

Venus Zoleta

Venus Zoleta is an experienced writer and editor for over 10 years, covering topics on personal finance, travel, government services, and digital marketing. Her background is in journalism and corporate communications. In her early 20s, she started investing and purchased a home. Now, she advocates financial literacy for Filipinos and shares her knowledge online. When she's not working, Venus bonds with her pet cats and binges on Korean dramas and Pinoy rom-coms.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net