How To Use GCash App 2025: Application, Cash-In, and More

Are you tired of going to the nearest payment center every month just to pay your bills and government contributions? Why not learn how to use GCash instead?

Touted as a convenient “mobile wallet” and an excellent alternative to debit cards, GCash enables you to do almost any transaction with just a few taps on your mobile phone.

But is this mobile payment innovation as good as it’s cracked up to be? Learn how to use GCash and discover what the experience is like–from initial registration to your first-ever cashless transaction.

Related Article: How to Load GCash: Different Ways to Fund Your Mobile Wallet

Table of Contents

Watch Video: How To Register With GCash and Get Your New Account Fully Verified

What Is GCash?

In simple terms, GCash is mobile money or “e-money” that allows you to pay bills, send or receive money, buy mobile loads, shop online, book movie tickets, and more with your smartphone.

Through a “mobile wallet,” you can do all these transactions anytime and anywhere without withdrawing money. Compare that to carrying cash in your pocket, which has a higher risk of getting lost or stolen.

GCash also ensures its users that going cashless through their platform is safe as they are licensed and regulated by the Bangko Sentral ng Pilipinas (BSP)1.

How To Use GCash in 4 Easy Steps

1. Register for a GCash Account

If you don’t have an account with GCash yet, it’s time to create one, so you can start using its services.

Registration can be done in four ways: through the GCash website, GCash mobile app, Globe *143# SIM menu, and Facebook messenger.

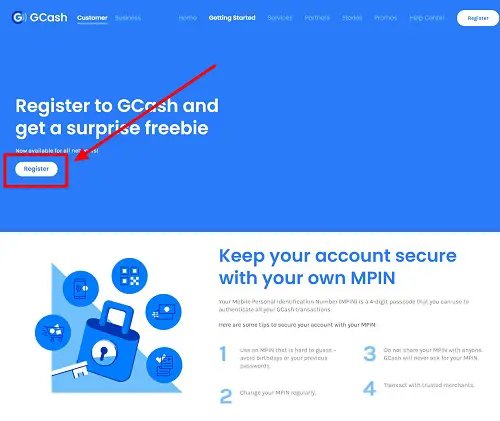

a. GCash Registration via the GCash Website

If you prefer to use a laptop or desktop, proceed to the GCash registration page and follow the instructions below:

- Click Register on the landing page.

- Click Proceed to GCash Registration to start the transaction.

- Enter your mobile number. Consider that GCash is open to all networks, not just Globe and TM subscribers. Click Next to proceed to the next page.

- Provide the 6-digit authentication code sent to your mobile number for verification purposes. Click Submit Code to complete the process.

- Fill out the GCash Registration form with your details which include your full name, birthday, home address, and email address. Click Submit to proceed to the next page.

- Set your 4-digit mobile PIN or MPIN. For security reasons, avoid choosing your birth date or other number combinations that are easy to guess (e.g., 1234, 1111, etc.)

- Once the registration is complete, you’ll be directed to a page with a QR code. Scan the QR code with your mobile phone to download the GCash app. If you’re lucky, you might receive freebies upon logging in.

- After logging in to the GCash app with your mobile number and MPIN, you can now cash in and use GCash.

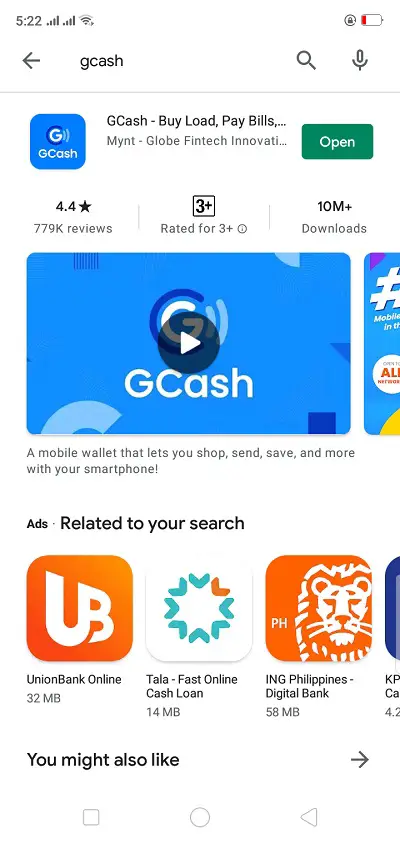

b. GCash Registration via the GCash App

For quicker registration, you can also download the official GCash app and do the following:

- Open the GCash mobile app.

- Provide your mobile number. Again, GCash is open to all networks, not just Globe and TM. Click Next.

- Enter the 6-digit authentication code sent to your mobile phone. Click Submit Code.

- Read and accept the Terms and Conditions. Fill in the information requested in the GCash Registration form, like your name, birthday, address, and email address.

- Set your 4-digit mobile PIN or MPIN, which you’ll use in all your future GCash transactions.

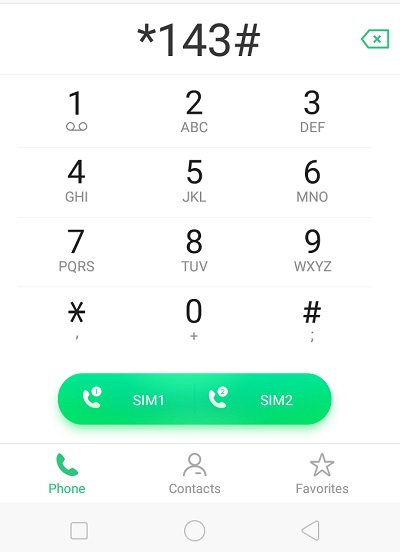

c. GCash Registration via the *143# Menu

You can also register through text for free by following the steps below:

- Dial *143# on your mobile phone.

- Enter the number that corresponds to GCash. Click Send.

- Enter the number that corresponds to Register. Click Send.

- Provide your 4-digit MPIN and personal information such as name, birth year, and address.

- Expect to receive a text message confirming that your registration is successful.

d. GCash Registration via Messenger

Update: As of September 2021, GCash registration through the Messenger app has been temporarily disabled. You can try one of the previously discussed methods to create a GCash account.

For those who regularly use Messenger, you can register with GCash through this app.

- Search for @gcashofficial.

- Click Start an Account.

- Enter your mobile number (any network) and click Continue.

- Read and accept the Terms and Conditions.

- Expect a message confirming that your GCash account is ready.

- Tap Create PIN. Set your 4-digit mobile pin. Enter it twice.

- Wait for a confirmation message that your GCash PIN has been generated.

2. Verify Your GCash Account

Before you can enjoy the full services of GCash, you must have your account verified first.

Account verification or “Know Your Customer” (KYC) is validating the identity of people who use money services like GCash. It is a one-time validation procedure required by the Bangko Sentral ng Pilipinas (BSP) to ensure that you’re a genuine GCash user.

There are currently two levels of verification2:

- Basic – allows newly-registered users to use GCash without verification, but the services available are minimal. Basic users can only use GCash to cash in over the counter, pay bills, buy mobile load, borrow load, and book movies.

- Fully Verified – enables you to access ALL GCash services such as sending money, cashing out, receiving international remittances, using GCredit, cashing in (through PayPal, debit cards, or banks), buying items with your GCash MasterCard, etc.

In addition to getting access to all GCash services, fully verified users also get the following benefits:

- Higher GCash wallet fund limit of ₱100,000 (or ₱500,000 if you link your BPI/Unionbank account or any locally issued, Mastercard/Visa-enabled debit card to your GCash wallet).

- Daily ATM withdrawal limit of ₱40,000.

- Daily Buy Load transactions (to Globe and other networks) of up to ₱20,000.

How To Verify Your GCash Account

Step 1: Prepare 1 Valid ID

According to the GCash website3, the following are the valid IDs accepted for verification purposes:

- UMID/SSS ID

- Passport

- Voters ID

- Pag-IBIG ID

- Postal ID

- Driver’s License

- PhilHealth ID

- PRC ID

- National ID

- Alien Certificate of Registration (ACR I-Card)

If your valid ID is not on the list, you can proceed to the nearest Villarica branch to submit the valid ID and have your account manually verified.

Step 2: Verify Your Account Through the GCash App or an Authorized GCash Outlet

There are two ways to fully verify your account–via the GCash app or through one of the various GCash partner outlets.

GCash Account Verification via the GCash App

- Log in to your GCash app.

- Click the Profile icon at the lower right corner of the home screen.

- Click the Verify Now button below your name and account/mobile number.

- Click the Get Fully Verified button.

- Select the valid ID you have on hand (see the previous section for a complete list of valid IDs accepted for GCash verification). Take a photo of your ID, ensuring it’s within the camera frame. Click Submit.

- Have your photo taken. Before taking a selfie, ensure that you’re in a well-lit room and your face is positioned within the frame.

- Provide any missing information in the partially filled registration form. Click Next to review all the information provided. Once everything is complete, tick the box to accept the Terms and Conditions. Finally, click Confirm.

- Wait for 30 minutes for your application to be reviewed. You’ll receive a text message confirming that your GCash account has been fully verified.

GCash Account Verification via Partner GCash Outlet

- Go to the nearest Globe store or any GCash partner outlet like Villarica Pawnshop and Tambunting Pawnshop. Don’t forget to bring a valid ID.

- Fill out and submit the GCash form for account verification.

- Have your photo taken.

- Wait for a confirmation message via text that your account has been verified and that you’ve been included in the KYC database.

3. Load Your GCash Wallet

A newly registered and fully verified GCash account has a monthly wallet limit of ₱100,000.

This ₱100,000 monthly wallet limit only applies to incoming transactions (e.g., cash-in, receive money, etc.). While fully verified users don’t have a monthly limit to their outgoing transactions (e.g., cash-out/withdraw, online purchases, etc.), there’s a daily outgoing limit of ₱100,0004.

In June 2020, GCash announced that users can now increase their GCash wallet limit from ₱100,000 to ₱500,0005 by linking their bank account (BPI or UnionBank) or any locally-issued Mastercard/Visa-enabled debit card to their fully-verified GCash wallets.

To link your bank account or debit card to your GCash wallet, open your GCash app, click the Profile icon at the lower right corner of the home screen, and tap on My Linked Accounts. Select BPI or UnionBank and fill out the required information. You should receive a text message instantly or within up to seven days confirming that your wallet limit has increased.

Note that the ₱500,000 wallet limit only applies to monthly incoming transactions. Users who have successfully linked their bank accounts to GCash still have no monthly outgoing limit, and the daily outgoing limit remains ₱100,000.

There are various options to top up or load your GCash account. You can do it either through mobile payment facilities available in the GCash app or by going to any GCash Partner Outlets (GPOs) like Globe Stores, SM Business Center, Villarica Pawnshop, and 7-Eleven Cliqq Kiosks, to name a few.

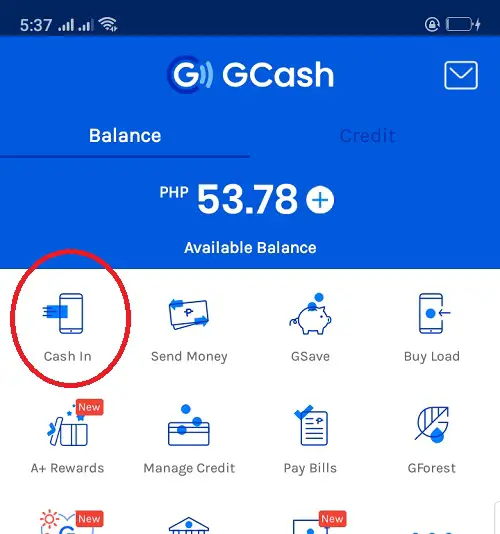

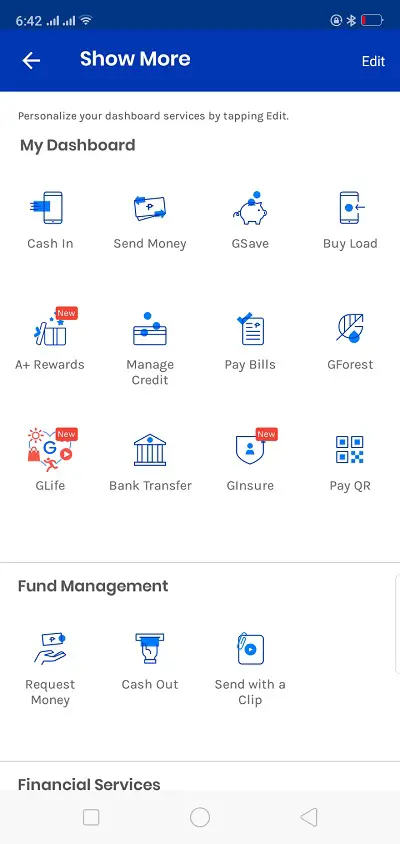

4. Start Using GCash for Your Desired Transaction

With a GCash app installed on your smartphone, you can proceed with your desired transaction in just a few taps.

To start using GCash, launch the mobile app and log in with your 4-digit GCash MPIN. On the dashboard, click the icon corresponding to the service you want to use. For every transaction you make, you’ll receive a confirmation message via text from 2882.

Aside from the app, you can also access GCash services by dialing *143# on your mobile phone and selecting the numbers corresponding to GCash and its services of your choice.

For online services/purchases that require a debit card and don’t have GCash on their list of payment options, you can still use your GCash fund by linking your account to one or more of the following:

- GCash Mastercard

- American Express Virtual Pay

- PayPal

- BPI

- UnionBank

To link your GCash wallet to any of the online payment solutions above, click the Profile icon on the lower right corner of the home screen and choose My Linked Account from the sidebar.

Here’s a summary of the things you can do with GCash:

a. Make Purchases Online or On-Ground

As long as the online store or shopping site has GCash as one of its payment options, you can simply check out your purchased items and pay directly using your available GCash funds.

You can pay with GCash for shopping at or using the services of:

- Lazada

- Zalora

- Netflix

- Spotify

For those without GCash as a payment option, you can also pay using a GCash Mastercard, GCash American Express Virtual Pay card, or PayPal linked to your GCash account.

The GCash American Express is a virtual debit card ideally used for paying for items purchased from U.S. stores. It also comes with the free U.S. address courtesy of My Shopping Box that you can use for all your shipping needs.

If you prefer to shop on the ground, there are also partner merchants that accept GCash. Simply look for a little signage that says “GCash Accepted Here” at the entrance door or near the cashier. You can also check out this list to learn whether the store of your choice accepts GCash payments or not.

To pay for your items with GCash, launch the app on your smartphone, scan the QR code at the counter, and type in the amount of money you’re going to pay. For each transaction you make using the GCash QR, you’ll enjoy 10% cashback.

b. Pay Bills

With GCash, you can pay almost any bills without leaving your home.

To pay bills, log in to the GCash app and tap Pay Bills. Select the Biller Category and then the specific Biller that you want to settle the bills with. Enter the requested information and proceed with the transaction.

You can also tap the heart sign beside the name of the biller to add it to your Favorites. You can then easily access these saved billers under My Saved Billers each time you pay your bills in the future, saving you time in the process.

Here’s a list of bills you can pay through GCash:

- Electric utilities (e.g., Meralco)

- Water utilities (e.g., Manila Water, Maynilad, etc.)

- Cable/Internet (e.g., SkyCable)

- Telecoms (including hour Globe AT HOME and Globe Postpaid bills)

- Credit Cards (e.g., BDO Mastercard or Visa credit card, BPI Credit Card, etc.)

- Loans (e.g., Home Credit)

- Government (e.g., NBI Clearance, BIR, DFA passport appointment, Pag IBIG, SSS contribution, etc.)

- Insurance (e.g., Cocolife, Manulife, Philamlife, etc.)

- Transportation (e.g., AirAsia and Cebu Pacific)

- Real Estate (e.g., Camella Homes, Crown Asia, DMCI Homes, etc.)

- Healthcare (e.g., Medicard)

- Schools (e.g., Adamson, Miriam College, UE, etc.)

- Others (access your GCash app for more info).

c. Buy Load

GCash app can also be used to load up any mobile number from any network, be it Globe, TM, or Smart.

With this feature, you no longer need to go to the nearest convenience store to buy a call and text card. You can even turn your GCash app into a mobile loading business, too!

Here’s how to load any mobile number straight from your smartphone:

- Log in to your GCash app.

- Tap on Buy Load.

- Enter the mobile number you want to load up or tap on the phonebook icon and select the desired number from your list of contacts. Click Next.

- Enter a value or choose from any of the denominations provided. Click Next.

- Confirm the payment to complete the transaction.

If you have zero GCash wallet balance but can’t cash in yet, you can also avail yourself of the Borrow Load feature. To access this, simply tap the same Buy Load icon on your GCash app dashboard.

You’re allowed to borrow ₱10 or ₱20 worth of regular load. You can also choose from the different load combos with a maximum of ₱20.

Once you get the load, make sure to cash in as soon as possible to pay back the loan. You must pay the amount you owe two days after the “Borrow Load” transaction was completed.

Update: As of September 2021, the Borrow Load feature is no longer available in GCash.

d. Send or Transfer Money

As long as you have money in your GCash wallet, you can send or transfer any amount to anyone anywhere.

You can transfer money to another GCash user in four ways:

- Express Send – if you want to instantly send money to another GCash user without any transaction fees.

- Send via QR – use this to send money by scanning, generating, or uploading a QR code.

- Send with a Clip – for those who prefer to customize the way they deliver their GCash money. With this feature, you can send GCash to your loved ones with an attached video, photo, or voice recording.

- Send Gift – a convenient way to send gifts in the form of GCash to your friends and loved ones during special occasions.

Meanwhile, if the receiver doesn’t have a GCash account yet, you can also send money to any of the GCash partner banks.

Simply tap the Bank Transfer option, choose the name of the bank, and enter the desired amount along with the receiver’s account name and number.

Tap Send Money to complete the transaction.

On the other hand, a new feature called GCash Padala enables you to send money to a receiver who doesn’t have a bank account or a GCash account. All you need is the recipient’s name and contact number. The recipient can easily claim the money at one of over 17,000 GCash-partner outlets nationwide.

Related Article: How to Choose a Bank: An Ultimate Guide to the Top Banks in the Philippines

e. Withdraw Money

“Cash-out” is the process of withdrawing your GCash and converting it into physical money.

You do this when you’ve earned enough GCash in your wallet, and you want to take out a portion of it and either spend or save it in a bank account. Whatever your reason, you can withdraw the money in three ways:

- ATM Withdrawal – if you have a GCash Mastercard, you can cash out your money by going to any Bancnet or Mastercard ATM.

- BPI Savings Account – if you’re a BPI savings account holder, you can easily transfer your GCash to your bank account by dialing *119# on your phone.

- Over-the-Counter – for those with neither a bank account nor a GCash Mastercard, proceed to any GCash Partner Outlet to withdraw your money. These include pawnshops such as Villarica, Tambunting, RD Pawnshop, and Palawan Pawnshop; Puregold Supermarket; and payment facilities such as Bayad Center and Expresspay.

f. Use Credit

GCash can also work as a credit card when you run out of money and need to pay for something urgently. With GCredit, you can use GCash for purchases even if you have zero balance and simply pay for it later.

However, GCredit will only work if you have an updated/verified email address as well as a high GScore.

The GScore is a trust score tied to your GCredit and is based on the number of your GCash transactions. The more often you use GCash to buy load, pay bills, and make purchases, the higher your GScore will be.

With a high GScore, you can earn a credit limit starting with ₱1,000 which can increase to ₱10,000.

READ: How to Use GCredit in GCash: A Quick Guide

g. Take Loans

Take loans using the GLoan6 feature of GCash that allows you to borrow up to ₱25,000 to start a small business, pay bills, shop online, and a lot more. The loaned amount can be cashed out through your bank account and is payable in 9 to 12 months. The applicable interest rate is 2% to 4% monthly.

Only GCash users who are already qualified to use GCredit can enjoy GLoan.

h. Use Its “Buy Now, Pay Later” Feature

With GCash’s GGives7 feature, you can now buy items from any GCash Partner Merchants and pay them in an installment of 3, 6, or 12 months. You can borrow up to ₱30,000 with an interest rate of 0% to 4.99% monthly (the shorter the period, the lower your interest would be!).

Unlike GLoan, you cannot cash out your GGives borrowed amount. Instead, you can only use it as an offline payment option by scanning the GCash Partner Merchant’s QR code.

i. Use Your Balance to Buy Cryptocurrency

GCash is also available as a payment option for various popular crypto exchanges such as Binance, Paxful, and PDAX8. This means that as you select GCash as a payment method for your crypto purchases in the aforementioned platforms, the amount will be deducted from your e-wallet balance.

j. Avail of GCash Pro to Upgrade Your Business Operations

Entrepreneurs who use GCash may further enjoy its services through GCash Pro9. A service under GCash Pro is BizStarter9910, a monthly subscription-based program that provides users with the following perks:

- Upgraded monthly wallet limit of ₱500,000

- Insurance coverage of not exceeding ₱50,000

- Five free bank transfers (save up to ₱75 monthly from bank transfers)

- GLoans interest rate rebates up to 10%

- Payment Links, a feature that enables customers to pay you through links that they will receive through messaging apps

Although this feature is best recommended for entrepreneurs, every fully-verified GCash user is eligible for GCash Pro. The subscription costs ₱99 per month.

How To Keep Your GCash Account Secure

Despite GCash’s relentless efforts to curb scammers, there will always be malicious actors who are ready to exploit every potential loophole in the country’s leading mobile wallet. From famous personalities11 to ordinary citizens struggling to get by12, no one is immune to online scams targeting GCash.

Therefore, to prevent yourself from being part of the statistic, you also need to do your part in protecting your account. Here are some of the proactive ways to ensure your account is protected from GCash scammers:

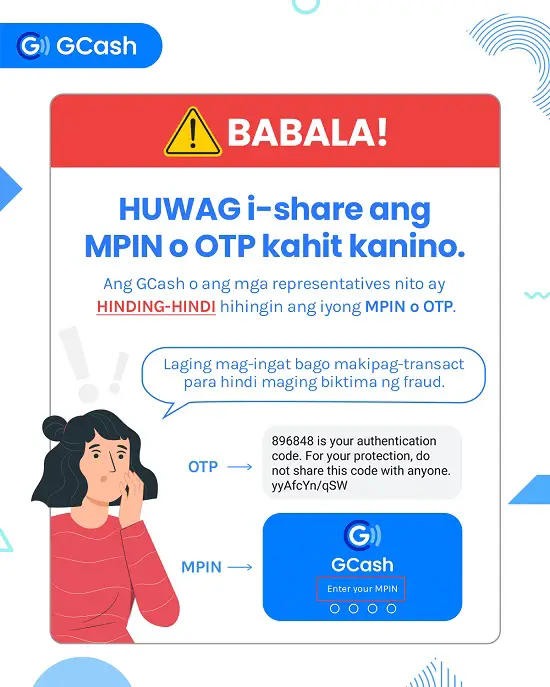

1. Never Share Your GCash Personal Data With Anyone, Especially Online

Always remember that GCash or any of its representatives will NEVER ask you to provide the following information:

- MPIN – the 4-digit code that serves as your GCash password.

- OTP – the 6-digit one-time password that GCash sends to your registered mobile number each time you log in to your account or confirm various bank-related transactions.

- CVV/CVC – the 3-digit PIN behind your GCash Mastercard.

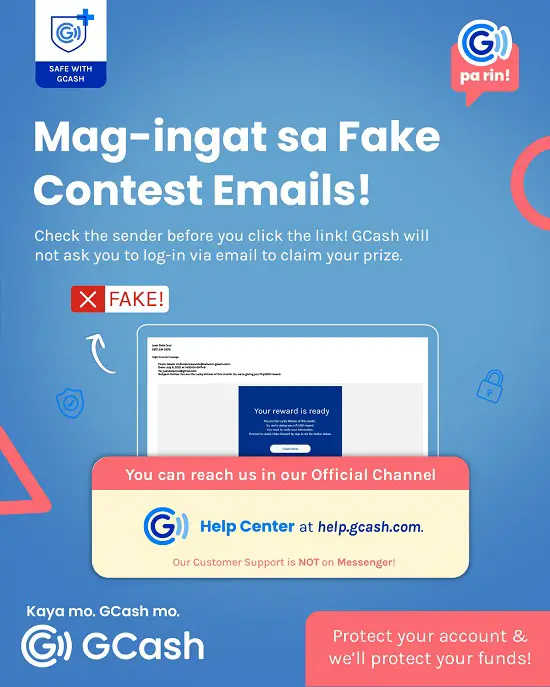

Scammers usually resort to phishing frauds to steal any or all of the personal details listed above. This means they will pose as GCash or a trusted entity and dupe you into verifying your account via email, answering fake surveys, joining fake contest emails, or filling out forms via Messenger to steal your data.

If you receive any of these messages or become a victim yourself, please report it to GCash immediately by calling its customer support hotline at 2882 or by submitting a ticket to help.gcash.com.

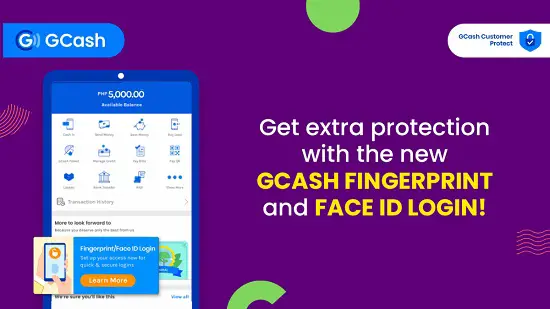

2. Log In to Your GCash Account Using Biometric Authentication Instead of MPIN

Since MPINs are very easy to steal, why not access your GCash account using traits that are uniquely your own? With the new biometric authentication13, this is now possible.

Once activated, the biometric authentication will enable you to log in via fingerprint or Face ID instead of MPIN which you can easily forget or give away to fraudsters. Logging in is relatively faster since all you have to do is place your finger on your phone screen or have your facial features scanned to access your account. More importantly, biometrics are uniquely yours so you can safely log in anywhere without the fear of a hacker stealing your login credentials or thieves cracking your phone open in case it gets stolen.

To start logging in to your GCash account using your fingerprint or Face ID, follow these steps14:

- Make sure the biometric authentication feature is available on your phone and is already activated as this will be integrated with GCash. Otherwise, you won’t be able to see the Biometrics Login option in your GCash app.

- Install the GCash app. If it’s already installed on your phone, ensure you’re using the latest and updated version.

- Log in to your GCash app and tap Profile at the bottom right corner of your screen.

- Click Settings on the sidebar menu.

- Select Biometrics Login under Security.

- Toggle Enable Biometrics Login to activate biometric authentication on your GCash app.

- Encode the 6-digit authentication code sent to your registered mobile number and click Submit.

- Log out and then log back in using your biometrics. Keep in mind that you will be prompted to provide your MPIN after three consecutive failed login attempts with your biometrics. Meanwhile, the biometric authentication will be automatically disabled once your reset your MPIN or click Forgot MPIN.

3. Follow or Like the Official GCash Social Media Pages To Get the Latest Advisories Against GCash Scams

GCash scams come in a variety of forms. Fortunately, every fraudulent activity reported to GCash is made public through the latest advisories released to the official GCash social media accounts. These advisories aim to warn all GCash users of the various modus operandi that scammers use to steal GCash accounts.

According to Chito Maniago15, the GCash vice president of Corporate Communications and Public Affairs as of this writing, GCash also releases SMS and app notifications to advise users against clicking fraudulent pages, donation links, and financial aid offers as well as the dangers of sharing their account details. Maniago also assures the public that fake social media advisories and accounts are quickly taken down as soon as they’re brought to their attention.

Tips and Warnings

- The MPIN or Mobile Personal Identification Number is a four-digit passcode that you will use in all your GCash transactions–from initial registration to every time you access the GCash app. This is the single most important information tied to your GCash account so make sure you don’t pick a number combination that is very easy to guess. Moreover, never share your MPIN with anyone and delete all messages containing it.

- There’s no minimum balance required to keep your GCash account active. The maximum balance, on the other hand, varies depending on your level of verification. Non-verified GCash users get a maximum monthly wallet limit of only ₱50,000 while fully verified users have up to ₱500,000 monthly wallet limit.

- The wallet limit doesn’t cover the combined incoming and outgoing transactions (e.g., cash-in, bills payment, bank transfer, cash-out, etc.) that you’ll do every month. For fully verified users, for example, there’s a ₱100,000 monthly limit for cash-in/incoming transactions while there’s no monthly limit for cash-out/outgoing transactions. So if you’ve already sent ₱100,000 (outgoing) this month, you can still use GCash for cash-in and other incoming transactions.

- Since June 2020, GCash has increased its wallet limit from ₱100,000 to ₱500,000 for users who would link their BPI, Unionbank, or any locally-issued, Mastercard/Visa-enabled debit card to their GCash wallets. Take note that this upgrade doesn’t apply to GCash wallets that have been linked to GCash Mastercard, Paypal, and American Express Virtual Pay cards.

- Although GCash funds/balance don’t expire, it is recommended that you keep your account active by using GCash in your online or offline transactions. Otherwise, leaving your account inactive for over 6 months may ultimately lead to either account closure or automatic deduction of your funds to cover the dormancy fee.

- Keep yourself updated with the latest advisory to avoid using GCash during a system upgrade. You’ll usually receive a text message or an update via the GCash Facebook page ahead of time, informing you that there will be service downtimes on selected dates. When GCash is upgrading its systems, all its services are temporarily disabled so it’s important to know when and how long it will happen.

- Avoid leaving a big amount of money on your GCash app if you’re a first-time user who never tried mobile wallets before. Start by cashing-in smaller amounts, say ₱10,000 to pay bills, and then commit to higher value transactions as you become more familiar with the GCash app and its services. Remember, there’s always that risk of making mistakes when you’re using GCash for the very first time.

- Use a stable Internet for seamless GCash transactions. Also, try to avoid using GCash, or any financial transactions for that matter, whenever you’re connected to public wi-fi.

- Don’t pay attention to phishing emails containing links that, when clicked, will enable the scammer to gain access to your GCash account. Most of these email messages go straight to your SPAM folder but there are few that escape the net and wreak havoc on users. Avoid them like a plague.

- You will receive confirmation messages of your GCash transactions in the app inbox

Frequently Asked Questions

1. What is GCredit and how can I use it?

2. How can I increase my GCash credit limit?

3. Can I use GCash with Smart number?

4. How can I cash in or send money to GCash through 7-Eleven?

5. How do I claim money from GCash?

6. How can I get a GCash Mastercard?

7. Can I use my GCash Mastercard abroad?

8. How can I withdraw money from GCash Mastercard?

9. Can I cash-out GCash without a card? How?

10. Can a regular load be converted to GCash?

11. Can I have more than one GCash account?

12. How much is the fee for GCash cash-out?

13. Is there a fee for GCash cash-in?

14. How can I save money in GCash?

15. How can I invest and earn money in GCash?

16. How can I send money through GCash?

17. How can I transfer money from BDO to my GCash account?

18. How can I transfer money from BPI to my GCash account?

19. How can I pay bills using Gcash?

20. How do I pay with GCash QR when shopping or buying groceries?

21. How do I pay tax with GCash?

22. How can I pay my SSS contribution through GCash?

23. How do I book a movie on GCash?

24. How much is the monthly wallet limit for GCash?

25. Is GCash transfer real-time?

26. How can I pay for my Cebu Pacific flight booking through GCash?

27. I’m having issues with GCash. How can I contact GCash customer support? What’s the updated GCash hotline?

28. How can I pay my PLDT bill using GCash?

29. How can I pay Netflix using GCash?

30. How can I link my PayPal account to my GCash account?

31. How can I transfer money from PayPal to GCash?

32. How can I transfer money from GCash to PayPal?

33. What are the different ways to earn money using GCash?

34. How can I pay PhilHealth thru GCash?

References

- GCash Terms and Conditions. (2020). Retrieved 7 July 2020, from https://www.gcash.com/terms-and-conditions/20190402/

- Why do I need to get Verified?. Retrieved 13 September 2021, from https://help.gcash.com/hc/en-us/articles/360017721953-Why-do-I-need-to-get-Verified-

- What are the IDs I can submit to get verified?. Retrieved 13 September 2021, from https://help.gcash.com/hc/en-us/articles/900000948786-What-are-the-IDs-I-can-submit-to-get-verified-

- What are my Wallet and Transaction Limits?. Retrieved 13 September 2021, from https://help.gcash.com/hc/en-us/articles/360021112894-What-are-my-Wallet-and-Transaction-Limits-

- Mercurio, R. (2020). GCash hikes wallet limit. Retrieved 7 July 2020, from https://www.philstar.com/business/2020/06/27/2023811/gcash-hikes-wallet-limit

- Insert your note here.

- How do I use GGives?. Retrieved 28 March 2022, from https://help.gcash.com/hc/en-us/articles/4408130159513-How-do-I-use-GGives-

- GCash now offers fast and secure ways to buy crypto. (2022). Retrieved 2 April 2022, from https://www.rappler.com/brandrap/gcash-ways-buy-cryptocurrency/

- Mercurio, R. (2022). GCash launches digital business solutions. Retrieved 18 April 2022, from https://www.philstar.com/business/2022/04/03/2171803/gcash-launches-digital-business-solutions

- GCash PRO Biz Starter 99. (2022). Retrieved 18 April 2022, from https://www.gcash.com/promos/gcashprobizstarter99

- Layug, M. (2021). Ronnie Liang warns public after scammers empty his GCash: ‘Nagtira pa ng P8.97’. Retrieved 26 September 2021, from https://www.gmanetwork.com/news/showbiz/chikaminute/781626/ronnie-liang-warns-public-after-scammers-empty-his-gcash-nagtira-pa-ng-p8-97/story/here.

- Garcia, V. (2021). Father who bartered chickens for kids’ e-learning gadget loses money in scam. Retrieved 26 September 2021, from https://newsinfo.inquirer.net/1337518/father-who-bartered-chickens-for-kids-e-learning-gadget-loses-money-in-scam

- Get extra protection with GCash biometric login!. (2020). Retrieved 26 September 2021, from https://www.gcash.com/login-with-biometrics

- How can I enable my Biometrics Login?. Retrieved 26 September 2021, from https://help.gcash.com/hc/en-us/articles/900005866343-How-can-I-enable-my-Biometrics-Login-

- Vasquez, D. (2021). ‘Protect your data like you would protect your cash’. Retrieved 26 September 2021, from https://businessmirror.com.ph/2021/05/22/protect-your-data-like-you-would-protect-your-cash/

Luisito Batongbakal Jr.

Luisito E. Batongbakal Jr. is the founder, editor, and chief content strategist of FilipiKnow, a leading online portal for free educational, Filipino-centric content. His curiosity and passion for learning have helped millions of Filipinos around the world get access to free insightful and practical information at the touch of their fingertips. With him at the helm, FilipiKnow has won numerous awards including the Top 10 Emerging Influential Blogs 2013, the 2015 Globe Tatt Awards, and the 2015 Philippine Bloggys Awards.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net